SteadyFund

@t_SteadyFund

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

SteadyFund

برنامه معاملاتی طلای امروز: فرصت خرید در صورت حفظ سطح کلیدی 4030!

Yesterday gold did rejected from 4050 and almost touched 4100 but dropped from there to as low as 4008, which is almost touching the channel top. The fact that gold didn't break 4030 is suggesting bull is not over yet. Therefore, I am still looking to buy as long as 4030 holds. It will be interesting to see the close of the next 4hr candle. If it's a green candle, I will buy toward 4150. If not, I will wait and see the daily close for better ideas.

SteadyFund

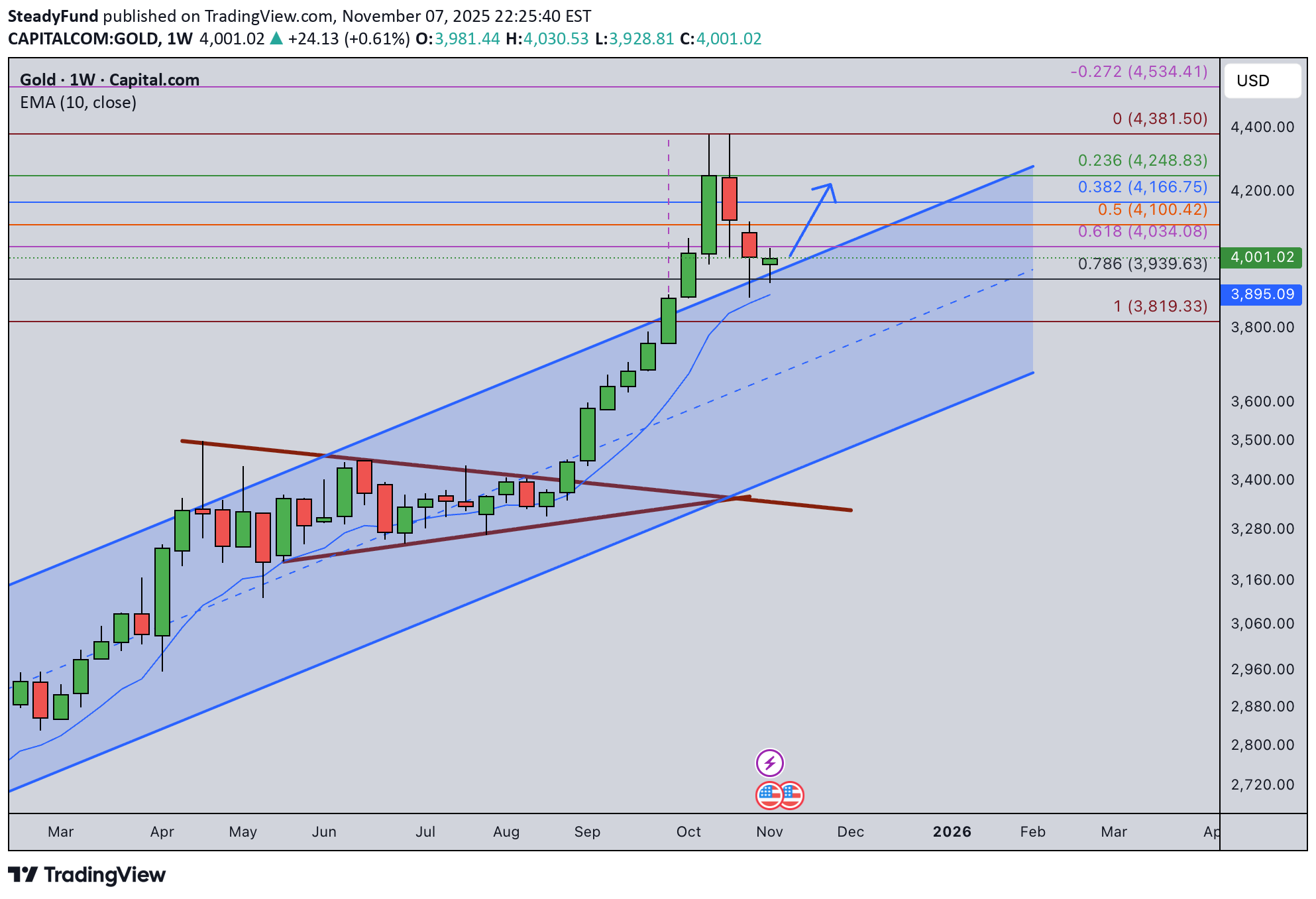

پیشبینی هفتگی طلا: صعود به سوی قله جدید یا سقوط ناگهانی؟ (تحلیل تا ۲۵ آبان)

