Thetraderscollective

@t_Thetraderscollective

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Thetraderscollective

Gold Outlook – Friday August 1st | Navigating NFP Volatility

Gold has been in a clear downtrend all week, confirmed on the 4H chart and pushed further by the Fed rate decision earlier this week. With NFP ahead today, I’m staying sharp and focused only on confirmed setups: 🔻 Sell Setup: Below 3274.33 First TP: 3268 (+50 pips) Final TP: 3264 (+97 pips) 🟢 Buy Setup: Above 3343 Target: 3359 (+160 pips) 🎯 This is not the day to guess — it’s about being fast, clean, and rule-based.

Thetraderscollective

$XAUUSD / $GOLD — July 22nd Outlook

Previous: Gold gave us a massive 600+ pip run on Monday, breaking above the key 3380 resistance that had held for over a week. The move confirmed bullish continuation in line with the overall HTF trend. Now: We’re now hovering just above 3380 again, with a break-and-retest setup forming on the lower timeframes (1H/4H). Key Zones: 🔁 Retest Buy Zone: 3380–3375 📈 Target 1: 3428 📈 Target 2: 3495 (ATH) ⚠️ Invalidation: Clean 4H close below 3360 Bias: Bullish as long as 3380 holds. Will be looking to scale in once support confirms.

Thetraderscollective

$XAUUSD / Gold - Thursday July 10th Outlook

Yesterday’s price action gave us a clean 200 pip run from the break and retest of 3308, and today we’ve already caught 140 pips using yesterday’s high (3317.17) as intraday support.But now we’re sitting at a critical inflection point.📍 Key levels:Safe Buys: Only looking to buy above Tuesday’s high of 3345.74, which gives room for a clean 200-pip move up toward last Thursday’s high.Bearish Scenario: If we fail to break that high and instead break yesterday’s high of 3316.65, we may see a sharp 340 pip drop back down to 3282.83.⚠️ Caution: The 4H bearish trendline from mid-June is still intact, and we're currently testing it. Wait for clear confirmation either way. Higher timeframes remain bullish, so we’re playing both scenarios carefully.

