Viatre

@t_Viatre

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Viatre

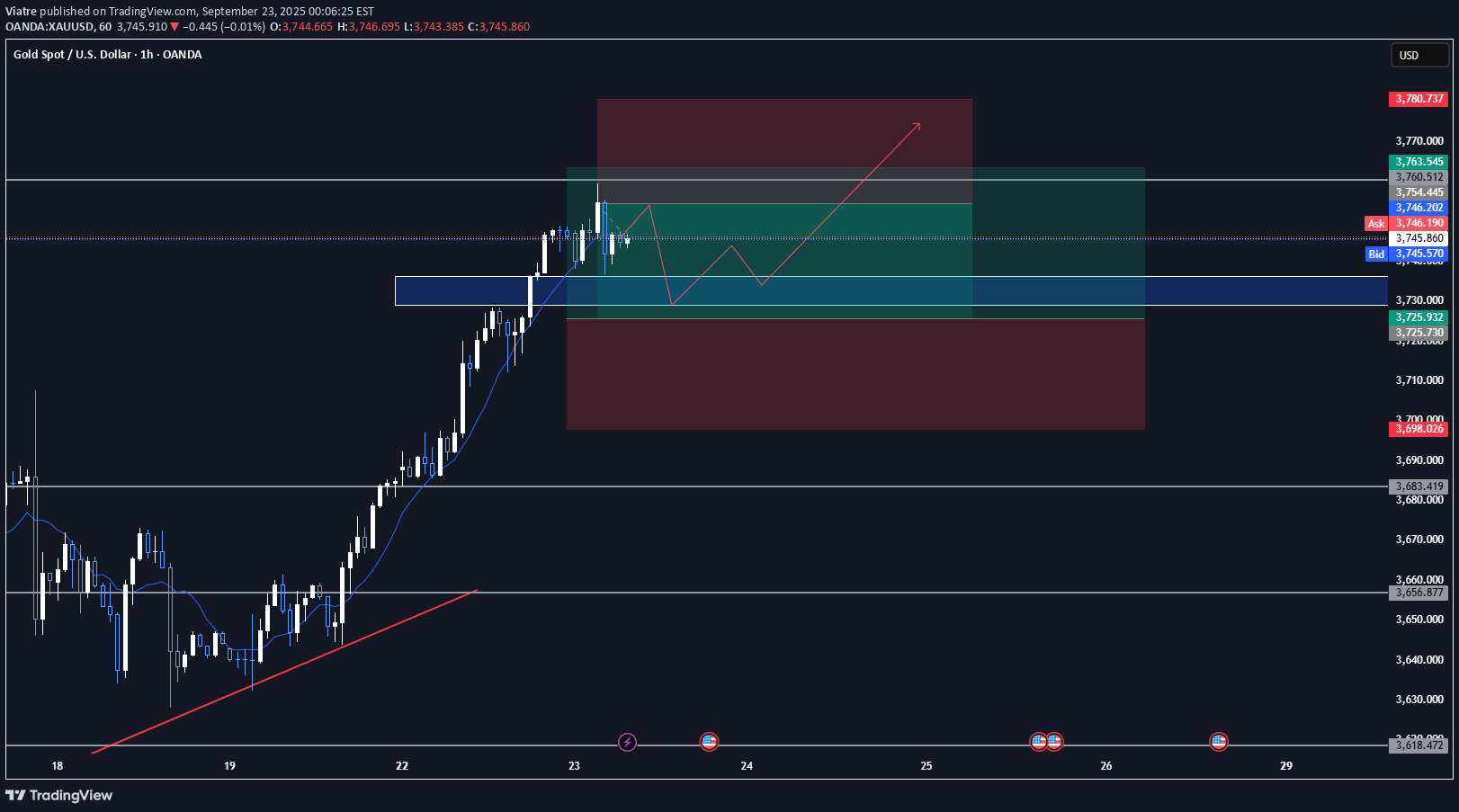

XAUUSD 23.09.2025

-Market formation: The opening of the week for the instrument was marked by new historical highs. Following the tightening of US immigration policy on September 21, bullish sentiment has clearly dominated the market since the beginning of this month, with the instrument gaining 10% over three weeks. -Forecast: In the short term, a slight correction of 0.5-1.5% from the resistance zone of 3760 should be considered, and after reaching the imbalance zone of 3730-3745, further upward movement is expected. If the price settles below the 3705-3700 level, deeper correction levels and a return to the established consolidation range of 3620-3655 should be considered. -News background: The main focus of attention is still on the US Federal Reserve's interest rate. After the speech, market participants expect the rate to continue to decline in October. Also, the tightening of US immigration policy, in particular the 100-fold increase in the cost of work visas, has become an extremely strong driver of growth. No particularly significant news is expected this week, so it is worth monitoring the general mood of market participants.

