supertrader72

@t_supertrader72

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

supertrader72

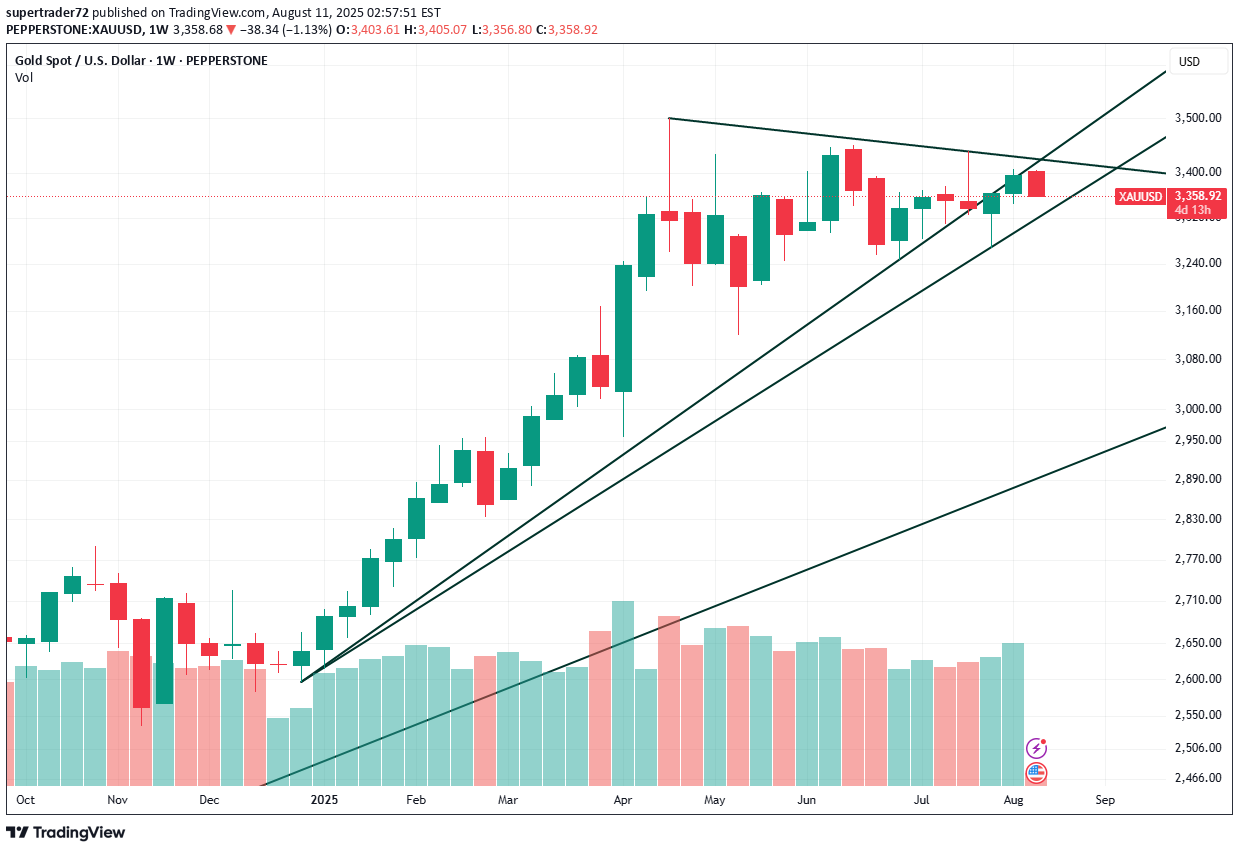

XAUUSD Analysis: Last Friday, XAUUSD hit a major supply zone and is now facing additional resistance from the major downtrend line on the weekly time frame. Given the current technical structure, a pullback toward the 3344 demand area is a strong possibility in the short term. COT data shows institutions increased their net long positions by 14,000 contracts last week, reinforcing the long-term bullish outlook. However, with price stretched near supply and key resistance, my short-term bias remains bearish until we see a confirmed breakout above the trendline.XAUUSD dropped below 3344 and is testing strong demand at 3330. If buyers defend this level, a rebound toward 3400 is highly probable. However, a daily close below 3330 early next week (Monday/Tuesday) would shift momentum bearish, opening the path toward the next demand area around 2980. Institutions also reduced their long positions last week by 6,000 contracts.

