savvyacademy

@t_savvyacademy

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

savvyacademy

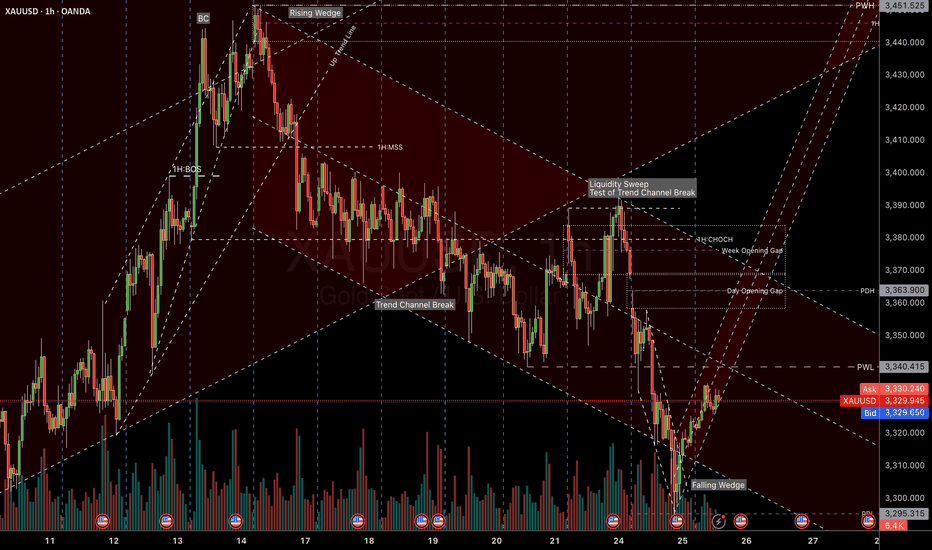

XAUUSD till mid-June 2025 is on the up trend channel - Based on 1 hourly chart - A rising wedge pattern, Buying Climax and a Secondary Test marks the start of Bearish Trend. - A Bearish Trend Channel saw a falling wedge below Previous Week Low that hints to a Bullish Trend - The bullish reversal is likely to draw on buyside liquidity and opening gaps where the confluence of the Bearish Trend Channel

savvyacademy

savvyacademy

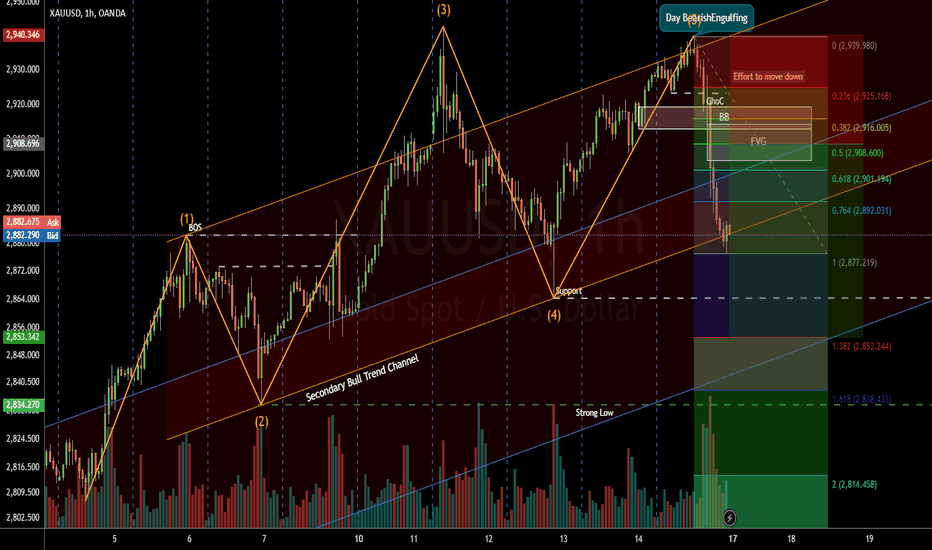

Daily chart of XAUUSD show a positive BOS And there are weekly BB, OB and FVG formed. The bullish momentum has not shown sign of weakness yet. Friday's bar showed a bearish pinbar after all time high near 2815. Bulls may look to buy near a retracement to 2770 and retest 2815 and then 2850

savvyacademy

On monthly chart XAUUSD recent price level rose up about 2 of the markup started in 2018. Volume on Oct 2024 is the highest and similar with Apr 2022. On weekly chart, the last bar appears to be a bearish since it has a long wick and closed near open. 2790 and 2640 are likely the current resistance and support levels. From daily chart The recent bearish engulfing may signify an upthrust formation. The next possible external liquidity maybe near 2628.

