michiotakeshi9

@t_michiotakeshi9

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

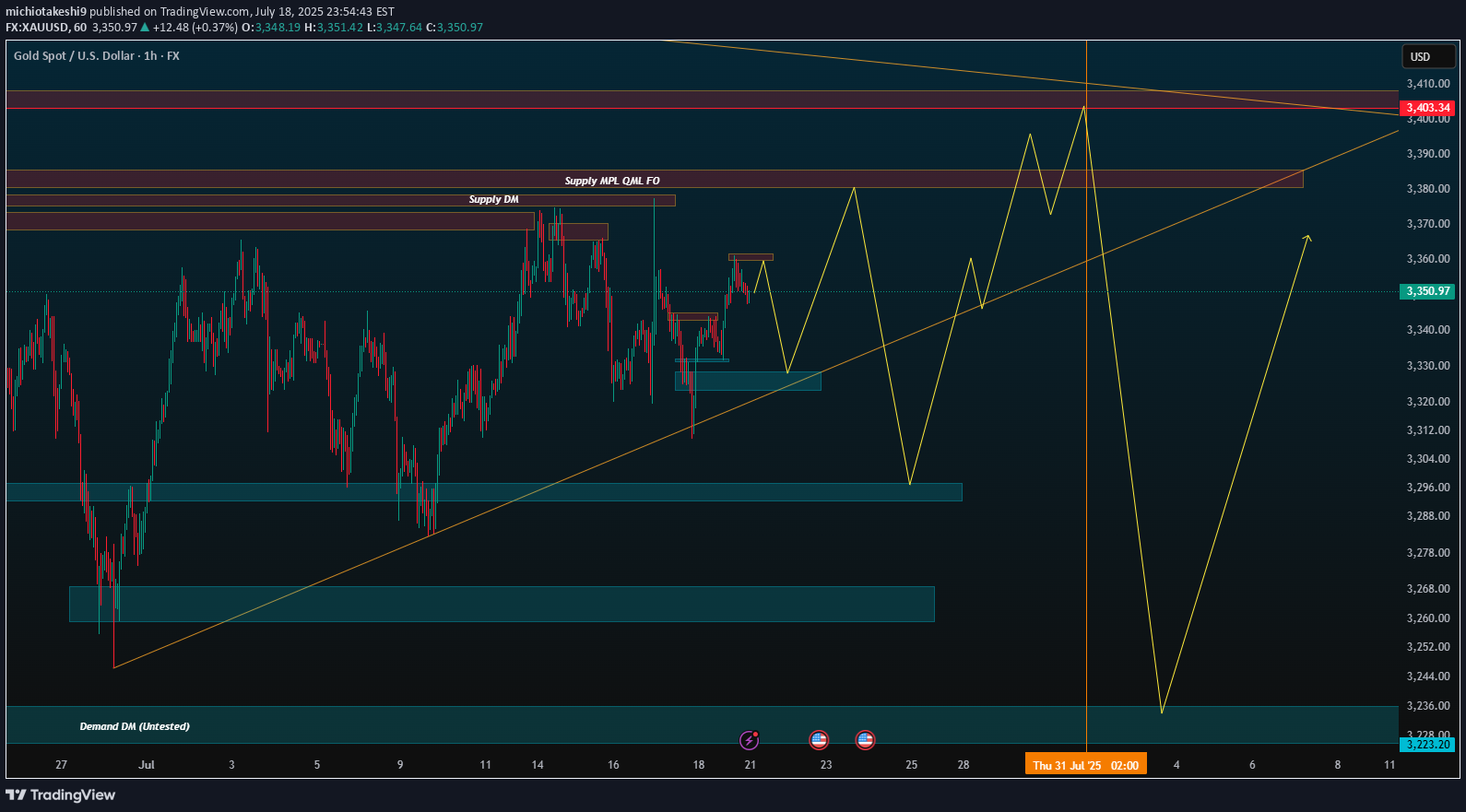

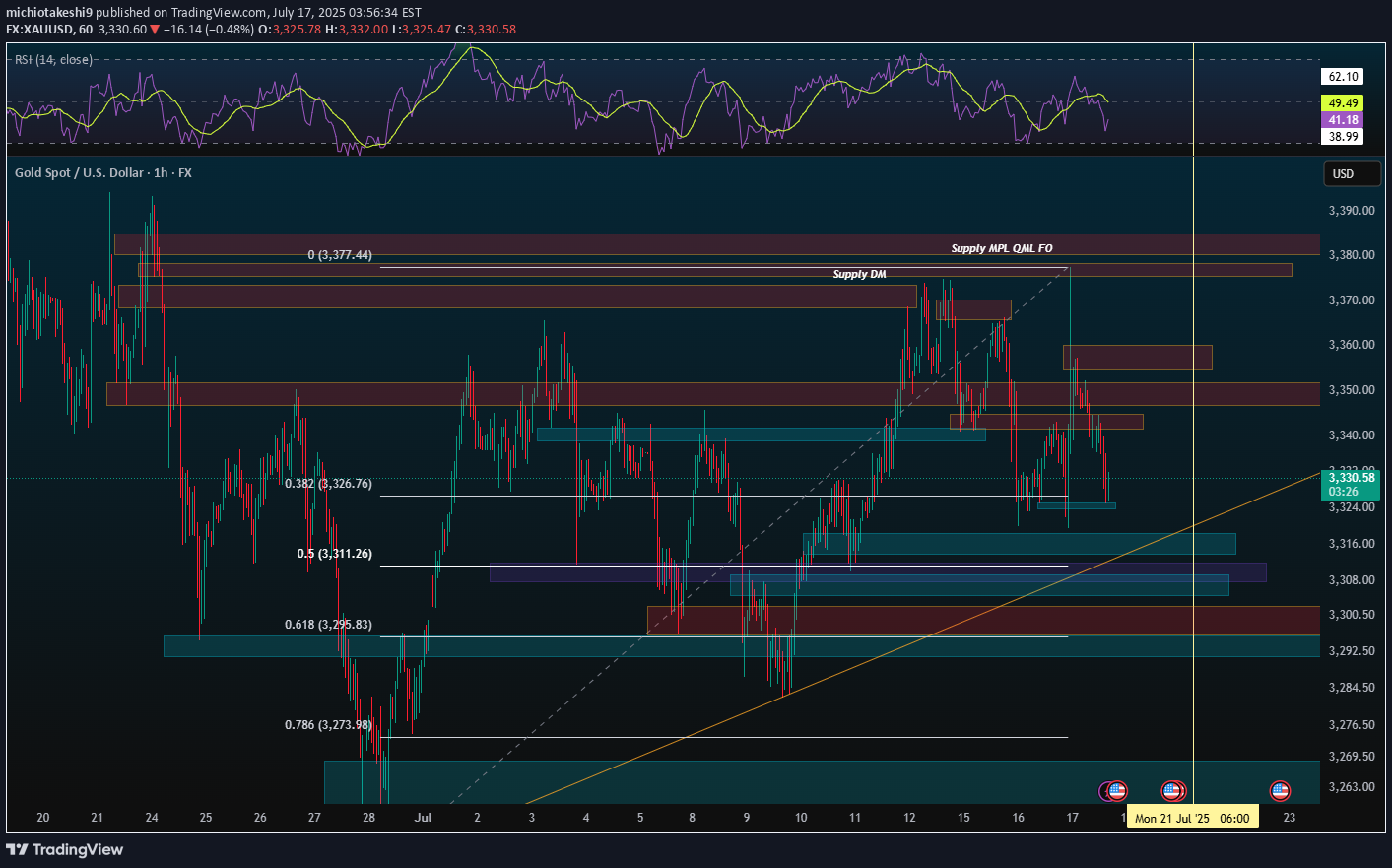

Today I explain the update of my position and some of the signs of another waterfall.meh~ the sniper entry gave only 50 pips, good enough for a scalperNo retracement whatsoever. This may just come to the lowstook some buy profits and sold at 3359. aiming to TP and buy at 3351.33 again.

