WavesPatternsCandlesIndicators

@t_WavesPatternsCandlesIndicators

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

WavesPatternsCandlesIndicators

Nasdaq at or near end of trend?

Broadening top seen, with current PO if the recent high is the top. There’s still room to run higher to test the upper boundary of this pattern. Should the current potential head and shoulders top on the hourly chart break out to the downside then the odds of the top being in now increases. The same head and shoulders pattern is showing up in the major averages and also for Berkshire Hathaway.

WavesPatternsCandlesIndicators

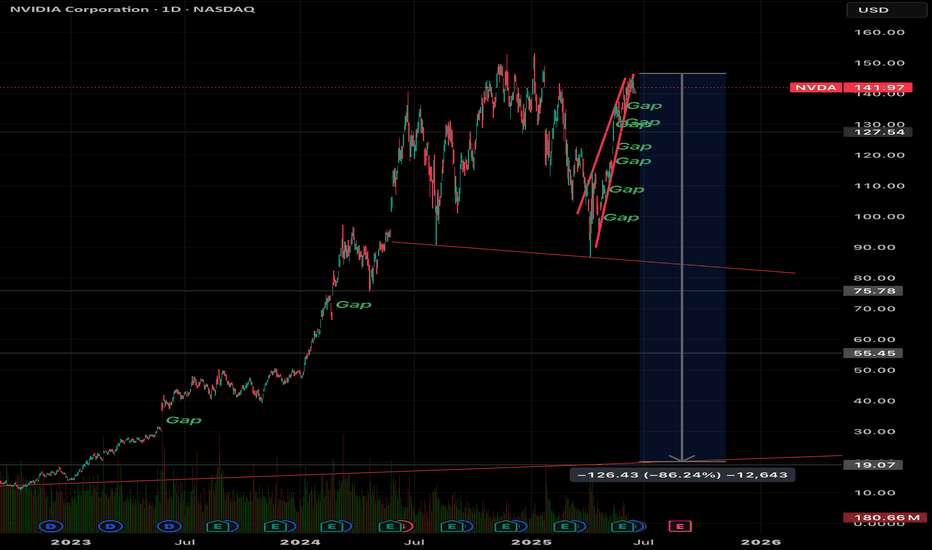

NVDA Short Idea

This bearish rising wedge just had a failed upside breakout, followed by a 5 wave move to test the lower trendline, and followed by a potential dead cat bounce. I’m short, with stop loss set if new highs are set.

WavesPatternsCandlesIndicators

NVDA bearish rising wedge for right shoulder (the bear thesis)

It looks like we’re just shy of a breakout confirmation this rising wedge which in itself might be only a right shoulder of head and shoulders top. Time will tell if this setup plays out or gets canceled out.

WavesPatternsCandlesIndicators

Gold potential upside

These chart formations have recently experienced breakouts. Not investing advice, but these are extremely bullish developments.

WavesPatternsCandlesIndicators

Wave 5 of 5 Gold?

If this wave count remains valid expect nothing less than a vertical blow off top type move. In commodities wave 5 can be the strongest wave. The higher could be interrupted by wild corrections to the downside. Keep in mind this is a long term chart so the move isn’t necessarily imminent.Not investing advice and do your own due diligence.

WavesPatternsCandlesIndicators

Gold wave 5 of 5 with spike incoming?

Not investment advice and do your own due diligence!

WavesPatternsCandlesIndicators

Gold Super Cycle Wave 5 Yearly Chart!

Not investment advice and do your own due diligence.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.