Solidified

@t_Solidified

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Solidified

پایان قدرتمند تسلا در روز پرنوسان بازار: سطوح و اهداف قیمتی امروز را اینجا ببینید!

TSLA has a solid finish today during the market stress test. Please watch the recording for levels and price targets. Cheers.

Solidified

$META Chart update

META just took out ATHs here's an update on my path tp $750, and possibily higher.

Solidified

$META - Consolidation Cluster Bullish Flagging Ahead of The Fed

Price held above key levels after breakout and is now flagging near highs. 700+ zone holding as new support Strong structure with rising 9EMA catch Volume cooling, but MACD remains bullish Eyeing potential expansion above $708–710 range This setup favors continuation. Watching for a clean break and close above $708 to confirm next leg higher.

Solidified

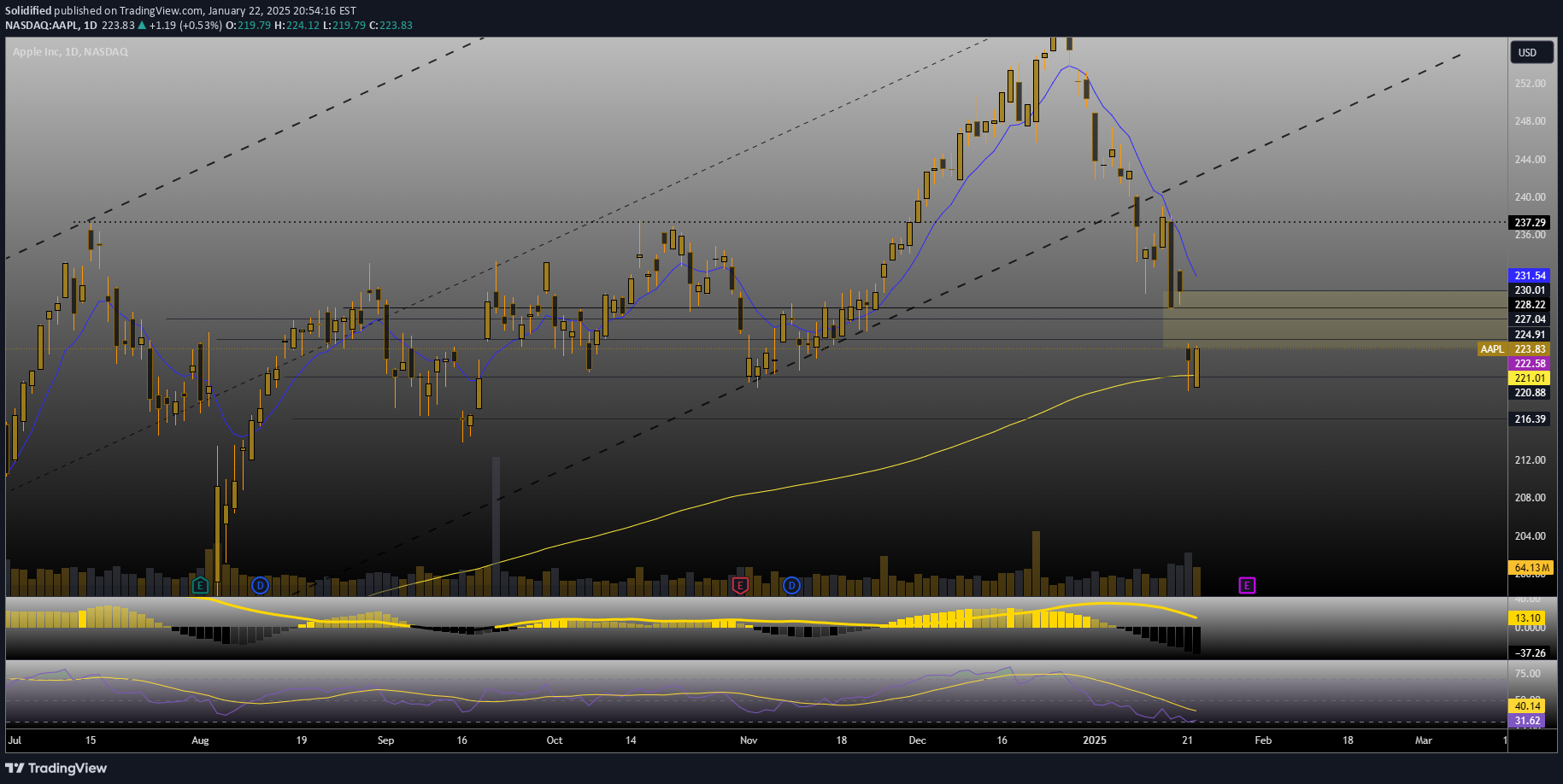

$AAPL Bounce Setup: Key Levels to Watch & 2-1-2u Reversal Potent

This is a strong setup for AAPL to bounce as it held its 200-day EMA again today. Above $225, watch for targets at $227, $228.22, and the bearish gap fill at $230. Keep AAPL on watch for a potential 2-1-2u reversal here. However, if it loses support at $219.79, expect a possible retest of $216.39. Keep an eye on these levels, fam.

Solidified

$QQQ Daily: Key Demand Zone Ahead of PPI Data

Markets are at a critical demand zone on the QQQ daily chart as we gear up for tomorrow's PPI report. 🔻 Will overnight selling continue, or can the bulls regain control and push prices higher ahead of the data? Let’s dive into the technical setup and potential scenarios!

