origami_capital33

@t_origami_capital33

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

origami_capital33

RSRUSDT – Clear Long After Liquidity Sweep

Sell-side liquidity has been fully cleared and price is now reacting strongly from demand. This move looks like stop-hunt → displacement → reversal, not continuation lower. • Bias: Long • Structure: Sell-side sweep + stabilization • Price holding above local demand • Expectation: Mean reversion into premium Entry zone: 0.00255 – 0.00260 Invalidation: Clean close below 0.00250 Targets: 0.00285 0.00320 0.00415 (range high / liquidity) As long as price holds above the sweep low, longs remain favored. Looking for continuation toward unfilled liquidity overhead. — Not financial advice. Trade responsibly.

origami_capital33

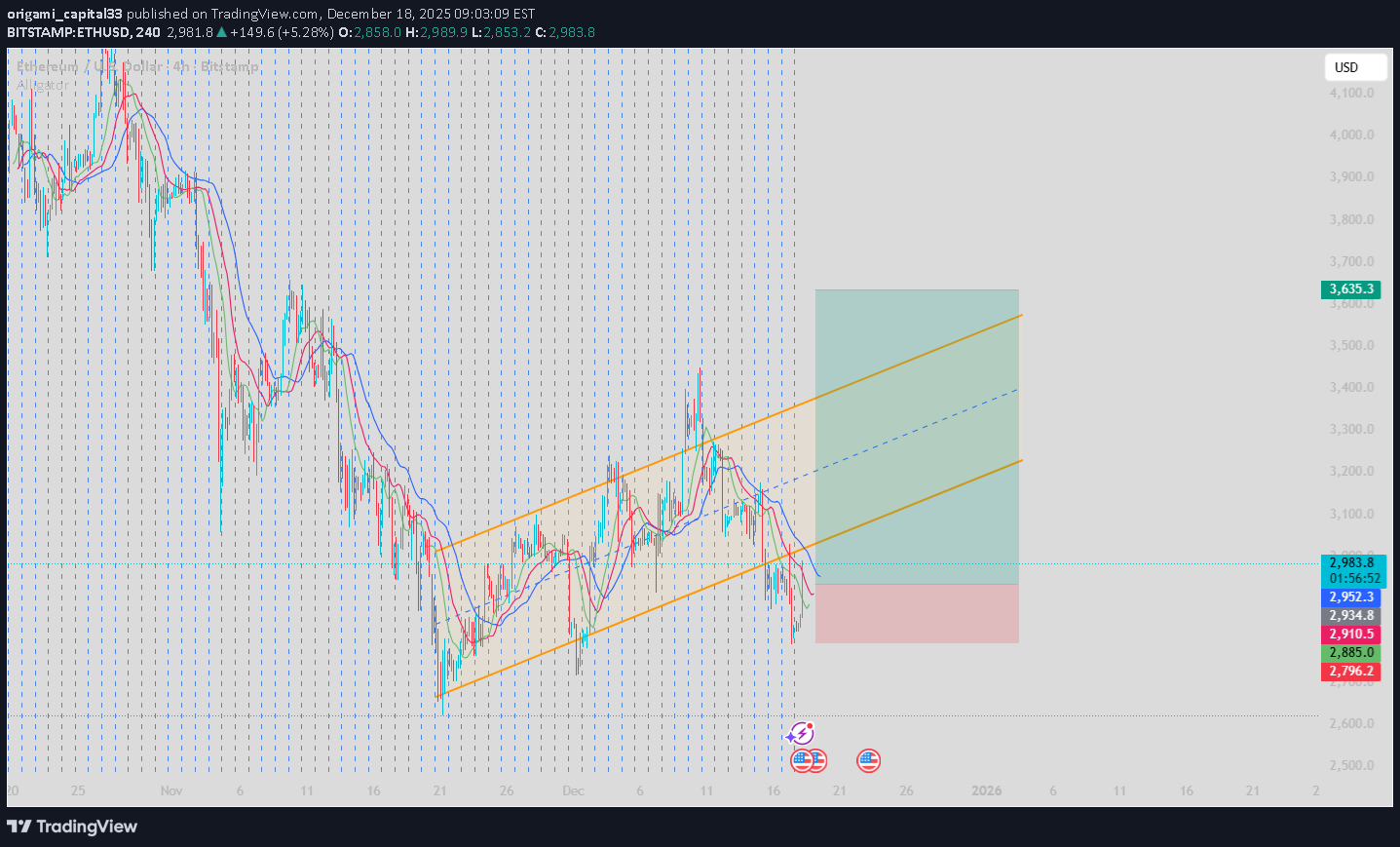

ETHUSD – Long Setup After Liquidity Clear

Price has swept sell-side liquidity near the channel support and is now attempting to reclaim structure. Reaction from the lower boundary suggests buyers defending the zone. • Bias: Long (conditional) • Structure: Higher-low attempt after liquidity grab • Channel support respected • Alligator EMAs compressing → potential bullish expansion Invalidation: Daily close below 2,880 – 2,900 zone Targets: 3,100 3,300 3,635 (channel top / main objective) As long as price holds above the sweep low, I’ll continue to look for long continuations. Failure to reclaim structure flips bias neutral.

