goldenBear88

@t_goldenBear88

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

goldenBear88

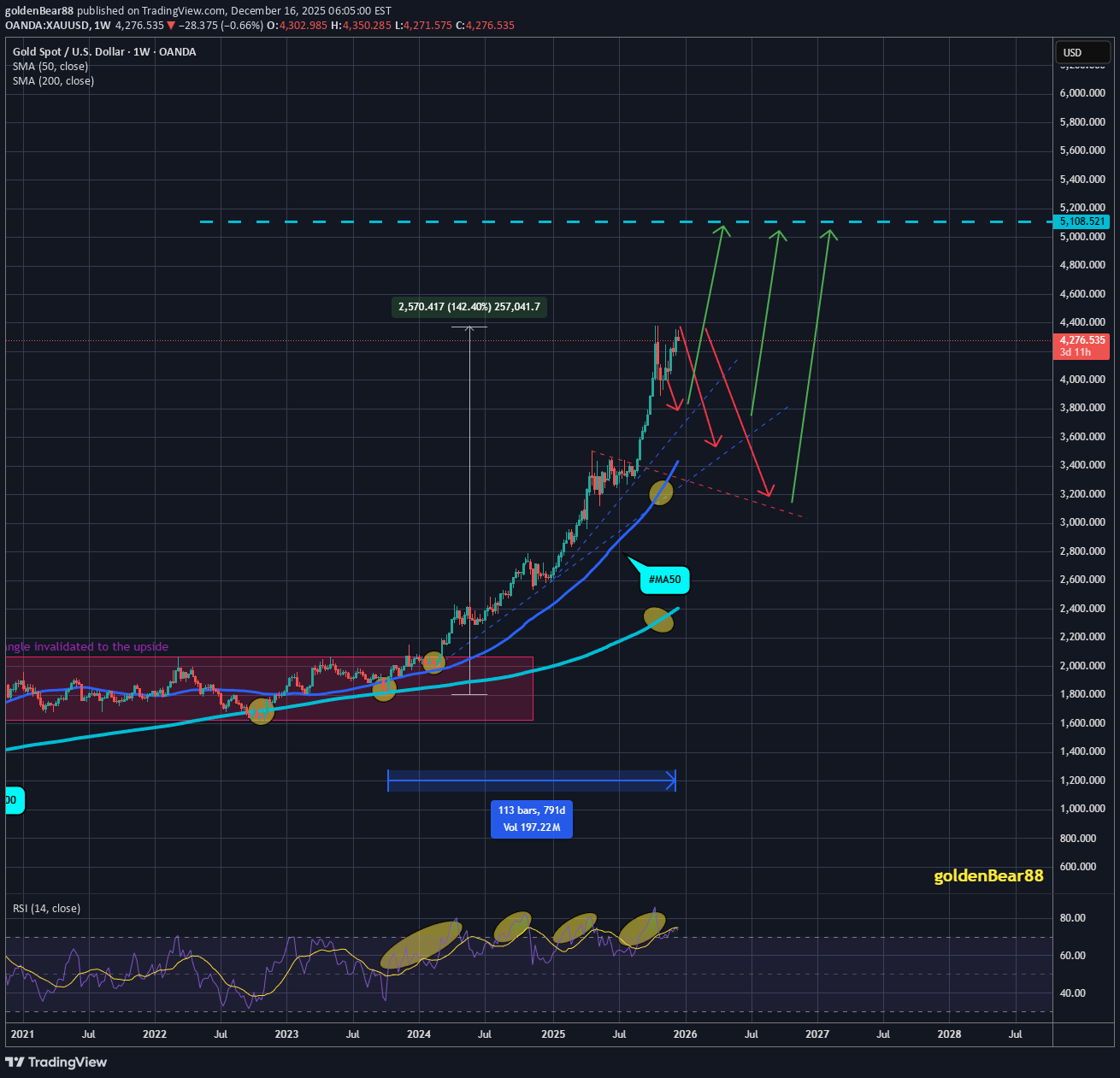

Gold Targeting #5,100.80 benchmark

Technical analysis: The Price-action has reversed following the #4,262.80 local Low's making Hourly 4 chart an aggressive Ascending Channel which is not against my Short to Medium-term expectations. However I am still expecting on the Medium-term the Daily chart's Ascending Channel no limits towards #5,100.80 benchmark, posing as well as an retracement level which on (1W) Weekly chart will form possible Annual Ultimate High's, however Short-term Targets are intact / #4,352.80 / #4,402.80. My position: I am on extended vacations as I have accomplished my Profits goal on November already however Trading Gold became very easy if you are a Bull. Therefore, my practical suggestion is to Buy Gold on local Low's and do not Sell at all costs. I have witnessed many Sellers sending me messages with wiped accounts. Remember, Bullish bias is here to stay both Technically and Fundamentally. I am back with full analysis from January #1.

