Patrick-Daniel

@t_Patrick-Daniel

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Patrick-Daniel

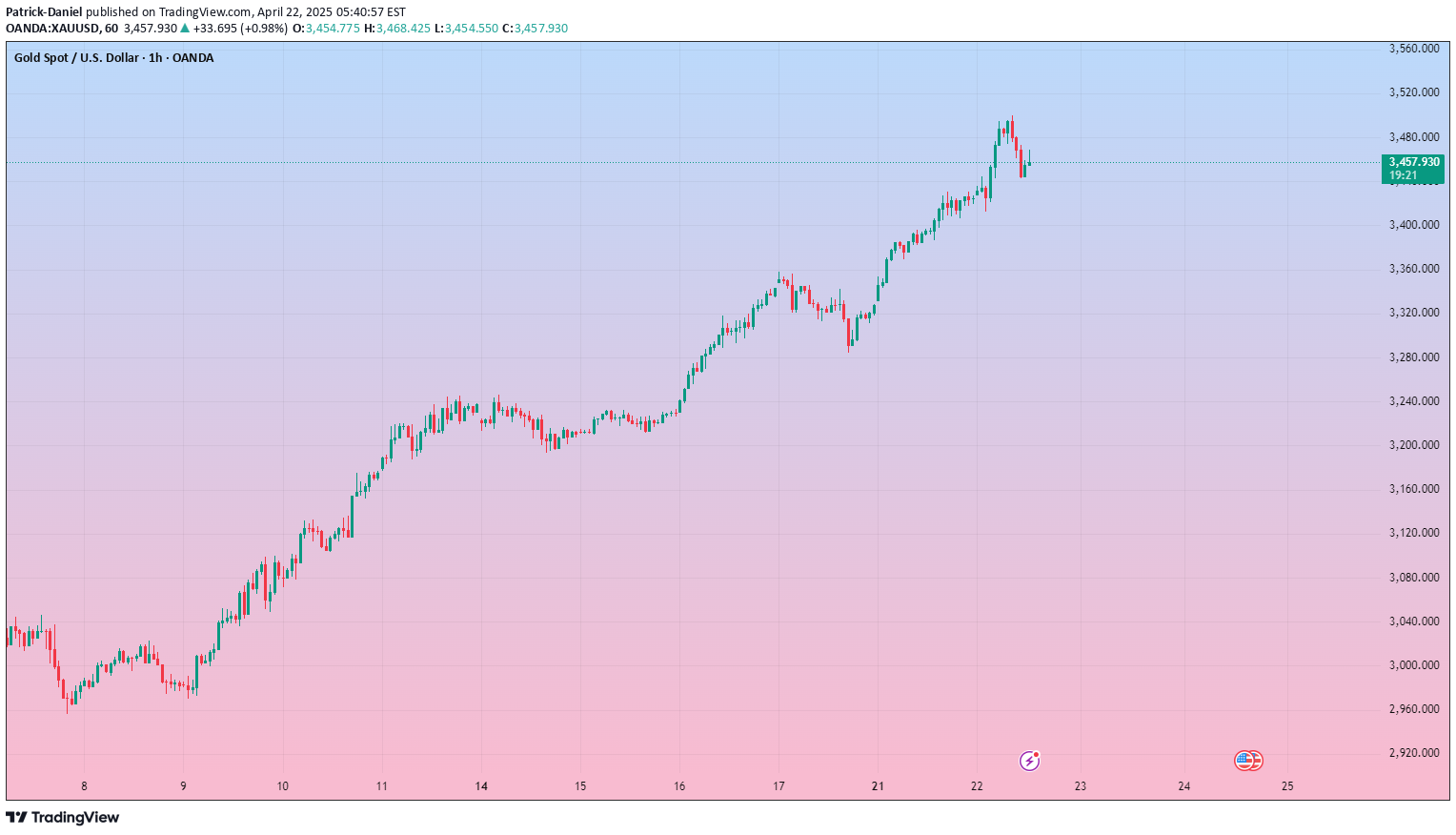

Gold ended successfully, Where will the market go next week?

The idea of keeping gold short at a high level is that after the winning streak of gold ended, gold continued to fluctuate in a narrow range. If there is no opportunity, then it will end early and rest. After all, it is Friday. After a hard week, it is time to rest. The news on the weekend has changed a lot, and it is full of uncertainty. Gold rebounded again in the second half of the night, which seems to be strong, but has gold reversed? It is too early to say now.The 1-hour moving average of gold continues to be short, but after gold bottomed out at the first-line support near 3265, gold rebounded by more than 50 US dollars. Is this rebound a reversal? Not necessarily, because now it basically fluctuates by about 100 US dollars every day, and it is hard to say that a rebound of 50 US dollars is a reversal. The strength of next week is the key. If the rebound of gold next week is not very strong, then gold will still fluctuate and be short. The resistance of the 1-hour moving average above gold is near 3354, and the top of the negative line of gold on Friday is near 3352. If there is no effective breakthrough of these two positions next week, it will still be a fluctuating and short trend.The weekly line of gold is also a shooting star with a long upper shadow at a high level. If there is no big bullish news to support gold in the short term, gold will be under pressure at a high level in the short term, and the daily line is also down from a high level without a strong counterattack. On the whole, there is still room for adjustment in the short term for gold.The market is changing rapidly and confusing. Sometimes we cannot be confused by the illusion in front of us. Only by not being afraid of the clouds blocking our eyes can we see clearly behind the market. Before gold reverses, it is still bearish in the short term. It is light to follow the trend and messy to go against the trend. The market is always right. Going against the market will eventually be taught a lesson by the market. Don't have any fluke mentality in the face of the trend. The market will not forgive your mistakes again and again.Next week's operation ideas: short gold 3350-60, target 3310-3300;

Patrick-Daniel

Gold is under pressure and falls again Short again on rebound!