Viatre

XAUUSD 12.08.2025

-Market formation: Last week, against the backdrop of new duties on gold exports from Switzerland, the price of the asset returned to the resistance level of 3400 and, with its sharp movement, formed a wide range of imbalance, 3300-3340, towards which a systematic decline is currently taking place. -Forecast scenario: The main movement is likely to be aimed at finding a new liquidity pool in the 3340-3330 area. With further consolidation in a sideways trend. -News background: Important news regarding this asset includes: 1. San Francisco-based startup Marathon Fusion announced the development of a method for nuclear fusion of gold from mercury. According to preliminary data, up to 5 tons of gold per year can be produced for each GW of reactor capacity. 2. Publication of the consumer price index (CPI): core inflation is expected to reach 3.0%.

Viatre

XAUUSD 22.07.2025

-Formation of the market: Against the background of the next trading tariffs, the price of the asset is again testing the level of 3400, forming the imbalance level of 3380-3385. -Forecast: In the medium term, there will probably be a decline to the imbalance level, and then another test of the 3400 level, with a likely subsequent pullback to the 3350 support level. -News Background: The main focus of attention this week should be on: 1.Fed Speeches (Tuesday, July 22) 2. Preliminary PMIs (Thursday, July 24) 3. Initial Jobless Claims (Thursday, July 24)

