Robert_V12

@t_Robert_V12

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Robert_V12

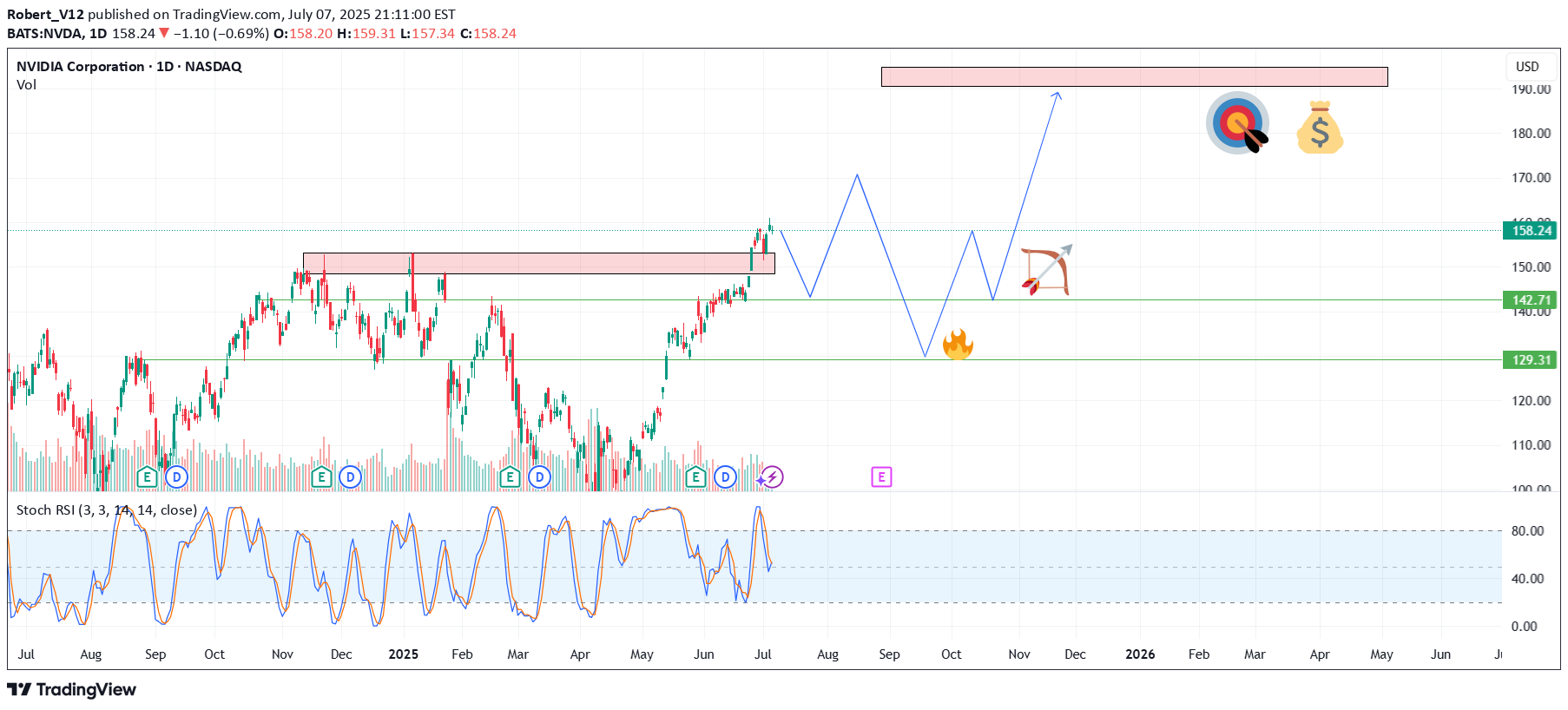

شوک تعرفهای ترامپ: نقطه ورود بعدی انویدیا (NVDA) کجاست؟

📰 Context: Tariff Shock Factor Trump has recently announced that starting November 1, the U.S. will impose an additional 100% tariff on Chinese imports, along with stricter export controls on critical software. The escalation in trade tensions puts semiconductor names like NVDA directly in the crosshairs — greater risk of export restrictions, supply chain stress, and demand cutbacks in China. So while the long-term AI narrative remains powerful, the short-to-medium term is more volatile than usual. 🧠 My Take Entry Points (Long): Entry A: $168 (near resistance break or pullback bounce) Entry B: $153 (deeper pullback, still within bullish structure) Entry C: $130 (if severe correction occurs) Targets: Target 1: +7% → ~ $180 Target 2: +15% → ~ $193 Target 3: +18% → ~ $198–200 📌 Disclaimer: This is my personal trading idea, not financial advice. Use your own research, match your risk tolerance, and always manage your position size and stops.

