SantaTradeGold

@t_SantaTradeGold

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

SantaTradeGold

XAUUSD : Gold continues to rise strongly again

Gold prices continued to expand their gains thanks to safe-haven demand amid concerns over escalating tensions following the assassination of a Hamas leader in Iran. The war in Gaza and the deepening conflict in Lebanon have left the entire region in turmoil. In particular, the rise of this precious metal was further boosted when US Federal Reserve Chairman Jerome Powell hinted that a rate cut could be discussed as early as September if inflation remains in line with expectations. As expected, the Fed decided to keep interest rates unchanged at this meeting. However, Mr. Powell raised investors' hopes for a possible rate cut at the September meeting. He said that policymakers are increasingly confident that inflation is moving towards the 2% target.🔝 XAUUSD BUY 2441 - 2443 🪙🪙🪙 ✔️ TP : 2450 ✔️ TP2 : 2455 ❌ SL 2435

SantaTradeGold

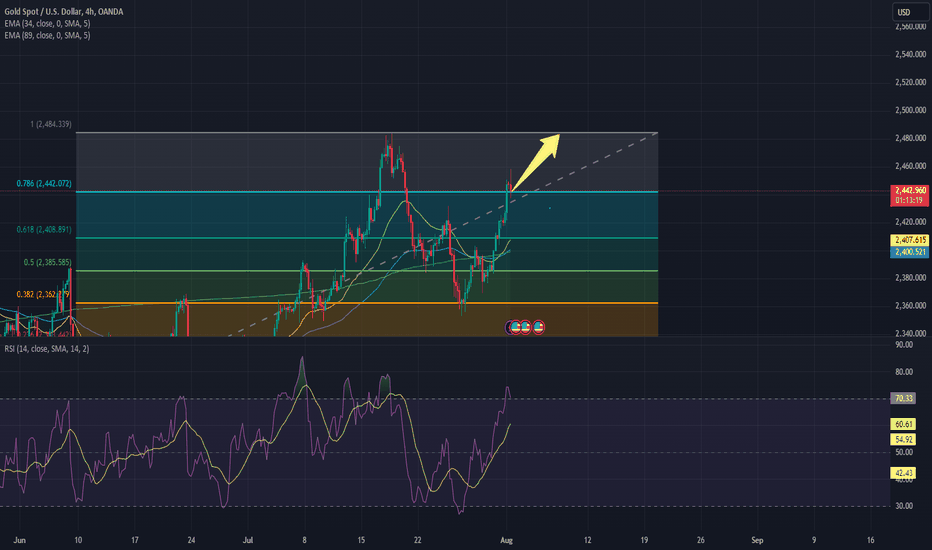

XAUUSD : Gold is down but that is bullish momentum

A drop below $2,380 could continue to attract buyers near the 50-day SMA, around $2,360-2,359. A break-down of the 50-day SMA would push the price towards the $2,350 support. The price could then continue to decline towards the 100-day SMA, around the $2,325-2,324 region. Further downside could see XAU/USD test the sub-$2,300 levels or the June 2024 low. On the contrary, the bulls are struggling to capitalize on the upside momentum above $2,400. Meanwhile, if XAU/USD breaks out of the $2,400 pivot, it could face some resistance around $2,412. Gold prices could then climb to the intermediate resistance level of $2,469-2,470 and challenge the record high, around $2,483-2,484.

