dragononcrypto

@t_dragononcrypto

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

dragononcrypto

Ethereum LFG

Fractal from beginning of last cycles bull market. Estimated target $20K by November/December 2025. Significant pull-back around physiological level of $10K in autumn.

dragononcrypto

BTCUSD: Time for a correction

Outlook for the remainder of the year. The ETF inflows have generally remained positive at new ATH levels, while volume remains low and price remains flat. This suggests considerable distribution from OTC sellers, namely longer-term holders, per HODL waves analysis. It's been 3 months since breaking ATH in March, with price unable to move higher. The consolidation at higher levels remains bullish until $60K is broken to the downside (foodgates moment), which would confirm the current range ($60K-70K) as longer-term distribution, rather than accumulation. First stop will likely be a re-test of the 50 Week MA around $50K after the floodgates for selling opens below $60K. With relatively low accumulation volume, I'm not expecting it to hold as support, but instead return to the 200 Week MA around $40K, likely after a re-test of previous support in order to confirm it as new resistance (around $60K). The 20 Week MA is currently around $63K, so below this level, there will already likely be an increase in selling pressure. The Weekly RSI is otherwise facing rejection from overbought levels >70, similar to late 2021 (minus the strong bearish divergence back then). The culmination of breaking the 20 WMA and confirming RSI rejection by returning to $60K, would be the catalyst for the break of support. As also noted (N.B.) the Mid Pi Cycle Top occurred in march, around $68K-$70K, with price unable to maintain the momentum above this rising MA multiplier, unlike in December 2020 at $21K.(1) The post-halving "Miner Capitulation" has also been signalled by Hash Ribbons indicator, not so dissimilar to summer 2020 that encouraged consolidation and a miner correction.(2) I'm not particularly expecting Path B to play out, unless there is a catalyst for a more full-blown capitulation, leading to a 65% haircut in price. Examples include ETF holders getting cold feet leading to panic as price goes below opening ETF prices , or otherwise some negative regulatory news. A -45% move down to $40K should otherwise be more then sufficient to build up momentum for a 2025 bull market reaching $100K+. Should price reach $GETTEX:25K to $30K levels (path B), there could be a "delay" within the usual cycle, with higher parabolic prices nearer to $200K. After the 3x from 2017 to 2021 ATH, 2x seems reasonable in 2025 however ~$138K. (1) lookintobitcoin.com/charts/pi-cycle-top-indicator/ (2) capriole.com/Charts/Last week closed below the 20 Week MA (~ 64K ) for the first time since October 2023. Failure to reclaim this MA will signal further weakness followed by higher probability of a capitulation to lower levels. The 200 Day MA is priced around ~$58K, that alongside recent closing Daily lows last month, will likely act as the "line in the sand" for the bulls to hold as support in order to maintain the current range.

dragononcrypto

BTCUSD: Short term bearish with $20K target

Price is breaking below the 50 Day MA,it doesn't look like there will be the imminent breakout above $25K this month anymore, unless price is to close back above $23K in coming days .

dragononcrypto

BTCUSD: How to form a 2019 Bottom

Based on 2019 fractal using Moving Averages (20,50,200) and Visible Range Volume Profile (VRVP): Some similarities, some differences. 20 MA @ $21,950 on 3 Day chart will be the key level to look out for.

dragononcrypto

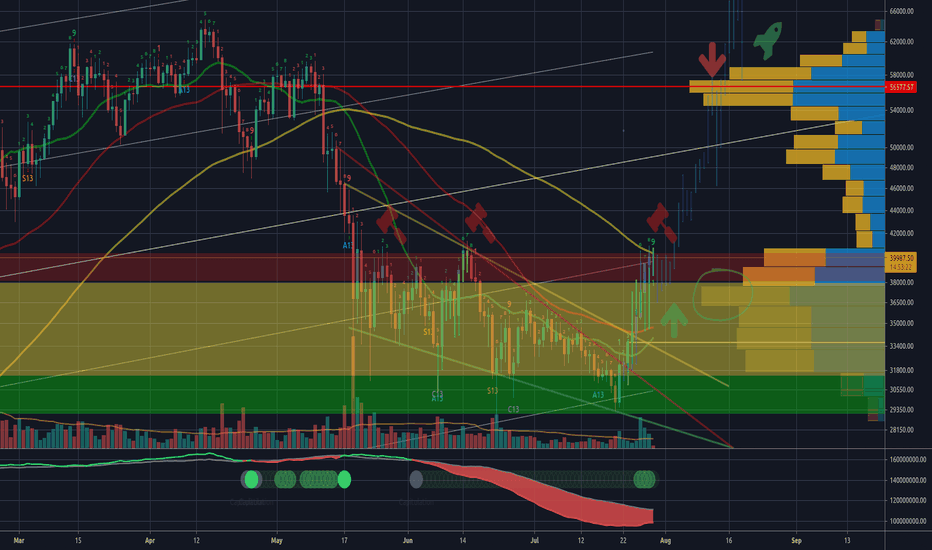

Bitcoin Market Sentiment for August

With the relief rally continuing, here's my overview of current and future market sentiment to come.

