Reliable_Trading

@t_Reliable_Trading

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

طلا (XAUUSD) سقوط کرد: فرصت فروش مجدد در چه سطوحی؟

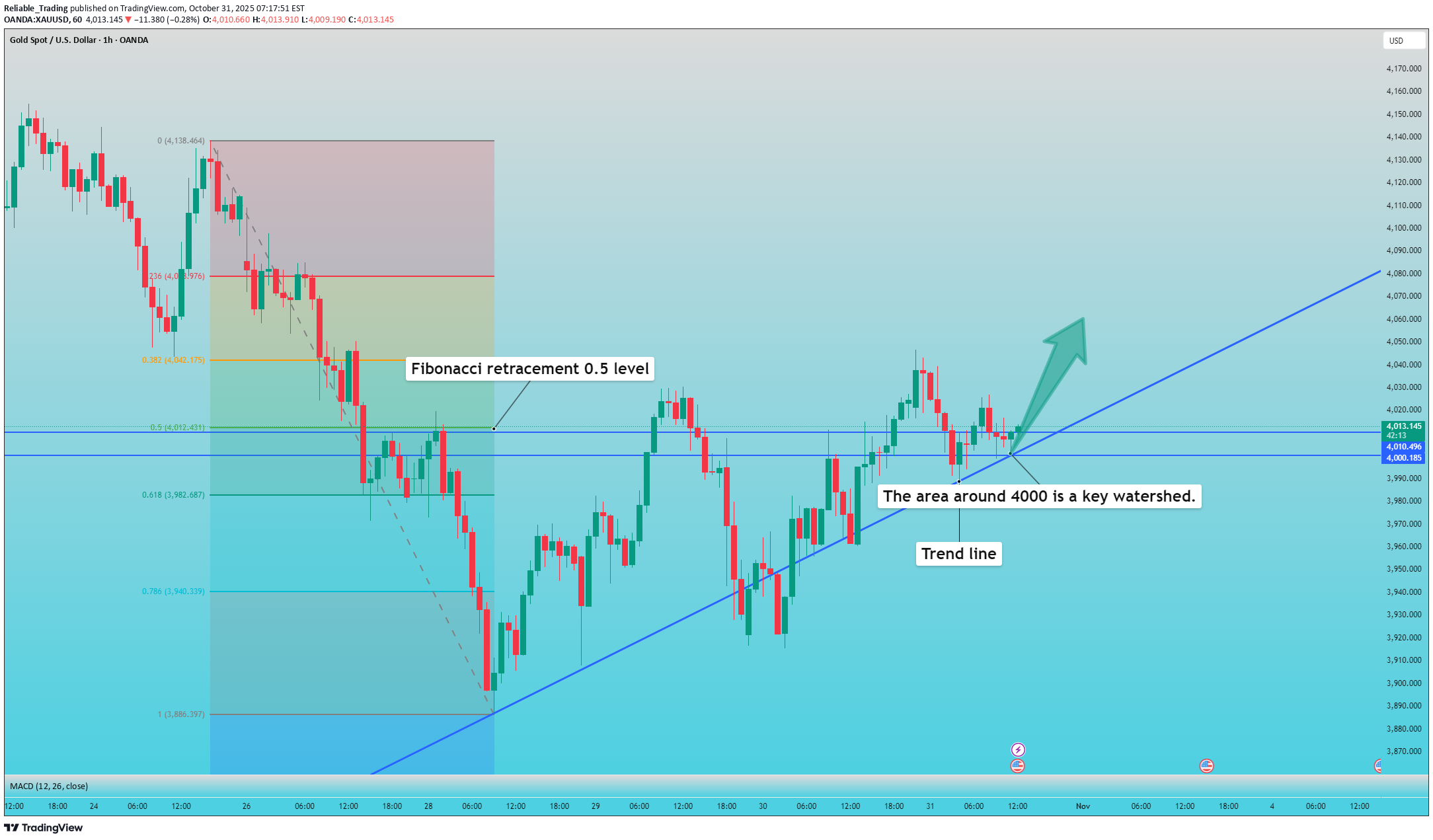

Yesterday, gold prices continued to fall as the US dollar index broke through the 100 mark, reaching a three-month high. The decline accelerated during the US session, briefly touching 3930. In yesterday's article, I suggested shorting if the 4000 level couldn't be broken, and that a move to the intraday low of 3970 could lead to a pullback to the 3950 support level. Yesterday's decline was more severe than I anticipated, reaching 3930. Given the current weakness in gold, as long as the US dollar index continues to strengthen, it's possible that the decline will continue. Therefore, today we can consider shorting at 3970 and 4000, with a target of 3935.