origami_capital33

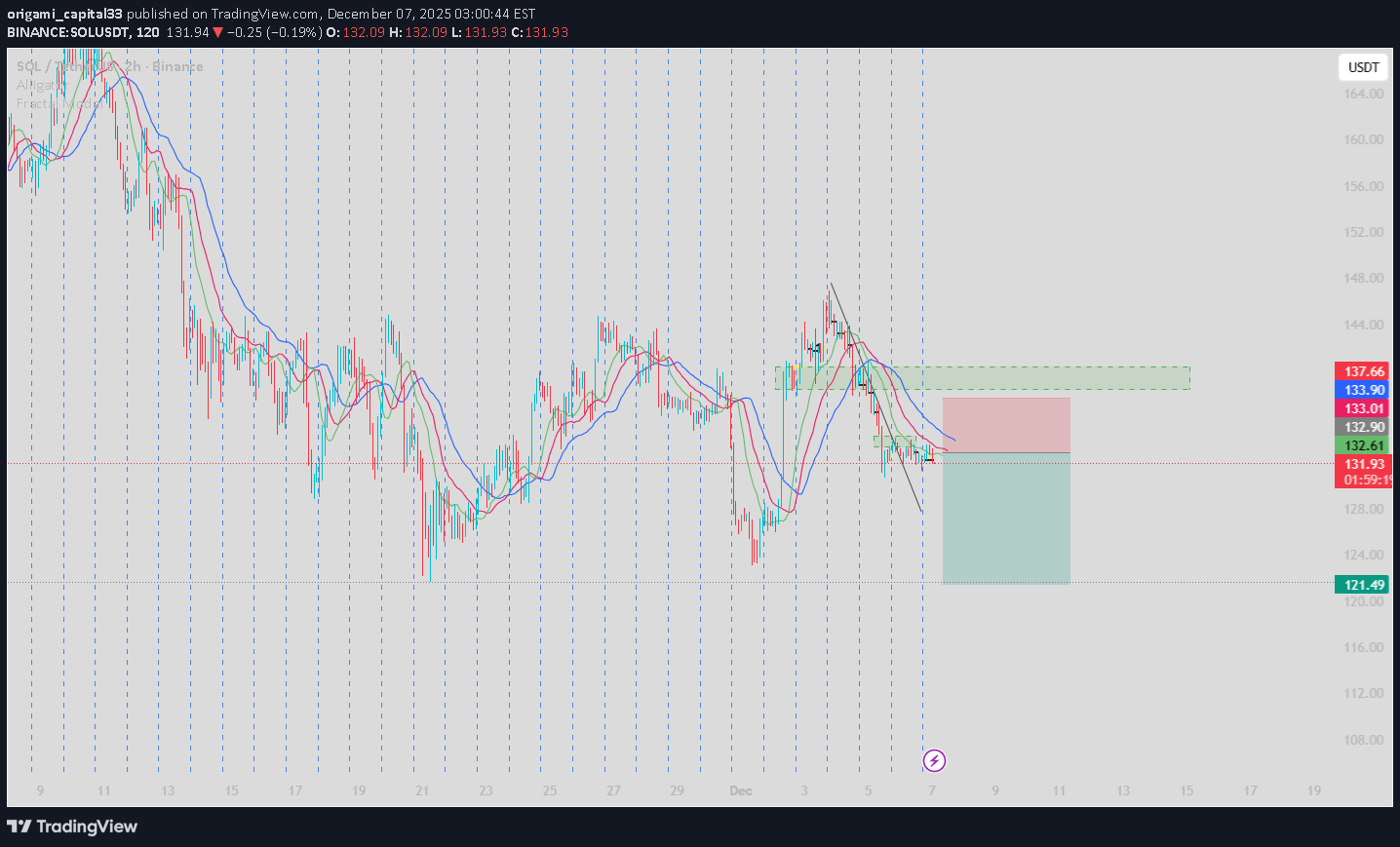

SOLUSDT – Long Setup Activated

Price has cleared liquidity to the downside and is now showing signs of acceptance above support. Sell-side taken → looking for continuation to the upside. • Bias: Long • Liquidity sweep completed • Holding above key support • Alligator EMAs starting to compress → potential expansion up Invalidation: Clean breakdown and close below 121.0 Targets: 132.0 138.5 145.8 (major objective) As long as price holds above the sweep low, dips are viewed as buy-the-dip opportunities.

