Technical_AnalystZAR

@t_Technical_AnalystZAR

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

Technical_AnalystZAR

XAUUSD will fall from 3393 towards the demand area at 3363 soon. Let us observe if price climbs towards this area of interest.

Technical_AnalystZAR

Technical_AnalystZAR

Sell orders have been triggered at 3369. Stop loss at 3377,77 and we are targeting 3324. A tight stop loss because should price break above, it may rally.

Technical_AnalystZAR

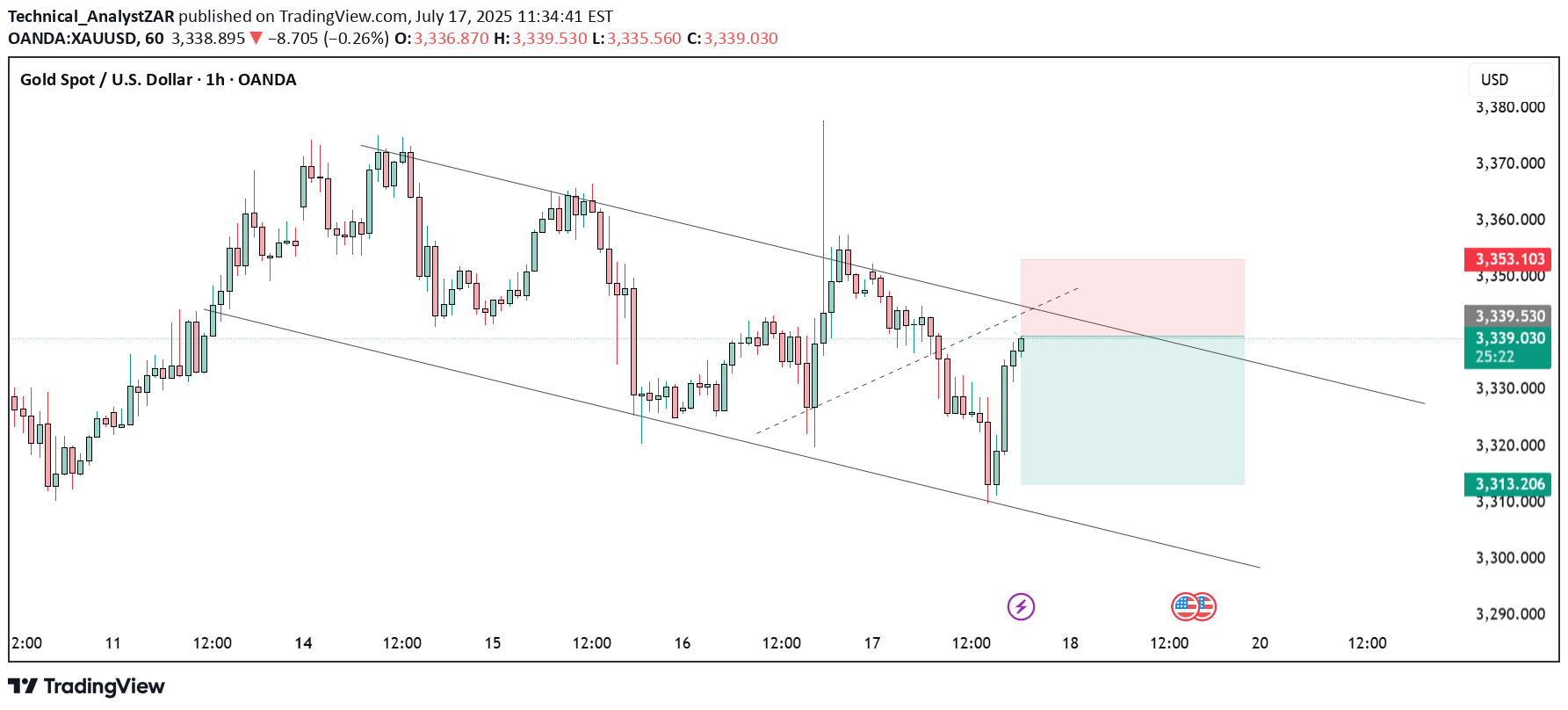

During and post CPI, we saw the price of gold spike up towards 3366 to create a sell order block and quickly reversed to 3310 indicating weakening in bullish momentum. With all the geopolitical tensions easing up, XAUUSD price will respect the technical view. Currently, price seems to be printing a bearish flag pattern. We can expect sharp declines from XAUUSD next week.

Technical_AnalystZAR

XAUUSD. We can expect a reversal to double test the support before the highly anticipated rally. Sell 3339 and take profit at 3312. Let us see how things unfold.

