TrategySherpa

@t_TrategySherpa

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

TrategySherpa

XAU slightly increased after a sharp decline in the previous ses

World gold regains momentum World gold prices recorded a slight increase of 2,636 USD/ounce, showing a recovery compared to the previous session. In the previous trading session, the price had fallen to 2,629.5 USD/ounce due to pressure from the signal of a moderate pace in the Fed's next interest rate easing cycle. Fed Chairman Jerome Powell spoke at the annual meeting of the National Association for Business Economics (NABE), emphasizing that the economy is in a solid state and the Fed will continue to carefully evaluate input data when considering the next policy adjustment.SELL XAU 2645 TP1: 2638 TP2: 2630 SL: 2653

TrategySherpa

SAU continues to rise after setting a record

Weaker US macroeconomic data has put significant downward pressure on the USD, pushing it closer to its lowest level this year while pushing gold prices to a new record high. The Consumer Confidence Index fell to 98.7 in September, down from 105.6 in August, while Current Conditions fell to 124.3 from 134.6. A Richmond Fed survey showed manufacturing activity remained weak, with the composite index falling to -21 in September from -19 in August. The CME Group’s FedWatch tool shows that markets are pricing in a more than 60% chance of the Fed cutting interest rates by another 50 bps at its November meeting.SELL XAU 2664 TP1: 2657 TP2: 2650 SL: 2670Running + 60 pipsRUNNING + 100 PIPS

TrategySherpa

World XAU continues to hit new highs

The US Federal Reserve’s interest rate decision last week did not disappoint the gold market. After the policy meeting, gold prices continuously “broke” records and ended the week above the $2,600/ounce mark. Currently, gold prices continue to expand their upward momentum and are fluctuating around $2,628/ounce.SELL XAU 2622 Tp1: 2617 Tp2: 2610 SL: 2630

TrategySherpa

World gold price is moving sideways around 2,573 USD/ounce

Pressured by a rebound in the US dollar and a slight rise in US government bond yields, the yellow metal lost 0.5% after hitting an all-time high of $2,589 an ounce earlier in the week. Traders are now waiting to see whether the US Federal Reserve will pivot policy at this meeting as expected. Following a series of optimistic data, financial markets are predicting the possibility of the Fed cutting interest rates more aggressively in its first interest rate cut since 2020. According to the CME FedWatch tool, the market is certain about the possibility of easing monetary policy with 63% predicting a cut of 50 basis points.BUY XAU 2576 TP1: 2581 TP2: 2590 SL: 2570