goldenBear88

Gold Targeting #5,100.80 benchmark

Technical analysis: The Price-action has reversed following the #4,262.80 local Low's making Hourly 4 chart an aggressive Ascending Channel which is not against my Short to Medium-term expectations. However I am still expecting on the Medium-term the Daily chart's Ascending Channel no limits towards #5,100.80 benchmark, posing as well as an retracement level which on (1W) Weekly chart will form possible Annual Ultimate High's, however Short-term Targets are intact / #4,352.80 / #4,402.80. My position: I am on extended vacations as I have accomplished my Profits goal on November already however Trading Gold became very easy if you are a Bull. Therefore, my practical suggestion is to Buy Gold on local Low's and do not Sell at all costs. I have witnessed many Sellers sending me messages with wiped accounts. Remember, Bullish bias is here to stay both Technically and Fundamentally. I am back with full analysis from January #1.

goldenBear88

خرید دوبل در کف قیمت: سودهای فوقالعاده از تثبیت طلا!

As discussed throughout my Friday's session commentary: 'Technical analysis: Gold is showing increasing Selling presence on Weekly (#1W) chart as it is virtually unchanged (the (#1W) candle at # +1.86% currently) as Price-action is on parabolic downtrend within July’s High’s and October Low’s. This has effectively constructed an series of red Daily chart's candles hence the Bearish values on almost all charts which was an ideal Selling opportunity for Short-term Traders however Gold is struggling to stage more serious decline below #4,000.80 benchmark which I mentioned many times as possible 'floor'. Personally I remain on Medium-term Buying set-up as Daily and Weekly chart (#1W) remains heavily Bullish indicating that the latest decline was simply another accumulation and distribution phase of the recently started renewed Bull market. However the Price-action just touched the Weekly chart’s (#1W) #4,052.80 benchmark for the first time since recent upswing which was essentially the start of the parabolic rise. As a result when the #4,100.80 breaks, the next are of my importance is new ATH's level before possible Stabilization zone where Medium and Long-term Sellers will re-appear. If that happens then I will add to my portfolio giving a horizon of #20 - #30 session horizon until Gold hit #4,300.80 benchmark. However it is important to mention that if DX continues the spiral downtrend and Gold re-captures (confirmation by market closing) Resistance zone, Gold can correct #4,100.80 today. My position: I have placed my Buys on #4,032.80 - #4,042.80 Long-term and my Targets are #4,100.80 - #4,127.80 zones. I maintain my #5,100.80 Long-term Target as these declines are excellent Buying opportunities / fuel for more up.' My position: I have closed first batch of my Buying orders on #4,102.80 (#3 Buying orders engaged on #4,032.80 - #4,035.80) delivering spectacular Profits and I have Traded the #4,062.80 - #4,082.80 belt throughout yesterday's session (aggressive Scalp orders). As I have mentioned many times throughout my recent comments, I do expect #4,000.80 benchmark to pose as an Ultimate 'floor' and inside yesterday's session strong decline towards #4,000.80 benchmark. I have engaged set of Buying orders on #4,010.80 and closed all the way on #4,052.80 benchmark delivering excellent Profits. Gold holds some Bearish bias however as long as #4,000.80 benchmark is posing as an strong configuration, I will continue Buying Gold.

goldenBear88

سودهای عالی با خرید پلهای در کف قیمت طلا!

