masterthemarkets2010

@t_masterthemarkets2010

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

masterthemarkets2010

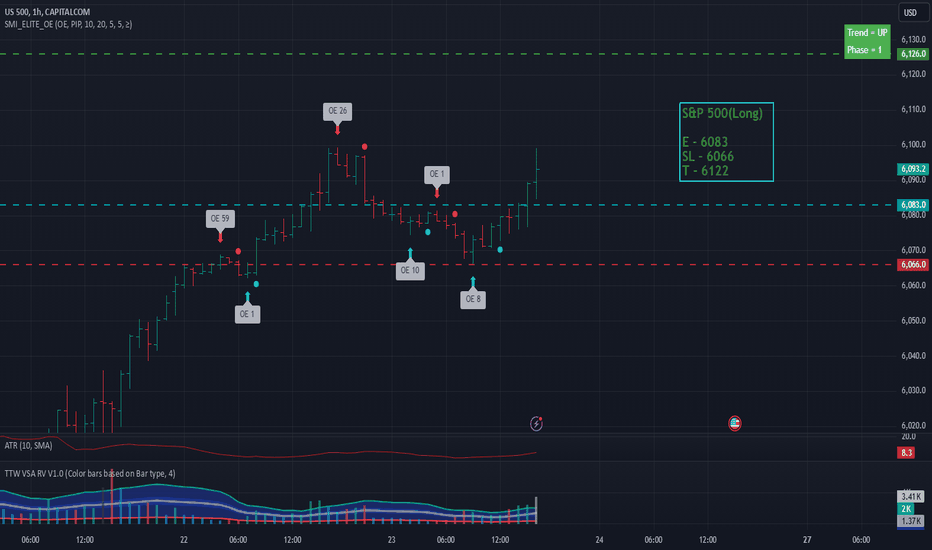

Potential trade setup on S&P 500

We are looking at a long trade on S&P 500 based on the stretch strategy. There is trend,stretch and direction alignment with this trade on both 1h and Daily TF. Early entry was taken on swing high breakout on 1h for a trend change. There is a high probability for range,previous daily high and range to be formed to the upside. We will exit the trade once range has been achieved. Trader Order Details: S&P 500(Long) E - 6083 SL - 6066 T - 6122 We will be tracking this move and updating the post as we go along on the charts and on video. Keep a look out for it traders.Trailing stop to 6089Towards close of trading day. Exit position

masterthemarkets2010

Live Trading Session 262: Open trade on ETH,EUR and more

In this live trading session video,we look at our open positions on Etherum,EURUSD,closed positions on BRTUSD for nice decent profit, potential trades coming on Bitcoin,S&P, etc and the thinking behind them. The concepts you learn from this video are cross transferrable principles onto any strategy.

masterthemarkets2010

Live Trading Session 259: Positions on GBP,BRT and more

In this live trading session video,we look at our positions on BRENT and GBPUSD and potential trades coming on Bitcoin,Etherum,US30, etc and the thinking behind them. The concepts you learn from this video are cross transferrable principles onto any strategy.

masterthemarkets2010

Live Trading Session 257: Potential & open positions on GBP,etc

In this live trading session video,we look at current live, open and closed positions on BRENT and GBPUSD and potential trades coming on Bitcoin,Etherum,US30, etc and the thinking behind them. We also look at how we are doing on our live 100k traders challenge account.

masterthemarkets2010

Live stream - Hold or dump - JPY and Silver live trades

In this live trading video,we are looking at the open live positions on USDJPY,EURJPY and Silver and analysing whether we should hold or dump them and the reasoning behind it.

masterthemarkets2010

Live Trading Session 251: Open position on Brent & more

In this live trading session video,we look at current live open positions on brent and potential trades coming on GBP,EUR,Bitcoin,US30, etc and the thinking behind them.

masterthemarkets2010

Live stream - 80% OE Case Study(SC Practical): Optimization(Part

In this video, we look at the final step where we will be looking at optimization and when and how you should optimize your strategy.

masterthemarkets2010

Live stream - 80% OE Case Study(SC Practical): Fwd Testing(Part

In this video, we look at step 4/5 where we will be looking at forward testing and what are the things you should be monitoring in real time.

masterthemarkets2010

Live stream - 80% OE Case Study(SC Practical): Stats Review & In

In this video, we look at step 3/5 where we will be reviewing the stats of the different variations we tested and how we can infer from the results to decide on the final version of the strategy.

masterthemarkets2010

Live stream - 80% OE Case Study(SC Practical): Testing Diffn Var

In this video, we look at step 2/5 where we will be exploring on how to test the strategy based on different variations. The insight here is invaluable and comes from our 15 years of research. and over 38 years of cumulative trading experience.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.