savvyacademy

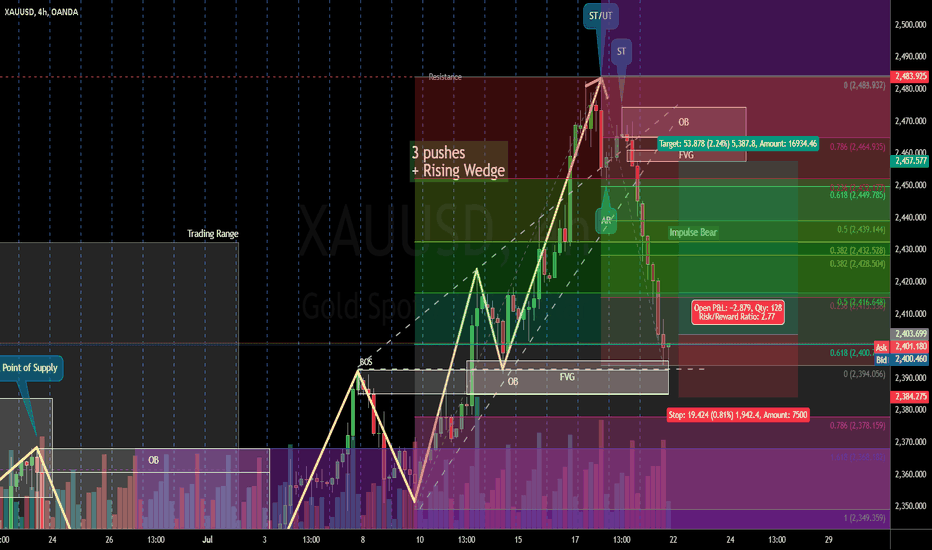

We have a good rally for gold and a recent impulse bearish move. On the 4 hourly chart, it seems a confluence of OB and FVG to suggest a bullish setup has been formed and a potential buy side liquidity is near the FVG at the top. Here we are biased that the underlying bullish trend is to continue and that the impulse bearish move is an opportunity for bullish re-entries.

savvyacademy

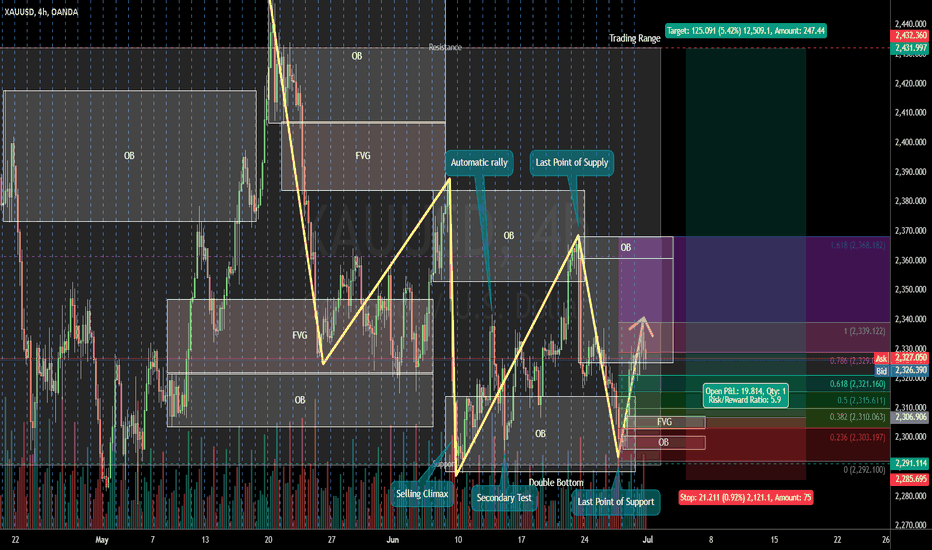

XAUUSD on daily chart seems to be in a trading range. On 4 hourly chart, a recent upthrust seem to have ended with a selling climax. Interpreting the current price action with Wyckoff schematic, there are last point of supply and last point of support and secondary tests. A double bottom seems to have formed. The possible buy setup could be near the recent 4 hour FVG, with TP1 near 2,370, TP2 near 2380 and TP3 near 2430

savvyacademy

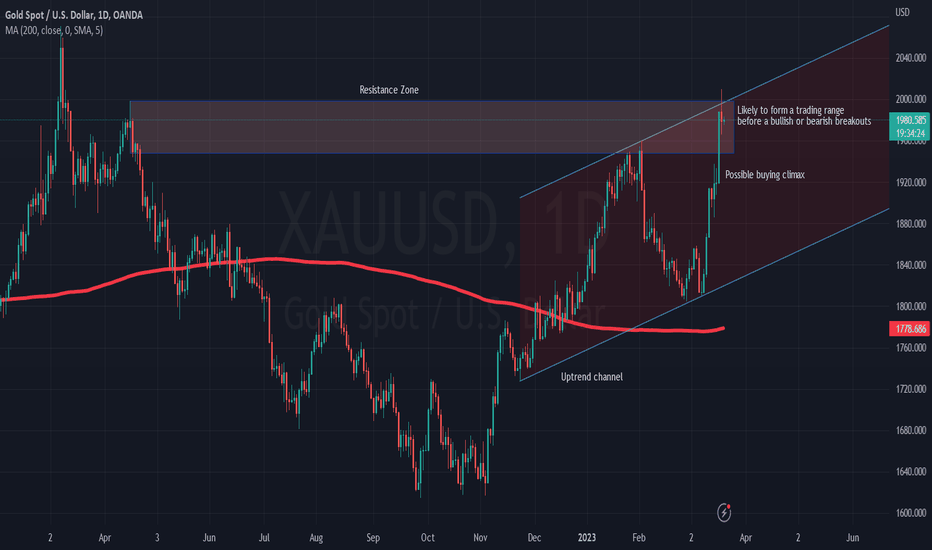

After hitting 2000 resistance,with the confluence of uptrend channel resistanceand last Friday's possible buying climax,it is highly that Gold will be consolidating for a time being beforedeciding a bullish or bearish breakout.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.