hash_pro

@t_hash_pro

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

Key Elements of the 4 Hours Chart: Current Structure : - Price is moving within a descending channel, potentially forming a bullish wedge. - Recent wick below support suggests a liquidity sweep before reversal. Order Blocks (OB): - Support OBs: - 112000 → Deepest block, aligned with wedge bottom. - 113000–112500 → Cluster of mid-level OBs indicating strong buying zones. - Resistance OBs: - 114700–122000 → Major supply zone where prior breakdown started. Liquidity Pools: - Downside: - Liquidity resting at 112784 (540.92M) — likely swept recently. - Upside: - 116132 (849.26M) and 117372 (1.81B) — attractive for market makers. These levels align with Fibonacci retracement zones and minor OBs. Fibonacci Confluence: 0.5 retracement at 118578.8 — a key level for mean reversion if the bounce continues. Potential Scenarios: 🟢 Bullish case: Rejection from wedge bottom + OB at ~112500 → rally to 116132 then possibly sweep 117372 before reacting at major OB (114700–122000). 🔴 Bearish invalidation: Breakdown from wedge → re-test 112000 OB → deeper drawdown to bullish wedge base around 110000–111000.

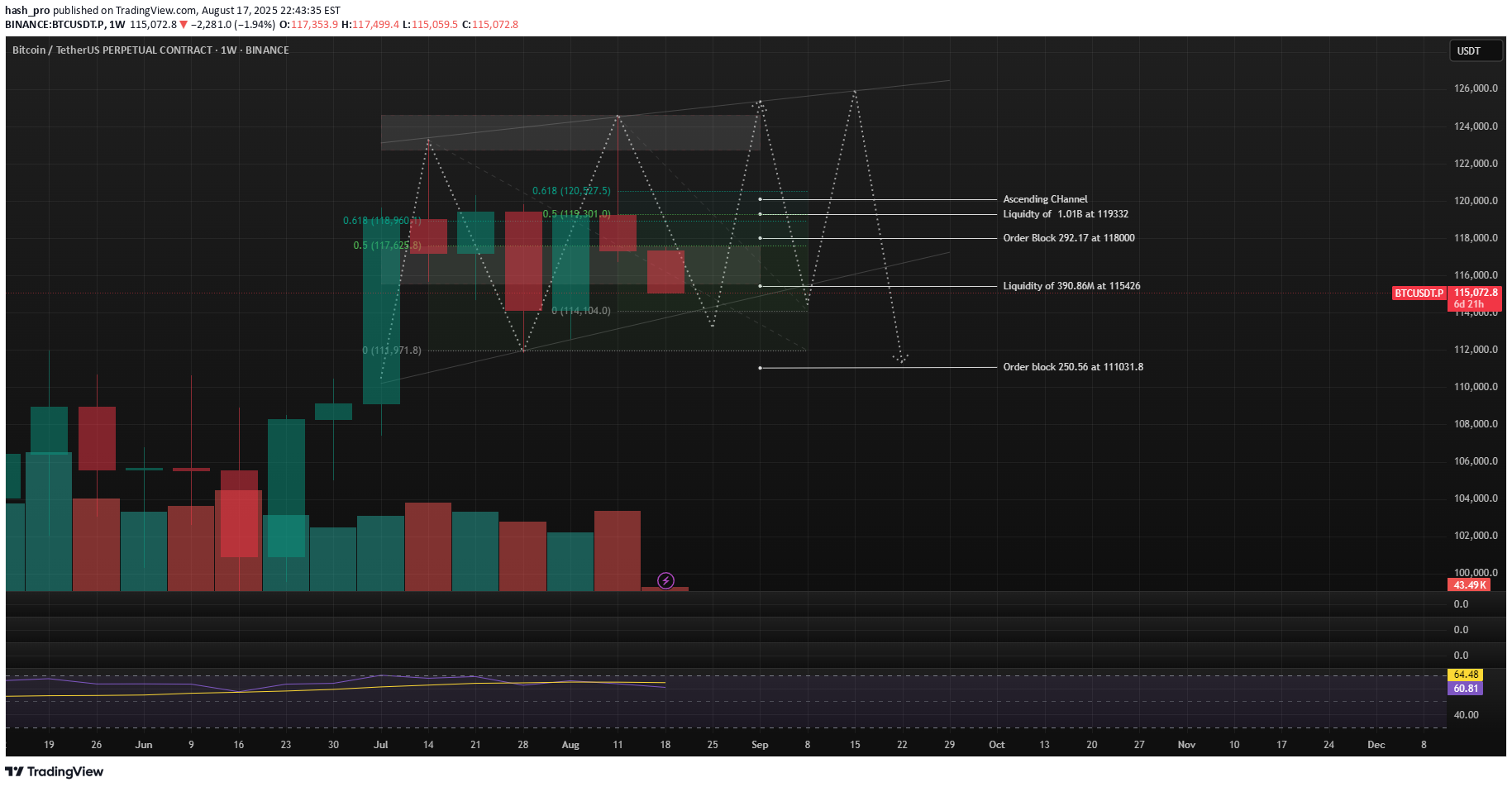

Smart Money Playbook: Liquidity Sweeps, Order Blocks & Fibonacci Rejection in Weekly Time Frame This chart outlines a smart money-driven scenario within an ascending channel, using Fibonacci levels and institutional order blocks as confluence zones. Key Levels: - Ascending Channel – Bullish short-term structure.-Buy-side Liquidity: 119,332 (potential sweep). - Order Block: 118000 (reaction zone). - Fibonacci Confluence: - 0.5 at 117,625 - 0.618 at 118,960 - Sell-side Liquidity: 115,426 (downside target). - Deep OB: 111031.8 (final liquidity draw if breakdown continues). Trade Outlook: - Price may first push higher to sweep 119,332, tapping into the 0.618 Fib zone + liquidity. - Then reverse toward 115,426, targeting sell-side stops. - A break below may lead to the 111031.8 OB, aligning with deeper liquidity and Fib levels.

Market Outlook in Daily Time Frame The chart displays a clear ascending channel, which was broken after a liquidity sweep above the upper boundary. Price tapped into a higher timeframe supply zone, followed by a strong bearish rejection — suggesting smart money distribution. Key Points - Ascending Channel: Structure broke after price swept buy-side liquidity. - Supply Zone: Rejection from confluence of supply + 0.618 Fib level at 120,527. - Order Block: Price may revisit the 118000 OB before continuing lower. - Liquidity Targets: - Buy-side at 119,332 (swept) - Sell-side at 115,426 (potential draw) Outlook Price is likely to continue downward toward the 115,426 liquidity pool, unless a short-term retracement occurs to mitigate the 118000 OB. This setup aligns with typical smart money distribution and liquidity engineering.

Thought Process: - Identify rejection at 0.618 Fib as a potential trend reversal signal. - Map out major liquidity pools where stop-loss clusters are likely. - Expect market makers to push price into these pools to collect liquidity. - Plan a long entry immediately after liquidity grab for a possible bounce. - Watch for bounce to align with right shoulder completion in Head & Shoulders pattern. - Use neckline as the main resistance and decision point for next move.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.