پیشبینی سقوط طلا: فرصت فروش (شورت) در 4000 با اهداف 3970 و 3950

Yesterday, gold remained above the 4000 level, and our long position bought at 3996 was closed at 4026 for a profit. Today's trend is completely different. Gold prices fell below 4,000 at the opening and failed to break through the 4,000 mark, basically indicating that it is about to enter a period of consolidation and decline. Therefore, the main trading direction today is to short gold. The strongest support level is currently around 3950. If it breaks below the intraday low of 3970, then 3950 is very likely to be reached. Today's trading strategy is as follows: Short positions will be initiated as long as the price fails to break above the 4000 level. The initial target is 3970, followed by 3950.Our shorting strategy around 4000 was absolutely correct. As we predicted, gold prices fell after failing to break through the 4000 level during the rebound, and have now reached the intraday low of 3970, successfully hitting our target. Congratulations to those who followed our strategy and made another substantial profit!As expected, after breaking below the intraday low of 3970, gold prices successfully touched the support level of 3950.

طلا (XAUUSD) در آستانه جهش بزرگ: بهترین زمان خرید کجاست؟

My view on gold today is that it will first pull back, then rebound. The main support level is at 3975, and the resistance levels are at 4050 and 4080. Trading strategies are as follows: Aggressive traders can enter long positions near 3996, and add to their positions if it pulls back to the 3975 support level. A more conservative approach would be to wait and see if gold prices retrace to 3975 before entering a long position.Excellent, gold rebounded as expected. Let's maintain this momentum and wait for further profit growth.Gold rebounded as expected, currently trading around 4026. Our long position bought at 3996 has yielded a profit of 300 points. Considering that 4026 is the previous high and presents resistance, I have closed the position for a profit, successfully securing our first trade of the week.

طلا (XAUUSD): رمز بقای خرید در آستانه 4000!

The Fed cut interest rates, gold fell; easing US-China trade tensions, gold rose? The gold market's movements in the past two days have left many puzzled, but this is normal. You can't predict the market every moment; when fundamentals and technicals contradict each other, price fluctuations are inevitable. I remain bullish on the overall trend, but in the short term, we need to pay attention to possible changes in the direction of gold prices, especially since the current price is fluctuating around the 4,000 mark. Only when gold prices truly break out of their direction will market buying be stimulated; otherwise, without buying interest, a pullback is possible. Given the volatile short-term market, we should choose to take profits promptly rather than holding on, unless significant factors supporting a sustained rise in gold prices emerge. Looking at the 1-hour chart, the 4000-4010 range has become a watershed between bulls and bears. If the price can hold above this level, it will inevitably attract bulls, at which point we can take advantage of the situation and enter long positions. If the support level around 4000 cannot be held, then don't consider going long.

طلا (XAUUSD) پس از کاهش نرخ بهره: آیا قیمتها سقوط میکنند؟ بهترین زمان فروش کجاست؟

We did not trade yesterday. Firstly, gold prices moved rapidly and unpredictably. Secondly, the Fed's interest rate decision and Powell's remarks caused market sentiment to fluctuate, making trading risky. Yesterday, the Federal Reserve cut interest rates by 25 basis points as expected, which was in line with market expectations and was beneficial to the gold market. The overall tone of the Fed meeting was slightly hawkish and cautious. More importantly, the Fed did not stop reducing its balance sheet during this meeting. Subsequently, Powell explicitly stated that whether there would be another rate cut at the next meeting (December) was "not a done deal," implying that there might not be a rate cut in December. Market expectations for a December rate cut immediately decreased. Powell's hawkish remarks and the internal divisions within the Fed suggest that future rate cuts will not be so smooth. For gold, the rate cut has been implemented, and the impact has been largely absorbed. Gold's upward momentum is not strong, and Powell's remarks have diverted some of the positive effects of the rate cut, suggesting that gold prices may continue to retreat in the short term. Gold prices just rebounded again to the 4010 resistance level. Based on this information, we've chosen to short at this resistance level. Good luck to us! My advice is this: if gold prices have a chance to return to the 4000-4010 range, you can consider shorting, with a target of 3950 first, then 3920.Gold has broken through the 4000-4010 resistance zone and entered a new resistance zone of 4025-4030. If this level is also broken, then you should not short gold; otherwise, you can hold your short position or even add to it.