Robert_V12

NVDA – Decision Week Ahead $200 or $140?

NVIDIA (NVDA) has been on an incredible bull run, climbing from $140 to nearly $180+ in just 2–3 months. Now, with earnings coming this week, the market is at a decision point: Will the AI leader extend its rally toward $200 🚀, or will profit-taking and cautious guidance send it back toward $150 📉? 🟢 Bullish Scenario Entry points: 170→165→160 Targets: $185 → $190 → $200+ Lose $170? I’ll wait patiently for $150–140 before sizing back in. 🔴 Bearish Scenario – Pullback to $150–140 If earnings disappoint or guidance weakens (China restrictions, slowing demand), NVDA could unwind toward prior support. Entry Points (for long re-entry after correction): $160 $150 $140 Targets on recovery: $160 → $175 → $190 📌 Disclaimer: This post reflects my personal trading plan, not financial advice. Always do your own research and use proper risk management.

Robert_V12

TSLA – Buy the Fear or Wait for the Setup?

Tesla (TSLA) is once again in the spotlight. Between robo-taxi hype, new product launches, and ongoing political noise around Elon Musk, the stock has become one of the hottest trading stories on the market. But as always the chart tells us where to act. Entry Levels $330 – First line of defense, early buyers may step in here $295 – Stronger support, better reward-to-risk zone $255 – Deep pullback level, only triggered on market weakness 🎯 Profit Targets TP1: ~$345 → ~5% move from $330 entry TP2: ~$370–$380 → 12–15% move depending on entry TP3: ~$400–$420 → 18–20% move on a sustained breakout Tesla remains a trader’s stock: volatile, narrative-driven, and technically reactive. If it holds the $330 zone, momentum traders could see a quick bounce. If we dip to $295 or even $255, that could be the bigger opportunity for those with patience. No one knows which path the market chooses, but the plan is set. Trade the structure, not the noise. ⚠️ Disclaimer: This is not financial advice. I’m sharing my personal analysis and trade levels. Always do your own research and manage risk responsibly.TP3: ~$400–$420 REACHED

Robert_V12

NVDA – Two Scenarios on the Table: 200 or 140?

NVIDIA has been the undeniable leader of the AI revolution, pushing higher for months and hitting fresh highs around $180+. But after such a strong rally, the market often faces a “decision zone”: either break higher with momentum or take a healthy correction. That’s why I’m laying out two clear trade paths — bullish continuation 🚀 and bearish retracement 📉. ✅ Bullish Scenario (Momentum Continues → $200) Entry Points (Bullish): $178 $170 $160 Profit Targets: TP1: $185 TP2: $190 TP3: $200+ ⚠️ Bearish Scenario (Healthy Correction → $140 Entry) If momentum fades and sellers push NVDA below $170, a correction toward $140 is possible — which would actually be a great long-term entry for buyers waiting on the sidelines. Entry Points (Bearish Long Setup): $160 $150 $140 (ideal deep value entry zone) Profit Targets on Rebound: TP1: $160 TP2: $175 TP3: $190 📌 Disclaimer: This is not financial advice. I’m sharing my personal trading view for educational purposes. Always do your own research and manage risk before entering any trade.

Robert_V12

COIN- Loading Up Before the Next Crypto Wave

Coinbase (COIN) is setting up for another big swing as crypto momentum keeps building. I’m looking to scale in with layered entries and ride the volatility to higher levels. 🔑 Entry zones: First buy: $295 Second buy: $275 Deep buy: $245 🎯 Profit targets: TP1: $330 ✅ TP2: $350 🚀 TP3: $375+ 💰 ⚠️ Disclaimer: This is just my personal trading plan, not financial advice. Do your own research and manage your risk!

