ShortSeller76

@t_ShortSeller76

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

ShortSeller76

خرید متا (META) زیر ۶۰۰ دلار: فرصت انفجاری در انتظار است؟

Strong support at $593 should bounce back to $676.78 reasonably off support within a couple of weeks

ShortSeller76

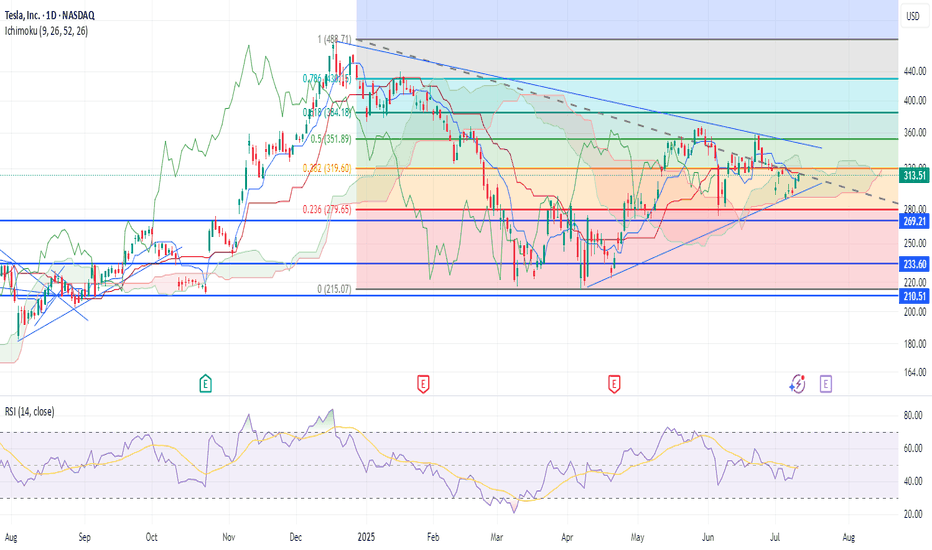

پیشبینی سقوط تسلا: محدوده ۳۶۰ تا ۳۷۰ دلار در انتظار است!

As I posted last week, and, clearly too early TSLA needs to test the $370 range where it broke out from. I do pat myself on the back for the epic bounce off support at $324.80 that needed to hold to see $426's and TSLA always goes further then we think both ways. We're way overdone and todays reversal shows it. $370's imminent in coming weeks

ShortSeller76

TSLA SELL AT $426! Retracement to $372 imminent

TSLA was a perfect ascending bullish triangle, yes, I drew the Elliott Wave wrong but got the calls right at $300 ($339 first target) and bounce off support at $324.80 ish (separate post). Remember the $7500 EV credit expires soon so there will likely be a pull forward of purchases this quarter which could temporarily juice the stock. We could see all time highs but first we must retrace once target of $426 is reached.

ShortSeller76

TSLA support $324.48 has to hold for long

TSLA bounced off $35 range support this morning on 4 hour was oversold. Needs to hold $324.48 bottom of uptrend support to see wave 5 target of $426 otherwise the trade is no longer valid and will need to wait for another support and oversold condition to go long$400 calls up +971%

ShortSeller76

NVDA IS A SELL+++ $136.25 target

NVDA tends to retrace to .5 and .618 fib on each previous correction before making another bull run. We are also on an exhausted Eliot Wave impulsive number 5 overextended. Dont get suckered into the bounces until the selling has been exhausted to the downside. It should bounce off $152.98 support before resuming lower

ShortSeller76

Bullish wedge, again..?

If TSLA breaks through this wedge an Elliot Wave and Fib Extension suggest wave 5 would be reached $426.70. I made this chart Thursday and did not publish. Fridays move I don't count because the entire market went up with J Powell said NOTHING. So on a pullback I'd look to enter a position, this move should come in 4-6 weeks or less as wave 5 on TSLA usually lasts a month

