peterbokma

@t_peterbokma

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

peterbokma

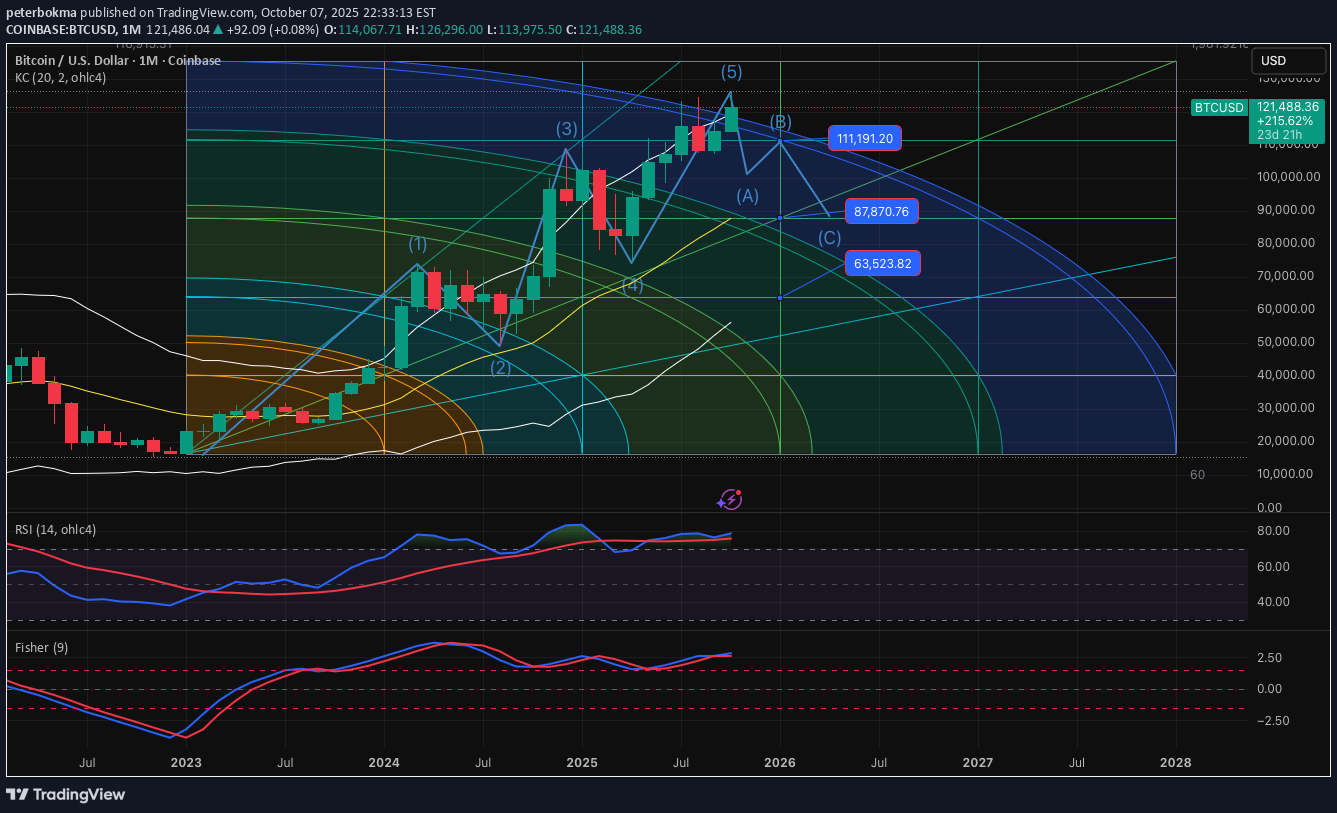

BTCUSD-BUY strategy weekly chart

Overall, we have downside bias, but short-term we should have recovery towards $ 102k. We are in a likely wave patter A which is ending near $ 102 k I suspect. Overall medium-term we should see test $ 87k again en route to $ 65k is my personal view.

peterbokma

پیشبینی سنگین بیت کوین: استراتژی فروش از 85 هزار دلار تا 55 هزار دلار!

