drasyrafz

@t_drasyrafz

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

drasyrafz

سقوط آزاد آیفون: سطوح کلیدی حمایت و مقاومت برای رصد (285 تا 210)

iPhone dominance is declining retest zone 260–254 , a retracement Key Levels to Watch: 🟥 Resistance Trendline: 280–285 🟦 Retest Zone: 260–254 🟩 Support Trendline: 210–220

drasyrafz

سقوط انویدیا بعد از حباب هوش مصنوعی: سناریوی پنهان کاهش ارزش سهام

this long term for nvidia if AI bubble failing, this would be the scenario downward pressure due to overvaluations

drasyrafz

پیشبینی سقوط ناگهانی انویدیا تا پایان ۲۰۲۵: آیا حباب قیمتی میترکد؟

Price in the middle of weekly range ($178.91–$200.05) at phase 1 to 2 EMA alignment confirms bearish weekly trend i believe NVIDIA might dip to $160 - $170 (near the gap it has created/ 1 x A Fib extension levels), with downward pressure due to overvaluations

drasyrafz

طلا در آستانه رکوردشکنی ۴۲۰۰ دلاری: تحلیل سطوح حیاتی و مسیر صعودی آینده

Gold continues its relentless climb, trading near a three-week high at 4,146$ as buyers remain firmly in control. Despite a mild rebound in the US Dollar — driven by cautious sentiment across Asian markets — gold’s momentum stays intact, fueled by expectations that the Federal Reserve may proceed with a rate cut in December. Key Levels: • Support Zones: 4,086$ – 4,039$ → retest area for new buyers • Immediate Resistance: 4,146$ • Breakout Target: 4,203$ • Extended Bullish Target: 4,382$ (ATH zone) If gold maintains structure above 4,080$, the bias remains strongly bullish. Only a confirmed close below this zone would suggest a short-term pullback before continuation.looks like all my TP hit this concluding my trade with gold, stocks seem bearish - so reflecting gold will be north for a while, maybe till end of year.

drasyrafz

تسلا در آستانه سقوط؟ چرا باید منتظر ریزش سنگین سهام تسلا باشید!

Short to 430 then up again ___________________________ summary Tesla, Inc. continues to make bold promises about autonomous driving, robotaxis, Cybercab, and Optimus robots that remain unfulfilled or face legal and technological barriers. TSLA's $1.5 trillion valuation is extremely high at a 348X Forward GAAP P/E, making the stock risky if Elon Musk's ambitious vision fails to materialize. Despite repeated delays, broken promises, and shifting timelines, somehow investor enthusiasm for TSLA persists, driven by Musk's compelling narrative. TSLA investors should exercise caution and conduct thorough due diligence rather than relying solely on Musk's visionary promises. I continue to recommend a strong sale or even a long-term short of TSLA stocki missed my analysis, and this cost me heavily as bearish sentiment starting this perhaps will be side way till december so i will stop trade for a while to recover back.

drasyrafz

Tesla

short tesla will go further down just few reactions from baseless fundamental aiming at 240-260