dragononcrypto

Bitcoin Hash Ribbons Buy Signal

Weekly Hash Ribbons buy signal confirmed, price: $43,829 (CB). This would be the 12th buy signal in 9.5 years if not mistaken, after the most aggressive miner capitulation since 2021 with hash rate dropping by more than 50%. . This buy signal is the first in 8 months as well as first of 2021, since the price of $19.375 last year. [u]Recent buy signals [/u]: Nov 2020: $19,375 Jul 2020: $9,303 Apr 2020: $7,706 Dec 2019: $7,384 Jan 2019: $3,514 The obvious trade. Reward/risk: 6.5:1. Hash Ribbons indicator: Stock to Flow Rainbow indicator: Logarithmic growth in 2021:

dragononcrypto

Bitcoin Summer Outlook

Price at TD 9 Sequential reversal on Daily chart with a bearish sloping 200 Day MA resistance level so expecting a small retracement. Price above $37K volume level for now, where most of the volume as come from in past two months. Likely to act as new support. Price held the $25-30K level as anticipated, the short and mid term MAs lie around $34K-35K, the resistance breakout level.

dragononcrypto

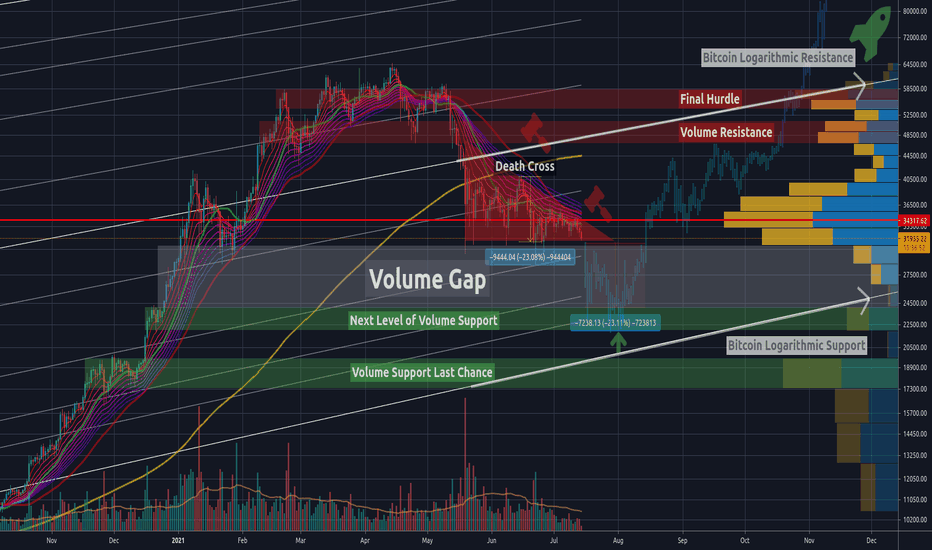

Bitcoin's Descending Triangle Target: $24K (Mind The Gap)

Bitcoin's imperfect descending triangle currently targeting a measured move to $24K volume support zone. The $20K level of VPVR strong support also lines up with the logarithmic growth support trend-line. Short term looks bearish, long-term looks like a buy the dip opportunity before 6 figures. Never underestimate the accuracy of Bitcoin's descending triangle measured move targets, if the breakdown is confirmed: For alternative broadening wedge theory and bullish buy the dip scenario, see here:Breakdown confirmed?

dragononcrypto

Bitcoin Accumulation Zone: Buyers vs Sellers

Hash Ribbons tells us to remain patient for the buy signal as capitulation continues MA Ribbon suggests further downside, but price is at Weekly MA support Bullish broadening wedge in the making, not yet confirmed Buyers vs sellers accumulation zone in yellow Based on the January 2020 VPVR model:Time for a bounce?Time for some selling pressure?It's selling time

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.