Robert_V12

NVDA-the AI Titan

NVIDIA (NVDA) continues to dominate the AI semiconductor space and remains one of the strongest momentum names in the market. After reaching new highs, price action is now offering a clean multi-tiered entry opportunity for swing traders positioning for the next leg up. Entry Points ✅ $160 – Breakout retest zone ✅ $145 – Key technical support ✅ $130 – Strong demand zone from prior consolidation Profit Targets 📈 TP1: $180 🚀 TP2: $190 💰 TP3: $200+ 📌 Disclaimer: This is not financial advice. Just sharing my view and trade idea. Always do your own research and manage risk accordingly.

Robert_V12

NVIDIA (NVDA)-Trade Plan

NVDA, After an explosive run powered by GenAI infrastructure and bullish earnings, the chart is setting up for either a bullish continuation or a healthy pullback. With volatility tightening and volume compressing, this is a great moment to prepare for either breakout or breakdown scenarios. 🎯 Trade Plan – Tiered Long Setup 📌 Entry Zones (Tiered Buying): 🔹 $150 🔸 $140 🔻 $120 📈 Profit Targets: TP1: $160 TP2: $175 TP3: $200+ – Long-term continuation play if AI macro momentum persists 📌 DISCLAIMER: This idea is for educational purposes only. Always use proper risk management and assess your own strategy

Robert_V12

TSLA – Calm Before the Storm or Just Another Dip Buy?

Tesla (TSLA) is trading around $315, bouncing off recent lows, but this isn’t just a clean technical setup. With Elon Musk’s political drama escalating (hello, “America Party”) and ongoing tension with Trump, TSLA is becoming a battleground stock with serious volatility. As swing traders, that’s exactly where we thrive. 📍 Entry Plan ✅ Entry #1 – $315 ✅ Entry #2 – $300 • Previous breakout zone — ideal for dip buyers ✅ Entry #3 – $265 • Strong macro support; only activated if market correction deepens. 🎯 Profit Targets • TP1: $335 • TP2: $355 • TP3: 400+ – if sentiment + volume align with narrative momentum (think: Robotaxi or AI catalyst) If $265 gets hit, I’m not panicking, I’m preparing for high-reward setups. ⚠️ Disclaimer: This is not financial advice. I’m just sharing my plan and technical zones. Always do your own research and manage your risk. 📌 Follow for more ideas based on price, narrative, and timing. Trade smart — not loud. 🧭📈TP3: 400 reached

Robert_V12

AMZN — Accumulation Zone or Just a Healthy Pullback?

📦Amazon (AMZN) is offering an interesting opportunity after a healthy correction from its 2025 highs. With continued AWS expansion and aggressive investment in AI infrastructure, the fundamentals remain solid — but short-term volatility opens the door for strategic entries. 🎯 Entry Points 🔹 $194 – First key support, ideal for early buyers 🔹 $187 – Strong technical congestion zone 🔹 $169 – Deep value zone with higher risk/reward potential 💰 Profit Targets ✅ TP1: $210 – First resistance and psychological level ✅ TP2: $227 – Last swing high area ✅ TP3: $241+ – Full recovery path if momentum holds 🧠 Strategy Insight This setup suits a swing trade horizon (30–60 days). Scaling into the position and adjusting stops under $160 offers a risk-managed approach. The upcoming earnings on July 31, 2025 could be the trigger for a major move — watch AWS growth numbers and forward guidance closely. ⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice. Always do your own research and manage risk accordingly.

Robert_V12

Is NVDA Building Strength Before a Breakout?

After cooling off from its $150 highs, NVIDIA (NVDA) is consolidating in the $140–$145 zone. While some traders fear the AI hype has peaked, others see this as the calm before another rally. With solid fundamentals, continued leadership in AI, and strong institutional backing, NVDA remains a name to watch closely. 🎯 Trade Setup: Entry Points ✅ $142 – Current price zone (speculative buy) ✅ $135–$130 – Strong support (ideal swing entry) ✅ $125 (only if market-wide pullback occurs) Profit Targets 📈 TP1: $149 – All-time high retest 🚀 TP2: $160 – Extension target 💰 TP3: $175+ – Long-term bullish scenario if momentum returns 💡 Strategy: This is a “buy-the-dip, trade-the-breakout” setup. Wait for confirmation above $146 if you're conservative, or accumulate gradually into weakness with a clear risk plan. 📌 Disclaimer: This is not financial advice. Always do your own research and use proper risk management. I'm sharing my personal view for educational purposes.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.