supertrader72

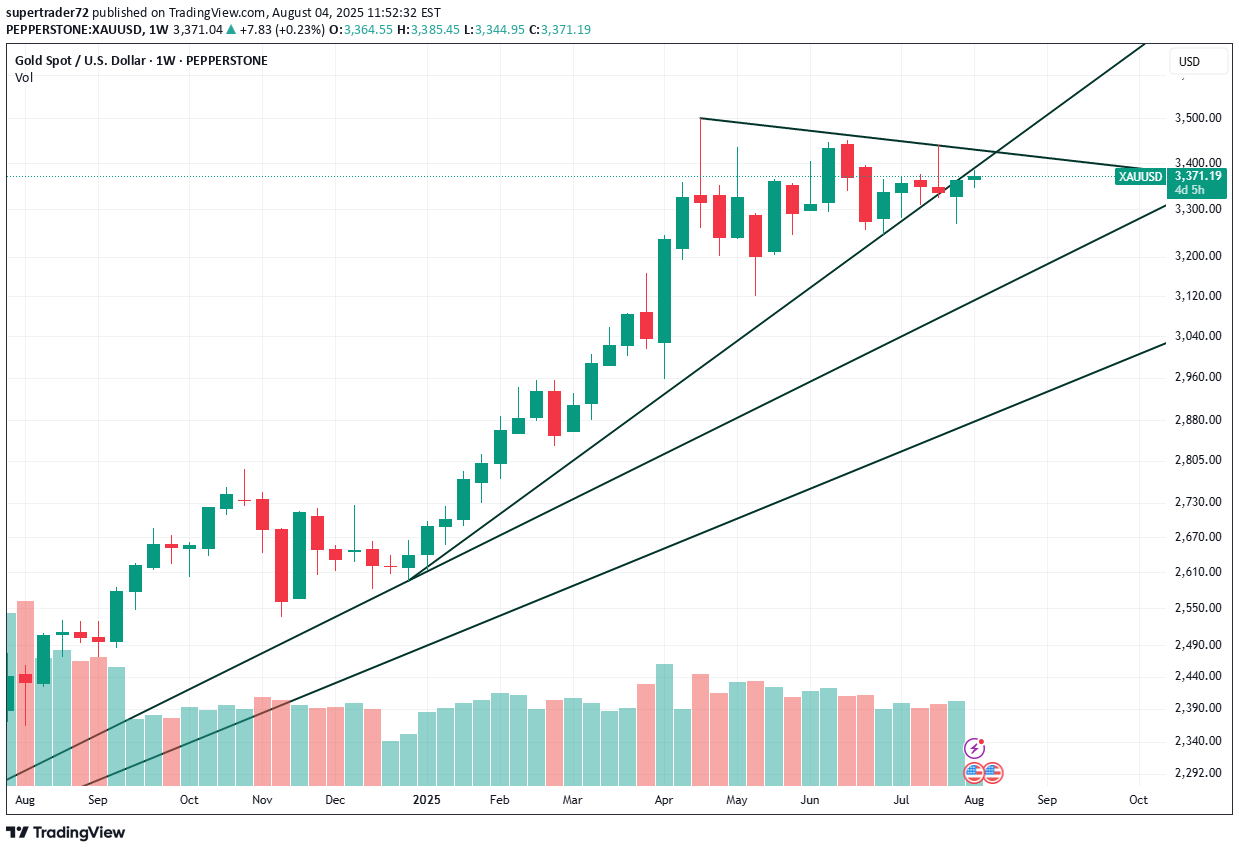

Last Friday, buying momentum lifted gold prices, with potential for a further move toward the 3400 level, provided bullish momentum continues. This move followed a weaker-than-expected Non-Farm Payroll (NFP) report, an uptick in the unemployment rate, and no change in the Fed's interest rate, all of which pressured the U.S. Dollar Index (DXY) lower and supported gold’s rise. Interestingly, while price advanced, institutional traders reduced their long exposure by nearly 30,000 contracts, indicating some caution or profit-taking at current levels. I remain bullish in the short term due to macro tailwinds, but bearish in the medium to long term as institutional positioning softens and resistance zones approach.

