arielfuggini

@t_arielfuggini

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

arielfuggini

BTCUSDT ready to bounce back up?

I am betting on BTCUSDT being bullish on the short term.

arielfuggini

BTCUSDT below 29000: About To Collapse?

BTCUSDT is below the 29000 as of now. It has not closed below 29000 on daily candles since June 20th this year. There is a clear RSI divergence indicating weakness in the movements of the last 2 months. If today's daily candle closes below 29000, it is very possible that price will keep dropping in the upcoming days. In that case, I will be entering a short trade and aim to the orange trendline, the 200 SMA level, maybe even the area below 26350 on my chart.In effect, price yesterday closed below 29000, and price went as low as 25166, way below the 26350 area I anticipated. I entered short, a bit late at 28455 and sold at 26026, making a 93.36% ROI. If price keeps dropping, my next key levels are 25000, 24385, 21500, and 19588.

arielfuggini

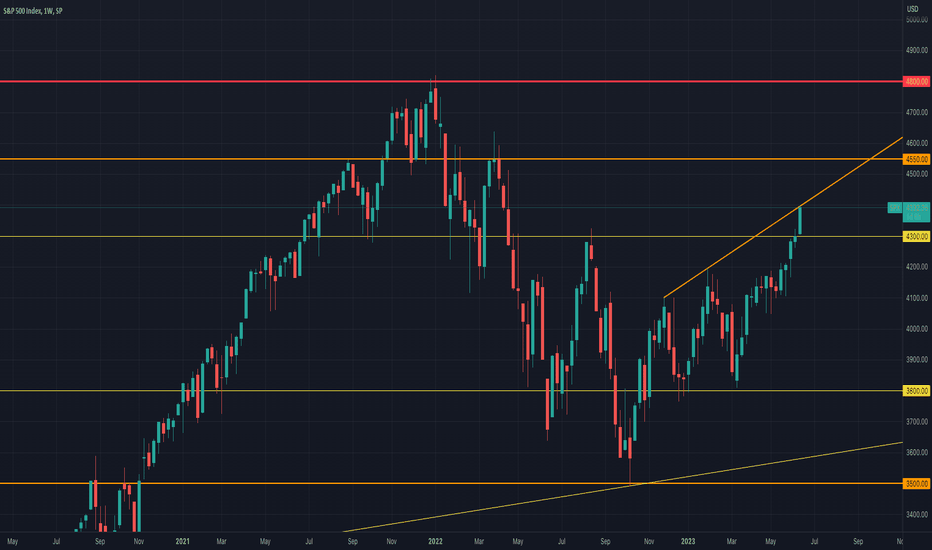

SPX on Weekly Resistance Trendline: Is It Correction Time?

The S&P 500 index ( SPX ) currently faces a pivotal juncture as it encounters a resistance trendline near the $4400 level. This price region assumes significant importance and necessitates close monitoring to assess potential market dynamics. Should SPX successfully breach and sustain a close above the $4400 resistance this week, it could portend the initiation of a bullish phase, with a notable target at the subsequent resistance level of $4550. This scenario suggests the possibility of further upward momentum for the index. Conversely, a failure to overcome the resistance barrier at $4400 may indicate the likelihood of a corrective phase or the continuation of the prevailing range-bound trading conditions. In such circumstances, it is prudent to exercise caution and consider the potential downside risks. It is worth noting that SPX recently exited the bear market territory, achieving the significant milestone of a close above $4190. This level represents a noteworthy 20% increment from the index's lowest point in October 2022. This development signals a discernible shift in market sentiment and serves as a reference point to assess the underlying strength of SPX. To make well-informed trading decisions, it is imperative to closely monitor the price action of SPX, particularly its ability to surmount the resistance trendline at $4400. Analyzing the index's response at this critical level will offer valuable insights into its near-term direction and potential opportunities. What do you think will happen next? Leave your comments below. Disclaimer: This trading idea is for informational purposes only and not financial advice. Conduct independent analysis and exercise due diligence before making trading decisions. Trading involves risk, and past performance is not indicative of future results.SPX has entered a correction phase, with increased trading volume in the $4440 zone. Possible support at $4300.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.