origami_capital33

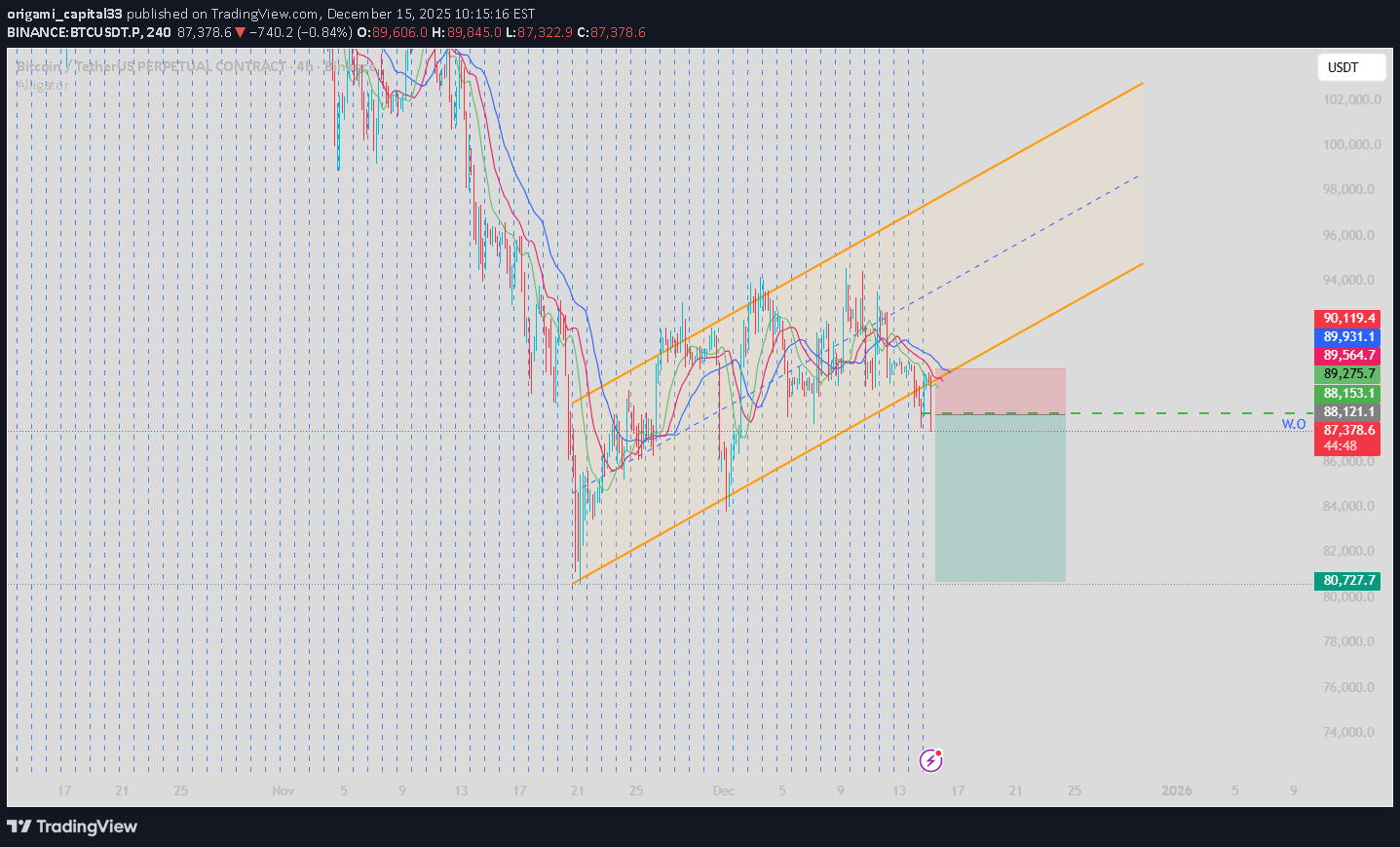

BTCUSDT – Bearish Continuation After Channel Distribution

Price completed a corrective move inside an ascending channel after the impulsive selloff. We’ve now rejected the upper structure and rolled over back below the EMA cluster, signaling trend continuation to the downside. The rising channel acted as a bearish retracement, not a trend reversal. Trade Plan (Short): • Entry: 88,100 – 88,500 (rejection zone) • Invalidation: Clean break & close above 90,100 • Targets: 1) 85,500 2) 83,000 3) 80,700 (main objective) Confluence: ✔ Bearish market structure ✔ EMA resistance ✔ Channel breakdown ✔ Weak follow-through from buyers As long as price remains below channel resistance and EMAs, shorts are favored. Expect continuation once liquidity above the red zone is fully mitigated.

origami_capital33

BTCUSDT.P – Bullish Reversal Targeting Key Highs

Price has swept the recent low near 89,934, triggering a sell-side liquidity grab and creating a Fair Value Gap (FVG) in the discount zone. This setup offers a high-probability long entry targeting the major swing highs from the previous structure. • Direction: Long • Entry Zone: 90,000 – 90,200 (Reaction within the FVG & mitigated sweep zone) • Stop Loss: 89,600 (Below the swept low) • Take Profit 1: 97,000 (Key previous high & major liquidity zone) • Take Profit 2: 100,500 (Major swing high / equal legs expansion) • Take Profit 3: 102,000 – 104,000 (HTF extension & liquidity target) • R/R: Exceptional – Tight stop below sweep, aiming for significant higher-timeframe targets. Key ICT/SMC Observations: Liquidity Sweep Complete: Sell-side cleared below 89,934. FVG & Order Block: Zone 90,000–90,200 provides premium entry. Break of Structure: Awaiting move above 90,345 for confirmation. Target Alignment: TP1 at 97,000 (previous high), TP2 at 100,500 (major swing), TP3 for full range expansion. Bias is bullish while price holds above the swept low. Entry within the FVG targets a move back into the range, first toward 97,000, then 100,500+.

origami_capital33

کفنشینی RSR: آیا بزرگترین برگشت قیمتی در راه است؟ (تحلیل پُرریسک/پاداش)

rsr is consolidating at a significant weekly support level after a prolonged downtrend. This zone, around 0.00326–0.00328, has acted as both a previous resistance and now a defended support, indicating potential seller exhaustion. If buyers step in here, this could form a major reversal base for a long setup. • Direction: Long (Conditional on bullish confirmation) • Entry Zone: 0.00326 – 0.00328 (on a bullish reversal candle or break above consolidation high) • Stop Loss: 0.00305 (below the recent swing low and weekly support) • Target: 0.00360 – 0.00380 -0.00480(previous consolidation zone / HTF resistance) • R/R: High‑quality mean reversion setup – well‑defined risk below key support, clear first target toward equilibrium. Key ICT/SMC Observations: Price is consolidating at a major weekly support level, showing decreased selling momentum. Liquidity likely swept below 0.00326 on recent wicks, trapping sellers. A break above 0.00330 would confirm a short‑term market structure shift. The Fair Value Gap from any bullish displacement will provide the optimal ent

origami_capital33

خرید اتریوم: بهترین نقطه ورود برای جهش بزرگ تا ۳۴۰۰ دلار!

