nohypetrader

@t_nohypetrader

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

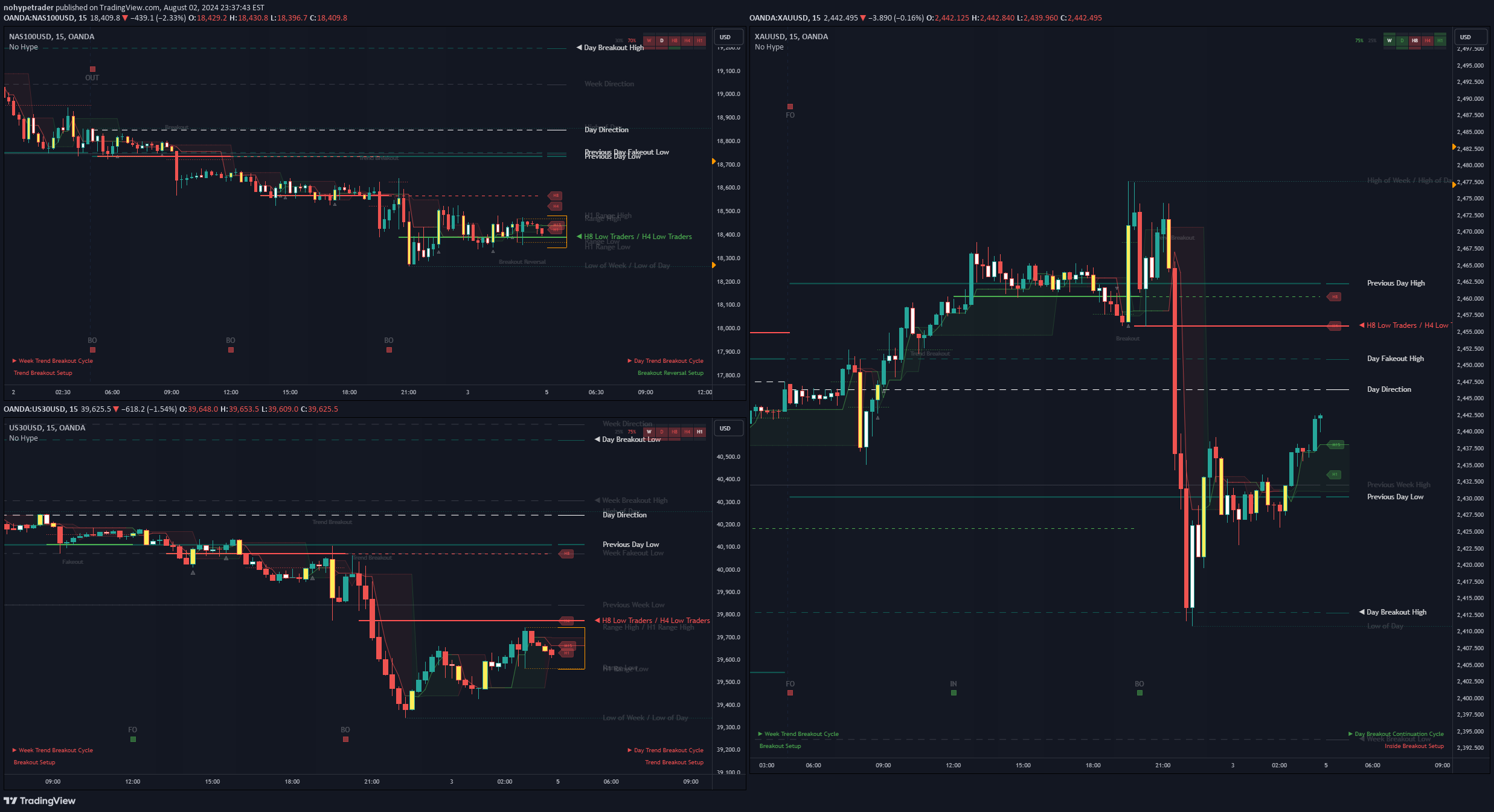

Taking advantage of the fractal nature of the markets by scalping my Momentum Theory mechanical setups on the 1 second chart and holding them to Daily levels. This is a New York session trade taken LIVE and shows my thought process every step of the way. I didn't take any losses on this one, but I usually would expect 2-3 losses before hitting the right entry. Because of this, whenever I'm scalping the seconds charts I risk very small (0.03% per position) and size in to the trade at specific intervals as it continues in my direction. In my opinion, it's really important to hold these types of trades for longer durations than traditional scalping. Traditional scalping advice is to aim for 1 - 2R, hold for a short duration, and aim for a high winrate. I pretty much recommend the exact opposite advice. Banking in 75R on this trade basically means I can lose the next 75 trades I take and still be at BE. If you follow my mechanical style of trading, you know there's a higher chance of me hitting another 75R trade than losing 75 in a row. When I string a few of these in a row, trading becomes completely emotion-free and a purely process-driven endeavor. On to the next!