supertrader72

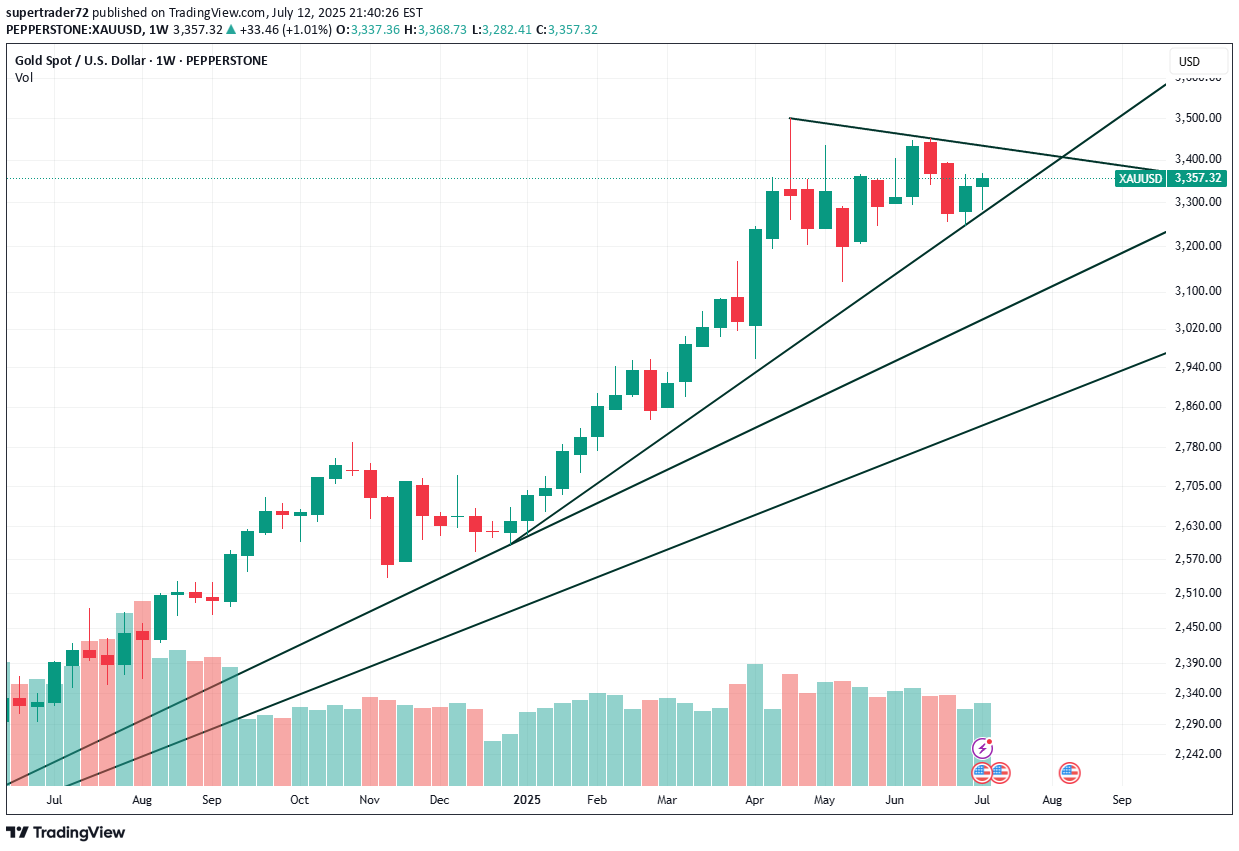

XAUUSD has broken its most recent descending trendline on the Weekly chart, signaling a possible short-term reversal. It’s now approaching a higher-timeframe descending trendline, which could act as resistance. The next key demand zone is around 3246; if that fails, the more significant demand lies at 3120. Despite this pullback, the macro trend remains bullish. Notably, institutional traders increased their net long positions by over 40,000 contracts last week, bringing the total to more than 253,000, reflecting a potential shift in sentiment.

