leeada2016

@t_leeada2016

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

leeada2016

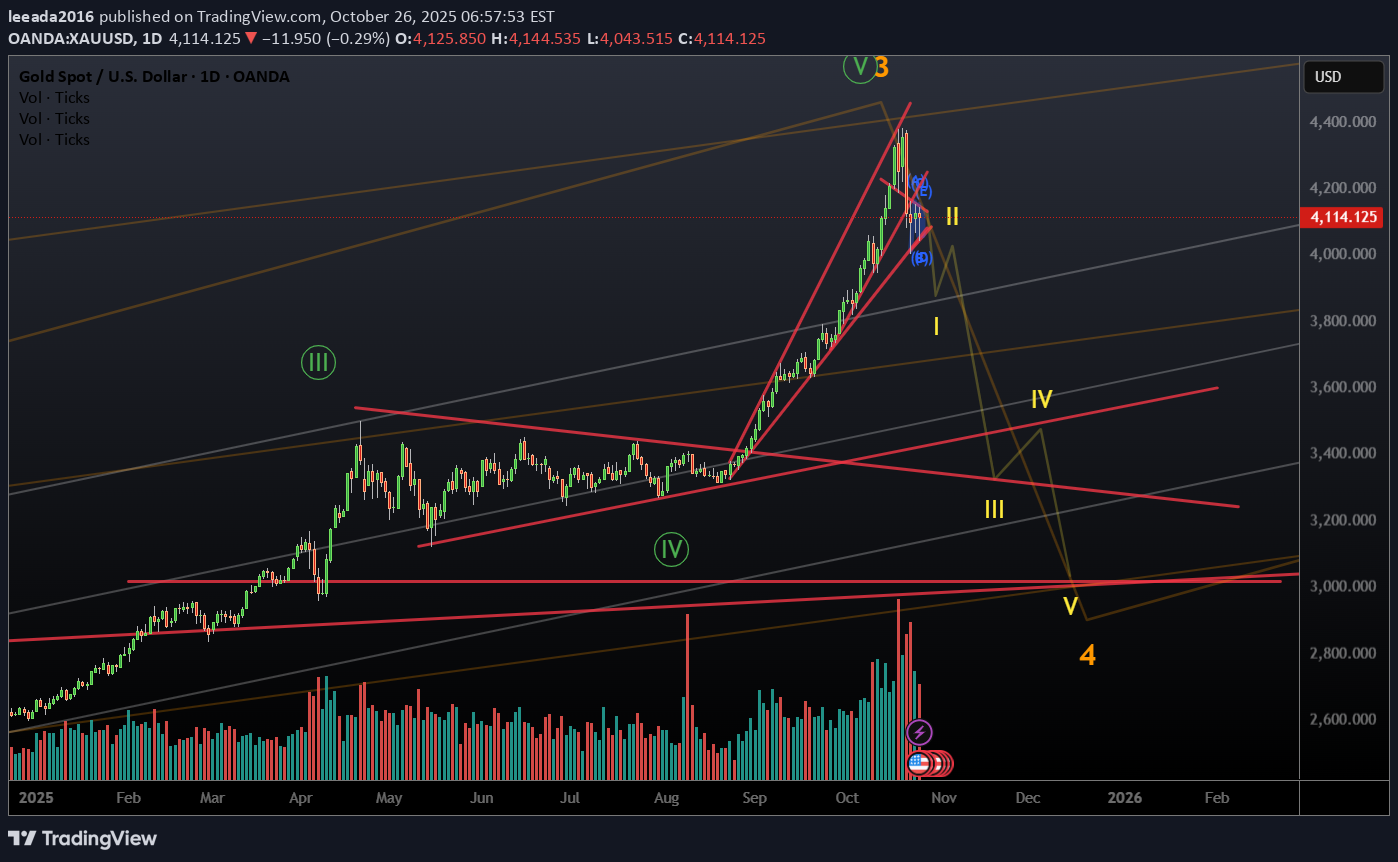

پیشبینی سقوط سنگین طلا (XAUUSD): آیا منتظر رسیدن به ۳۰۰۰ دلار باشیم؟

Same bearishs cenario once 3900 is broken expect a heavier drop. So many ways this can play look for 3300 region but more likely is near to 3k imo :). Lets hope this is a correction and short in time time. The alternative can take months

leeada2016

تحلیل ساده XAU/USD: هدف ۳۳۰۰ و منطقه کلیدی ۳۱۰۰ کجاست؟

simple pattern trade for those who trade them. 3300 would be target with extension at around 3100.

leeada2016

تحلیل موج دوم: دو سناریوی متفاوت برای بازار و سطوح کلیدی ریزش و بازگشت!

second scenario both giving wave 4 scenarios within different longer term counts. That give different wave levels as such this one can see 3700 area before next move or 38% att 3300 area. No doubt trend at this time is down but levels of reevrsal will be determined with pa

leeada2016

تحلیل XAU/USD: مسیر احتمالی طلا و سناریوهای پیش رو تا ۳۸۰۰

Inside route possability. Numeorus ways this can go floor been 3000. However is a scenrios for triangle (unlikely) 38% around 3800 area. We have a triple top on lower tf. Whether leg was impulsive or corrective determines if this move will be quick or more complexed triple 3 etc.