Technical_AnalystZAR

XAUUSD has collated liquidity and looks ready to decline. A bearish pin bar at the resistance on the H4 chart is on display. A double top pattern further confirms the possible downs. Price may fall deep into 3200 area.

Technical_AnalystZAR

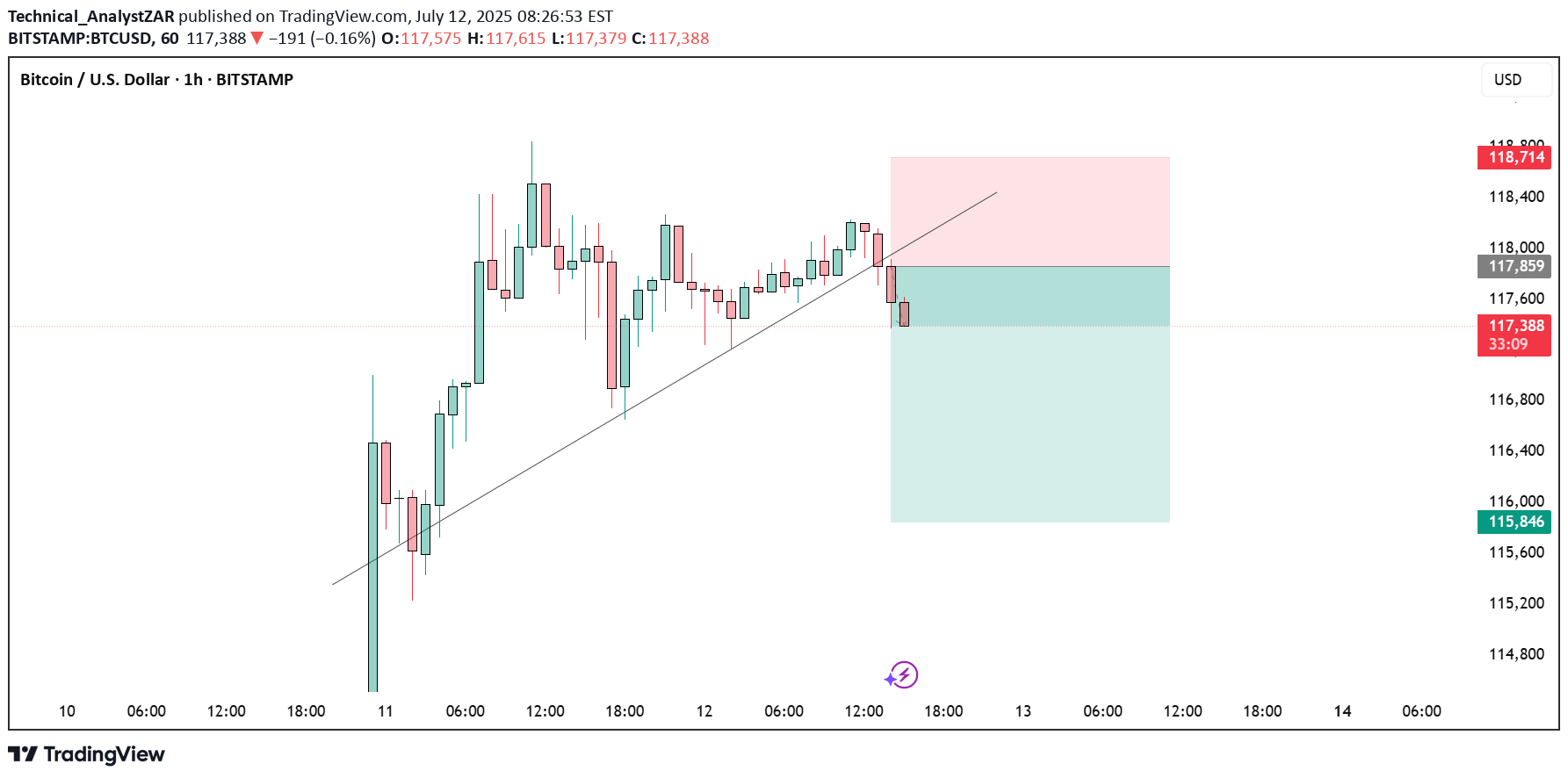

BTCUSD will decline from 117000 towards 115000 in today's trading session. A break of structure occurred and now price seems to be free falling.

Technical_AnalystZAR

Buy US500 Target: 6300,00 Pattern: Inverse Head and Shoulder

Technical_AnalystZAR

XAUUSD is slowly establishing a downtrend while everyone buys. I advice sells here from 3340 towards 3280. This trade should have a very tight stop loss at 3346 because should it break above, it could rally

Technical_AnalystZAR

The SPX500 price will drastically grow in the coming days. Price has broken out a bullish flag pattern. We may anticipate and enter on the retest around 6230

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.