خرید طلا (XAUUSD): منتظر پولبک به حمایت ۴۰۰۰ برای ورود باشید!

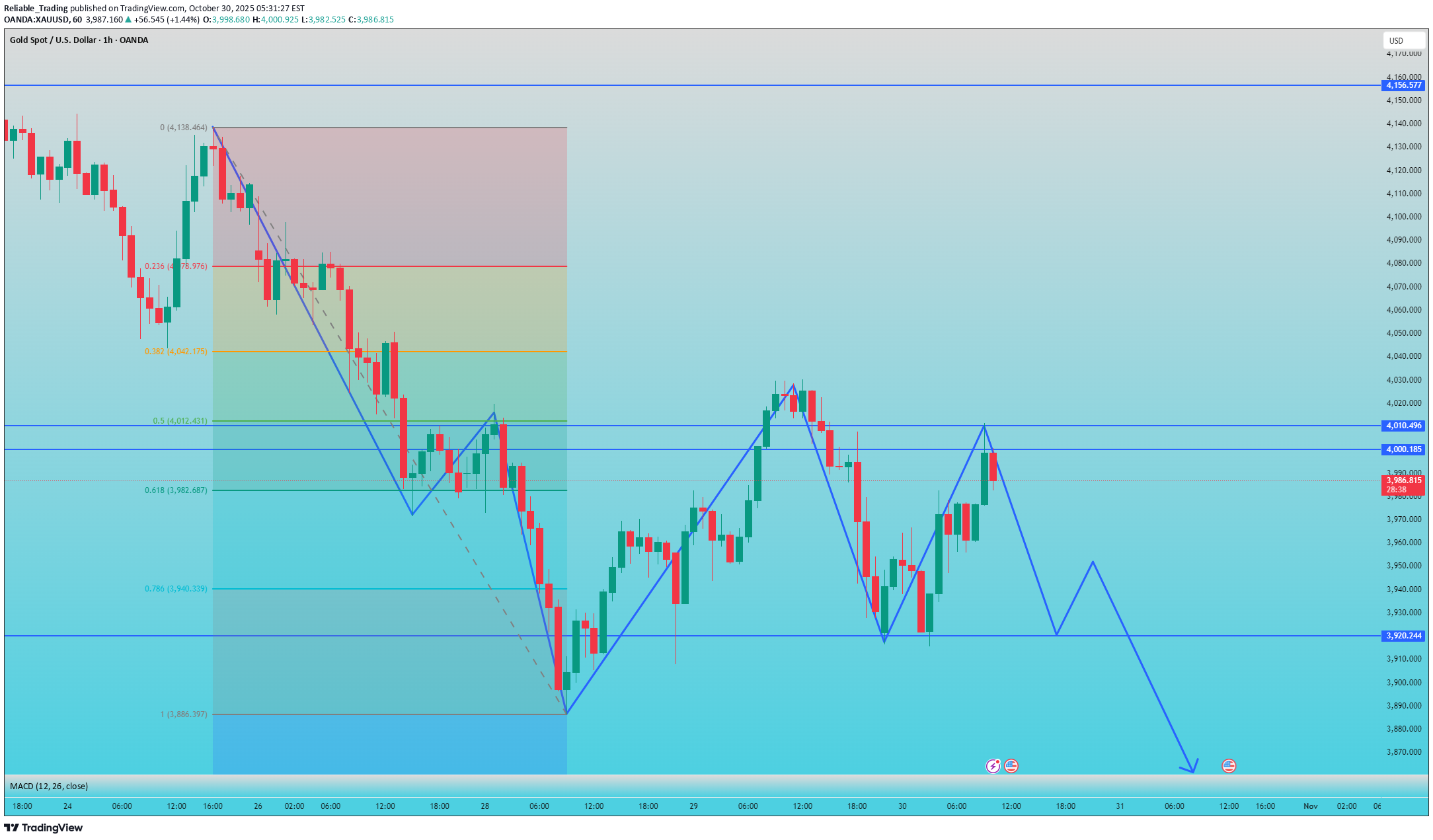

Yesterday, gold prices rose to 3970 after breaking through 3950, then quickly fell to 3909, just hitting our stop-loss before dropping further. This was incredibly frustrating; we lacked a bit of luck, otherwise it would have been another big profit. Today, the rebound in gold has continued, breaking through the 4000-4010 resistance zone. Once this zone is broken, resistance will turn into support. Given the recent volatility and sharp fluctuations in gold prices, I do not recommend chasing the rally. If you want to enter the market, you should at least wait for a pullback to the 4000-4010 range before considering it.The 4000 level has been broken again; do not enter long positions. Observe the support at 3980. If it does not break, consider whether to enter a position.

سقوط طلا ادامه دارد: پشت سر گذاشتن 3950 و هدف جدید 3900!

The correction of gold prices has not ended yet. After falling below the 4000 integer mark yesterday, I said that this meant that gold prices would fall further. Therefore, we decisively sold when the gold price rebounded to 4010, successfully achieving the target of 3950, with a profit of up to 600 points. With the 3950 support level broken again, there's no longer any strong support here in the short term, and further declines are likely. Next, we will focus on the 3950 line. If we cannot break through here, we can enter the short position again, and the target will be 3900.

پیشبینی طلا: فرصت فروش در محدوده 4000 تا 4010 (هدف 3950)

Gold briefly rebounded after hitting its lows, then fell directly below the 4000 mark. The 4000 mark can be said to be an important support position. If it is broken here, it means that the gold price still has room to fall further, at least to the support of 3950. Therefore, we can choose to short gold in the 4000-4010 range during the rebound, with the target at 3950. If the gold price stabilizes at 4010, then do not short.Attention brothers: Gold has reached the target level of 3950, and