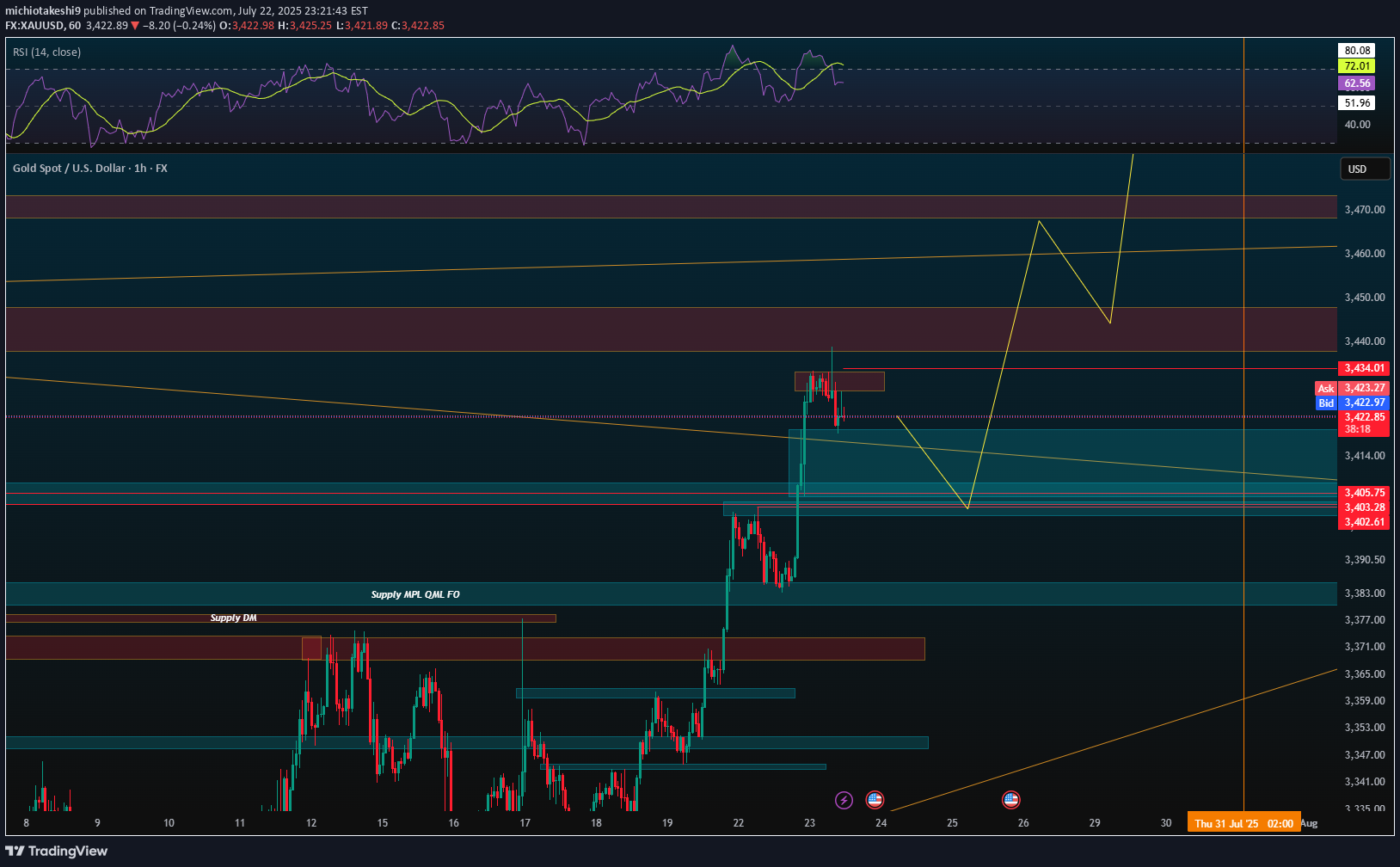

Hey guys today is looking pretty good for us. My swing sell has gone more than 600 pips and my buy is also looking pretty good. let's see how it goes from here. I will update in the notes if I found anything.I think it's pretty safe to put our 3352.2 buys SL to breakeven now.If tomorrow (friday) breaks the swing high at 3438 yesterday then next week will most probably be another green candle. (I can't be certain cause we will have JOLTS, FOMC and NFP at the same week, which will be very unpredictable for intradays, be careful)