Solidified

$META Trade Update

This is just a follow up to the previous META setup I posted yesterday. Please watch video for additional commentary.

Solidified

$META Wedge Breakout Setup with Key Targets Ahead

META is attempting a wedge breakout on the session hourly, with a candle confirmation above the 9-EMA. If the breakout holds, our first target is a retest of $594.24. Should we break that, we’re looking at a potential retest of the all-time high (ATH) at $602.90. However, if the breakout fails, we could see a retest of key support levels at $588.36 and $583.14. On the daily chart, we’re seeing a hammer candle after retesting support, alongside a 2-1-3 pattern that could signal continued momentum.

Solidified

$META Trade Idea

Calls over $580 Target: $583, $590 Puts under $575.15 Target: $573, $569.46

Solidified

Unlocking $META's Momentum: A 10AM Breakout Analysis -5min Chart

Dive into the heart of market volatility with our latest analysis of META 's price action, centered around the critical 10AM box on the 5-minute chart. This video breakdown offers a comprehensive look at the key movements and trading opportunities that emerge in the early hours of trading. Whether you're a seasoned trader or just getting started, our insights will help you understand the nuances of META 's behavior and how to potentially capitalize on its patterns. From technical indicators to momentum shifts, join us as we uncover the strategies that could define your next big trade

