Prince677

@t_Prince677

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

Prince677

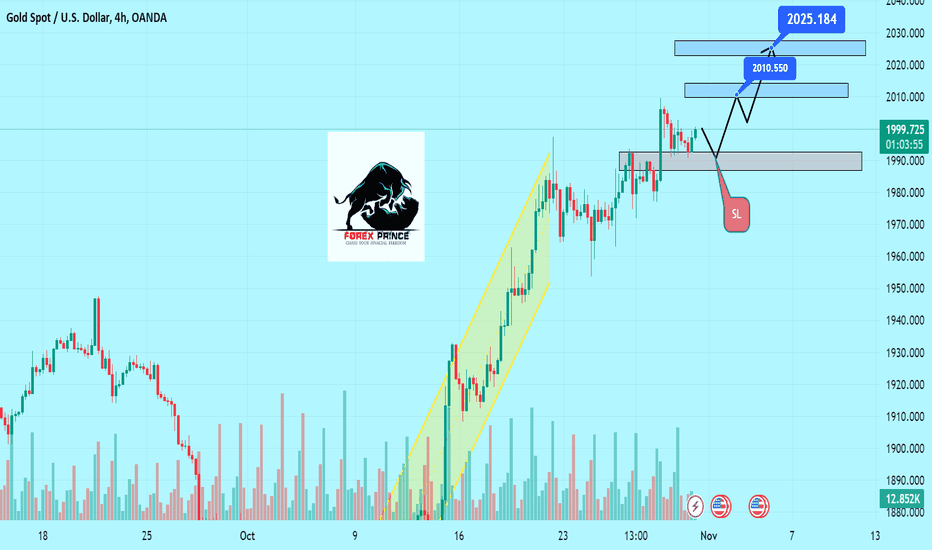

Gold price (XAU/USD) reverses an intraday dip to the $1,990 area and climbs to a fresh daily peak during the early part of the European session. The precious metal, however, remains below the $2,000 psychological mark amid expectations that the Federal Reserve (Fed) will keep the door open for one additional rate hike in 2023 to bring inflation back to its 2% target. The hawkish outlook remains supportive of elevated US Treasury bond yields, which helps revive the US Dollar (USD) demand and might cap the non-yielding yellow metal.Apart from this, Israel's more measured approach to its incursion into Gaza has eased fears about a broadening crisis in the Middle East and further undermines the safe-haven Gold price. That said, the risk of a further escalation in the Israel-Hamas conflict remains, which, along with the uncertainty over the economic recovery in China, assists the XAU/USD in attracting some dip-buying near the $1,990 region. The emergence of some dip-buying, meanwhile, warrants some caution before positioning for any meaningful corrective decline GOLD BUY : 1998TP. : 2008TP. : 2015TP. : 202510 Pips RuuningConfirm Chart20 Pips Done30 Pips Running enjoyFollow My Chart40 Pips Done50 Pips Enjoy60 Pips Done Nicely70 Pips Done.100 Pips Done Amazing

Prince677

Gold price falls nominally from five-month high of $2,009 as investors remain concerned about the interest rate guidance from the Fed, which will be delivered on Wednesday. The precious metal stabilizes above the crucial resistance of around $1,990, which is now acting as a major support for the Gold bulls. The broader Gold demand outlook turns bullish as the 20-day Exponential Moving Average (EMA) has delivered a bullish crossover above the 50 and 200-day EMAs. XAUUSD BUY : 1996TP. : 2005TP. : 2013TP. : 2020SL. : 198320 Pips Done30 Pips Done.40 Pips Running50 Pips Done60 Pips RunningFollow My ChartConfirm TargetRunning Amazing Profit

Prince677

Gold declined to $1,980 during the European trading hours on Friday but managed to retrace its daily decline. The benchmark 10-year US Treasury bond yield turned flat on the day near 4.85% following US PCE inflation data and allowed XAU/USD to find a foothold GOLD BUY : 1981TP. : 1988TP. : 1995TP. : 2000SL. : 1972Tp 1 70 Pips DoneTp 2 140 Pips DoneTp 3 190 Pips Done190 Pips Target CompletedBig Profit DoneFollow Us For More Best Charts

Prince677

Gold price recovers the recent losses on improved risk sentiment. Escalation in Middle-East conflict could drive the demand for the safe-haven asset Gold. Updates from China might contribute to a positive shift in market sentiment.Gold price treads waters near the $1,980 post-intraday gains during the Asian session on Tuesday. The price of the precious metal receives upward support due to the correction in the US Dollar (USD), which could be attributed to the downbeat US Treasury yields.GOLD BUY : 1985TP. : 1990TP. : 2000TP. : 2015SL. : 197020 Pips RunningConfirm TargetFollow My Chart