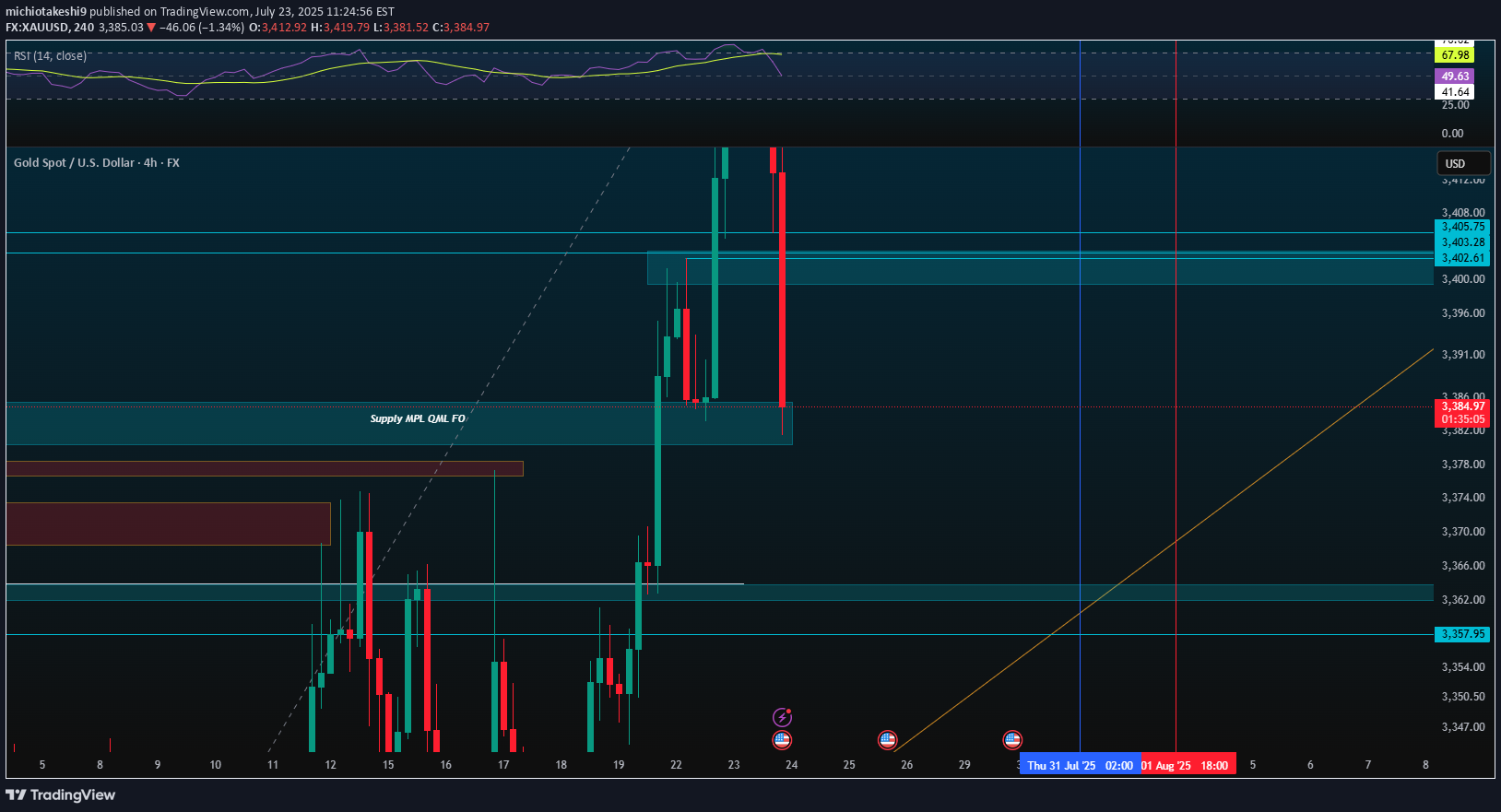

Hey guys this is an important update of the overall trend and I am more excited from this drop than ever. We could have the best opportunity to buy gold soon! Thank you.The sell level is 3401.40. (demand turned into supply). SL 50 pips .TP 370 pips or higher Buy level 3363.72. SL 20 pips. TP 370 pips or higherI also noticed the price levels may differ a little bit depending on your broker. if the entry is too sniper then the price may or may not hit from the price I've given, so adjust accordingly. (selling a bit lower than my entry or buying a bit higher than my entry)

Hello guys today I update the gold price action analysis, some parts of my journey and plan, and how we must prepare for every scenario that would come. Thankyou for watchingWell well well, sell profit almost 300 pips in a bullish trend. where can you get this? hahai will only close my sell half at 3404. to hedge against the buyDid you guys mark the resistance levels that turned support? if u bought again today at the same level it would've been sniper entry.