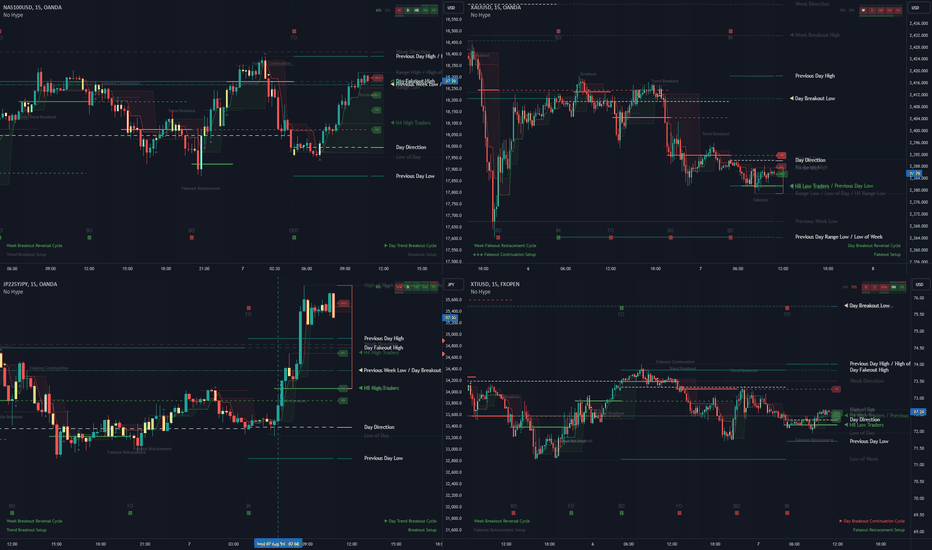

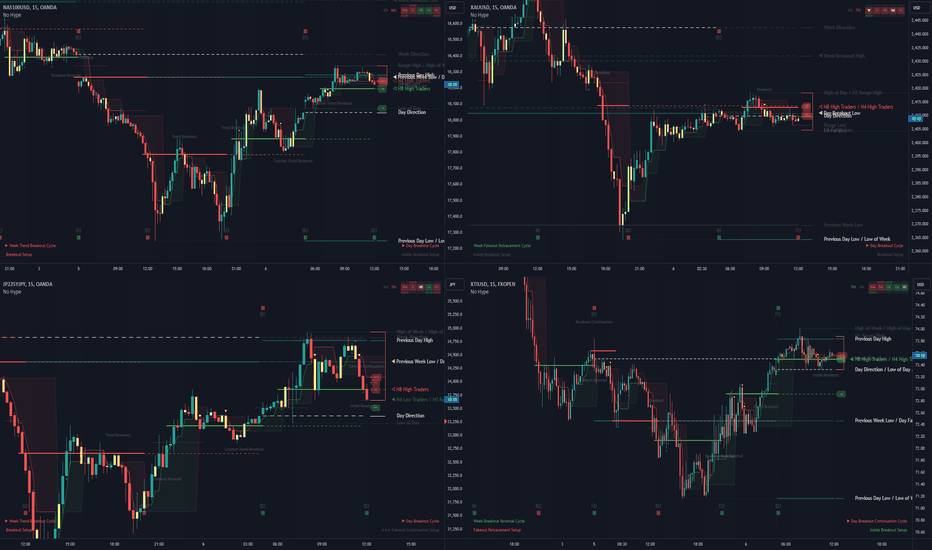

A live recorded walk through of my trading process during Asia Session. Took 1 setup on Gold and I go over my entire thought-process as I took it. There were some risks taking this trade, mainly being stuck in an H8 range and faking out a Monthly range, but I accepted that risk by taking scalp-level entries to increase my risk-to-reward ratio.

Gold Breakout Reversal Setup Gold Breakout Setup NAS100 Breakout Reversal Setup NAS100 Fakeout Retracement Setup US30 Breakout Setup

GBPAUD Trend Retracement Setup GBPAUD Weekly Counter-Trend Breakout Cycle

NAS100 Breakout Setup (L) JP225 Trend Retracement Setup XAGUSD Trend Retracement Setup

Gold Breakout Setup US30 Breakout Setup Took 2 trades in New York session

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.