short-term-catcher

@t_short-term-catcher

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

short-term-catcher

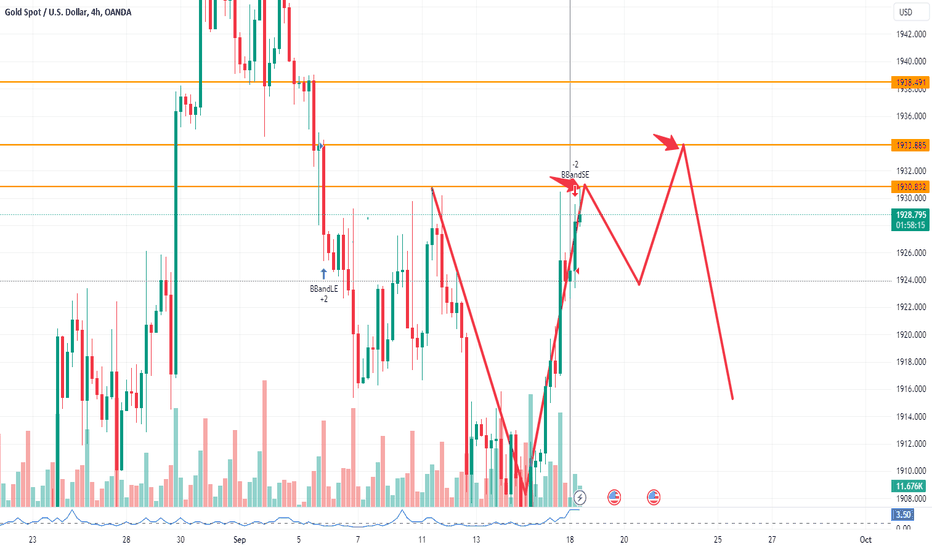

Gold top may be formed, go short directly

Gold broke back last Friday, and then retraced slightly in the early morning after hitting the 30 line. After the opening of the day, it directly countered near 22. It is continuing to counterattack. At the same time, the daily line is above the short-term moving average, and the moving average The system's point position will also remain near 15, which is basically the same as the previous top-bottom transition line. The weekly line also closed in a small positive shape last week, mixed with the arrangement of the moving average system, and the short-term long-short trend It still needs to be discussed, and the current key pressure above is maintained at the 30 line. This position is also the previous top downward point, and it is also the position where the pressure retracement last Friday, so it is still possible to continue to decline in the short term, and this position is also It is expected that the three-top pattern will form again, giving the short sellers a greater choice in the later period. Although the bulls are currently rising slightly, it is far from the bottom of the reversal. In the current tentative upward trend, we still try it first. If you want to go short and wait, you can go short gold directly around the current price of 1929-1930 during the day, with the target around 1915-1920 and stop loss of 1938. [Monday operation]: Gold is short-term directly around 1929-1930 in the short term. The target is around 1915-1920 and the stop loss is 1938.

short-term-catcher

Gold is short in the 1930 area today

Only when your profit is greater than your stop loss each time can your account achieve the inevitability of profit in the long run. Trading method: follow the daily trend in sync, choose 1 hour, and 4 hours to trade with the trend, Gold's 1-hour support is 1920.50, 4-hour pressure is 1916, daily pressure is 1930, weekly pressure is 1983.00, and monthly support is 1810.00 Trading plan: Short selling in gold 1930 area with stop loss 1936, and look at 1921

short-term-catcher

Gold stabilizes, go long directly

The golden hour line maintains the arc bottom situation, that is, the low points continue to move upward. The bottom is all a large increase in the positive line. The K line runs close to the 50 moving average. The moving average naturally runs upward. One positive line crosses three negative lines. This It is a bullish trend. The closing price of gold price overnight is also above 1900. Going long is the requirement of the market. Even if it falls back to around 1905, the big positive line will still engulf the upward trend. Go long. If it falls back to around 1910, go long directly. Operation strategy: gold 1910-1912 long, stop loss 1902, target 1926

short-term-catcher

Draw back to 1910 and continue shorting!

Recently, since gold broke its position at 1917, we have been shorting all the way. Of course, there are many bargain hunters who buck the trend. As an analyst, I think the most important thing is to stick to your own ideas. The current hourly chart trend has maintained a volatile and downward trend, and the daily trend has been continuous in recent times. New lows. Whether it is the daily or hourly trend, the overall strength of the short side is dominant. There is no suspense about shorting. We connect the previous high of 1930 and today's high of 1912 to form a downward trend. The hourly pressure of the corner theory is at Continuously extending downward, the highest pressure in the evening can be traced back to the 1910 line, so the price rebounding below 1910 tonight gives us the opportunity to short! The first target line looks towards the important integer support level of 1900! Trading strategy: short gold 1910, stop loss 1914, target 1900