As discussed throughout my Friday's session commentary: 'Technical analysis: Gold is showing increasing Selling presence on Weekly (#1W) chart as it is virtually unchanged (the (#1W) candle at # +1.86% currently) as Price-action is on parabolic downtrend within July’s High’s and October Low’s. This has effectively constructed an series of red Daily chart's candles hence the Bearish values on almost all charts which was an ideal Selling opportunity for Short-term Traders however Gold is struggling to stage more serious decline below #4,000.80 benchmark which I mentioned many times as possible 'floor'. Personally I remain on Medium-term Buying set-up as Daily and Weekly chart (#1W) remains heavily Bullish indicating that the latest decline was simply another accumulation and distribution phase of the recently started renewed Bull market. However the Price-action just touched the Weekly chart’s (#1W) #4,052.80 benchmark for the first time since recent upswing which was essentially the start of the parabolic rise. As a result when the #4,100.80 breaks, the next are of my importance is new ATH's level before possible Stabilization zone where Medium and Long-term Sellers will re-appear. If that happens then I will add to my portfolio giving a horizon of #20 - #30 session horizon until Gold hit #4,300.80 benchmark. However it is important to mention that if DX continues the spiral downtrend and Gold re-captures (confirmation by market closing) Resistance zone, Gold can correct #4,100.80 today. My position: I have placed my Buys on #4,032.80 - #4,042.80 Long-term and my Targets are #4,100.80 - #4,127.80 zones. I maintain my #5,100.80 Long-term Target as these declines are excellent Buying opportunities / fuel for more up.' My position: I have closed first batch of my Buying orders on #4,102.80 (#3 Buying orders engaged on #4,032.80 - #4,035.80) delivering spectacular Profits and I have Traded the #4,062.80 - #4,082.80 belt throughout yesterday's session (aggressive Scalp orders). As I have mentioned many times throughout my recent comments, I do expect #4,000.80 benchmark to pose as an Ultimate 'floor' and inside yesterday's session strong decline towards #4,000.80 benchmark. I have engaged set of Buying orders on #4,010.80 and closed all the way on #4,052.80 benchmark delivering excellent Profits. Gold holds some Bearish bias however as long as #4,000.80 benchmark is posing as an strong configuration, I will continue Buying Gold.

goldenBear88

تحلیل طلای امروز: آیا زمان خرید است یا فروش؟ استراتژی معاملاتی بر اساس تحلیل تکنیکال

Technical analysis: Gold is showing increasing Selling presence on Weekly (#1W) chart as it is virtually unchanged (the (#1W) candle at # +1.86% currently) as Price-action is on parabolic downtrend within July’s High’s and October Low’s. This has effectively constructed an series of red Daily chart's candles hence the Bearish values on almost all charts which was an ideal Selling opportunity for Short-term Traders however Gold is struggling to stage more serious decline below #4,000.80 benchmark which I mentioned many times as possible 'floor'. Personally I remain on Medium-term Buying set-up as Daily and Weekly chart (#1W) remains heavily Bullish indicating that the latest decline was simply another accumulation and distribution phase of the recently started renewed Bull market. However the Price-action just touched the Weekly chart’s (#1W) #4,052.80 benchmark for the first time since recent upswing which was essentially the start of the parabolic rise. As a result when the #4,100.80 breaks, the next are of my importance is new ATH's level before possible Stabilization zone where Medium and Long-term Sellers will re-appear. If that happens then I will add to my portfolio giving a horizon of #20 - #30 session horizon until Gold hit #4,300.80 benchmark. However it is important to mention that if DX continues the spiral downtrend and Gold re-captures (confirmation by market closing) Resistance zone, Gold can correct #4,100.80 today. My position: I have placed my Buys on #4,032.80 - #4,042.80 Long-term and my Targets are #4,100.80 - #4,127.80 zones. I maintain my #5,100.80 Long-term Target as these declines are excellent Buying opportunities / fuel for more up.

goldenBear88

بهترین زمان خرید طلا فرا رسید؟ تحلیل اختصاصی و سیگنالهای خرید برای سودهای بزرگ

Technical analysis: Gold is showing increasing Selling presence on Weekly (#1W) chart as it is virtually unchanged (the (#1W) candle at # +1.86% currently) as Price-action is on parabolic downtrend within July’s High’s and October Low’s. This has effectively constructed an series of red Daily chart's candles hence the Bearish values on almost all charts which was an ideal Selling opportunity for Short-term Traders however Gold is struggling to stage more serious decline below #4,000.80 benchmark which I mentioned many times as possible 'floor'. Personally I remain on Medium-term Buying set-up as Daily and Weekly chart (#1W) remains heavily Bullish indicating that the latest decline was simply another accumulation and distribution phase of the recently started renewed Bull market. However the Price-action just touched the Weekly chart’s (#1W) #4,052.80 benchmark for the first time since recent upswing which was essentially the start of the parabolic rise. As a result when the #4,100.80 breaks, the next are of my importance is new ATH's level before possible Stabilization zone where Medium and Long-term Sellers will re-appear. If that happens then I will add to my portfolio giving a horizon of #20 - #30 session horizon until Gold hit #4,300.80 benchmark. However it is important to mention that if DX continues the spiral downtrend and Gold re-captures (confirmation by market closing) Resistance zone, Gold can correct #4,100.80 today. My position: I have placed my Buys on #4,032.80 - #4,042.80 Long-term and my Targets are #4,100.80 - #4,127.80 zones. I maintain my #5,100.80 Long-term Target as these declines are excellent Buying opportunities / fuel for more up.

