forexmoneya

@t_forexmoneya

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

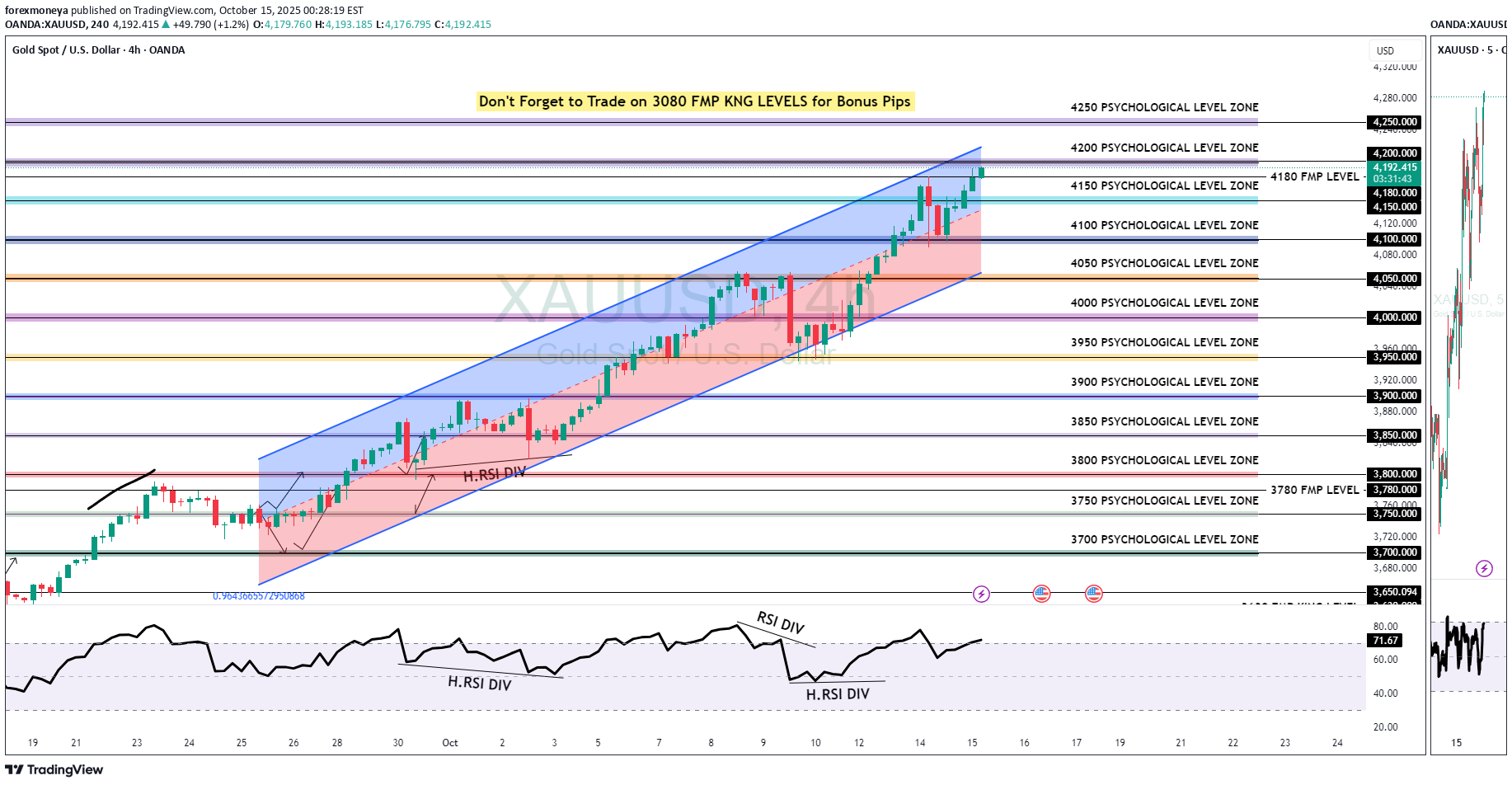

تحلیل طلا: رمزگشایی حرکتهای مهم امروز؛ از 4080 تا 4250!

GOOD Morning Traders, As long as GOLD sustains above 4080 FMP Level it will remains bullish however the only way to join Trend Rally is following Psychological Levels with 3080 chain Major Support zone for the day is located @ 4130-4150 below this zone GOLD will move Towards 4100 or even 4080 Above 4150 Psychological Level GOLD Next Target will be 4230 FMP Level or even 4250 Disclaimer: Forex is Risky