Viatre

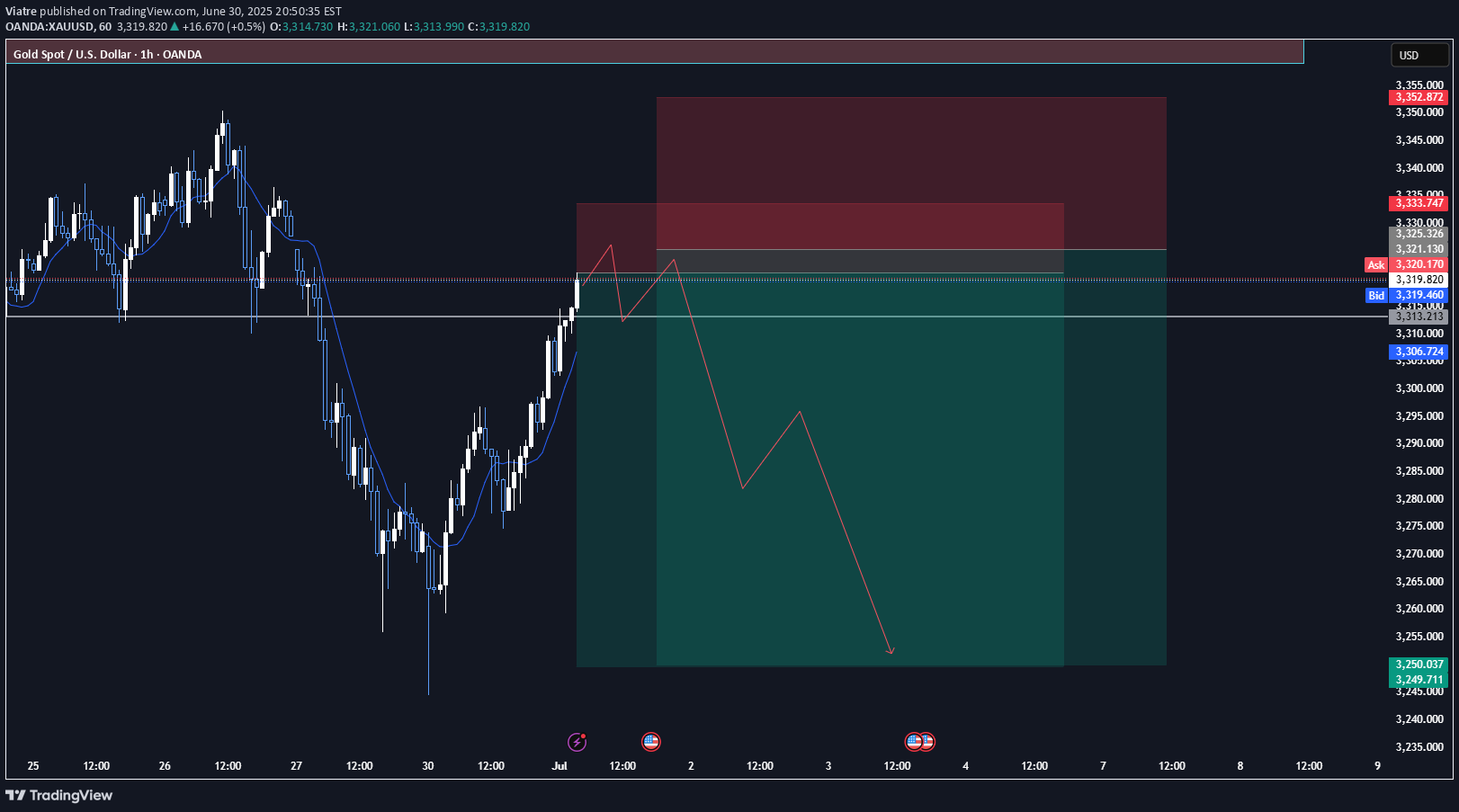

XAUUSD 01.07.2025

-Formation of the market:On the background of general cooling of geopolitical situation gold continues its fall to the levels of 3250. The main preference of market participants is now given to less "conservative" assets, which is clearly reflected in the record values of cryptocurrency and stock market.-Forecast:In the medium term, capital outflows are likely to continue and the asset will again test the 3250 level as support.-News Background:There will be many "strong" news releases this week that could be a strong driver of movement for the asset:Today:-ISM Manufacturing PMI and JOLTS Job openings.Thursday:Unemployment rate, and Non-Farm Payrolls.

