bas20230503

@t_bas20230503

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

bas20230503

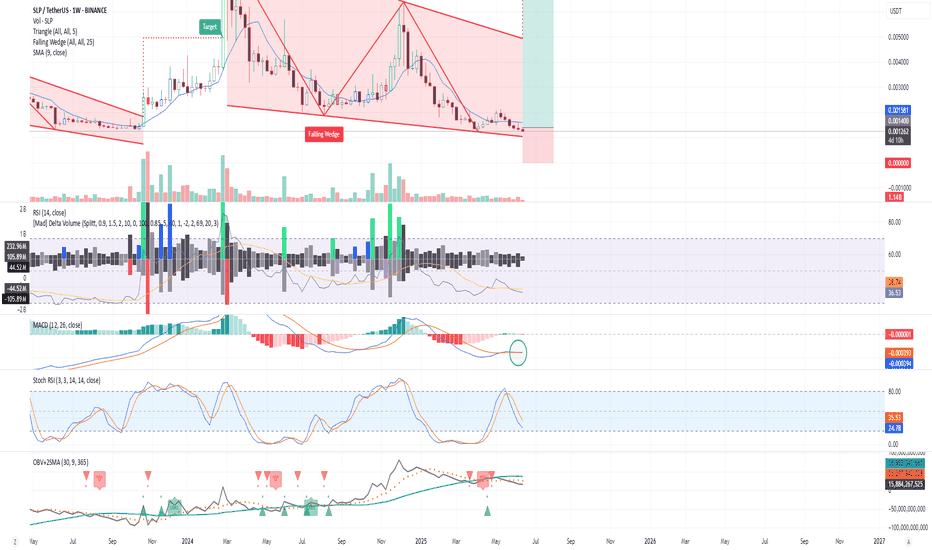

🎲 **Lottery SLP is highly risky. RR Ratio: 5:1 — High Risk, High Gamble** It looks like a **Falling Wedge** pattern might be forming. What, you want me to wait for a breakout and enter “safely”? There’s no such thing as “safe” with SLP — only piles of corpses soaked in blood. Right now, accumulation seems to be starting — based on **OBV** and **MACD**. **Stoch RSI** is currently crossing down — wait for an upward cross if you want more confirmation. There’s a high chance this is real accumulation, not just another setup for a pump and dump. Or maybe it *won’t* be a third rug pull. * **RSI** is at **37** * **OBV - SMA** is starting to trend up * **MACD** just turned green after being red since January If you’re still unsure: ✅ Wait for **CDC to turn green** ✅ Or wait for a strong green candle ✅ Or wait for **MACD to cross above zero** --- **The win ratio is 5x** with an **SL of 0.000000 (or none)**. Any funds used for SLP must be “fully disposable.” For example: If your portfolio is \$50,000, allocate only **1%** (\$500). If you lose, it’s \$500. But if you win, it’s **\$2,500**. Worth it — *as a gamble.* This is a gambling strategy. Pure and simple. --- 🔍 **Things to know** My average accuracy rate is just **25–30%**. That’s why aiming for **5x return** covers the risks. --- ✅ **Plan:** **Entry:** when price ≤ **0.0014** * **TP:** 0.0085 * **SL:** 0.0000 or none Split into **4 entries**, accumulating throughout **H2 of 2025**. If the price rises **10–20%** above cost, “cover your base” (break even). Or split your risk: take partial profits at 10% and the rest at 20% (average 15%). * First entry: **Now** * Second entry: **25% lower** * Third entry: **50% lower** * Final entry: **when price hits 0.0014 again** If, by 2026, the whole market rallies but **SLP stays behind** — Then… suck it up, sell it, or do whatever fits the situation. If it crashes, we crash together. **Fabulous. Mwah 💋** ---

bas20230503

From the AXSUSDT chart, it shows: Market Trend: The chart is currently in a clear downtrend along the EMA (Exponential Moving Average) line, with the 100-day EMA and 200-day EMA still above the price chart, indicating strong resistance. Important Support: The support area around 4.145 USD has been tested several times. If the price breaks this support level, it may see a continued correction to the 3.843 USD and 3.831 USD areas, which were previously rebounded. Stochastic RSI: It is in the oversold zone (below 20), indicating that the market may have a chance to recover in the short term due to weaker selling pressure, but other indicators should confirm it. RSI (Relative Strength Index): The RSI value at 40.61 is still in the downtrend zone. If the RSI value increases and crosses the 50 line, it may be a sign that the price has a chance to return to the uptrend. Trading Volume: Trading volume has decreased during the price correction, which may indicate that selling pressure is starting to weaken. Or there are fewer sellers Entry Recommendation: Buying at the support level of 4.145 USD should consider waiting for confirmation from Stochastic RSI that there is a reversal from the oversold zone and see if the RSI value can cut through the 50 line. If so, it may be a good time to buy. Set the stop loss below the important support level at around 4.00 USD to hedge the risk if the price falls below the support level.Not yet confirmed as an uptrend yet, but the percentage of being an uptrend is higher, but it will make the risk less worth it.

bas20230503

Relative Strength Index (RSI): The RSI is around 26.75, suggesting the market is in an oversold condition, which could signal an upward reversal. Volume and OBV: The Volume fight is at 0.21, and the OBV (On-Balance Volume) shows a notable increase, indicating a change in trading volume trends. Price Trend: The price has been in a downtrend for some time, but with the RSI in the oversold region and increasing volume, there might be a potential for a price reversal soon.

bas20230503

Is it worth gambling to lose everything on SLP, considering the first-level return in two years is considered high risky? If you only use 1-5% of your portfolio for this gamble. SL 0.00122 TP 0.2422024-05-17 short term if u and me buy now 0.0038 TP1 0.004270 (TP2 0.00584) SL 0.00347 Risk/Reward Ratio : 1.42 not good!2024-06-04 short term, a few months if u and me buy now 0.00441 TP1 0.006 (TP2 0.0066) SL 0.003746 Risk/Reward Ratio : 3.2 ok? If place a bet 65 dollars, will lose 10 dollars.

bas20230503

I gamble < 5% port Actually, I don't know . This work is just gambling. There are no principles at all. Just speaking like a noob person.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.