drasyrafz

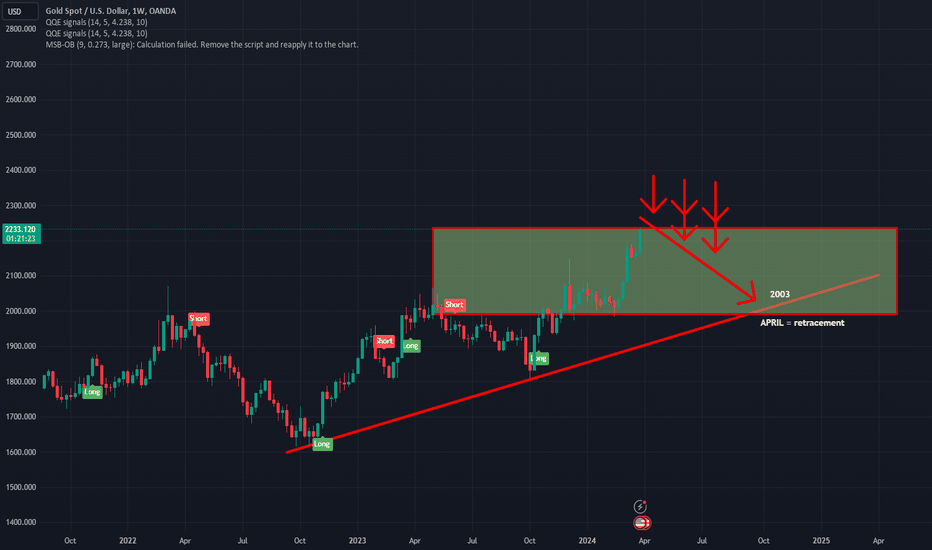

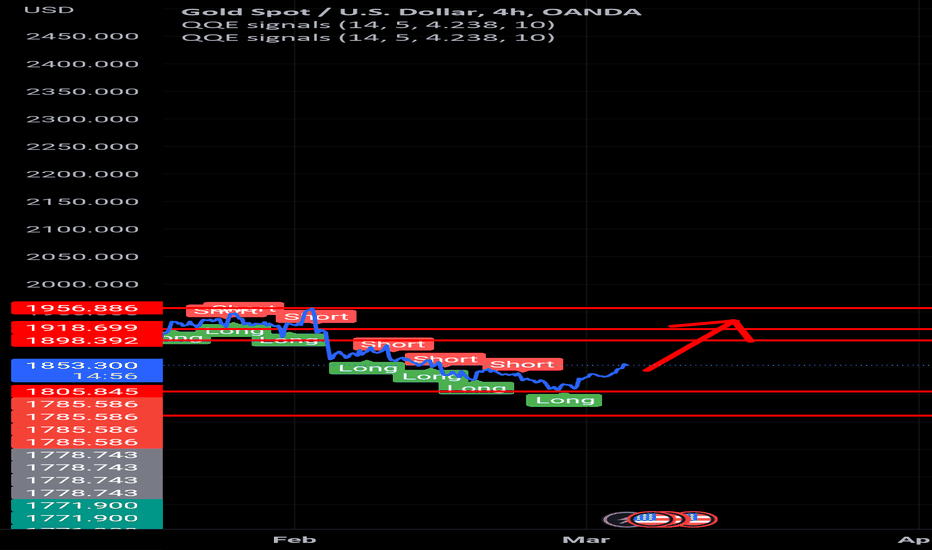

XAUUSD - to find next lower support possibly 2000 zone

1. to find next lower support 2. retracement zone possibly at level 2000 3. april possibly a bearish retracement month, meaning always look for seller

drasyrafz

XAUUSD - SHORT

aim for short for next support. The one-quarter outlook remains bullish, but at this moment, the majority of experts do not see a sustainable run above $2,100.

drasyrafz

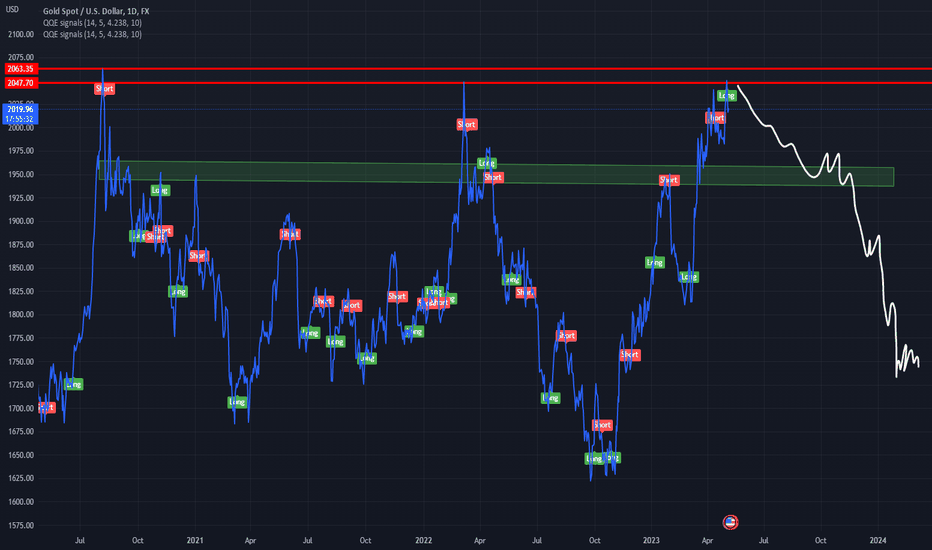

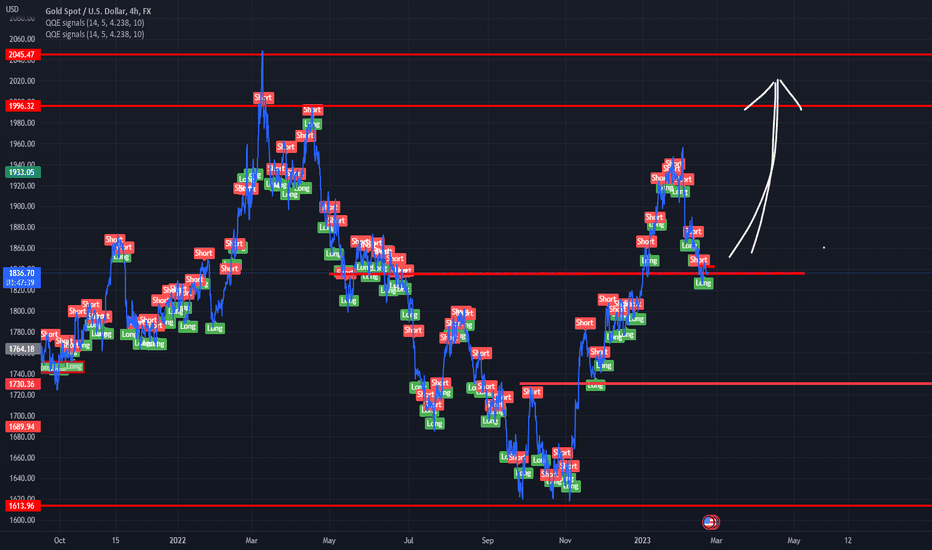

XAUUSD LONG

at supply area still, gold will go up to next resistance, *careful to sellers...

drasyrafz

LONG XAUUSD

gold now at strong support, probably will go up to next R

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.