SPYder_QQQueen_Trading

@t_SPYder_QQQueen_Trading

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

SPYder_QQQueen_Trading

SPYder_QQQueen_Trading

محدوده معاملاتی فردا QQQ: آیا سقف تاریخی مقاومت میکند؟

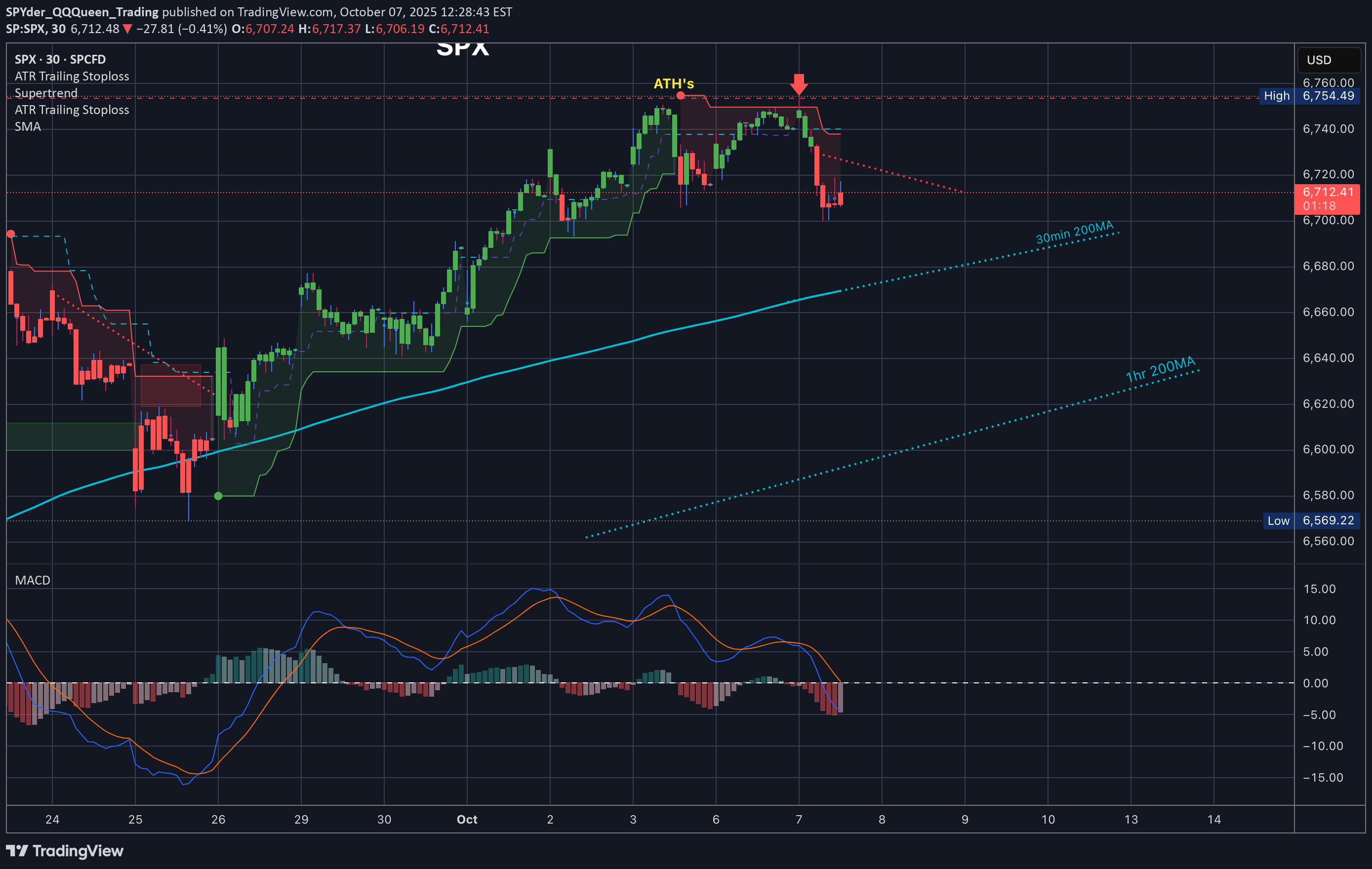

What are we thinking here? ATH's were clearly a resistance after mondays gap up, and we consolidated back to the 35EMA. That upgap from monday is looking like a good target.