TrategySherpa

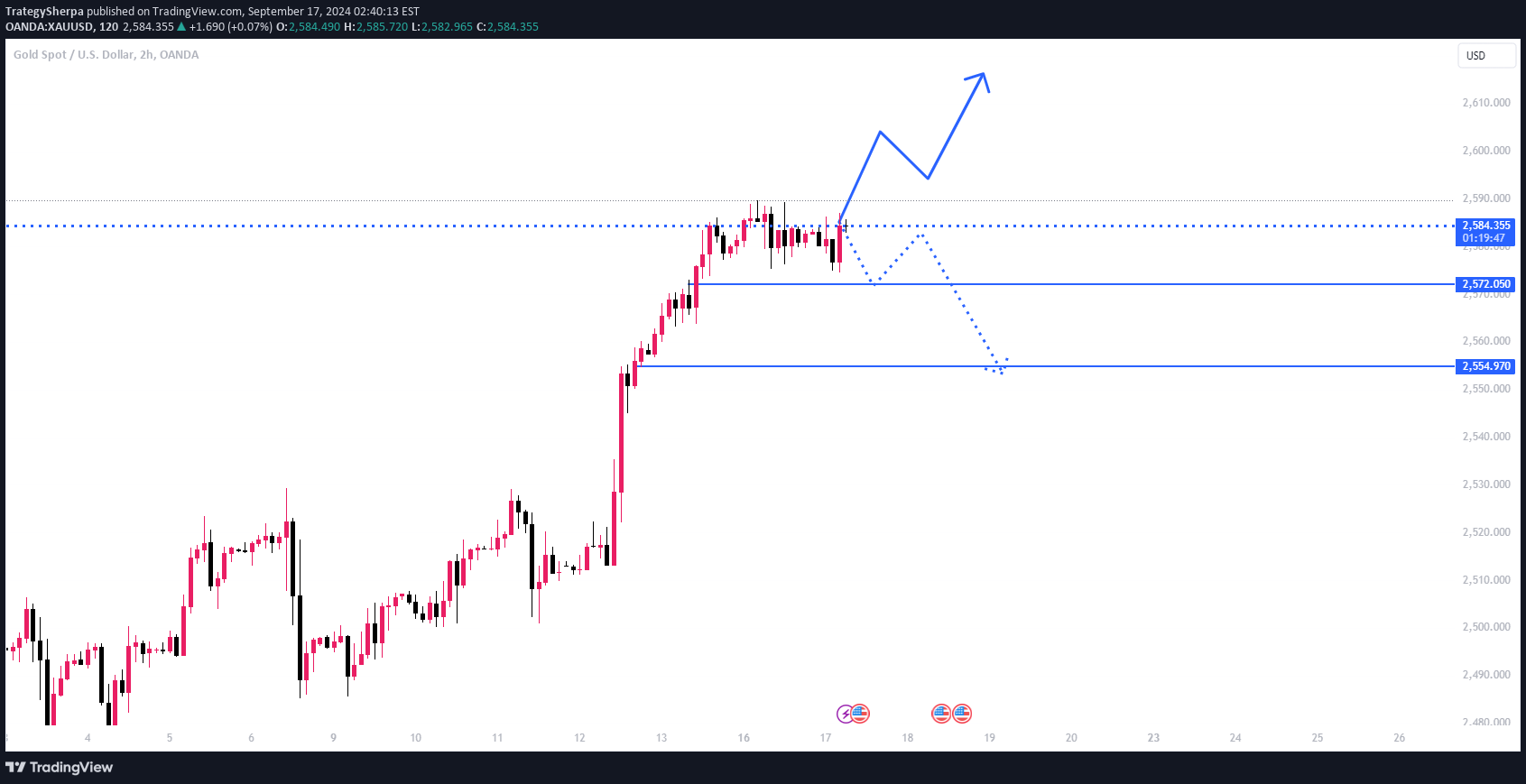

Gold after Fed rate cut?

Gold could confirm a breakout and unless something major happens in other markets, this would be a bullish sign. So far, nothing has happened in the precious metals sector, while the DXY has fallen. This is a bearish factor, but before we jump to conclusions, let’s dig deeper.BUY XAU 2579 Tp1: 2587 tp2: 2590 sl: 2472

TrategySherpa

Gold hits record high as USD/JPY drops nearly 150 pips

Gold prices are on track for their biggest weekly gain since mid-August, rising 2.8% to a record $2,570 an ounce. The gains were fueled by a weaker dollar. Gold was last up 0.4% at $2,568 an ounce. The MSCI Asia Pacific ex-Japan Index rose 0.53%. US stock futures rose 0.1%, following gains in currency indexes on Thursday.BUY gold 2586 Tp1: 2592 Tp2: 2600 SL: 2578running + 30 pips

TrategySherpa

XAU hits record high as USD falls

"The market is currently pricing in a moderate FOMC rate cut outside of a recession. We, along with the majority of US economists, do not expect the US economy to fall into a recession." Global stocks rose for a fifth straight day, posting a 0.2% gain. This was helped by gains in European stocks, where the STOXX 600 index rose 0.4%, heading for a 2.6% weekly gain and its biggest one-month gain.BUY XAU 2585 Tp1: 2593 TP2: 2600 SL; 2578runnning + 40 pips

TrategySherpa

XAU sets many new records

The world gold price is currently at $2,563/ounce, up $46 compared to early yesterday morning. The main driving force comes from the ECB's monetary policy easing move. Specifically, the ECB has lowered the base interest rate by 25 bps to 3.5%, while reducing the refinancing rate and marginal lending rate to 3.65% and 3.9%, respectively. In addition, the gold price is also driven by expectations that the Fed will aggressively cut interest rates, after US economic indicators showed signs of slowing down.BUY XAU 2569 TP1: 2576 TP2: 2583 SL: 2562

TrategySherpa

September begins with weak US jobs market report

September began with a weak US jobs report and news that Japan had raised interest rates from zero to 0.25%. This sent the CBOE Volatility Index (the “fear index”) soaring from 16 to 38, and crowd favorites like the yen carry trade and the world’s most important stock, Nvidia (NVDA), down double digits. In his speech at Jackson Hole in late August, Fed Chairman Jerome Powell hinted at future rate cuts. “The time has come for policy to be recalibrated,” he said. “The path is clear, and the timing and pace of rate cuts will depend on the data, the outlook, and the balance of risks.” So they got the message. Rates are falling and the data is weak. The latest US jobs reports show fewer people being hired, fewer new jobs being created, and layoffs are happening more frequently.BUY XAU 2494 TP1: 2500 Tp2: 2510 SL: 2486running + 30 pips+ 60 pipsrunning + 100 pipshit Tp 2

TrategySherpa

XAU stays green in the trading map

A report showing a weakening U.S. labor market on Friday could help the Fed determine whether to cut interest rates by 25 or 50 basis points at its next meeting. Lower interest rates would weaken the dollar but significantly increase the appeal of non-yielding assets such as gold. Gold prices have risen more than 20% this year, hitting a peak of $2,531.75 an ounce in August. Along with expectations of a Fed rate cut, gold has been supported by strong retail demand and safe-haven demand due to conflicts in the Middle East and Ukraine.SELL XAU 2521 - 2524 TP1: 2516 TP2: 2510 SL: 2530

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.