leeada2016

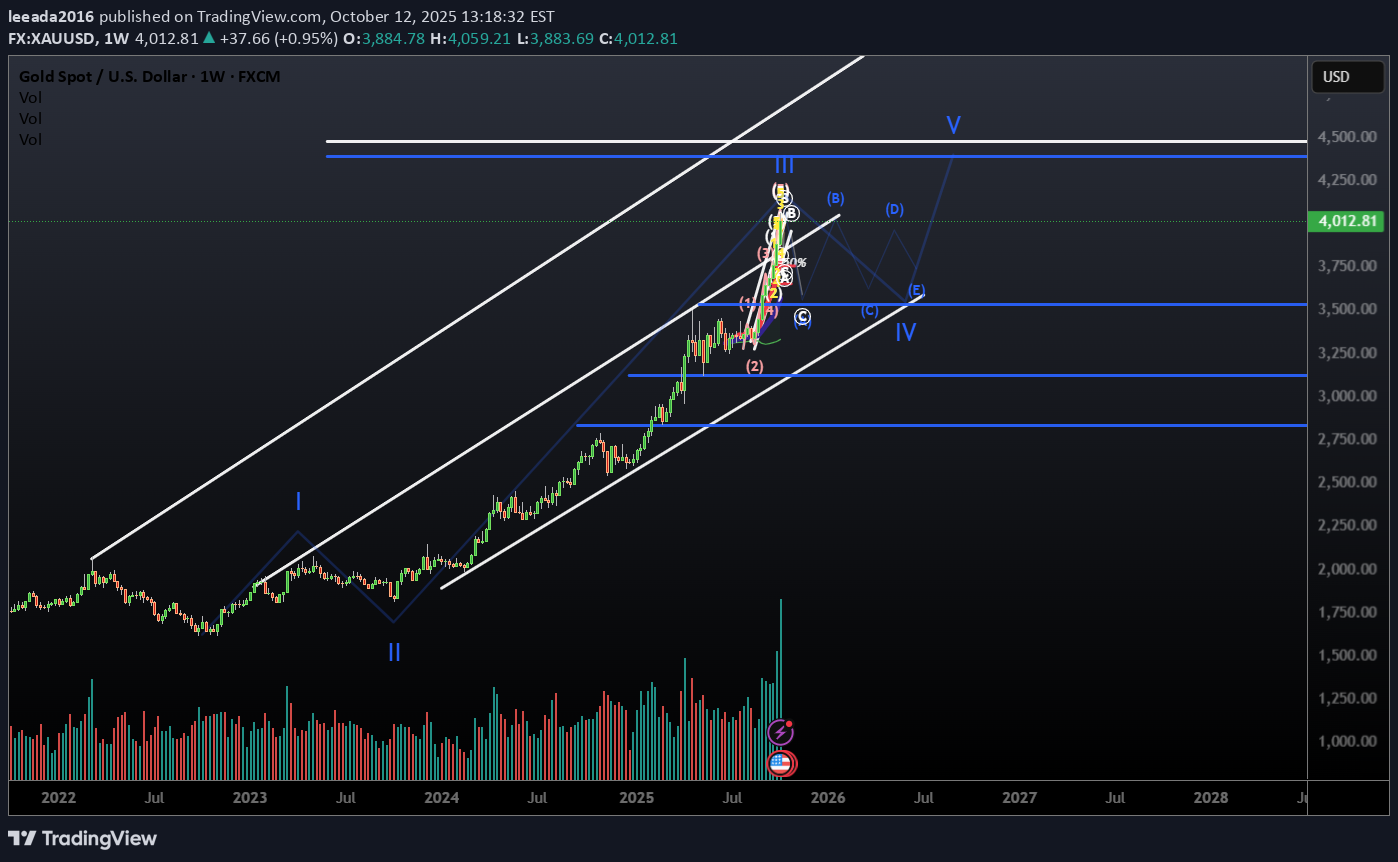

پیشبینی انفجاری طلا (XAUUSD): مسیر صعودی 6000 دلاری و فرصت ترید کوتاه مدت!

Longer term idea and count 6k minimum target for now. In shorter term we have a bear swing that will target 38 to 50% most likely around 3k area for buys and tp. wave 3 ended around 2.618 wave 2 was long in time but shallow. Rules alternation towards 50% time 4 to 6 weeks 24 nov early december. A good swing trade having collected high shorts

leeada2016

پیشبینی طلا (XAUUSD): آیا سقوط تا ۳۸۰۰ قطعی است؟ تحلیل موجی کوتاهمدت

Shoter term set up, may retest of breaak 4190-4200 area before more down side. Target for first leg 3800 area should see strong bounce. Never know how these corrections will go in terms of pa. But working on persumption of abc rather than triangle, we see.

leeada2016

تحلیل طلای امروز (XAUUSD): آیا ریزش بزرگ در راه است؟ (پیشبینی حرکت اصلی)

Self explanatory really, possibly done after extension which targetted 4170 area as per previous chart. Bias is short for swing, seems should make this clear for those not so educated ;0). 38% retrace level alternative to a possible triangle/flag scenario i have published. This is such scenario would be fast!. Before resuming bull!. Lets see ;)

leeada2016

تحلیل تکنیکال طلا (XAUUSD): آیا موج 3 تمام شده؟ سناریوی نزول به 3500 و سرنوشت موج 5!

Could wave 3 been finished, it is possible. We may see a sideays for a few months. In such case 3500 area may be teste dor near 24% seems most likely. Where 5 goes after we would have to see marked at 4500 for now but gold loves 5th wave extensions. Hard to know if and when they come!!. More fo rmy own record as to if it does follow this path.

leeada2016

سناریوی شوکه کننده طلا (XAUUSD): آیا 4200 دلار پایان سال است؟

Alternative scenario, 4200 done for year if extends here. Not impossible. pa inside supports it. But as i am bull i see fisrt scenario as more likely. Let see

leeada2016

تحلیل موج بیت کوین: هدفهای صعودی بزرگ در انتظار BTC/USD!

wave 3, looks like extension of 5th.. Red lines 1.618 2.618 targets. At least one more leg up before retrace

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.