SPYder_QQQueen_Trading

محدوده معاملاتی فردا QQQ: آیا بازار صاف میماند یا سقوط میکند؟ (21 اکتبر 2025)

QQQ Tomorrow’s Trading Range 10.21.25 Alway’s know where your 35EMA is. It is underneath the implied move right now, which means tomorrow has a high probability of being flat or down. ATH’s are in tomorrow’s range above us, and 35EMA underneath us with that 30min 200 and also the bull gap from open as well… let’s go…

SPYder_QQQueen_Trading

محدوده معاملاتی فردا SPX: آیا بازار صاف میماند یا سقوط میکند؟ (پیشبینی 21 اکتبر)

Alway’s know where your 35EMA is. It is underneath the implied move right now, which means tomorrow has a high probability of being flat or down. ATH’s are in tomorrow’s range above us, and 35EMA underneath us with that 30min 200 and also the bull gap from open as well… let’s go…

SPYder_QQQueen_Trading

راز سوددهی در بازار: چرا باید اندیکاتور سوپرترند (Supertrend) را حرفهای یاد بگیرید؟

SPX $ES_F SUPERTREND is definitely an indicator you should learn how to use. What's funny is it doesn't act the way you likely originally think it works, so learning to read it well can give you a huge edge. Look at where we got smacked down today, right at supertrend. We got the signal Friday, moved up to it yesterday, tested it today and got smacked down. So beautiful!! So if you have Super trend and the 35EMA you have everything you need. For ES Traders you should be checking these levels on Regular Trading hours not Electronic, once in a while.

SPYder_QQQueen_Trading

محدوده معاملاتی $QQQ برای فردا: حمایتها و مقاومتهای کلیدی

We closed right at the 35EMA so that is right in the middle and will be a key level. 30min 200MA is just underneath the bottom of the implied move so if for whatever reason we come near it look to it as a support to pop us back into the implies move. And of course above us we have ATH's. Just .66% implied tomorrow so don't get crazy... shkspr