Here I explain analysis for the small TF of the upcoming week. Thanks.there is another zone at 3363.24. it may or may not work, but certainly not my place to swing.my bad, to be precise, the zone is 3368. if you sell at 3363 then SL is gonna be pretty big (100 pips)

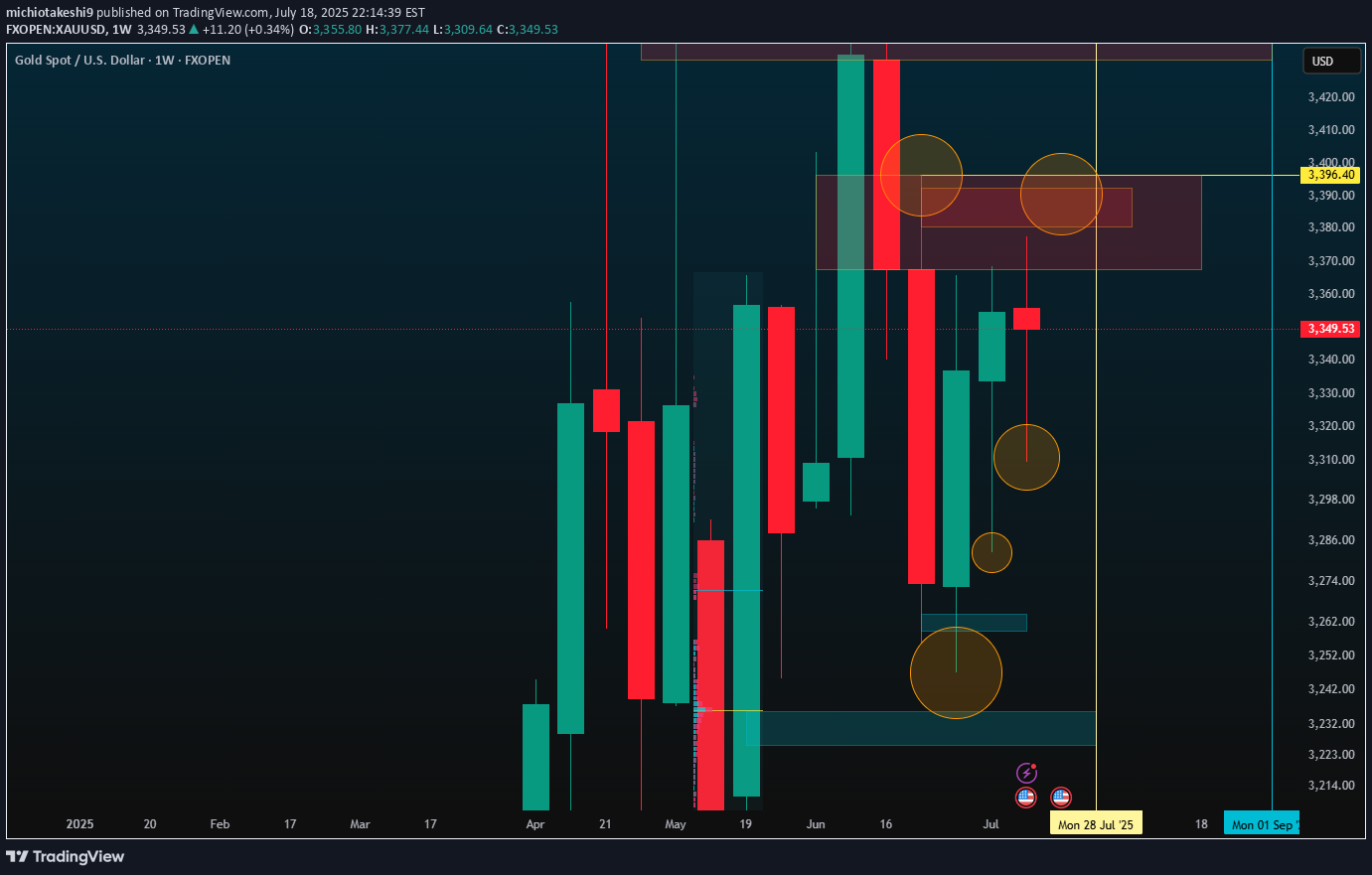

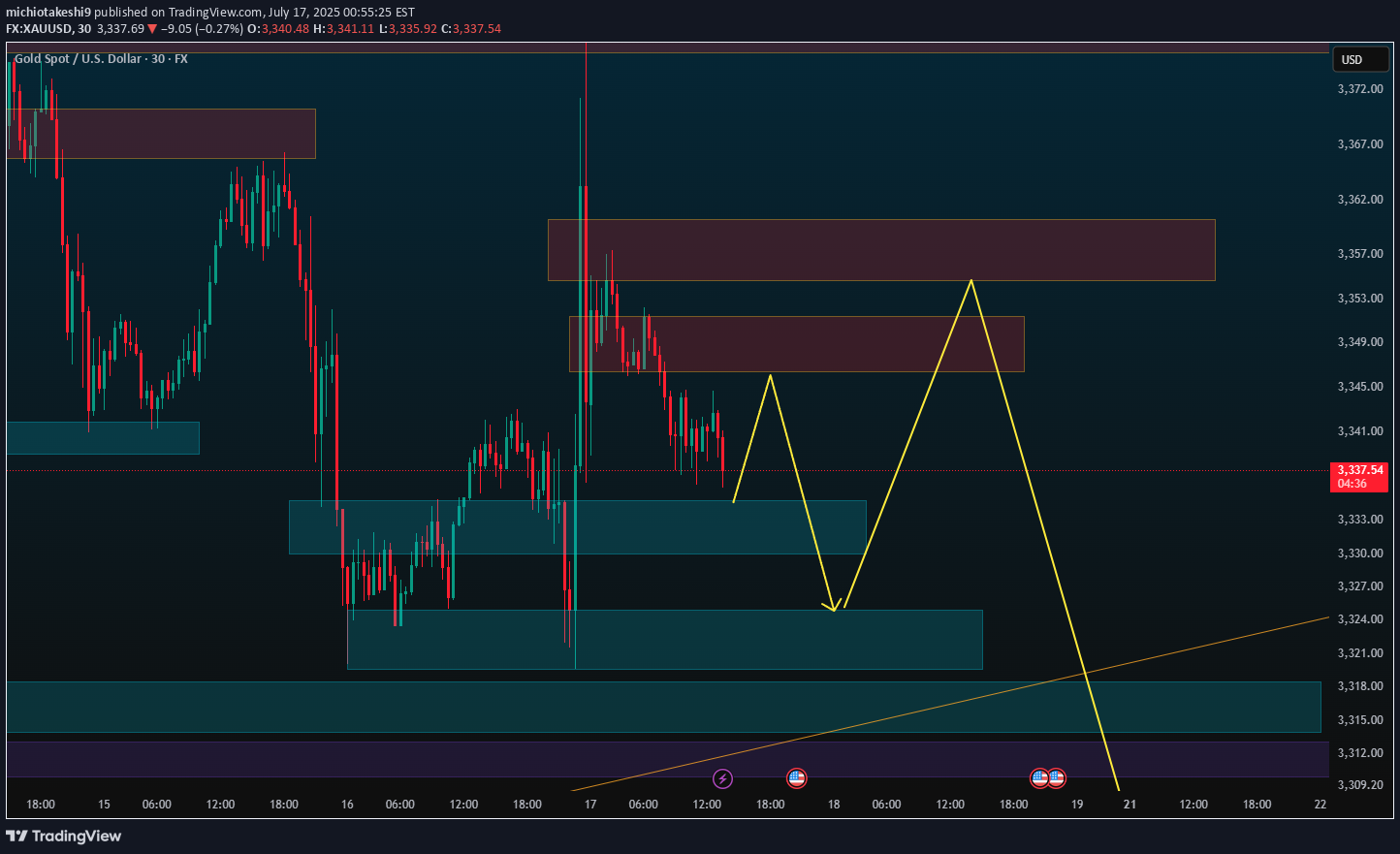

This is just pure speculation projection I made. Just ignore, I wanna save this and compare before and after next month.

Here I explain the weekly and market structure for the week. Thanks for watching.

Hope you benefit from this sharing. Goodluck to all.If the m30 candle close inside the zone, it will be a clear sign of invalidation. let's seewhat I meant to say was, cutting loss or exit at break even is an option if m30 closed inside the zone. because 1H timeframe should be a rejection, if there's no rejection, there's no reason to hold.cut loss. out out out hahaha. this ain't going down. I'll post another new structure before next week.there is another zone at 3354.69. But personally I wouldn't try to sell anymore as the 2H volume seems quite high. we're close to weekly closure.if there is a place that I'd sell, I would sell at 3380.50. that's all.

Here I explain something I forgot to mention in my previous video.

Hello traders here is my post CPI analysis. Thankyou very much, I shall update from time to time in the notes.Nope. selling pressure is still so high, not recommended to buyit went a little deep but still a good buy regardless

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.