our short positions at 4000-4010 have been profitable. Congratulations to friends who participated in the strategy. Yesterday, we executed two trades. The first one, a buy at 4000, hit our stop-loss. As you all know, we subsequently switched to shorting around 4010, making a massive profit of 600 pips. Next, you can pay attention to the support situation in the 3950-3940 range. If it does not fall below, you can consider intervening in long positions. If it falls below, don’t consider it. Given the current bearish trend, we can proceed with caution here; premature entry is not recommended.

طلا در آستانه خیزش دوباره: استراتژی خرید در محدوده حیاتی ۴۰۰۰-۴۰۱۰!

First of all, I need to say sorry to everyone. I have not been able to update in the past three weeks due to family illness. I am very sorry for this. However, starting this week, I will resume updating my strategy for your reference! In the past three weeks, I have been paying attention to the dynamics of gold every day. After a wave of sharp rise, gold entered a correction period, and then to the current wide range of fluctuations. A lot of things happened in the meantime, and I believe everyone understands it, so let’s talk about the current situation. Gold prices are currently in a period of consolidation after a sharp correction. My personal view is that after this correction, they will continue to rise, as various global issues are supporting the continued rise in gold prices. Although the gold price has recently retreated by over $300, central banks around the world are still increasing their gold holdings, demonstrating that gold still has potential for further growth. There are many reasons for this, and I won't list them all here. The current oscillation range is 4004-4160, and the current price is around 4018, which is at the bottom of the range. Therefore, we can focus on the 4010-4000 range today. As long as it does not fall below the 4000 integer mark, I think gold will still rise. Whether in the long term or short term, I think you can try to build a bullish position here.