SPYder_QQQueen_Trading

$QQQ Tomorrow’s Trading Range 9.26.25

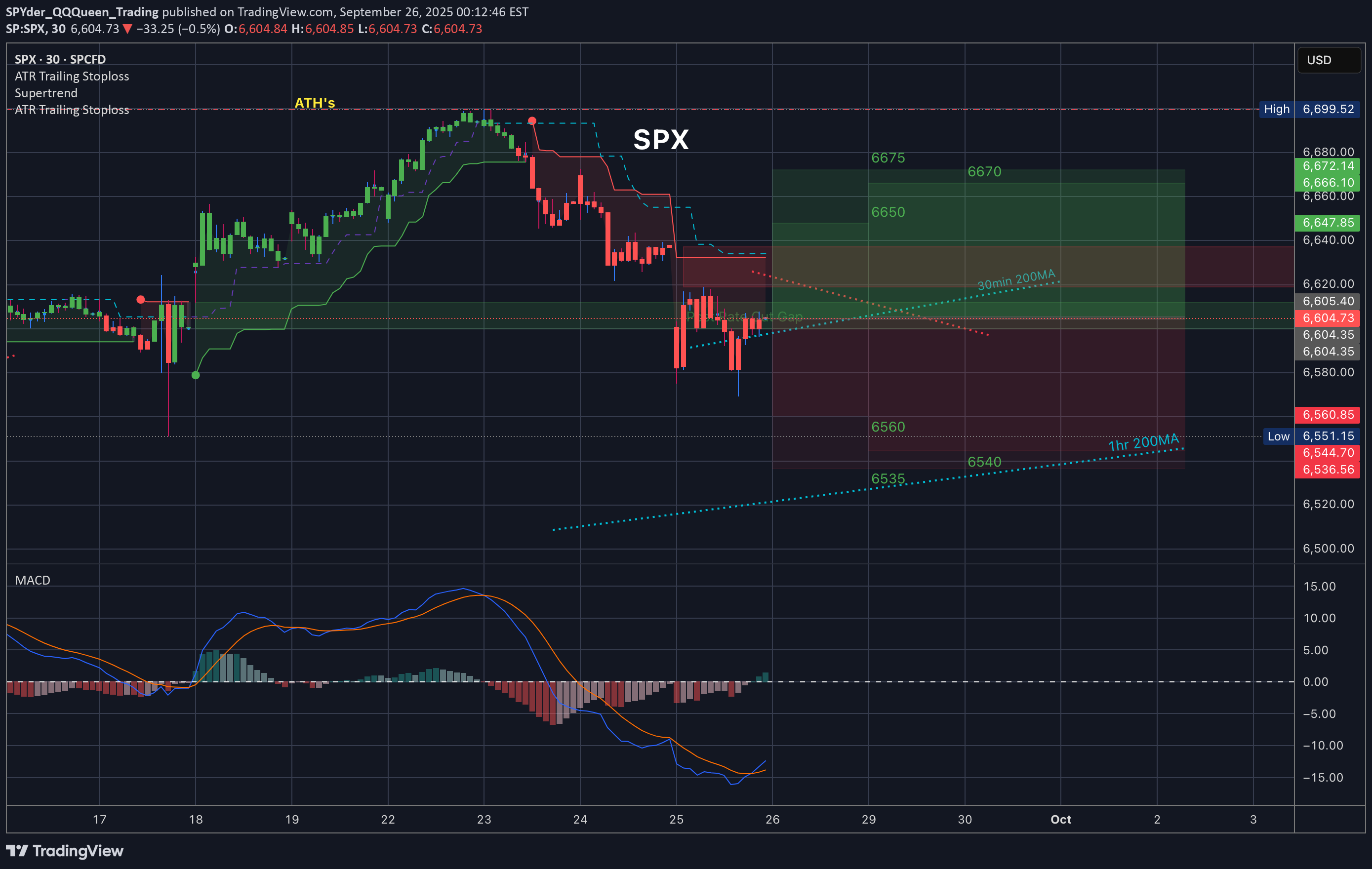

This is tomorrow’s trading range for SPX - Look at that Island gap in the upper part. What do you think? End of the rally? Rates were cut, equities are overvalued and it’s time to reverse this beast. Just my opinion - trade the chart not my opinion.

SPYder_QQQueen_Trading

$SPX Tomorrow’s Trading Range 9.26.25

This is tomorrow’s trading range for SPX - Look at that Island gap in the upper part. What do you think? End of the rally? Rates were cut, equities are overvalued and it’s time to reverse this beast. Just my opinion - trade the chart not my opinion.

SPYder_QQQueen_Trading

$QQQ Analysis, Key Levels & Targets 9.8.25

Watch that downward facing 30min 200MA - that looks like trouble. 35EMA and 30min 200MA are the only levels in tomorrow’s range so I would look down, personally

SPYder_QQQueen_Trading

$QQQ Trading Range for 9.2.25

Ok, so we are heading into tomorrow after the three day weekend a little bearish. Friday every candle printed red and the 35EMA is above us facing down so definitely look to that as resistance. The 30min 200MA is also facing down and above that we have even more resistance. I am not in a hurry to go long here until we print a green candle OR hit the bottom of the implied move at 565, which ever comes first

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.