Solidified

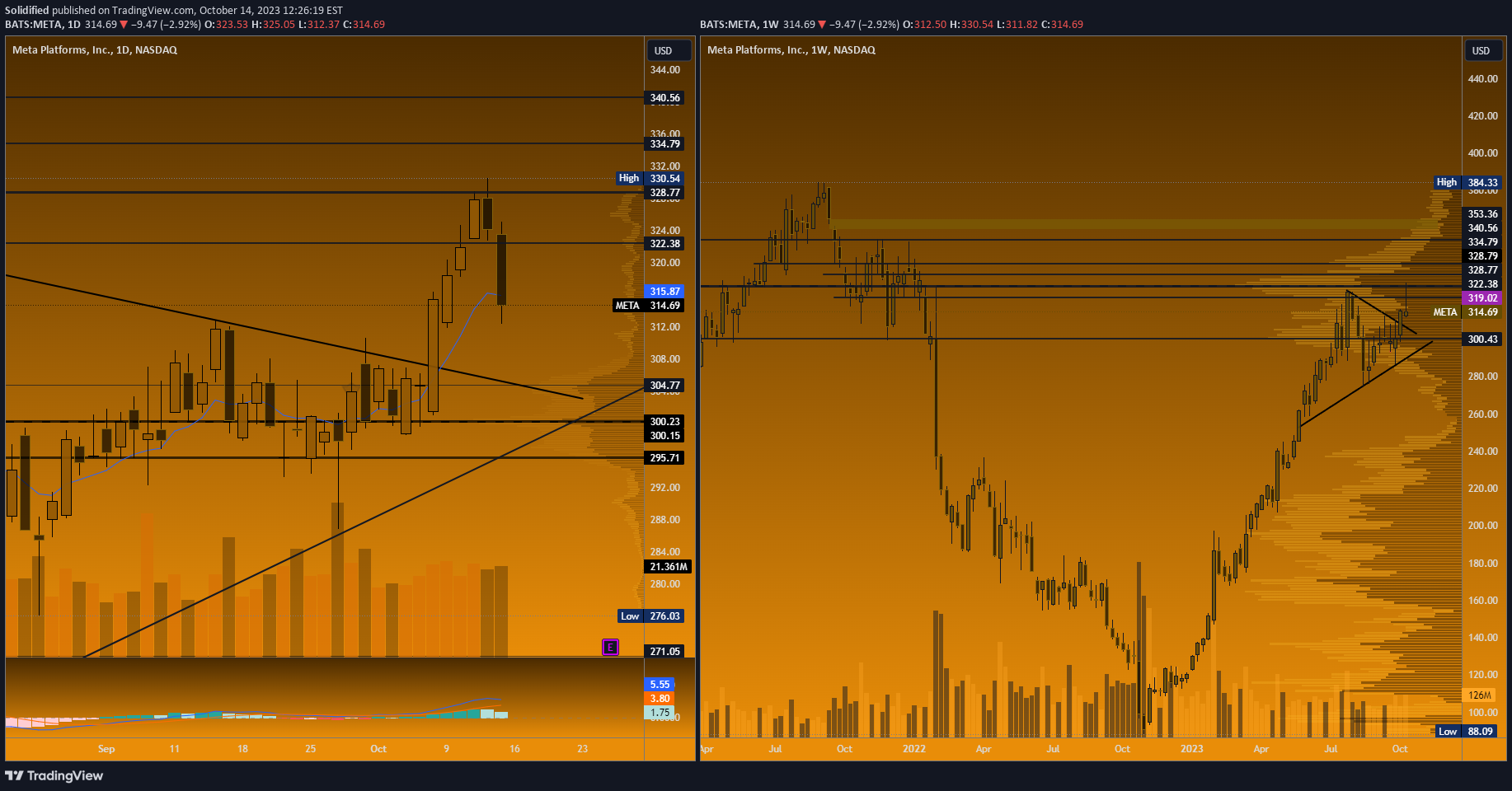

Mission Rejected at Mt. Everest -Bullish Market Structure Intact

META Update - Bullish Outlook - October 15, 2023 Opening Summary : Bullish breakout stalled at a key resistance level. Market Structure: Currently in Markup, signaling bullish trend continuation. Key Price Levels: Support: $300, $304.79, $309.32, $311.7 Resistance: $325.88, $328.79, $334.79, $340.56, $353.36 Chart Patterns: Day: 2-2-2d reversal Week: 3-2-2u continuation, bullish flag breakout, inverse hammer Month: 2-1-2u reversal, bullish flag pattern Quarter: 2-2-2u continuation Volume Analysis: Day: Bearish volume confirms the 2-2-2d reversal. Week: Bullish volume supports the 3-2-2u continuation. Month: Volume data not conclusive. Quarter: Bullish volume strengthens the quarterly 2-2-2u pattern. Overall Outlook: If bearish sentiment continues, a retracement to $300 PL is likely. Note : Back-testing shows an inverse hammer typically leads to a gap up or gap down.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.