SantaTradeGold

GOLD : Gold is turning around unexpectedly

Gold prices ended the US session and started the new day quite calmly compared to previous developments, trading around 2,400 USD after peaking on July 24 at 2,432 USD. Last night, the fluctuations after the release of the preliminary PMI report were not too significant. Besides, before the opening of the 5-year US government bond auction, gold prices increased slightly as yields decreased. But soon after, the 10-year government bond yield increased 2 bps to 4,274%, putting pressure on gold prices. Although the USD weakened slightly, the impact was insignificant. CME's FedWatch tool shows a 100% probability of a 25 bps rate cut in September; while market forecasts show that the Fed could cut interest rates by a total of 53 bps in 2024. On the economic front, the US trade balance improved more than expected, but the preliminary manufacturing PMI fell, indicating weakness. Specifically, S&P Global's July services and composite PMIs both exceeded expectations, reaching 56.0 and 55.0 respectively; while manufacturing PMI decreased from 51.6 to 49.5, lower than forecast. Investors are waiting for the release of Q2 GDP data and the core PCE index - the Fed's preferred inflation measure - to have more basis to evaluate the economic situation and guide monetary policy. Regarding forecast, Q2 GDP is expected to reach 1.9% over the same period last year, showing that the economy is accelerating. It is worth noting that inflation calculated on core PCE is expected to decrease from 2.6% to 2.5%.

SantaTradeGold

XAUUSD : Gold is plunging, will it return to 2300?

Gold prices have formed a "Bullish Harami" pattern, but unfortunately cannot maintain the upward momentum and are currently struggling around the $2,400 mark. If it closes below this mark, gold prices will likely continue to decline. The RSI indicator is in the 40.0-60.0 zone and moving sideways, showing a balance between buying and selling power. If gold prices can return and surpass $2,430, the next target will be $2,450, followed by the historical peak of $2,483 and the psychological threshold of $2,500. On the contrary, the gold price continuing to adjust below USD 2,384 may open up deeper declines. The next support levels are SMA 50 at $2,359 and SMA 100 at $2,315, respectively.

SantaTradeGold

XAUUSD : Gold returns to create upward momentum

World gold prices tend to recover after falling in the previous session, losing the mark of 2,400 USD/ounce right after Joe Biden announced he would not run for the next US presidential election. Previously, analysts predicted that after a sharp decline from a peak of 2,482 USD/ounce, gold could witness another sharp decline at any time, when the overbought volume is dominating, especially in if it falls below the psychological mark of 2,400 USD/ounce. Gold can only stabilize or reverse the situation, when upcoming economic data will benefit this precious metal. In particular, the US June CPI - announced this weekend is expected to continue to decrease, which supports gold prices.🔝 XAUUSD BUY 2399 - 2401 🪙🪙🪙 ✔️ TP : 2410 ✔️ TP2 : 2415 ❌ SL 2395

SantaTradeGold

XAUUSD : Gold is recovering after a sharp decline

World gold prices tend to recover after plunging in the last trading session of last week. While investors are waiting for important reports at the end of the week, experts predict that the gold market may stabilize at the beginning of the week and will witness fluctuations after the inflation report. However, many opinions believe that the June core personal consumption expenditure index report may not create large price fluctuations. Although gold is likely to decline in the short term, some experts say that will not affect the medium-term prospects of this precious metal. Accordingly, optimistic opinions are that the decline will not last long and gold is still strongly supported by interest rate expectations, geopolitical situation along with uncertainties surrounding the elections.🔝 1. XAUUSD BUY 2403 - 2405 🪙🪙🪙 ✔️ TP 2415 ✔️ TP2 2420 ❌ SL 2395 🔝 2. XAUUSD BUY Limit 2399 - 2401 🪙🪙🪙 ✔️ TP : 2410 ✔️ TP2 : 2415 ❌ SL 2395