Prince677

Gold price (XAU/USD) gains some positive traction on Wednesday and move away from the weekly low, around the $1,954-1,953 area touched the previous day. The precious metal manages to hold its neck above the $1,970 level through the first half of the European session and for now, seems to have stalled its recent retracement slide from the vicinity of the $2,000 psychological mark, or a five-month top touched last Friday. Looming recession risk, fueled by a flurry of weaker economic data from Europe on Tuesday, along with the Middle East conflict, turns out to be another factor lending some support to the safe-haven Gold price. That said, a fresh leg up in the US Treasury bond yields and the emergence of some US Dollar (USD) dip-buying, bolstered by hawkish Federal Reserve (Fed) expectations, cap the upside for the non-yielding yellow metal. GOLD BUY : 1971TP. : 1978TP. : 1986TP. : 2000SL. : 1950-52Confirm TargetFollow Us20 Pips Running Enjoy25 Pips Enjoy.Follow The chart90 Pips DoneConfirm BuyFollow My ChartEnjoy Big ProfitConfirm ChartFollow Us100 Pips Done110 Pips RunningFollow Us Need Support

Prince677

At the end of the latest reporting week on 17 October, financial investors were on balance betting on a rising Gold price again. The data show net long positions amounting to 15,100 contracts, compared to net short positions totalling 26,700 contracts a week earlier. Three quarters of the shift of just shy of 42,000 contracts was due to short covering, which shouldn’t come as any surprise in view of the price performance. Short covering and the simultaneous build in long positions combined amounted to the equivalent of 130 tons of Gold being purchased via the futures market. As the Gold price climbed further in the subsequent days, short positions are likely to have been further reduced and long positions further increased in the meantime.70 Pips RunningConfirm Target

Prince677

Gold price (XAU/USD) recovered after a corrective move from the psychological resistance that was inspired by rising long-term US Treasury yields. The precious metal aims to recapture a five-week high as Israel-Palestine tensions keep the fears of widening Middle East conflict persistent. The 10-year US Treasury yields jumped to a multi-year high of 5% amid expectations of firmer US economic data, which will be published this week.Investors will keenly watch for the growth rate in the July-September quarter, which will set the undertone for interest rates by the year-end. An upbeat growth rate would demonstrate strong labor market conditions, robust consumer spending, and a recovery in economic activities despite tight monetary policy by the Federal Reserve (Fed). GOLD BUY : 1975TP. : 1982TP. : 1990TP. : 2000 SL. : 196220 Pips RunningCoonfirm Chart

Prince677

Gold price was shy of testing the $2000 troy ounce barrier on Friday amidst increasing geopolitical risks, as the conflict between Israel and Hamas is briskly spreading toward more countries in the region. At the time of writing, XAU/USD is trading at around $1980.20 after the yellow metal bounced from daily lows of $1972.12 . If Gold price extends its gains past $2000, Gold’s next resistance is seen at the May 10 daily high of $2048.15, followed by last year’s high of $2075.14, before challenging the all-time high (ATH) at $2081.82. If XAU/USD cannot stay above $2000, the first support would be the July 20 high at $1987.42, followed by the September 1 high turned support at $1952.95.

Prince677

Gold price (XAU/USD) rose sharply as Middle East tensions kept escalating and the Federal Reserve (Fed) Chair Jerome Powell endorsed a stable interest rate policy in his speech on Thursday. The demand for bullion strengthened as Israeli troops prepared to enter the Gaza strip with the goal of dismantling Hamas, the Palestinian military group. Meanwhile, despite the promise of humanitarian aid for civilians in Gaza by US President Joe Biden, Iran could step in and intervene directly in the conflict, which could turn into a feared Middle East regional war. GOLD BUY : 1981TP. : 1993TP. : 2005TP. : 2020SL. : 197020 Pips Done.30 Pips RunningConfirm Target.35 Pips RunningFollow My ChartNeed Ur SupportConfirm ChartTrade In Buy40 Pips EnjoyFollow My ChartNeed Your Some SupportHold In BuyConfirm BuyHold On It Will Go Up HighNeed Some Support60 Pips Done.70 Pips RunningConfirm Analysis,.Support Us80 Pips EnjoyFollow My Chart100 Pips Done110 Pips Running115 Pips Done EnjoySupport Us NEED Your SupportConfurm AnalysisFollow Us Need Some SupportSupport USConfirm Chart.120 Pips Done Enjoy125 Pips RunningConfirm AnalysisFollow Us130 Pips Done,135 Pips RunningConfirm AnalysisFollow My ChartNeed Your Support...Follow For MOre Best Profitable Charts./140 Pips Done.150 Pips Done Enjjoy160 Pips Running.>Confirm BuyEnjoy WeekendFollow For More Profitable Charts.Enjoy Free Charts

Prince677

Gold capitalized on safe-haven demand amid escalating geopolitical tensions and gathered bullish momentum to start the week. As US Treasury bond yields turned south on dovish Fed expectations, XAU/USD extended its rally and snapped a two-week losing streak. GOLD BUY : 1948 TP. : 1960 TP. : 1970 TP. : 1980 SL. : 193420 pips runningConfirm Target80 Pips DoneRunning Good ProfitFollow My ChartSupport UsConfirm TargetFollow For More Profitable ChartsTp 1 Hit 100 Pips.,120 Pips RunningConfirm MarketFollow Us160 Pips Running320 Pips Done320 Pips Target Completed...Follow Us Need Your Support.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.