Viatre

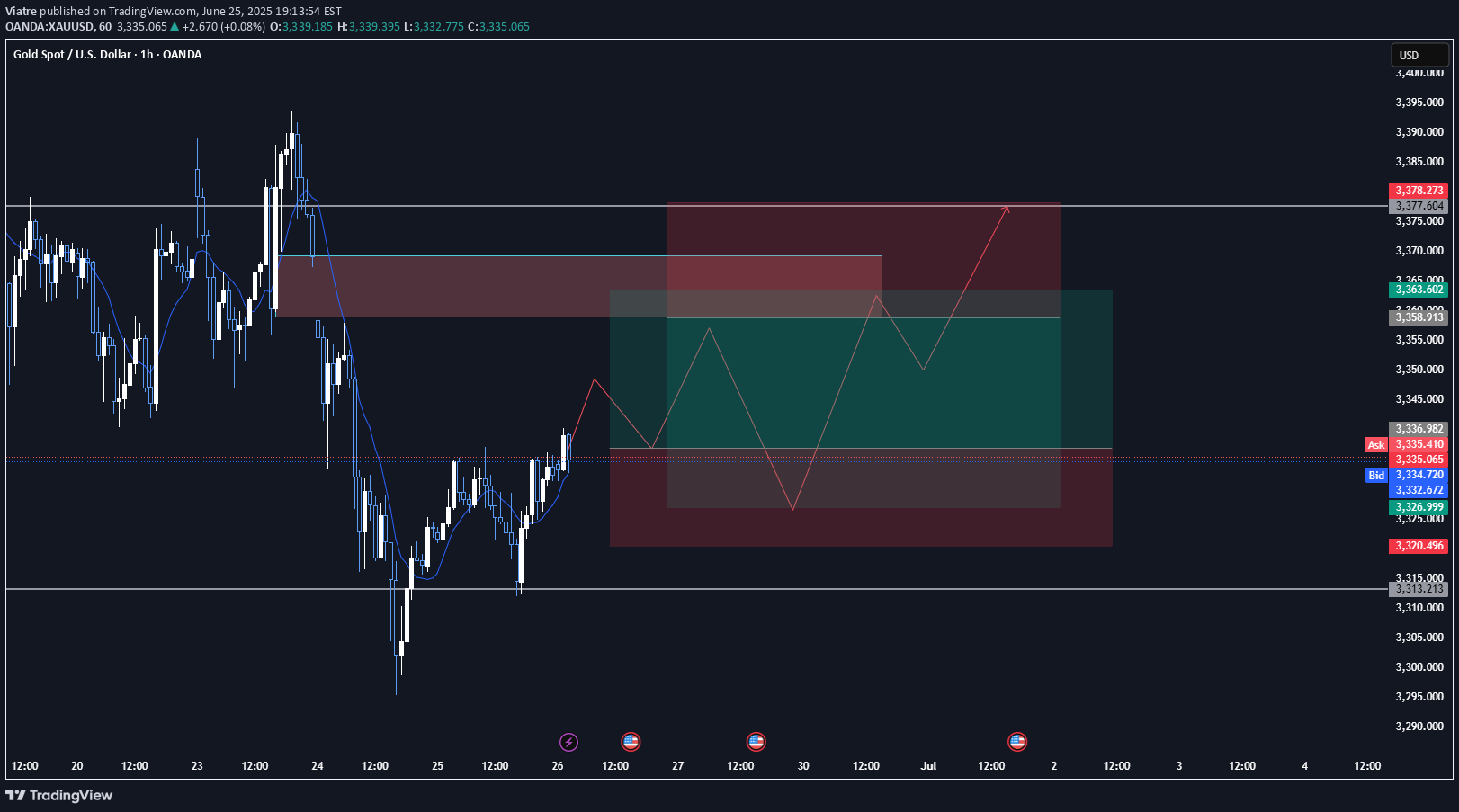

XAUUSD 26.06.2025

-Formation of the market:The geopolitical situation brought strong uncertainty in the expectations of market participants, due to which the asset lost 4.5% of its price from the last high, and re-entered the wide consolidation channel 3300-3380.-Forecast:In the medium term, the main movement is likely to be in the consolidation range of 3300-3380.The price could probably reach the imbalance/gap range of the opening session at 3365 and then return to test the support level at 3300.-News Background:The situation in the Middle East has turned peaceful, but it is worth watching for further developments as tensions remain.The main focus on economic events is now centered on the PCE Index, which could trigger a move towards one of the consolidation channel boundaries.

