TheAlphaGroup

@t_TheAlphaGroup

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

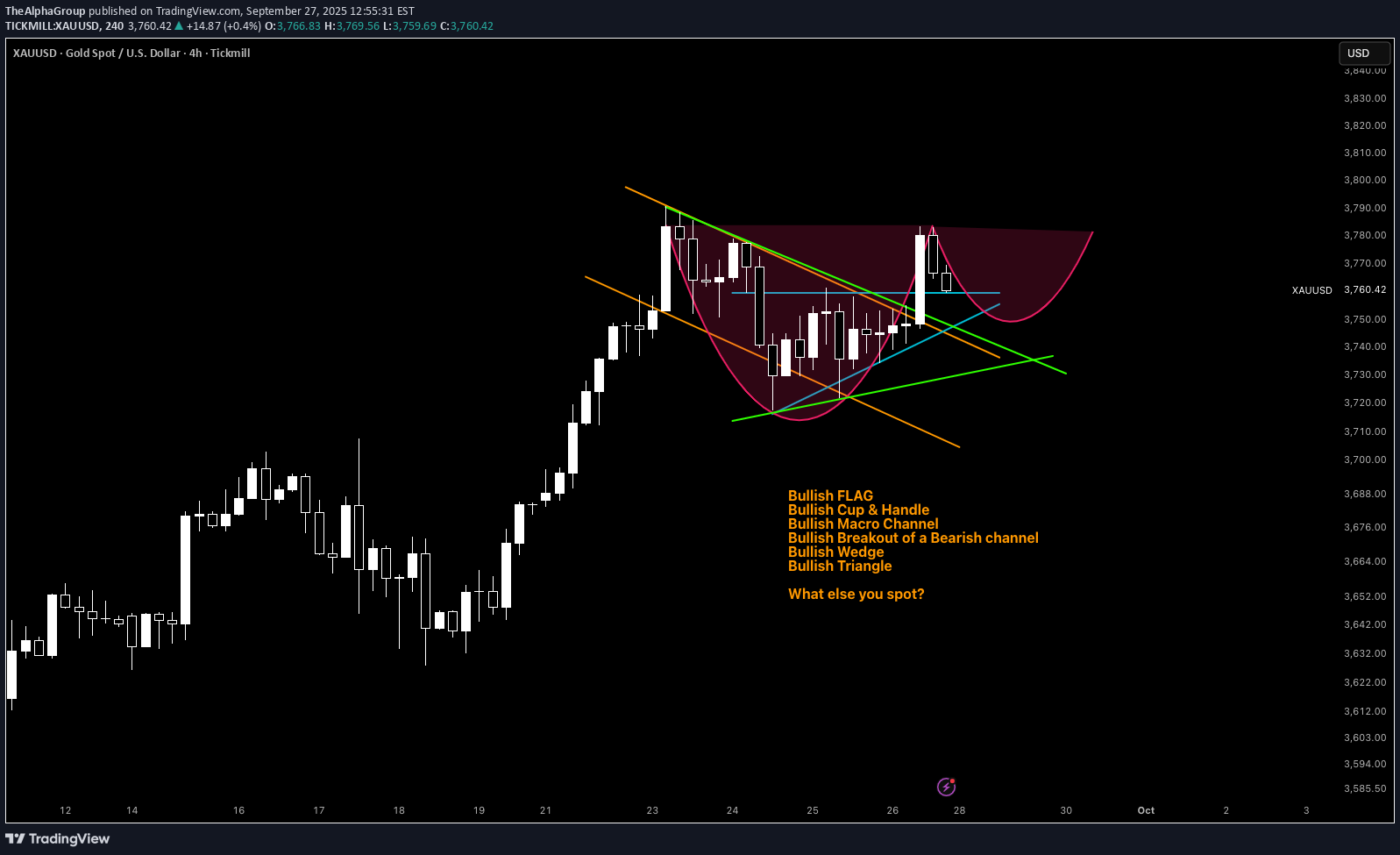

Technical View A potential bullish cup & handle pattern is forming, often seen as a continuation signal. Price has already broken out of a bearish channel, which suggests that buyers have taken control. Triangle and wedge formations point to pressure building upward. The broader macro channel remains intact, so the larger trend has not been broken. Clear invalidation levels are visible near 3,730 and 3,612, which provides trade structure from a technical perspective. Overall, the technical picture continues to lean bullish. Macro View US CPI remains sticky while jobless claims are softening, hinting at stagflation dynamics. The Federal Reserve is under pressure to cut rates, with real interest rates already negative. Historically, when real rates are negative, gold tends to outperform bonds as a store of value. Global central banks remain net buyers of gold as they diversify away from Treasuries. This combination is similar to the 1970s stagflation backdrop: falling rates with inflation uncertainty often encouraged capital flows into gold. Opinion Technicals suggest upward momentum. Macro factors also support a bullish bias. The main caveat is that positioning in gold is already heavy, which can lead to sharp short-term volatility. Directionally, however, the long bias aligns with both the charts and the macro backdrop. Disclaimer This post reflects only my personal market observations and opinions, shared for educational and informational purposes. It should not be considered financial advice, investment recommendation, or a call to action. Trading financial markets involves risk, and you should carefully assess your own situation and risk tolerance before making any trading decisions. Past performance or historical patterns do not guarantee future results. Always do your own research and consult a licensed financial professional if needed.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.