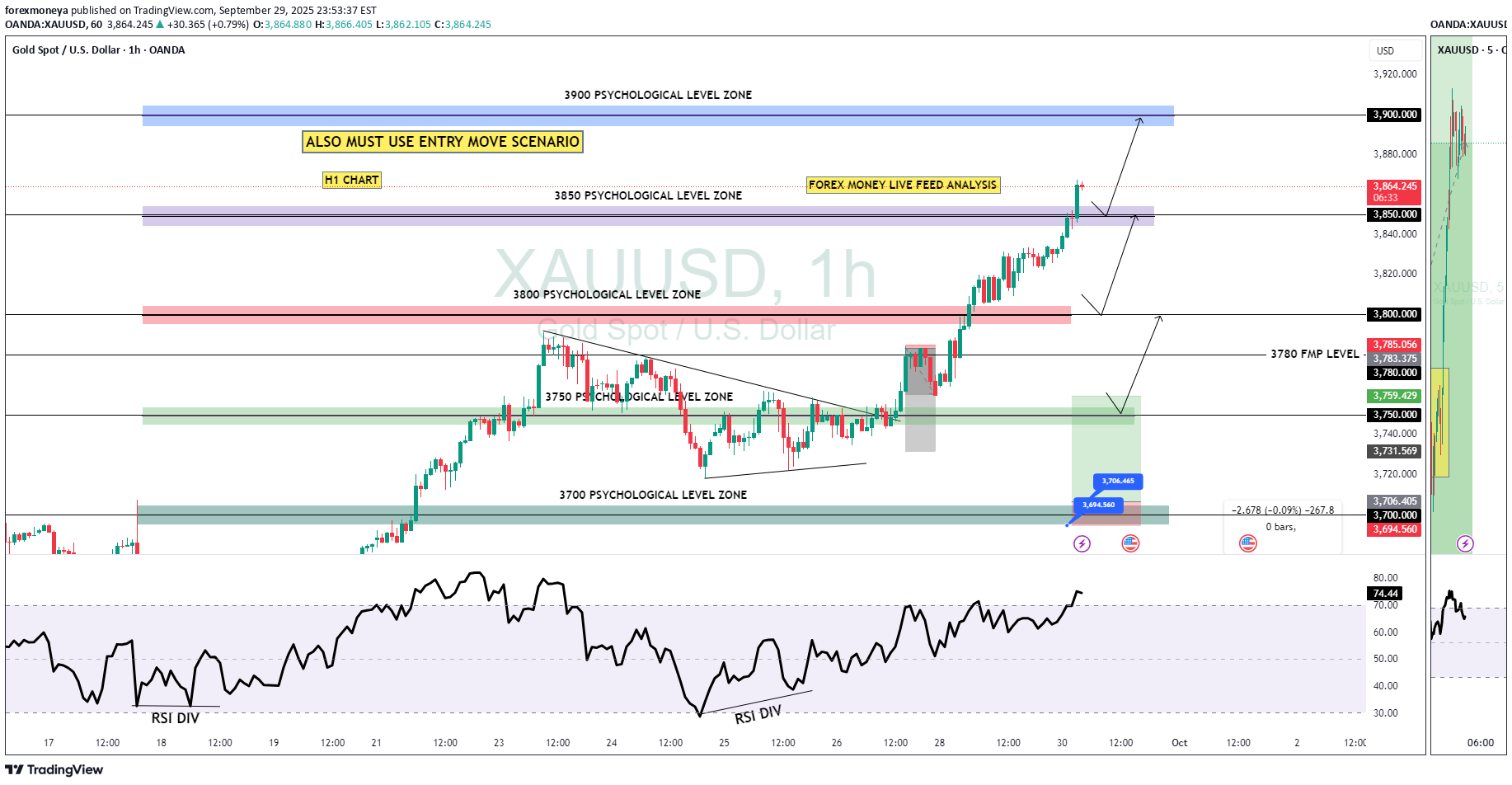

GOLD H1 Chart Update for 30 Sep 25

Hello guy, GOLD H1 Zonal chart just shared with you, as you can see that there multiple psychological zones appear there Try to go with Psychological zones in Long direction, Trend remains bullish in GOLD we might see 4000 Giant Psychological zone in the near term Today is monthly closing, Stay Active Disclaimer: Forex is Risky

GOLD H2 Intraday Chart Update For 29 July 2025

Hello Traders, Welcome to new day we have US JOLTS high impact news today, for market sustains above 3300 psychological level if market successfully break 3280 level then it will move towards 3280 or even 3270 if market crosses 3330 level successfully then it will move towards 3345 or even 3360 All eyes on FOMC & NFP news for the week Disclaimer: Forex is Risky

GOLD H1 Chart Update for 24 July 2025

Hello Traders, we got fall yesterday on RSI DIV and right now all eyes on 3350 Psychological level breakout if market successfully breaks that level then it will move towards 3330 or even 3315 level some retracements remains pending around 3400-3412 zone GOLD will might retrace that zone before going further down Reminder: PMI's day in the market Disclaimer: Forex is Risky

GOLD Intraday Chart Update for 23 July 25

Hello Traders First of all i hope you were enjoying yesterday move with 400 Pips Reward For today we have 3400 Psychological remains in focus if market breaks below 3400 then it will move towards 3364-76 zone otherwise we are remain buyers above 3400 Level Strong Resistance zone for intraday is at 3445-3465 if market cross 3465 the it will move towards ATH test which is around 3500 Disclaimer: Forex is Risky

GOLD Intraday H1 Chart Update For 22 July 2025

Hello Traders, Today we have FED Chair Powell Speech ahead all eyes on 3400 Psychological Level Break for now, if market successfully breaks 3400 then it will move towards 3435 below 3400 it will move back towards 3350 level Disclaimer: Forex is Risky

GOLD Intraday H1 Chart Update For 18 July 25

Hello Trader, Today we have closing day For now market is still in Bearish Channel range and try to sustains below 3350 Psychological Level Further only market clear breakout of 3385 level then we will be on Bullish side other we are remains bearish for now All eyes on Todays Closing Disclaimer: Forex is Risky

GOLD Intraday Chart Update For 17 July 2025

Hello Traders, welcome to new Trading day Today we have some high impact news of USD, Currently market is still in tight range and we still need breakout of 3300 Psychological for downside clearly For upside market must need to close above 3380-90 zone for further upwards continuation currently we are also keep an eyes on WAR Fundamental news Disclaimer: Forex is Risky

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.