SantaTradeGold

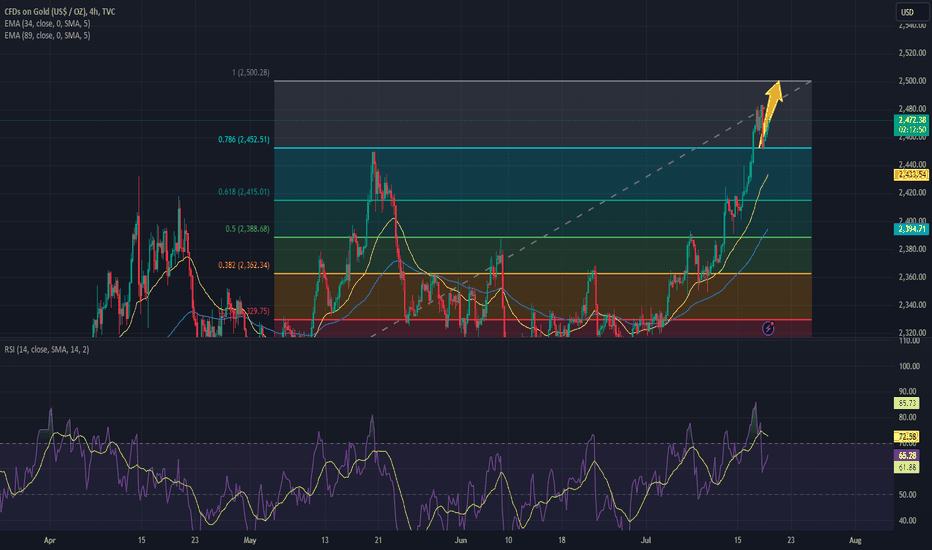

Gold is falling after creating a record for itself

Gold prices continued to decline on Thursday, although remaining around the old peak of $2,450. Currently, XAU/USD is trading around 2,444 USD, down more than 1.5% from its peak of 2,483 USD due to the greenback's recovery, supported by rising US government bond yields. Jobs data released by the US Bureau of Labor Statistics (BLS) showed that more people than expected applied for unemployment benefits, signaling a slowing economy. This, along with last week's string of data showing inflation moving toward the 2% target, could prompt a change in stance from Fed policymakers. The number of Americans filing new unemployment claims increased more than expected last week, but according to data released by the Labor Department on Thursday, the labor market did not change significantly. Finally, Fed officials have expressed that the central bank may be "getting closer" to lowering interest rates as inflation and recession risks have become more balanced. Still, the International Monetary Fund (IMF) said on Thursday that the Fed should not rush to cut interest rates until the end of 2024. In the context of extremely increased expectations of interest rate cuts in September, gold prices reached a new all-time high of 2,483 USD, but demand could not maintain the upward momentum as a part of investors moved forward. take profit. This, along with former US President Donald Trump's announcement of imposing at least 60% tariffs on Chinese goods, has boosted the flow of money back to the USD. The DXY index, which tracks the greenback's performance against six other major currencies, rose 0.43% to 104.18. Besides, US government bond yields also increased on many terms. Typically, the 10-year term reached 4.187%, an increase of more than 2.5 bps.💵XAUUSD BUY NOW 2425 - 2427💵 ✔️TP1: 2440 ✔️TP2: 2450 ❌SL: 2418XAUUSD ✅✅✅running + 45 pips

SantaTradeGold

XAUUSD : Will falling gold create strong momentum in the future?

XAU/USD has fallen for two consecutive sessions since hitting a new peak at $2,483, suggesting traders are taking profits after gaining more than 8.0% in the past three weeks. In the medium term, the general trend is still up, but the RSI indicator on the daily chart is turning down, showing that investors are somewhat cautious as the gold price gets closer to the 2,500 USD mark. In the short term, XAU/USD may continue to fall deeply if it does not quickly regain the $2,450 mark. If selling pressure remains overwhelming, gold prices may move towards the July 5 high at $2,392 after breaking through the $2,400 mark and then the $2,350 mark. On the contrary, if XAU/USD successfully surpasses 2,490 USD, conquering the 2,500 USD mark is completely feasible.💵XAUUSD BUY NOW 2425 - 2427💵 ✔️TP1: 2440 ✔️TP2: 2450 ❌SL: 2418XAUUSD ✅✅✅running + 45 pips

