SirWiggir

@t_SirWiggir

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

Many analysis came out last year that Gold will shoot up to 2200 since its last pump to 2150 area. But was it hyped for a reason? Or is it really the so-called demand-season?For me, Gold will forever be looking for a way up due to the following reasons:- Gold is always a good investment option: physical gold (i.e. gold bars, rings, luxury items) or traded gold- Semi-con industries requires Gold: microchips, ICs and such devices- Gold is one of the 'safe-havens' of investment (google it for more details)Fundamentally, Gold usually has huge demand during year-end as investors tend to convert funds to safe-havens (USD, Gold, Silver, and other commodities). Additionally, US dollar weakens for the final quarter of 2023 (political, military and economic reasons).However, on the technical perspective, a huge rejection was evident on Dec. 4, suggesting that if a resistance retest will be successful, it might fall deep.On my personal view, since there are looming news about war, nuclear threats, economic shifting, a possibility of recession, and Gold failing to break the resistance around 2080, I would look for SELL positions targeting 1950 in the short term while waiting for a possibility of a drop down to 1800 mid term.USD is still the king of safe-havens. Should a war broke-out to multiple countries, currencies and commodities (including Gold) would drop to an unbelievable levels; probably worst than Covid and Ukraine-Russia effect.On Jan. 17, TP1 @ 2005 was hit.It retested the resistance at the trendline, but it failed today during the NFP news.I now see GOLD falling to 1950 area.P.S. I reopened position at 2043-2033 area during the news. Now at +50% profit running.Closed trade with +300% profit! waiting for re-entry at 2020-2030 area

USD got weak after the news wherein Continuing Jobless Claim data hits below the consensus.But GOLD seems to hit resistance around 1965.If this price bounce signals a reversal, market needs to wipe out the stop losses set at the breakout point around 1950-1955.However, should GOLD proves its strength, I think 1965 will get broken with huge volume. Otherwise, 1935 play is still on.Updated stoploss to 1966Closed at 1948

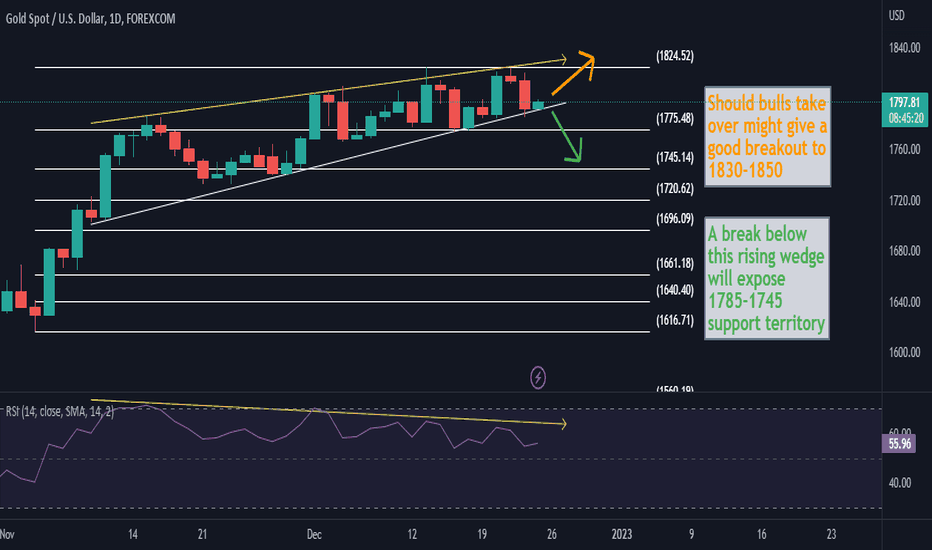

Gold is trading within a RISING WEDGE pattern.After its rejection to 1824 yesterday, it might give us a new low if it breaks down below the structure around 1785.It might expose the support around 1766-1745.However, if the bulls take over again, it might bounce up and breaks the upper limit which could potentially went up to 1830-1850.Great setup and patience is the key.TP Hit at 1875

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.