WHYUCAMPING

@t_WHYUCAMPING

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

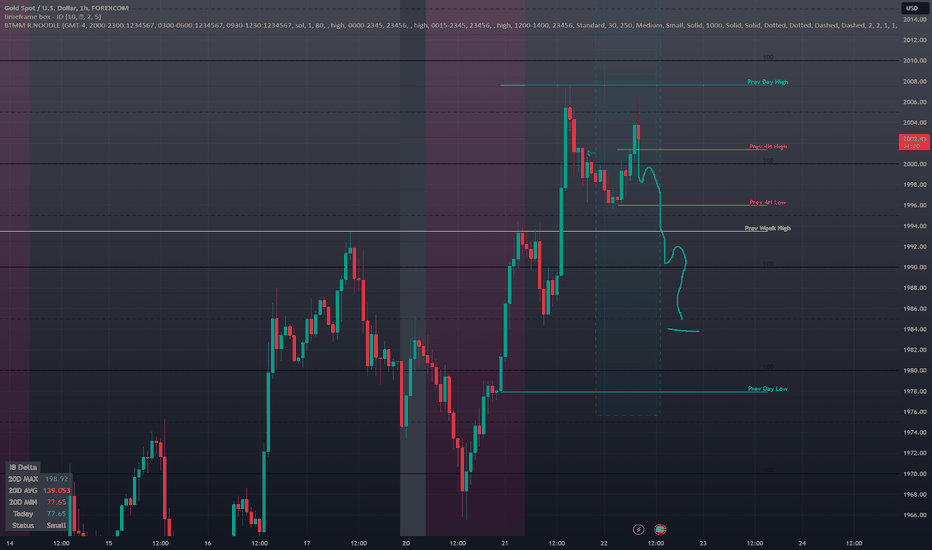

HEAH & SH PATTERN - - - 3 DAY CYCLE

Based on the combined data, here's a valid trade bias for trading gold: **Neutral to Slightly Bearish Bias** Reasoning: 1. The industry is trading close to its 3-year average P/E ratio of 3.7x, indicating a relatively neutral sentiment from investors. 2. The industry's past earnings growth has been declining, but revenues have been growing at a 12% annual rate. This suggests that the industry is still generating more sales, but the profitability has been impacted by increasing costs or investment. 3. The industry's performance has been relatively weak compared to the broader US market and other industries, with a negative 1-year return of -0.78%. 4. The forecasted growth rate is not mentioned in the provided data, but given the declining earnings growth and weak performance, it's likely that the growth rate is not expected to be very strong. 5. The typical/expected impact on USD pairs is high, indicating that a strong USD could be expected to impact the price of gold. 6. The consensus forecast for Consumer Price Index (YoY) is 3.4%, which suggests a slightly higher-than-expected inflation rate. A higher-than-expected CPI reading tends to be bullish for USD pairs and bearish for gold prices. 7. Gold prices have been trending lower in recent years, with the industry's performance also being weak. Considering these factors, a neutral to slightly bearish bias is suggested for trading gold. This means that you may want to consider taking a neutral or slightly short position in gold, but with caution and a tight stop-loss in case the trend reverses. In terms of specific trade ideas, you could consider: * Shorting gold or taking a short position in gold-related ETFs * Selling call options or buying put options on gold futures * Hedging long positions in other assets by taking a short position in gold Please note that this is not personalized investment advice, and you should always consult with a financial advisor before making any investment decisions.

BEAR BREAK LOOMING MNLY ADR

Based on market stuc we can see a bigger wedge pattern, and the MNLY adr is only but to be put more selling presure to the mix..

Positive news for DXY - Bear trend for Gold

news forecast is bull and dxy is already running up.. Gold will trap then fall sharp for NY..

BIG BEAR FROM HIGHS FROM 10 YEARS AGO

Last Friday's news saw market makers making a shrewd move by only moving 100 pips despite WTI experiencing a bearish dip of 300 pips. Gold market makers are wiser and will ensure that long-term holders carefully consider their next move. Personally, I believe it's time to sell.

BTC SHORT TERM Yusuf uu

Sell The pump and dump Iffuxxy Build Ivvv .fststtstt Ifichsif Poi Lh

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.