Viatre

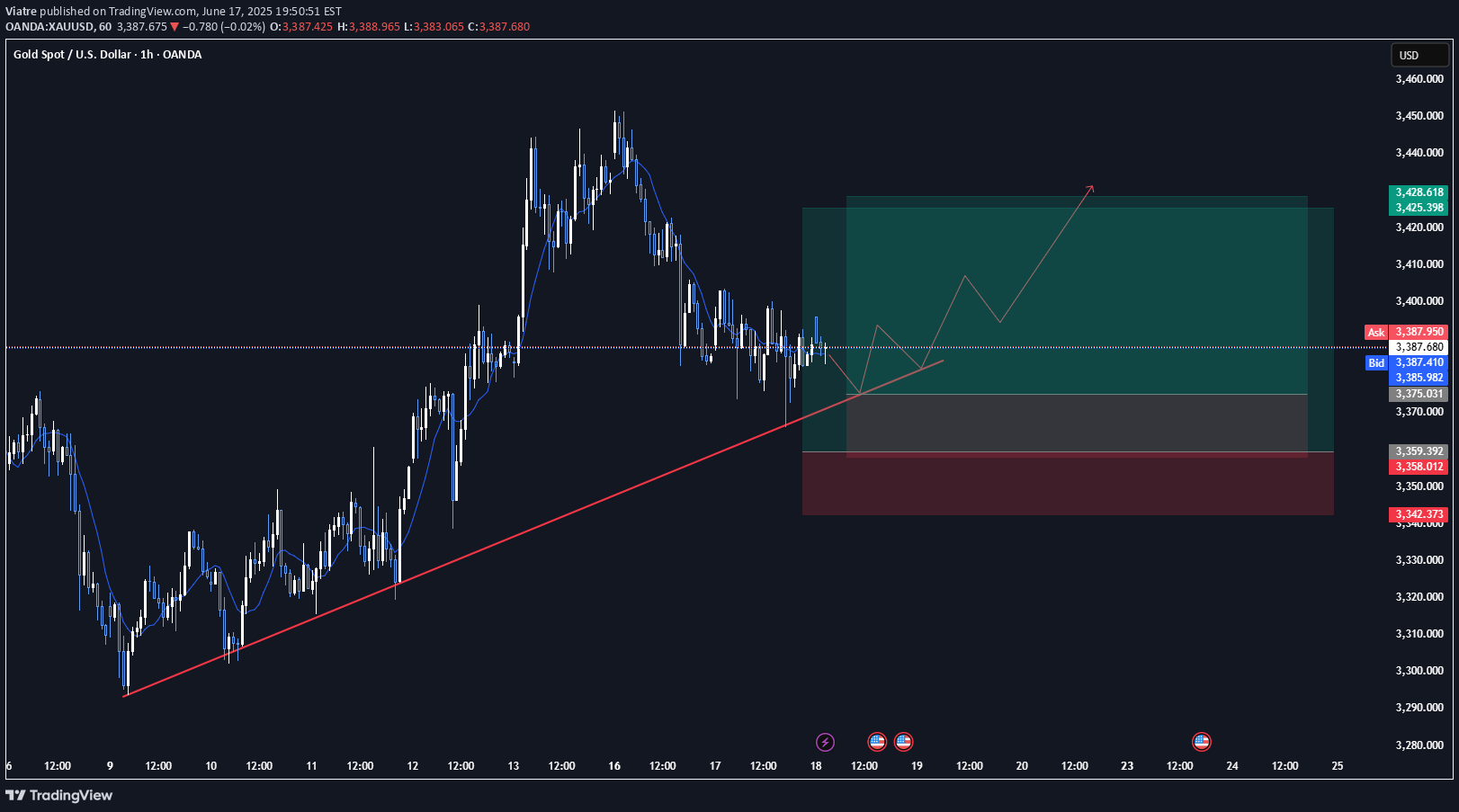

XAUUSD 18.06.2025

-Formation of the market:After the geopolitical "panic" a correction of the upward movement was formed, but the trend retained its strength after testing the support level at 3365 and returned to the consolidation channel 3380-3400.-Forecast: Target level at the moment is at 3400, if it is broken and fixed above, we can consider further growth targets at 3500-3650.News background:The escalation of the Israel-Iran conflict strongly affects the gold positions, it is worth to follow the further course of events, although in many respects, the "moment of stress" is already reflected on the chart by a new historical maximum.Also today will be the Fed interest rate meeting, which may also become a driver of further growth in gold, although the rate is expected to remain unchanged with 99% probability.

Viatre

XAUUSD 16.04.2025

-Market Formation:New rounds of the “Trade War” have taken gold back to all-time highs, amid economic uncertainty and tensions. The asset has risen by a record 10% over the past week, in an almost unstoppable move, and if the political situation continues to worsen, possible targets could be at 3300-3500 levels by the end of this summer.-Forecast :After a consolidation phase in the 3200-3240 range, a continuation of the dominant upward movement towards the 3300 level is likely.-News Background:The main background is still focused on the fees imposed by the US, and the views of analysts are extremely contradictory, many believe that the new policy brings the US recession closer, while others believe that the “cooling” of the economy will allow the US to gain economic advantages, against the background of the global “overheating” and overcrediting of economies.

Viatre

XAUUSD 08.04.2025

-Formation of the market:After the release of the announcement of the introduction of new trade duties in the U.S. and a number of positive economic activity indicators, the dollar is strongly strengthening, thus bringing the price of gold back to the imbalance level of the past growth of 2955, and in general setting a new downtrend, which reduced the position of gold by 5%.From the imbalance level a pin-bar was formed, which has already recovered its movement to the 3000 level, another test of the 2950 level is possible, followed by a rise.-Forecast:On the background of general uncertainty, it is likely that the price may go for a long consolidation, as the past fall may also indicate a capital outflow, which will lead to a new period of accumulation of positions.Possible return to the level of 3050, but the main movement is likely to occur in the range of 2950-3050- News background:The main expectations after the Fed speech are still in favor of strengthening the dollar, even despite the call of the U.S. President to reduce the key rate, most analysts still believe that the May meeting will end with an unchanged decision or increase.

Viatre

XAUUSD 26.03.2025

-Market Formation:After updating new historical highs, gold corrects twice to the 3000 level, which indicates consolidation of large volumes at this level, thus forming a descending triangle on the hourly chart, and the imbalance level at 2955-2960.It is likely that the growth goals of significant market participants have been achieved, and now there is a fixation of volumes, for further upward movement will require new liquidity, passed in the imbalance zone.-Forecast:Main downside target to the level of 2955-2960, followed by testing 3000 already as a resistance level, and possible consolidation at this level.-News background:Expectations of new customs tariffs, strengthen the position of the dollar.Also, the settlement of geopolitical tensions, weakening the gold positions.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.