supertrader72

Gold continues to attract demand as a safe-haven asset amid ongoing global political tensions. Institutional traders have increased their net long positions by approximately 1,000 contracts, signaling growing confidence in the bullish outlook. On Friday, Gold printed a new Higher High, surpassing last week's peak — a technical sign of continued upward momentum. This price action, combined with increased institutional interest, suggests that a move toward the $3,420 level is within reach. That said, I remain cautiously optimistic. There's still a risk of a short-term pullback, especially to fill the nearby gap left behind during last week’s price acceleration. Any retracement may offer another opportunity to buy at a discount. Chart Breakdown (Weekly – XAU/USD) Symmetrical Triangle Forming: Gold is consolidating within a tight triangle, with higher lows and lower highs converging. A breakout above the upper trendline (~$3,420 zone) could trigger a new leg upward. Volume Analysis: Volume remains steady but not explosive — indicating consolidation, not reversal. Watch for a volume spike on breakout to confirm the move. Trendline Support Holding: Price is respecting the rising trendline from December 2023. As long as this line holds (~$3,300), the bullish structure remains intact. Upside Targets: Breakout above $3,420 could open room toward $3,500+. A failure to break may lead to a retest of the support near $3,280–$3,300. Bearish Scenario: If the triangle breaks to the downside, price may revisit $3,100–$3,180 to fill the gap.

supertrader72

After the bears dominated two weeks ago, the bulls regained control last week and could potentially extend the rally into this week.The latest jobs data played a key role—unemployment dropped to 4.1% from 4.2%, and Non-Farm Payrolls (NFP) rose to 147K—which initially triggered a pullback in gold on Thursday. However, bullish momentum returned strongly on Friday, signaling renewed buying interest.Supporting this shift, institutional long positions increased to 195K contracts, up from 187K the previous week. This continued buildup suggests that smart money is positioning for further upside.

supertrader72

2 weeks in a row, the sellers were in control. The downward force this week is strong. The possibility of a further drop in the future is highly probable. However, there's also a potential recovery next week. Overall, it's still an uptrend; however, I won't ignore the new LH that formed this week as well.

supertrader72

Gold exhibited considerable uncertainty, as sellers pushed the price back to nearly its starting point this week. Is it profit taking? What do institutions know that we don't, as they increased their long positions this week? 81% of institutions are long. So, where the whales are is where I want to be.Note: This is not advice. This is for educational purposes only. Past performance is not indicative of future results.XAUUSD strong demand last week could potentially continue this week especially with the geopolitical tension between Israel and Iran. It could even create a new High and surpass 3500. Otherwise, the plan is too short it when the time comes.

supertrader72

BTCUSD created new Highs 2 weeks ago (almost 112,000). Last week, it created a new LH and bearish engulfing pattern. Sellers took over and the odds it will continue to drop down to 90,000 as a form of correction is highly probable.

supertrader72

XAUUSD created a new LH and didn't want to continue last week's demand. However, it also created a new HL. Who takes precedence in this scenario? The HL since it's an overall Up Trend. It might consolidate in the next few days and the 4th of June will be a good indicator if it break to the upside or continue to drop.

supertrader72

Gold corrected itself all the way down to 3120 yesterday which is a significant demand level by institutions. Price then rebounded and closed at 3150. If it creates a confirmed HL by the end of Friday, the odds and probability XAUUSD will go back to its supply area at 3500 is highly probable. Price will also depend on macro fundamentals. The weekly shows a strong uptrend and so as the monthly chart. Institutions started buying back and increased their long positions.Gold broke minor supply level at 3250 and minor down trend. Heading toward 3347 - 3350 to test major down trend line. If that breaks, Gold will head back to 3500 with a high probability.Gold created a HL on the Weekly Time Frame, the odds it will go back to supply between 3440 and 3500 to either create a new HH or LH is highly probable.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.