It feels heavy to the downside, and indicators (especially the monthly chart) have turned negative. Even though there are plenty of arguments for higher levels over time, one cannot deny we have reached very oversaturated levels. The potential to test $ 55k is there medium-term. Strategy SELL @ $ 85k - 95k and take profit near $ 60k for now.

peterbokma

پیشبینی سقوط بیت کوین: استراتژی فروش طلایی بر اساس زوایای گن (BTCUSD)

I feel that we may see strong downward move coming months. It has been trying to maintain its heights, but the evening star and shape of GANN angle, I think the chances are there for a sharp decline. I suspect $ 80 - 62k potential. Strategy SELL @ $ 108-120 k and take profit initially @ $ 84k

peterbokma

طلا در اوج حباب؟ استراتژی فروش میانمدت برای سود در محدوده ۲۹۰۰ دلار!

GOLD is way overbought, and yes one can find reasons for the increase of value, but we should understand that the value is overdone. I feel strongly at a personal viewpoint, that a decline back towards $ 2,900 area is very possible. Strategy SELL medium-term between $ 4,000-4,350 (or add even when short since $ 3,800 is fine). Take profit between $ 2,900-3,100. also note I will be providing lesser updates, due to a lot of activities and managing funds, making it a little difficult to update regularly.

peterbokma

پیشبینی فروش بیت کوین در نمودار ماهانه: آیا اصلاح شدید در راه است؟ (استراتژی گن)

It has been impressive moves till now, and we hear clearly what the forecasts are, i..e. $ 500k by 2030 etc. Happy for those longs, if it does. Technically we are very overbought for a long-time now, and also the chances are for a solid correction is there. the GANN SQ surely suggest ther higher side still could be $ 130k or so, but the return level $87 k and $ 63 k seems very possible from a correction stand point of view. for the medium-term. Markets are very long adding to that, and if they start unloading in large quantities, moves down will be extremely sharp. Anyway, this is my personal view, and let's see what will happen next.

peterbokma

GOLD-SELL strategy Mon thly chart Reg. Channel

GOLD is remaining extremely overbought since $ 3,600 upwards. It's a longer term viewpoint, hence the movements short-term are not relevant when managing long term positions, and one should expect not being able to fish for the top :). anyway, the RSI is in uncharted waters, but history tells us that this correction will be imminent. I remain in the believe and holding onto shorts adding slowly, i.e. careful adding to shorts with low leverage for the awaited correction. Strategy SELL between $ 3,700-3,900 (and even lower before) and take profit near $ 2,950.

peterbokma

BTCUSD-SELL strategy Monthly chart Reg. Channel

it's manipulative investment, which means a turn around will be as swift as it's up-move we have been observing. For now, RSI shows negative divergence, and the reg.channel boundary is current $ 125 - 80 k. Lower down is $ 78 k support, and considering the overall view, the down side is possible based on over bought state, and also the likely turning of the indicators such as Fisher Form and MACD. Streategy SELL @ $ 110-120 k and take profit near $ 75-80 k.

peterbokma

GOLD-SELL strategy 3D chart BB

GOLD is still controlled by the bulls, but am very cautious about this, since we are very overbought and the correction towards $ 2,750 is very plausible, but not in short-term time frame though, is my personal viewpoint. Indicators are positive still but the market status warns we should take care on long side. Strategy SELL @ $ 3,625 - 3,675 and take profit near $ 2,975 for now.

peterbokma

GOLD-SELL srategy monthly chart reg. channel

The longer-term picture clearly shows we are overbought on the extreme side, and a major correction is imminent. However, short-term we are still positive, but for those that are able to trade medium-term to long-term, scaling in slowly on sell side may be a reasonable strategy to have. Strategy SELL between $ 3,500 - 3,800 and take profit near $ 2,850 for now. This should be carefully done with proper levering and scaling in, is my personal viewpoint.

peterbokma

ETHUSD-SELL stratregy 6 hourly chart GANN

It has some short-term upside and I feel we may get to $ 4,750 before we will move south again. Overall, I think it may test $ 3,750. Strategy SELL @ $ 4,650 - 4,800 and take profit near $ 3,850 for now.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.