khlin712

@t_khlin712

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

khlin712

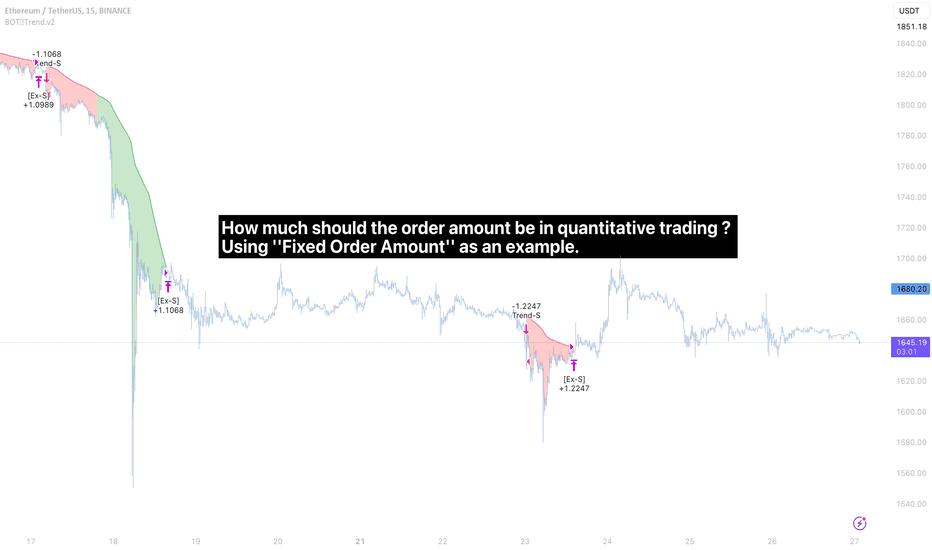

How much should the order amount be in quantitative trading ?

First, you need to determine how your strategy calculates the order quantity, which can be based on: 1. Quantity of shares 2. Amount of money 3. Percentage This article elaborates on the points of using "Fixed Order Amount" . The amount of margin required for a trade depends on your risk tolerance. Using "BOT | Trend" as an example, In the backtested performance, a fixed "initial capital leveraged by 1x" is used as the order amount for each trade, with a maximum drawdown of 25%, meaning the assets decrease by 25% from the "peak performance point" to the subsequent lowest point (1000 ➡️ 750). Therefore, there are two key points to note here: * The amount of margin required should consider “How much risk you can bear? ” Assuming you currently have 1000 to operate "BOT | Trend," and you can tolerate a maximum loss of 500 (-50%), then the total amount of each trade (margin * leverage) can be set as 2000, and so on. Example: Now you have 2000, and you can tolerate a maximum loss of 400 (-20%), then the total amount of each trade (margin * leverage) is 1600. Practice: Now you have 5000, and you can tolerate a maximum loss of 2000 (-40%), then the total amount of each trade (margin * leverage) is ______ (Hint: What is 25% of 2000?). * Timing to start running quantitative trading. Running a "trend-following" quantitative trading strategy should not start during a continuous profitable period but rather when the strategy incurs losses (relative low point of equity). This is because for trend strategies, sideways market conditions can cause the strategy to go long at highs and short at lows, resulting in a depletion of funds during this period. Starting during a continuous profitable period is likely to encounter fund depletion right after entering because markets alternate between trending and ranging phases. Answer: 8000

khlin712

2023/04/02 ETHUSDT Forcast SHORT

Power of Three (Po3) 1.accumulation 2.manipulation 3.expansionNice trade !

khlin712

ETHUSDT Trading Plan

---X--- : Potential reversal square : demand and supply The analysis is based on ORDERFLOW. The trend structure in H4 is bull , so we are going to entry long positions before becoming bear . We could identify some demand and supply zones by orderblock regarded as a large-scale buy or sell zone . It was mentioned above , the trend is a going up , therefore we will hardly entry short positions , ALWAYS FOLLOW THE TREND . There are 2 opportunities to trade Long : 1675.74 SL : 1653.23 TP : 1886.46 RR=9.36 Long : 1632.18 SL : 1610.31 TP : 1886.46 RR=11.63 if price goes to the yellow line before reach our limit orders, the trades should be cancelled .

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.