amirmoghaddam

@t_amirmoghaddam

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

amirmoghaddam

GALAUSDT 1W

The price has reversed from the static support zone and the lower boundary of the descending channel, forming favorable reversal candles. The target is the previous static resistance level (the upper boundary).

amirmoghaddam

#AVAXUSDT 1W

The price has faced an increase in demand within an appropriate time and price range, forming favorable reversal candles. If the $22 level is broken, the growth trigger will officially activate, and one could be optimistic about the price reaching the upper boundary of the descending channel, around the $47 range, in the medium term.

amirmoghaddam

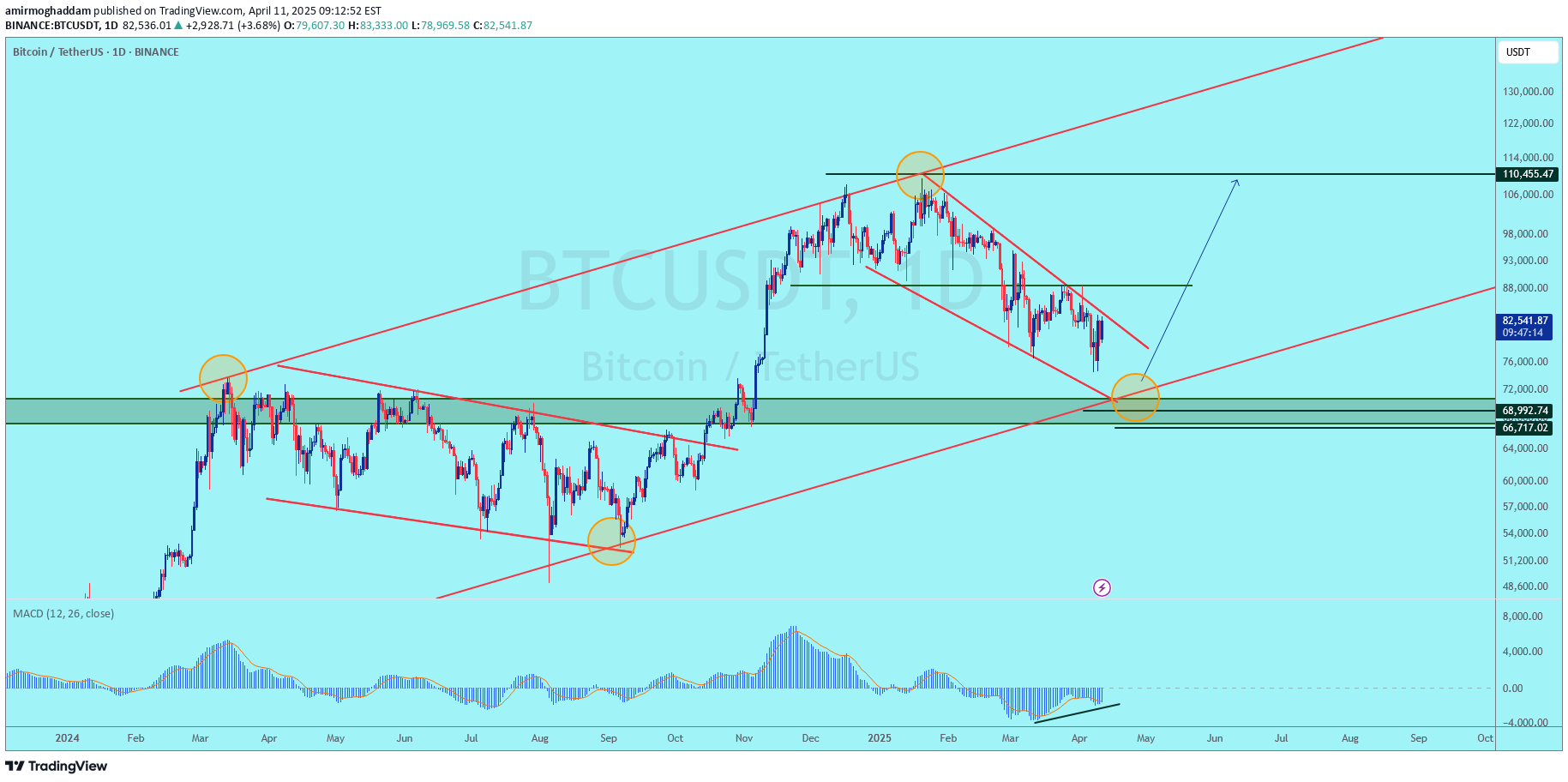

BTCUSDT 1D

A downward consolidation has been broken to the upside. It seems like we should get ready for a good buying opportunity

amirmoghaddam

BTCUSDT 1D

In an established uptrend, the price has reached the lower boundary of the ascending channel. Given the shallow correction, it appears that the price is testing the support level at the channel’s bottom. In the medium term, this suggests a potential recovery, with prices likely moving back toward the previous channel high.

amirmoghaddam

XAUUSD 1H

At the top boundary of the long-term channel, we are witnessing the formation of a head and shoulders pattern. If the neckline is broken, we expect a correction in gold.Everything is clearly shown in the image.

amirmoghaddam

FILUSDT 1W

The price has reached three strong and valid support levels:1. Static support zone2. Lower boundary of the descending channel3. Mid-band support of the pitchforkIt seems that if any correction occurs, it will likely be more of a time correction rather than a significant price drop. I don’t anticipate any major decline for this asset.

amirmoghaddam

XAUUSD 4H

Gold; has reached the upper boundary of its long-term ascending channel. In previous instances, we have witnessed significant declines after touching this resistance level. Now, we have to see whether the same scenario will unfold this time.

amirmoghaddam

PENDLEUSDT 1W

Technical AnalysisThe price has reached the lower boundary of a descending channel structure, accompanied by suitable reversal candlesticks. It appears that with the beginning of the new month, we may witness an upward movement in this chart.

amirmoghaddam

LINKUSDT 1W

The price, while in an uptrend, has reached the support level at the bottom of the ascending channel. In terms of price action, I do not anticipate any further significant correction beyond this point. From a temporal perspective, I am considering the period from April 25 to May 25—a one-month span—as the timeframe for the bottom formation. Conditions within this defined area and timeframe appear to be conducive to a solid upward rally.

amirmoghaddam

BTCUSDT 1W

The price, currently in an uptrend, has reached key support levels, including static support and ascending trendline support. Additionally, signs of bullish hidden divergence are observed in the RSI indicator. These factors suggest that the asset is likely to begin its upward movement soon.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.