ShortSeller76

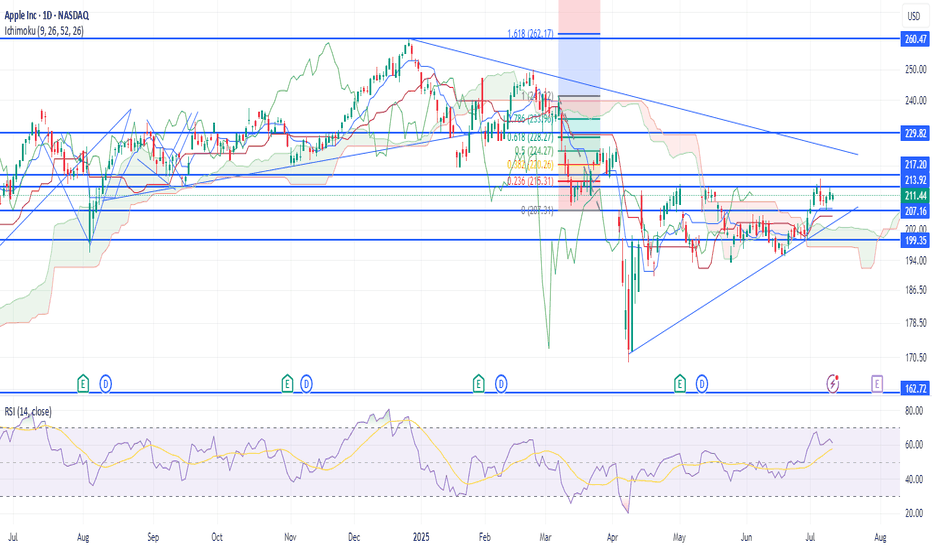

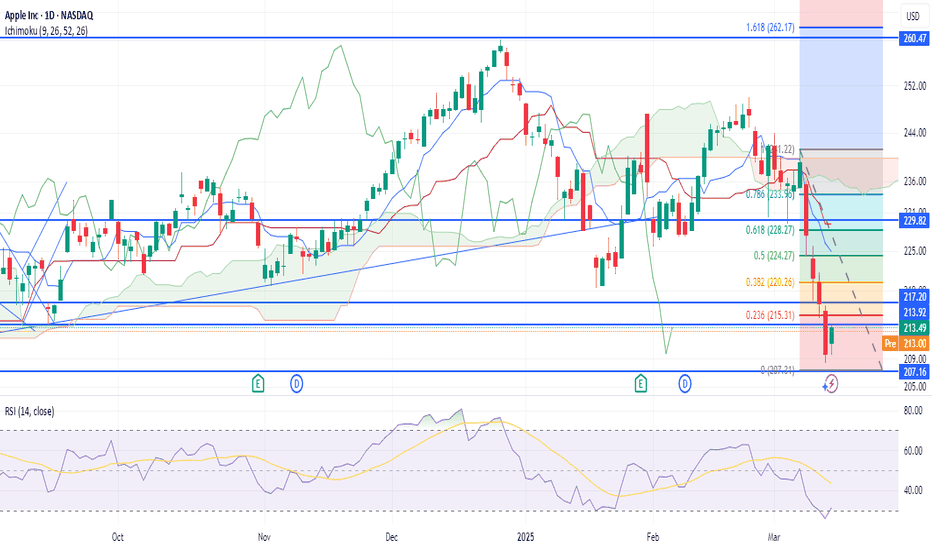

AAPL SELL + Stalling out or consolidating?

AAPL has had 4 red daily candles volume and strength are slowing It needs to break $230 then we should see $218 in coming weeks before possibly making another run for highs. The run, though I not only predicted and lost money on was for BS reasons, AAPL is lagging in AI and seemingly has no plan there as of yet. The move from $202 to $232 was epic and congrats for those who has the correct expiration on their calls as I did not.....

ShortSeller76

TSLA BUY+++ WEDGE FORMING $339 first target

TSLA, like AAPL, is forming a bullish wedge which likely will break to the upside. First target is $339 at wedge resistance then will reevaluateTSLA is still a buy regardless of the obvious earnings miss that was NO SURPRISE to anyone. Seems the wedge is still in tact. I have traded TSLA several times since posting this mostly on lower time frame 5-30 minute. Theta decay is a killer on these higher IV stocks so in an out, in and out, and, if you get "stuck" in a position so long as you have the direction called correctly one would simply ADD to their position

ShortSeller76

AAPL BUY 1st target $223

AAPL is forming a wedge and been lagging for 2 years. I was expecting $182 but we never saw that level, after weeks of $200 range consolidation it's clear this is basing, first target of resistance is $223 then we could be off to the races. I would expect to see this as soon as next week provided #donthecon can stop bullying American companies long enough to focus on important thingsAAPL still a BUY here. However I don't do earnings plays as of the last 2 years I will not hold any position overnight. The IV and theta decay dont make the risk reward make sense. I have traded in and out of APPL 6 times since posting this mostly using the short term chart 5-30 min, when I have a direction called I don't mind getting "stuck" with calls on a bullish position. AAPL is frustrating a lot of people since it's lagging but I do believe it will have a catch up trade very soon, the direction pre- earnings is clear UP. Weeks of consolidation and higher highs and higher lows. ER is always a wild card with all stocks as no matter the number the interpretation cannot be predicted ergo it's not worth the risk to hold through ER releaseAnother rough week, took at $54,000 loss on this. Broke structure IV on options was over elevated and of course it was a sell the news

ShortSeller76

AAPL is a BUY BUY BUY! $224 FT

Oversold, bounced off support, a strong BUY here first target is $224 second $228

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.