chiefwils0n

@t_chiefwils0n

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

chiefwils0n

Massive Bullish Falling Wdge

XLM has reached and bounced from the infamous 78% Fib level, while simultaneously forming a bullish falling wedge pattern. I believe that we will breakout in the future, to claim .75, then $1.00 and who knows from there. I'm loading up now.....Happy Trading!

chiefwils0n

$290 climb or further downside?

BLUF: COIN may run to $290, $305 upon break to upside of bearish pendant. Or if COIN closes below $270, further downside with $250 and $220 targets, respectively. When I analyze charts using technical analysis, I search for trend lines, support & resistance, divergences, and patterns (not necessarily in this order). I also analyze multiple time frames including the 15m, 1h, 2h, 4h, daily, and weekly candles with the premise that higher time frames give the “big picture,” or the overall trend, while the “smaller timeframes” provide details about price action, momentum, and identify key areas of entries/exits. My goal is to trade with the dominant trend, but only at key support areas or pullbacks to maximize my profit. In the case of COIN, I assess the following: Weekly: Bullish Upside breakout from a cup + handle pattern. Pullback from $350 area after several negative divergences. Two rejections around the $260 area, a 38% retracement, establishes support. ADX and DI indicate a strong bullish trend Daily: Bearish Bearish pendant forming. ADX and DI indicate a strong bearish trend Several positive divergences Two rejections around the $260 area, a 38% retracement, establishes support. 4H: Bearish Bearish pendant much clearer. ADX and DI indicate a strong bearish trend Several negative divergences Trend support around $263 Happy Trading!$250 Target Reached.

chiefwils0n

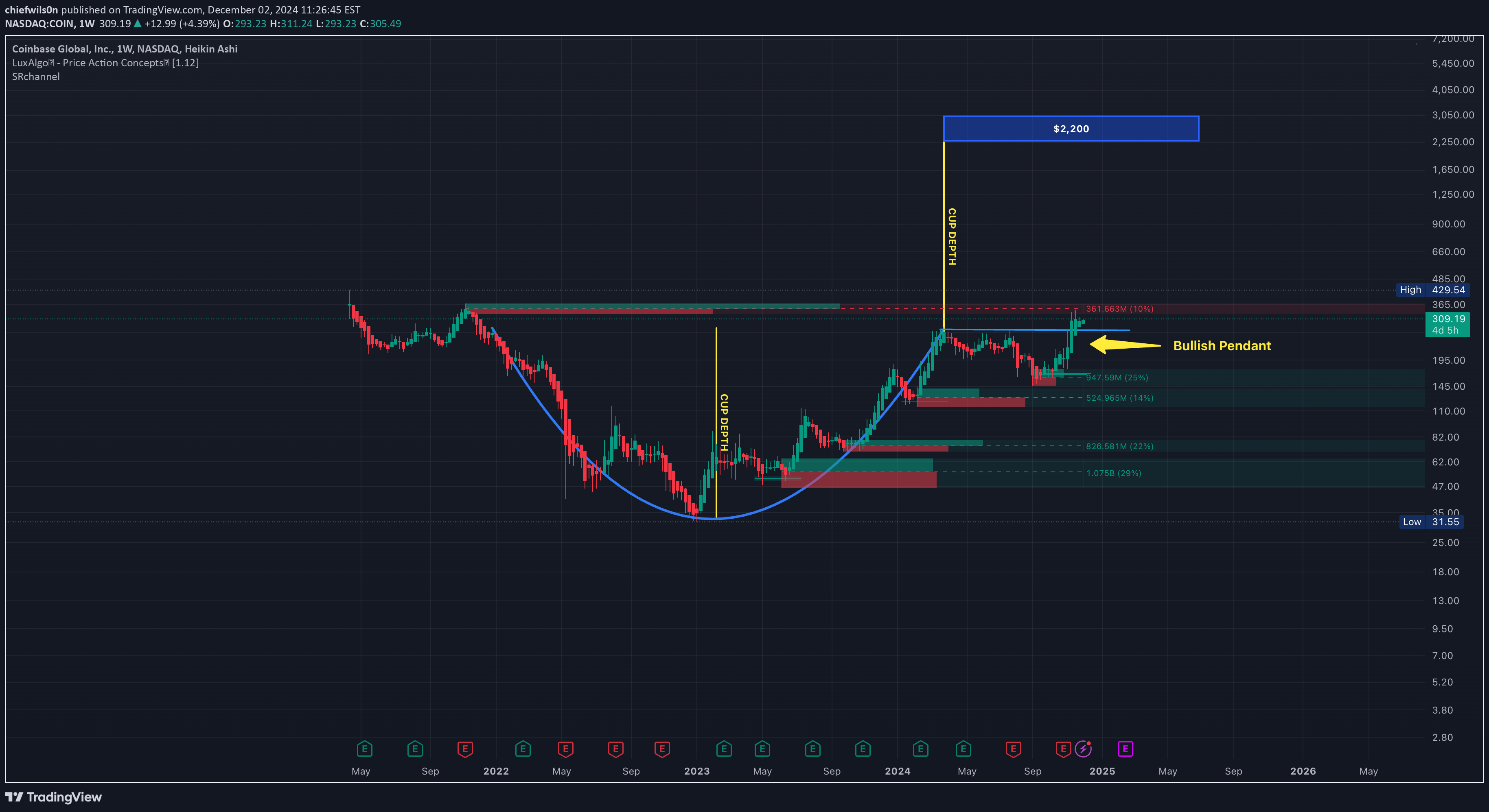

$2K Cup + Handle?

Team - think BIG!!! COIN is on its way to 2K (unless the stock splits) on the weekly. The Cup + Handle is massive! Lots of selling pressure as 2021 bag holders exit their positions. But the break above the handle is clearly visible. I'm not sure how long it will take to reach $2K, but the current technicals tell me we are headed to that target. Also, ask yourself which US exchange stands to benefit from this crypto altcoin rush? #Bullish Happy Trading!

chiefwils0n

$COIN. Cup + Handle with $540 Target

I see a cup + handle pattern on the renko 240 bars. I'm targeting $540 upon a $260 4H close.Next Target: $290$290 Target reached. Anticipate a $271 pullback based on Harmonic Crab pattern.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.