طلا به مقاومت خورد: بهترین زمان خرید در اصلاح قیمت کجاست؟

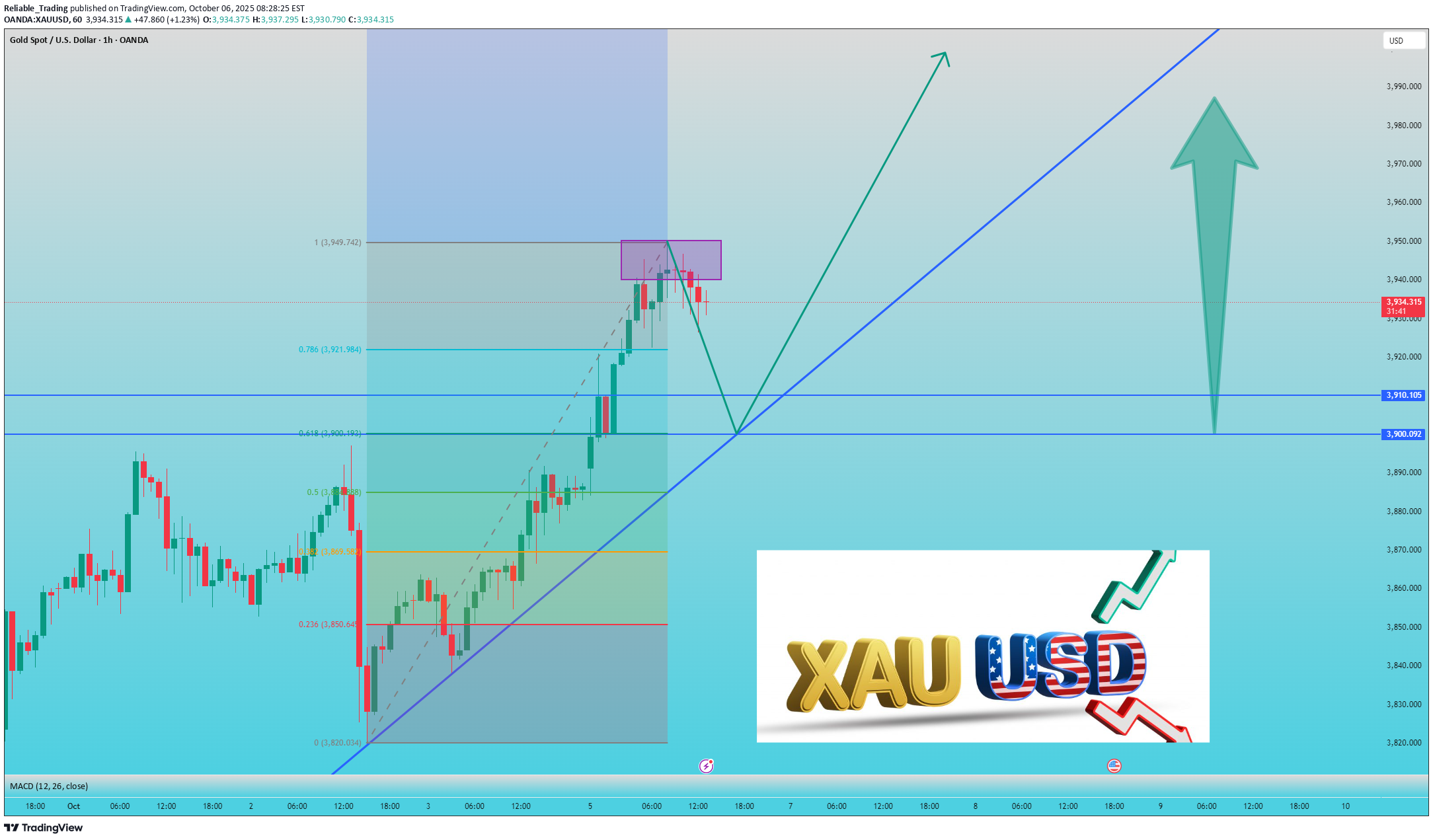

Last week, we executed six trades, one of which hit our stop-loss, while the other five yielded healthy profits. As we begin a new week, we hope these results continue. Gold fundamentals remain impacted by the US government shutdown. Gold prices opened this week with a strong rally, breaking through the 3900 mark and reaching a high near 3950. This market trend is driven more by fundamentals and risk aversion. When prices cease to rise and become capped at high levels, some profit-taking is inevitable, leading to a price correction. This is the current gold price trend, so we shouldn't chase the rally. Looking from below, the 3900 mark lies at the 0.618 Fibonacci retracement level of this uptrend, providing important short-term support. If we're considering a long position, we can consider the 3900-3910 range. If you are more aggressive, you can make a short-term short position in the high range of 3940-3950, and then go long when it falls back. Come on, let's get moving.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.