Price has completed a textbook bullish market structure shift (MSS) after sweeping significant sell‑side liquidity below the $3,069 level. Following the displacement, price is now in a pullback phase, retesting the newly formed support zone and Fair Value Gap (FVG). This is a high‑quality ICT long setup for continuation toward the recent swing highs. • Direction: Long • Entry Zone: 3,135 – 3,145 (retest of FVG support & previous resistance turned support) • Stop Loss: 3,049 (below the swept low and bullish order block) • Target: 3,400 (previous high + equal legs projection / HTF liquidity pool) • R/R: High‑quality expansion setup – risk is well‑defined below the liquidity sweep, reward offers a clear path to the next major liquidity zone. Key ICT/SMC Observations: Clear sell‑side liquidity sweep below $3,069 followed by a strong displacement candle. Bullish Market Structure Shift (MSS) confirmed with a higher high and higher low. Price is now retracing into the Fair Value Gap (FVG) created during the initial rally, offering a premium entry. The 3,135–3,145 zone now acts as a support confluence (FVG + previous resistance). Bias remains bullish above the swept low. A reaction from the 3,135–3,145 support zone will signal buyers are in control, targeting the 3,400 liquidity area for the next leg up. Trade at your own risk. Manage size and always use a stop.

origami_capital33

تحلیل SOL/USDT: فرصت خرید طلایی پس از خستگی فروشندگان (آماده جهش به ۱۵۶)

Price swept the lows and is now stabilizing below structure, showing early signs of seller exhaustion. If buyers reclaim momentum, this becomes a clean continuation-reversal long setup. • Direction: Long • Entry Zone: 132.40 – 133.00 • Stop Loss: 127.99 • Target: 156.13 • R/R: High-quality expansion setup if price pushes back above the EMAs Bias remains bullish as long as price holds above the recent liquidity sweep and does not break back below 128. Watching for a clean break and close above the short-term EMA cluster to confirm the move.

origami_capital33

پیشبینی سقوط بیت کوین: آیا فرصت فروش (شورت) همچنان معتبر است؟

BTCUSDT – Short Position Still Valid Price continues to respect the bearish structure after the reversal. We rejected the mitigation zone and stayed below the Alligator EMAs, confirming continuation. • Short remains active • Invalidation: Any 2H close above 89,632 – 89,892 • Structure: Lower highs + compression under resistance • Expectation: Continuation lower after wedge breakdown Targets: 1. 88,900 2. 87,700 3. 82,160 (main objective) Still watching for a possible stop-hunt into the red zone, but bias remains bearish unless invalidated.

origami_capital33

سقوط قریبالوقوع سولانا (SOL): بهترین نقطه ورود شورت با تأیید اندیکاتور آلیگیتور!

SOL failed to break structure to the upside and instead delivered a clean retracement into premium, rejecting right at the supply zone + Alligator alignment. This is classic continuation orderflow. 1️⃣ Premium Retracement Complete Price traded up into the bearish supply block (green zone) aligned with the Alligator’s sell bias (bearish mouth formation). Smart money sells inside this region → displacement follows. 2️⃣ Lower-Timeframe Breakdown Confirmed A clean bearish break and retest formed after the tap: • Trendline break • Shift in micro-structure • Weak reaction back down → showing no bullish strength All confirm continuation lower. 3️⃣ Targets Below Remain Untouched The next draw on liquidity sits at the 121.49 inefficiency/untapped zone. Trade Idea – Short Entry: 🔴 132.8 – 133.5 (supply zone retest) Stop Loss: ⛔ 137.66 (above the supply block & invalidation) Targets: 🎯 TP1: 127.00 🎯 TP2: 121.49 (main liquidity draw) Model: ⚡ Bearish Continuation after Premium Retracement Alligator confirmation Supply rejection Trendline break → retest

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.