Thetraderscollective

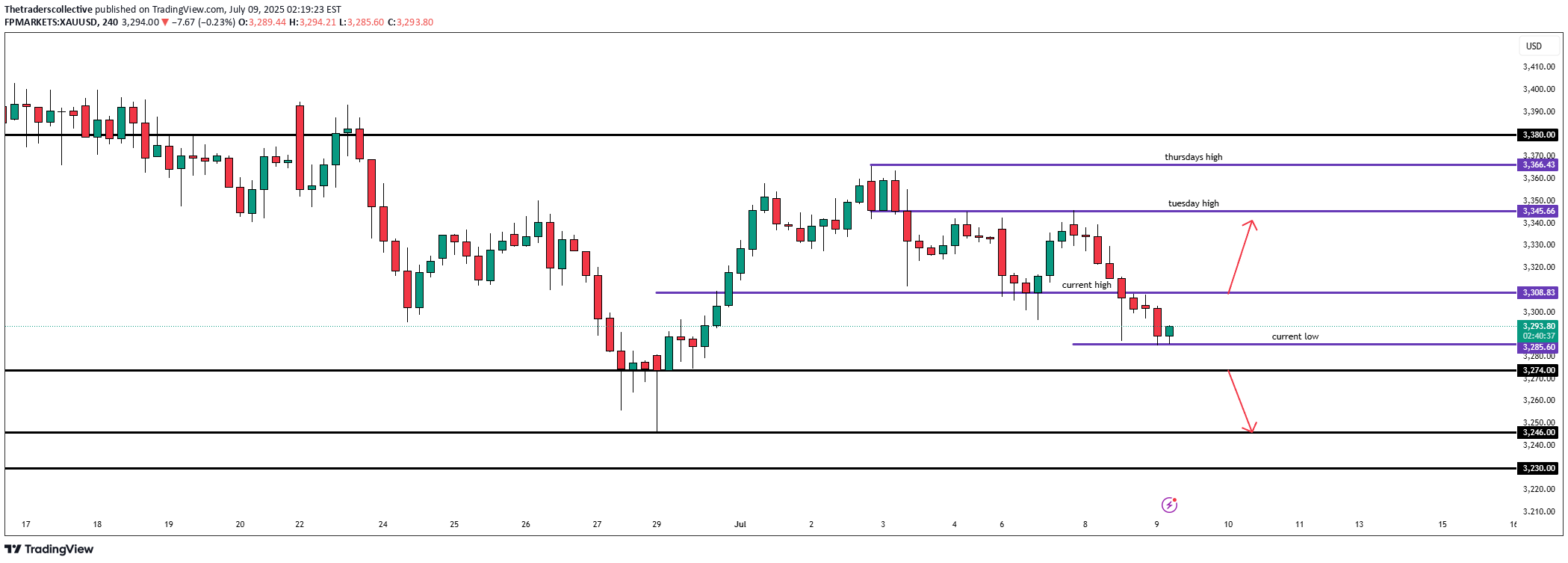

🇺🇸 XAUUSD – July 9 | Structure Testing Key Levels Again

Yesterday’s clean rejection from 3328.76 gave us a profitable 300+ pip move down to 3298. Today, we’re seeing a potential double bottom near 3284.61 — the same level price held during yesterday’s drop.📌 What I’m Watching:🔼 Buy Setup:Break above today’s high → bullish continuation to 3345.66➤ Estimated 300+ pips upside🔽 Sell Setup:Break of today’s low = move to 3274.00➤ If 3274 breaks, extension to 3246.00 opens up another 180 pipsOverall bias remains bullish (daily & weekly trendlines still respected), but I’ll trade what price confirms — not what I expect

Thetraderscollective

XAUUSD – Monday, July 7th Analysis

Gold is sitting on a knife’s edge as we enter the NY session.Current price action:Rejected twice at 3307 on the 4hrBroke Friday’s lowNow approaching today’s lowScenario 1 – Bearish:Clean break below current 4hr low → target: 3274 (323 pips)This is a key higher timeframe swing level, last tested in MayScenario 2 – Bullish:If we reject current lows and support forms →First target: 3307 (170 pips)Second target: 3344 (390 pips)📌 Risk is balanced — both directions offer 300+ pips. Monitor structure + volume closely.

Thetraderscollective

GOLD (XAUUSD) – June 30th Outlook

Weekly: Gold opens bullish while still respecting the Dec 2024 trendline, despite the last two weekly candles closing bearish.Daily: Currently at 3295, approaching key intraday bearish structure at 3310.Last Week’s Bounce: From 3274 delivered 220+ pips, now becoming a pivotal reaction zone.If 3310 Breaks: Expect continuation to 3344 – a 350-pip swing.If 3310 Rejects: Anticipate a move back to 3274 for re-evaluation.⚠️ Note: Today is the final trading day of the month. Watch for false breakouts and potential liquidity traps.

Thetraderscollective

Gold Approaching Key Retest Zone – Watching for Pullback to 3274

Gold (XAUUSD) is slowly climbing back toward our previously broken structure around 3344, which we identified as a key retest zone. I’ll be looking for rejections here to confirm a short-term pullback before a continuation of the broader bullish trend.What I’m Watching:🔻 Short-term sells from 3344 to 3274✅ HRHR Buys: From 3274 if we form support there✅ Safe Buys: Break above 3380✅ Safest Buys: Above 3428The broader trend remains bullish on higher timeframes, but without a solid break of 3380+, we may still see that healthy correction.

Thetraderscollective

GOLD (XAUUSD) Analysis – Tuesday, May 20th, 2025

GOLD (XAUUSD) Analysis – Tuesday, May 20th, 2025Since breaking out of the bearish channel late last week, gold has lacked momentum.We've had multiple failed attempts to break and close above 3274.00, making it difficult to maintain a bullish stance.🔸 Current Range:Resistance = 3274.00Support = 3115.00Structure is unclear on intraday — trapped between two major zones.🔸 Bullish Bias Resumes If:Break and close above 3274.00Target = 3350.00🔸 Bearish Bias Triggers If:Break and close below 3115.00Target = 3046.00🧠 Plan:No intraday trades while stuck in this chop.Wait for confirmation above/below the range to align with higher timeframe movement.

Thetraderscollective

XAUUSD Bias: Intraday Bullish (cautious) Timeframe:4hr

Gold opened with a 600-pip gap down overnight due to easing geopolitical fears (US/China trade talk optimism), breaking below our key support at 3274.00.However, price quickly snapped back above 3274.00 and is currently showing bullish signs into the London open.📊 Key Zones to Watch:3274.00 → if support forms again, early buys possible3333.00 → safer buy trigger3380.00 → wedge resistance and key short-term target🎯 Target Range:From 3274 to 3380 = 1000 pipsFrom 3333 to 3380 = 400+ pips⚠️ Caution: 3380 also aligns with technical wedge resistance. If we reject there, we may see bearish structure set in for the second half of May.

Thetraderscollective

XAUUSD: Strong Bullish (Intraday & Swing)

Gold closed Friday with indecision, rejecting both 3230.00 and 3274.00 as NFP remained muted. That led to an explosive 936 pip candle yesterday, ripping straight through 3274.00 and closing just shy of the major 3333.00 level.Today, price has already pushed 400 pips higher and is currently hovering around 3365 on the 4H chart.Key Buy Setups:Break above 3380 → Target 3428Pullback & successful retest of 3333 as support → Target 3428Pip Range Opportunity:500 – 900 pips depending on the entrySummary: Bullish bias remains intact on all timeframes. I’m watching for a clean break of 3380 to ride the next leg up, or a healthy pullback to 3333 before continuation.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.