short-term-catcher

Gold trading strategy on September 14

Through the analysis of the golden hour chart, we know that the market continued to maintain a weak consolidation trend yesterday. Since the upper trend line support at 1935, it has been oscillating downward along the downward trend line and moving average system recently. We can also clearly see from the MACD below When there are signs of bottom divergence below, although it has been running in a weak area in the short term and has been suppressed above, once the intraday data is affected by the data and the volume breaks through the downward trend line, it is very likely to continue to return to the oscillating upward trend. In terms of operation, we will continue to go high and low. Many ideas, specific suggestions are as follows: Gold 1907 and 1902 are long respectively, the stop loss is 8 US dollars each, and the take profit is 15 US dollars each; Gold 1918 and 1923 and 1928 and 1932 are short respectively, with stop loss of US$7 each and take profit of US$15 each.

short-term-catcher

Gold US market 1910 backhand long!

The gold news is negative but it has not fallen below, and the U.S. market is going long at 1910! Although the gold market fell to a new low after the US CPI data, there was no continuity, and it rebounded strongly, breaking through the pressure position during the day. If it is weak, it is strong. If it is not negative, it will rebound! , directly backhand and go long! Although gold is in the downward trend on the daily line, there is still the possibility of a short-term rebound! The pressure above is at the 1925 line! In the U.S. market, we will use the data to make a rebound first, and then go short after encountering resistance! Trading must not be long or short, but should be adaptable and flexible according to market trends! Just like now, if it is clear that the negative news will not fall, then it is necessary to adjust the thinking in time!

short-term-catcher

Gold short selling 8 consecutive wins

Through the analysis of the golden hour chart, we know that yesterday's market rebound was unable to increase the volume and fell below the 1916 line support. Now it has become a pressure level. The support level has stopped falling and rebounded. We can also clearly see from the picture below We see that the short term has also entered a phased bottom area, but we do not rule out a further drop to the lower support level. In terms of operation, we continue to think high, low and long. The specific suggestions are as follows: Gold 1908 and 1902 are long respectively, the stop loss is 8 US dollars each, and the take profit is 15 US dollars each; Gold 1917 and 1922 are short respectively, the stop loss is 8 US dollars each, and the take profit is 15 US dollars each.

short-term-catcher

Gold reverses, the market outlook is kan'k

Judging from the hourly trend, the market outlook is bearish. In the absence of news stimulation, only shocks can brew unilaterally. Today's trend has been perfectly verified. The price quickly broke through the shock range and continued to run in the original direction. A new round of space opens below. Our recent operation ideas will be based on high altitude, with a firm goal of looking at the integer mark of 1900! Judging from the four-hour pattern, since late August, the current upward trend has formed a spire shape. The bullish trend has ended, and shorts will dominate the market outlook! Driven by the breaking of the hourly shock trend and the head and shoulders top of the four-hour line, it is only a matter of time before the price reaches the 1900 integer mark. In the evening, the price rebounds to the 1915 line and directly places short orders. The rest is to stick to our short orders and wait for the market situation. Cash in on profits after plunging! Trading strategy: short gold at 1915, stop loss at 1923, target at 1900

short-term-catcher

gold trading strategy

Through the analysis of the 4-hour chart of gold, we know that the market first rose and then fell, and received strong support at the 120-day moving average support level below. When there was a decline in the early stage, it turned into an increase. It was pressure. After a wide range of intraday fluctuations, the volume was adjusted. The breakthrough pressure has now become support in turn. In the short term, the suppression of the annual line above is still relatively strong. After all, the moving average system has not yet formed a long arrangement. The MACD below is still running in the weak zone and cannot constitute a strong upward attack in the short term (except for emergencies). In the short term, it will continue to fluctuate within a narrow range of 1917-1935. In terms of operation, we will continue to think of high altitude, low and long. The specific suggestions are as follows: Gold 1917 and 1911 are long respectively, the stop loss is 8 US dollars each, and the take profit is 15 US dollars each; Gold 1933 and 1937 are short respectively, with stop loss of US$7 each and take profit of US$15 each.

short-term-catcher

Gold continues to be bearish on Monday

Let’s continue to look at the 1903 line. We will look at the 1903 line on Friday, but unfortunately the breakthrough is not strong enough, or the energy to build momentum is insufficient. We will definitely reach this target today. The gold four-hour line is obviously in a short position, especially on Friday when it rebounded to around 1930, and then the negative line fell, directly breaking through below 1920, and it also clearly closed the upper shadow line. The large negative line continued to fall, and the 50 moving average moved upward. Press the pause button, and it is obviously moving downward. This kind of top Yin line engulfing the Yang line must be short. The short orders from 1928 to 1926 continue to be successful. Operation strategy: short gold at 1928, stop loss at 1935, target at 1903

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.