In my last week's weekly post, I did predict gold to rise sharply and touch 4248. Well, it almost hit and quickly retrace and found its support around 4050. It did close the week with a positive note. I am still bullish on gold for the next week. It will be interesting to see what is the price action on next Monday. In regard of the heavy drop on Friday, I am cautious for the bull's continuation. Therefore, I will watch closely on Monday. If 4050 level is held, we could see more pumps and gold could test another ATH. My target will be 4440. However, If daily closes below 4000, we could see more drops coming. Let's see what the market will give us.

SteadyFund

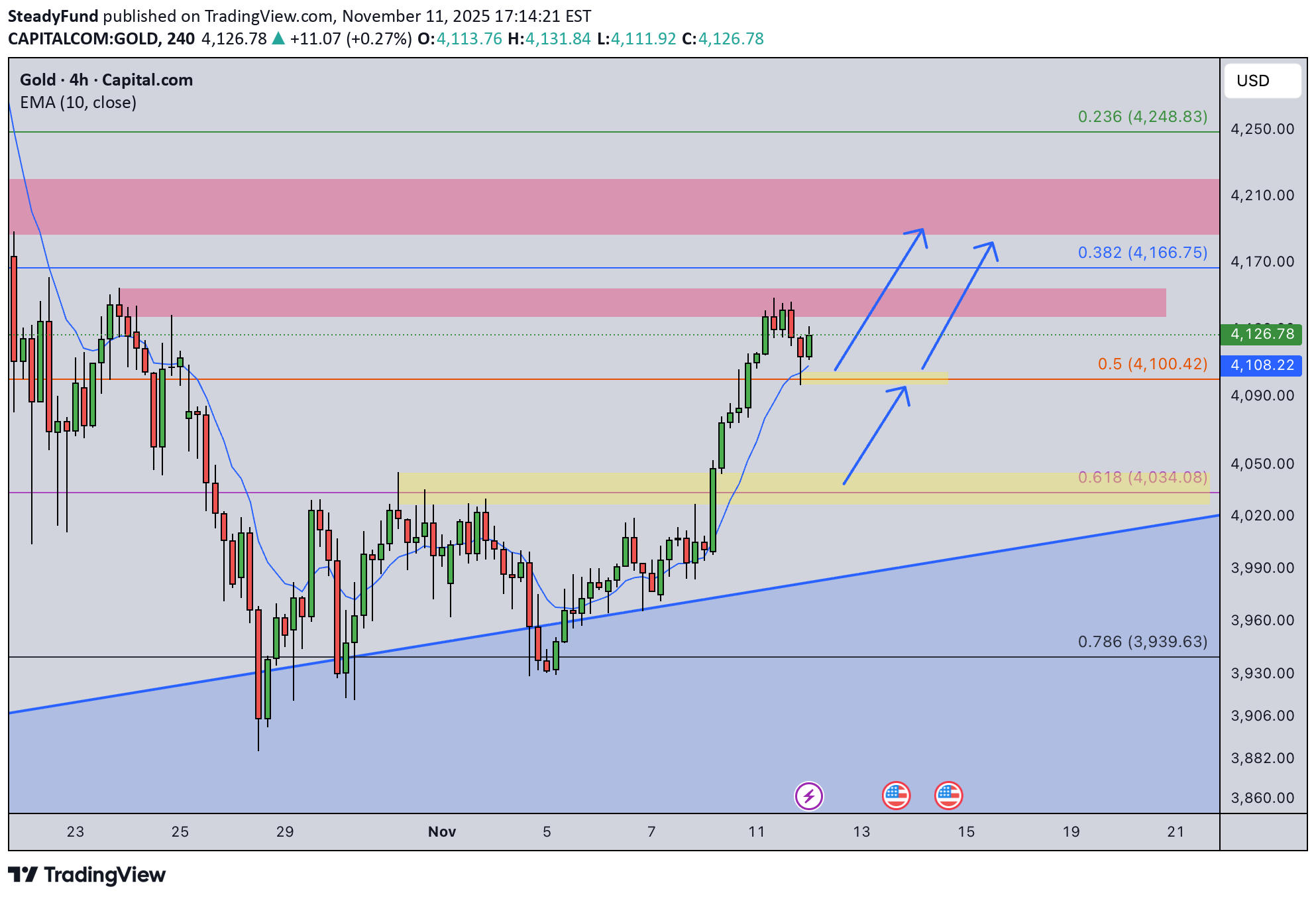

برنامه معاملاتی روزانه طلا (۱۴ نوامبر): خرید از ۴۱۲۵ و هدف احتمالی ۴۲۴۵

Yesterday gold rose initially and got rejected from 4245. After that, it dropped by almost 1k pips and found its support at 4145. I am still bullish in gold while it may go through small period of intraday correction. It could drop from 4190-4200 and may bounce from 4125. If 4200 is broken, it could test 4245 again. Therefore, I will look for buying opportunities from 4125 today.

SteadyFund

برنامه معاملاتی طلا در روز (۱۳ نوامبر ۲۰۲۵): فرصت خرید جدید از ۴۱۵۷!

As predicted, gold rose from 4100 for another 1k pips and closed the day just below 4200. Today should be another buying day. I am looking to buy from 4157, targeting 4281.

SteadyFund

برنامه معامله روزانه طلا: فرصت خرید از ۴۱۰۰ یا انتظار برای ۴۰۳۵؟

Gold moved very slowly yesterday. It did face resistance at 4150 and dropped to 4100 thereafter. I am looking for buying opportunities from 4100 and targeting 4200. But if 4100 is broken, I will look for buying opportunities again at around 4035.

SteadyFund

برنامه معاملاتی طلای امروز: استراتژی خرید در افت قیمت و رسیدن به قله ۴۲۰۰!

As predicted, gold broke 4034 resistance and rose without any looking back and closed the day above 4100. Also as explained in my weekly post, I will be only engaging buying orders for this week. Therefore, I am going to implement buying the dips strategy. For today, I expect price to rise to 4150 and get rejected there. Thereafter, it will bounced from 4072 and should all the way test 4200 or even higher levels.