SantaTradeGold

Gold is looking for new peaks for itself

In his latest speech, Fed Chairman Jerome Powell once again expressed a dovish stance, but it could go in either direction. As has been pointed out many times, gold appears to be very sensitive, with just the slightest impact being able to push gold prices to new record highs in any given week. Robert Minter, Chief Strategy Officer of abrdn, said that inflation is only half the reason for this price increase, the other half is the weakness of the economy. "There is a basis to cut interest rates in September. If you look at the current high level of consumer debt, even a little pressure on the labor market can cause serious problems for the economy. I don't think we're going to see a recession, but it all depends on the Fed. They're a little late, but it's not too late to do something." Despite supposedly positive economic data, economic optimism seems increasingly foolish. We supposedly avoided a Volcker recession, but have we really? Or is the media downplaying how bad the real situation is? Could a devastating recession begin after the Fed starts lowering interest rates? That's often what happens, as Ryan McMaken warns us - the reason "soft landings" are so elusive is simply because they're impossible, "But there are two problems with the "soft landing" story: The first is that the Fed has never done this in the past 45 years. Normally, the Fed denies a recession until it happens. Then, the Fed reduces Interest rates on unemployment have begun to rise." The market has high expectations that the Fed will reduce interest rates. The CME FedWatch tool shows an over 90% probability of this happening. According to expert Carsten Fritsch, the market is predicting that the Fed will reduce interest rates in September and may reduce it again before the end of the year. Based on these, Fritsch thinks gold has all the elements to test and could surpass record highs this week. And all of this is still in the short term. As we approach the end of the year, gold will exit its weakest quarter and enter the election cycle, a period that is expected to be turbulent even by the standards of the past twenty years. The dynamics driving gold prices are changing, and investors should stay one step ahead. In the latest report, Incrementum AG's Ronald Stoeferle notes that gold investors should pay attention to the changes driving the gold market. (This is not to say that the old factors are disappearing. Inflation and currency depreciation will still ensure gold's appeal, and any discussion of safe investments must include Yellow.)

SantaTradeGold

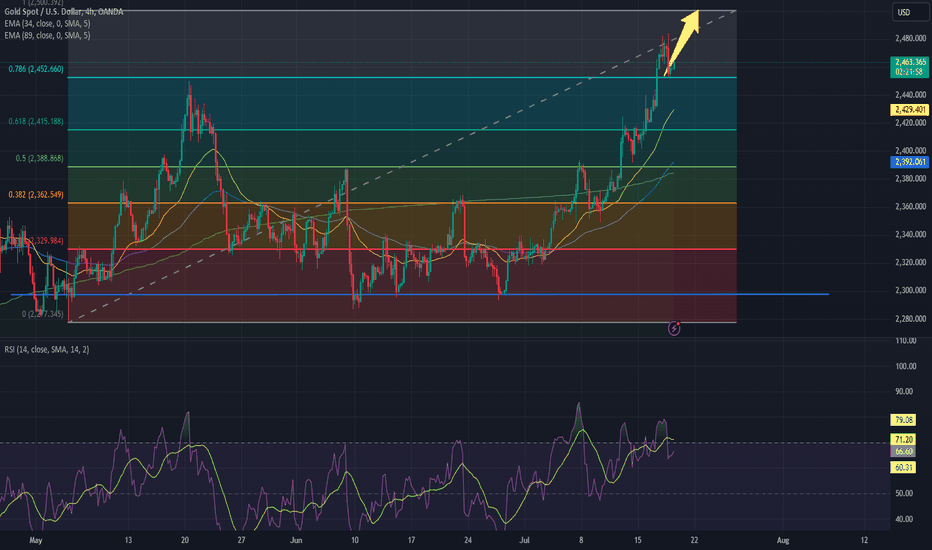

XAUUSD : Gold is at its historic peak

World gold prices continue to climb and are at a historic peak due to the further weakening of the USD. According to the CME FedWatch tool, the market is betting on a 100% chance that the US Federal Reserve will cut interest rates on September 18. Earlier this week, Fed Chairman Jerome Powell said that recently released data "increases confidence" that inflation is falling sustainably toward the Fed's target level. Many Fed policymakers also said they are increasingly optimistic that price inflation is on track and falling toward the 2% target mark.🔝 1. XAUUSD BUY 2463 - 2465 🪙🪙🪙 ✔️ TP 2470 ✔️ TP2 2475 ❌ SL 2455 🔝 2. XAUUSD BUY Limit 2457 - 2460 🪙🪙🪙 ✔️ TP : 2465 ✔️ TP2 : 2470 ❌ SL 2450running 50 pips 🪙🪙🪙hit tp1 70 pips 🪙🪙🪙hit 100 pips 🪙🪙🪙

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.