mr16kprime

@t_mr16kprime

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

Elliott Wave count on Litecoin shows that the market is unfolding within a larger bullish structure. A clear five-wave impulse (1–5) is developing, with waves 1, 2, and 3 already labeled. Wave 3 peaked around the $132–$143 region, which aligns with common Fibonacci extension levels. Following this strong rally, the market has entered a corrective phase for wave 4. The red circle highlights the current price action, suggesting the start of a pullback. The expected retracement zone for wave 4 lies near $104–$107, which coincides with prior support and the 200 EMA. If price respects this zone and holds above it, a powerful fifth wave could emerge, driving Litecoin towards the $140–$150 region and potentially higher. On the bearish side, if price breaks significantly below $103 and moves deeper, then the correction could extend further, possibly towards the $85–$90 area before resuming higher. The bull confirmation level is set at $140.92 — if broken, it would signal strong continuation to the upside. Overall, the structure remains bullish, with the current dip appearing as a corrective opportunity rather than a trend reversal.

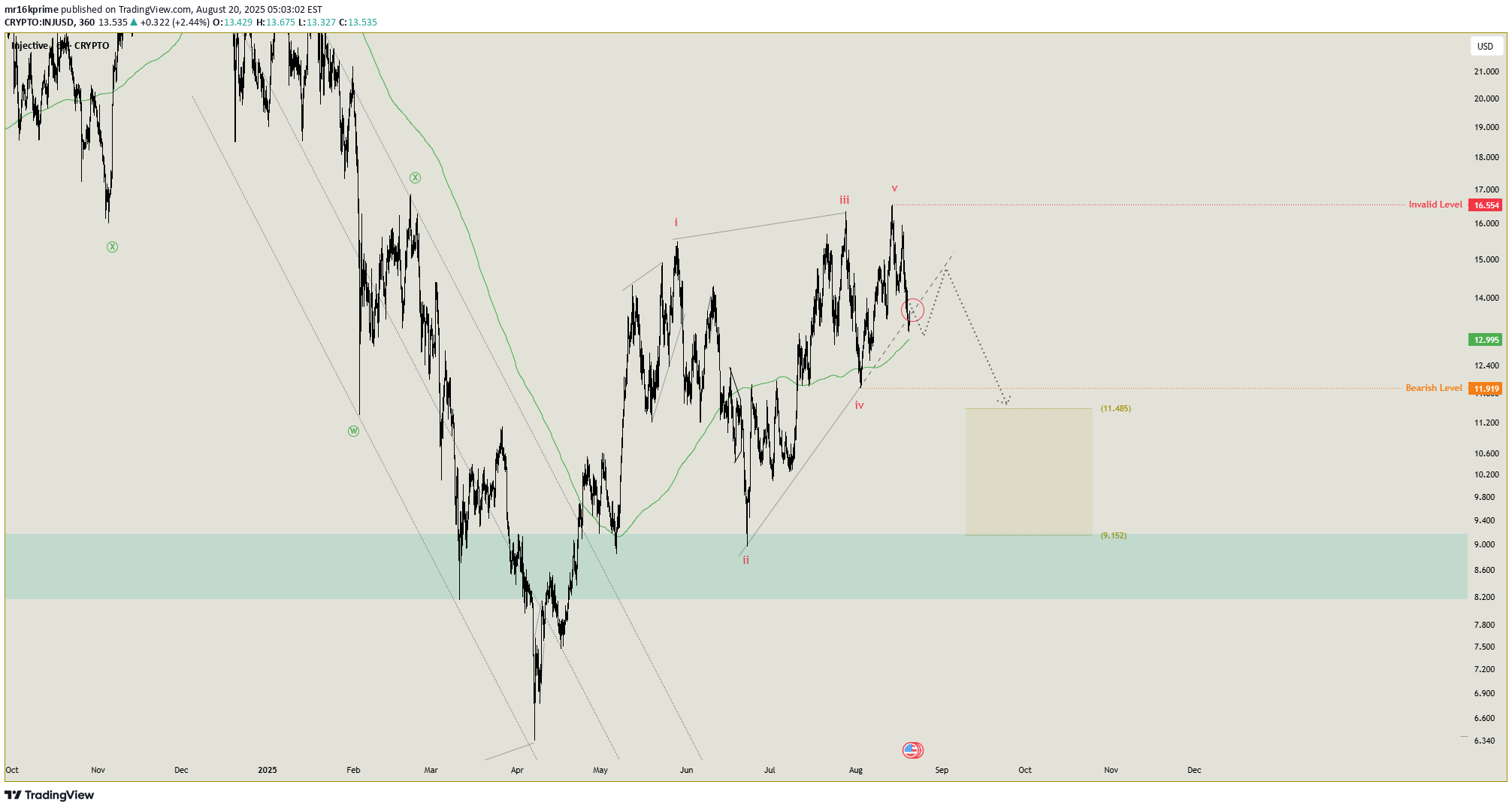

INJ Elliott Wave count shows that a five-wave impulse structure (i–v) has been completed to the upside. Wave i and iii developed strongly, with wave iii being the extended leg, and wave v marking the final push higher. After this completion, the market is now likely entering a corrective phase, forming an A–B–C pattern. The invalidation level is marked at $16.954 — if price breaks above this level, the bearish outlook would be invalidated and a different wave count would be required. On the downside, a break below the $11.919 bearish level would confirm the start of a deeper correction. Based on Fibonacci retracement zones, the corrective target area is projected between $11.485 and $9.152. This suggests that while the uptrend has shown strength, the immediate expectation is for a corrective decline before any potential resumption of trend.

ETH have a 2 scenarios 1 flat correction 2 motive wave up trend we need conform this is a flat of motive

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.