caylibhendricks007

@t_caylibhendricks007

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

آینده طلا (XAUUSD): پایان رالی 9 هفتهای یا شکستن رکورد تاریخی؟

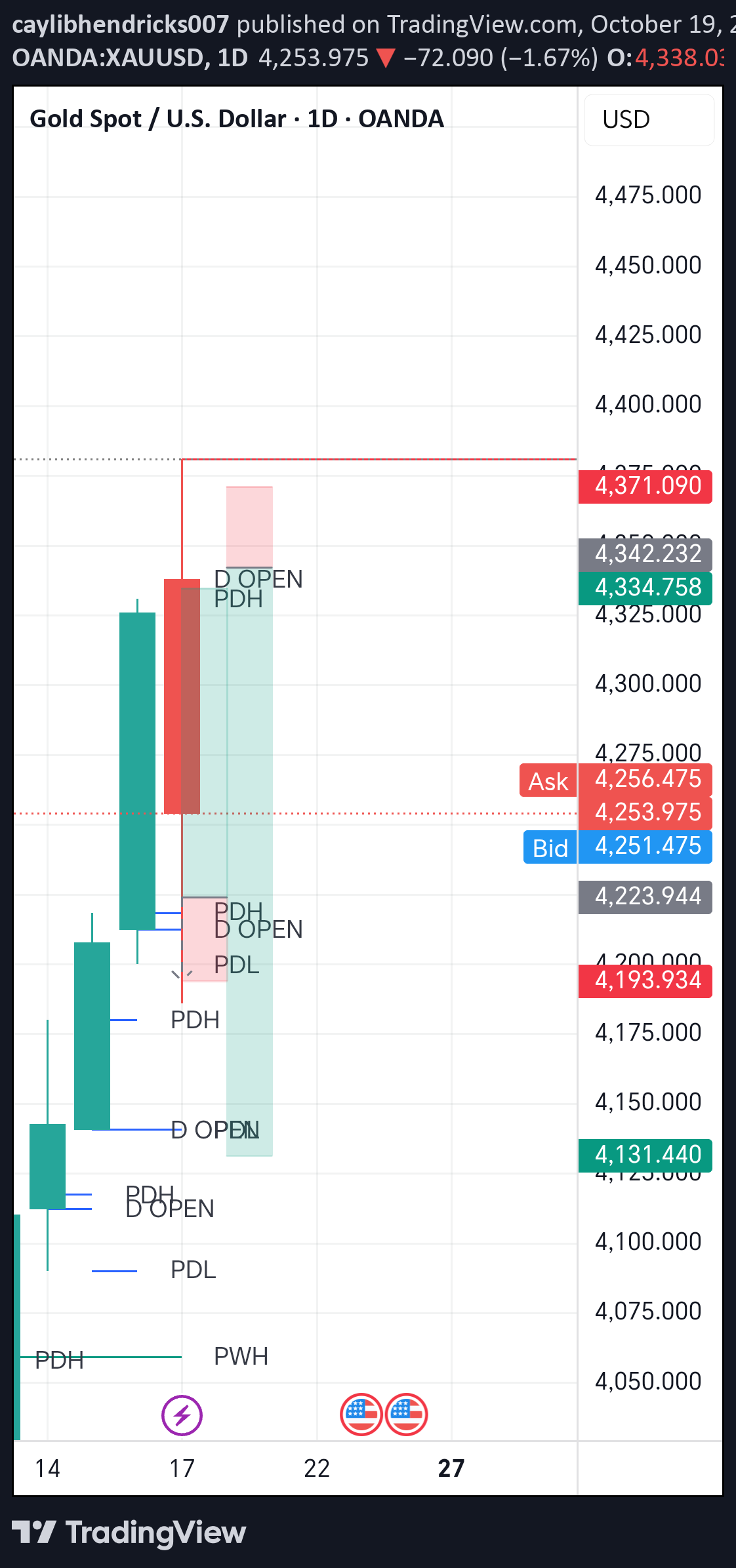

Gold has had a 9 week bullish run based on historical data this has only occured 6 prior times . This is a strong indication that this might be the last leg of the run for gold . With China finding mines of gold and south Africa having a massive reseve in gold up to 1. Trillion , we might see the supply increase if these countries decide to utilize these reserves . Outlook gold closes previous week high creating the top wick for the coming week and selling off to follow , Gold can either continue with this run to month end breaking history where gold has only ever traded once for 10-12 consecutive bullish Weeks . With us still looming in a shutdown , and no economic data release yet such as NFP. causing more uncertainty.

gold

this is the hr time frame showing the power of 3 -4hr time over lay with market indicators gold has shown tremendous strength in these last few months . watch for the month zone prices such as the 3month prices and monthly price zones

gold

Gold outlook has been bearish for the last few days ,with price closing roughly at market open. us dollar impacting news events this opening week be mindful the final month of the second quarter, closing year trades before year end.

Gold

Gold has been set too a new historical price Geopolitical has impacted the globe significantly . The wars have pushed major country inflation rates to unbearable heights

Market outlook

Inflationary pressures in Europe continue to decline. OPEC+ countries continued their voluntary production cuts The Eurozone Consumer Price Index for March declined to 2.4% y/y from 2.6% y/y in February, better than expectations of 2.5% y/y. The core CPI declined to 2.9% y/y in March from 3.1% y/y in February, better than expectations of 3.0% y/y and the slowest growth rate in 2 years. The disinflation trend coincided with recent remarks by ECB policy director Robert Holzmann, who said that a slowdown in price growth could make a June rate cut appropriate. WTI crude oil prices fell slightly and are trading just below $86 per barrel after the latest EIA data showed an unexpected rise in US inventories. US crude inventories rose by 3.21 million barrels instead of the expected decline of 1.511 million barrels. Nevertheless, prices remained near 5-month levels as traders were concerned that the Middle East's geopolitical tensions could disrupt oil supplies. In addition, OPEC+ countries decided to extend a voluntary production cut of 2.2 million barrels per day until June to stabilize the market. Latest changes in the stock market with only US stock pushing back : Bearish -Dow Jones Index (US30) down by 0.11%; Bullish - S&P 500 Index (US500) up by 0.11%; Bullish- NASDAQ Technology Index (US100) up by 0.23%; Bullish- German DAX (DE40) up by 0.46%; Bullish - French CAC 40 (FR40) up by 0.29%; Bullish -Spanish IBEX 35 (ES35) up by 0.52%; Bullish -British FTSE 100 (UK100) up by 0.03%.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.