goldenBear88

سودهای نجومی از طلا: راز خرید در کفهای بازار صعودی چیست؟

My position: As I spotted #4,100.80 benchmark test, I started Buying Gold on each dip towards #4,116.80 first Resistance. On another #4,106.80 Support sweep, I engaged strong Buying orders towards #4,127.80 extension last night. I will continue Buying every dip on Gold from my key entry points. That is my practical suggestion. My position: I have Bought Gold on multiple occasions throughout yesterday's session / each reversal I have Bought the dip ultimately towards #4,192.80 Resistance. I have awaited Gold to form a benchmark on #4,200.80 then I have waited this morning to re-Buy Gold multiple times from #4,227.80 towards #4,240.80 Resistance. I will continue Buying Gold from each reversal / dip as I await #4,201.80 - #4,211.80 to Buy more. Congratulations on spectacular Profits, making money on Gold became so easy / just stay with the trend.

goldenBear88

سودهای انفجاری در بازار صعودی طلا: استراتژی خرید در هر ریزش!

My position: As I spotted #4,100.80 benchmark test, I started Buying Gold on each dip towards #4,116.80 first Resistance. On another #4,106.80 Support sweep, I engaged strong Buying orders towards #4,127.80 extension last night. I will continue Buying every dip on Gold from my key entry points. That is my practical suggestion. My position: I have Bought Gold on multiple occasions throughout yesterday's session / each reversal I have Bought the dip ultimately towards #4,192.80 Resistance. I have awaited Gold to form a benchmark on #4,200.80 then I have waited this morning to re-Buy Gold multiple times from #4,227.80 towards #4,240.80 Resistance. I will continue Buying Gold from each reversal / dip as I await #4,201.80 - #4,211.80 to Buy more. Congratulations on spectacular Profits, making money on Gold became so easy / just stay with the trend.

goldenBear88

طلای داغ: تحلیل تکنیکال صعودی و بهترین نقاط خرید برای سود بیشتر

Technical analysis: The Hourly 1 chart's Ascending Channel increases it’s gains towards Overbought levels as #4,152.80 psychological benchmark (so far) is showcasing durability. Both Weekly chart (#1W) and Monthly (#1M) are on encouraging gains (# +4.13% and # +2.48% respectively) and with ranging candles I can't see any rebound possibility before #4,200.80 benchmark test. Yesterday the #4,100.80 benchmark was tested twice and as I mentioned on my remarks balanced MA periods to settle within the #4,122.80 - #4,132.80 range. More and more Buying signs are appearing as I am confident in my Bullish model. Trade accordingly. My position: As I spotted #4,100.80 benchmark test, I started Buying Gold on each dip towards #4,116.80 first Resistance. On another #4,106.80 Support sweep, I engaged strong Buying orders towards #4,127.80 extension last night. I will continue Buying every dip on Gold from my key entry points. That is my practical suggestion.

goldenBear88

خیز طلا: سیگنالهای قوی صعودی و سطوح کلیدی برای خرید!

Technical analysis: The Hourly 1 chart's Ascending Channel increases it’s gains towards Overbought levels as #4,152.80 psychological benchmark (so far) is showcasing durability. Both Weekly chart (#1W) and Monthly (#1M) are on encouraging gains (# +4.13% and # +2.48% respectively) and with ranging candles I can't see any rebound possibility before #4,200.80 benchmark test. Yesterday the #4,100.80 benchmark was tested twice and as I mentioned on my remarks balanced MA periods to settle within the #4,122.80 - #4,132.80 range. More and more Buying signs are appearing as I am confident in my Bullish model. Trade accordingly. My position: As I spotted #4,100.80 benchmark test, I started Buying Gold on each dip towards #4,116.80 first Resistance. On another #4,106.80 Support sweep, I engaged strong Buying orders towards #4,127.80 extension last night. I will continue Buying every dip on Gold from my key entry points. That is my practical suggestion.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.