SteadyFund

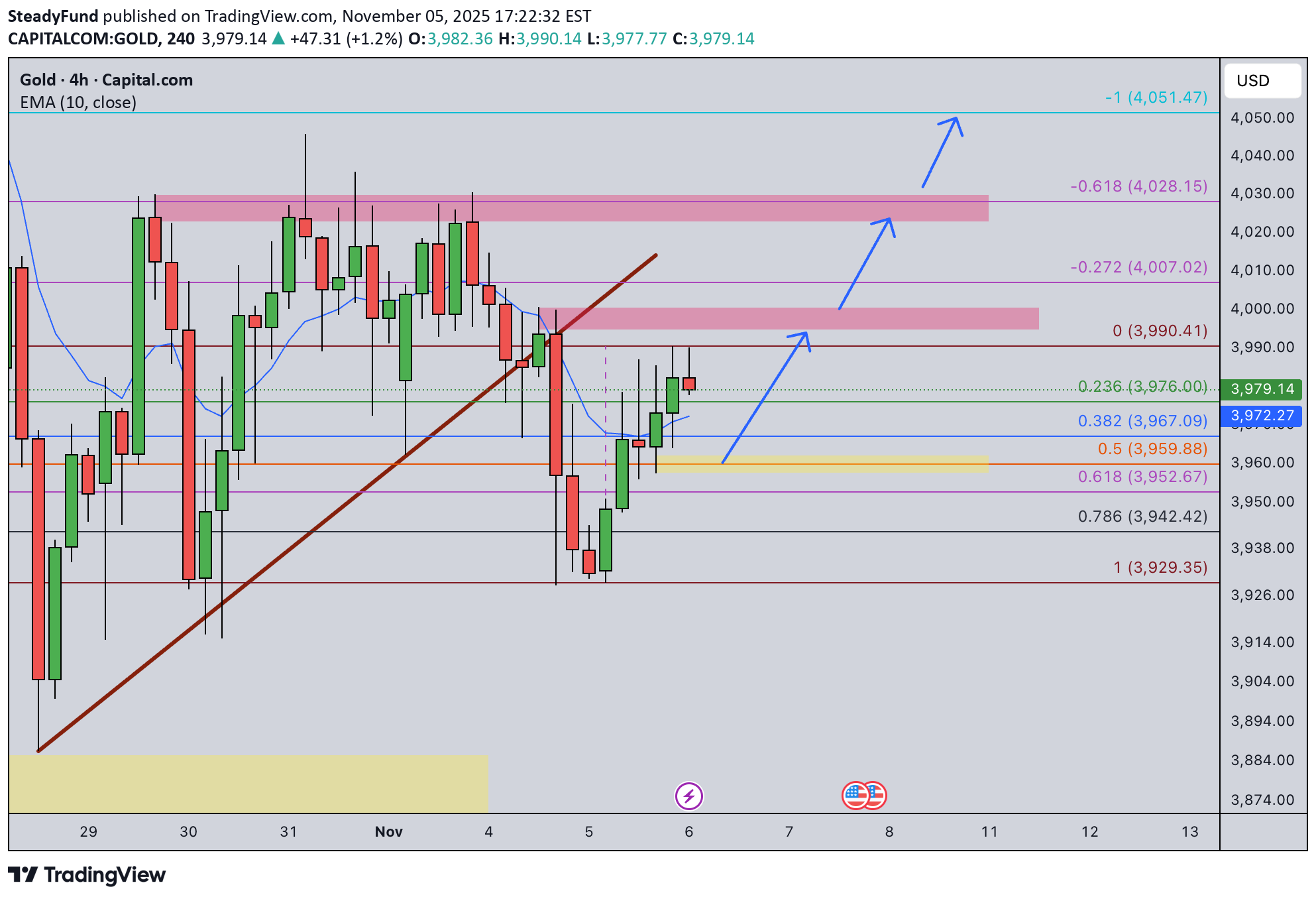

برنامه معاملاتی طلا در روز (11/10/2025): آیا ریزش در راه است یا صعود تا 4062؟

As explained in my weekly post, I am bullish in gold for this week. In lower TF, the trendline drawn in the chart is still valid. I do expect gold to rise from the trendline around 3990. If 4020 is broken, we could target 4038 or even 4062 today. However, if 3970 is broken, the bullish setup is invalidated. Let's see what the market will give us.

SteadyFund

پیشبینی هفته طلا: آیا قیمت طلا جهش بزرگی خواهد داشت؟ (خلاصه و استراتژی خرید)

In my last week's weekly post, I expected gold to test 3939 and rise from there as shown below. Gold indeed bounced from there. However, the movement is very slow in the past week. Especially for the last two days, price is ranging from 3970-4020. Nevertheless, gold closed the week with a positive note. And it is clearly bouncing from the previous channel top as well. Therefore, I expect gold to rise sharply next week. For next week's trading strategy, I will only look for buying opportunities.

SteadyFund

برنامه ترید روزانه طلا: آیا امروز سقف ۴۰۲۰ شکسته میشود؟

Gold initially rose and broke 4000 yesterday but got rejected at 4020 and quickly closed the day at 3976. Gold has been very unpredictable these days but I still believe in larger picture and it's bullish. I am expecting gold to rise from 3975 today. If 4020 broken, we should find it at 4044 or even 4075 today. But if 3960 is broken, the setup is invalidated.

SteadyFund

برنامه معاملاتی روزانه طلا: پیشبینی صعودی از سطح ۳۹۶۰ تا ۴۰۵۰

Although gold dropped to 3930 on Tuesday, yesterday it didn't continue the momentum but rose to 3980. I am switching my view to my weekly prediction. Gold should continue to rise this week. Currently, bull's strength is not strong enough. It will face resistance of 4000. I will buy from 3960. If 4000 is broken, I will have more confidence on hitting 4028 target or even 4050.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.