Gold rebounded weakly during the European session, and fell twice during the US session, with the lowest price dropping to 3265. However, even though it is extremely weak at present, it is not recommended to blindly chase the short position. The support below is 3260, which is the previous low point and is close to the volatility limit. Instead, you can try short-term long positions with a light position. The short-term pressure above is maintained at 3306, and the breakthrough will gradually reach 3315 and 3328!Operational suggestions: Gold is short near 3310-20, and look at 3300 and 3280! Long positions can be made if the support below 3260 is not broken!At present, gold is still in a state of small shock adjustment. I share a complete morphological system, hoping to help you avoid detours! It doesn’t have to be grand, steady happiness is enough.

Patrick-Daniel

Oscillating downward! The bearish trend is beginning to emerge!

【Gold Analysis】Interpretation of news: The current market presents a "three-legged" pattern: First, the uncertainty of the trade war. If the US insists on imposing new tariffs, the gold price may hit the $3,500 mark again; second, the suspense of the Fed's policy. Whether the May meeting will release a signal of interest rate cuts will become a key turning point; finally, the trend of the US dollar. If subsequent economic data continues to deteriorate, the US dollar index may fall below the 99 integer mark. The current gold market is caught in a fierce game of long and short factors. In terms of the trade war, the situation is not as good as Trump's remarks. The Asian giant issued a solemn statement on Thursday, emphasizing that if the US is sincere about solving the problem, all unilateral tariffs should be immediately cancelled. This statement is in sharp contrast to the "negotiation signal" recently released by the White House, making the trade outlook more confusing.The current market sentiment is cautiously optimistic. On the one hand, Finance Minister Bensont's statement that the trade confrontation may continue has triggered a rise in risk aversion; on the other hand, the expectation that the Fed may cut interest rates has provided fundamental support for gold. This complex psychology is the main reason why the price of gold fluctuates in the range of 3260-3500 US dollars. There is one last trading day this week. Let's see how this week ends.From the daily chart of gold, after the exaggerated reversal in the middle of the week, the current price of gold has not only lost the important support of 3350, but also formed an obvious bearish evening star in terms of shape, which means that there may be further correction space in the future. In addition, at this stage, the short-term moving averages MA5 and MA10 have been broken one after another, so it is not ruled out that they will continue to move closer to MA20, but their position is still below 3200.From the 4-hour chart of gold, although it once fell nearly 200 US dollars from the high, the price of gold gradually stood firm yesterday and began to fluctuate and rebound. It has now returned to above 3270. However, given that the moving average group is in a sticky state and the MACD indicator is adjusted to near the 0 axis, the short-term long and short competition may become more intense. Therefore, it is recommended to keep selling high and buying low as the main strategy, which is more stable. Pay attention to the resistance of 3370-3375 on the top and the support of 3285-3280 on the bottom;Investment strategy: short gold at 3310-3320, target 3265.If the support of 3290-85 below is not broken, you can continue to go long! Cautious investors can choose to wait and see, and continue to short at high levels after the rebound.The market changes rapidly. There is a lyric that says "I don't ask for forever, forever is too far away." I want to say, don't say what the future market will be like, the future is too far away, the market is all current, and the transaction is also current. There may be some changes in the news and emotions every day. Nothing is constant. The important thing is the present. Facing the ups and downs of the K-line, you must know the meaning behind it. Facing the confusing market, only by watching more, summarizing more, and learning more, the market sense will naturally follow you, and you can see the light. Facing the ups and downs of the market, if you are still wandering and confused, you must first improve and change yourself, and keep learning! I can still maintain an accurate trading plan every day.The above are several viewpoints of the author's technical analysis. They are for reference only. They are also the summary of technical experience accumulated from watching the market and reviewing the market for more than 12 hours a day in the past decade. Technical points will be disclosed every day, accompanied by text and video interpretation. Friends who want to learn can refer to the actual trend for comparison; those who agree with the ideas can refer to the operations, take good defense, and put risk control first; those who disagree can just ignore it; thank you for your support and attention;

Patrick-Daniel

How to break through the gold shock patternOperation suggestions

Technical analysis of gold: The current gold price is in a stalemate stage of long-short game. On the one hand, the path of the Fed's easing policy has been basically clear, and the US dollar is facing correction pressure; on the other hand, the stable global risk sentiment and the strong performance of the stock market have weakened the attractiveness of gold as a safe-haven tool. The repeated signals of global trade negotiations have also made the market direction unclear. From a technical point of view, gold has received support after the correction to the 26.3% Fibonacci retracement level near 3317 this week, and has returned to above $3,300 in the short term. The upper resistance focuses on the position of 3380. Once it breaks through, it will open up the space leading to the 3400 mark.From the daily chart of gold, yesterday's gold price fell sharply and recorded a large real body Yin line K-line pattern. The peak pattern of the previous price high is more obvious, suggesting that the upper pressure effect is strong. The MACD indicator double line began to turn downward, increasing the risk of further correction in the short term. However, the MA5 and MA10 moving averages have not turned downward yet. You can pay attention to the support and defense of the moving average. From the 4-hour gold chart, the gold price has been fluctuating and falling since it came under pressure at the 3500 level. The current price has fallen back to the 3260 level, with a short-term decline of 240 US dollars. Although there has been a rebound during the day, the upward trend has been destroyed. The MACD indicator has issued a dead cross signal, suggesting that the correction trend may have started.Gold fell after rising in the Asian session, and fell below the support levels of 3351 and 3330. Now the market rebounded near 3314, which is also in line with our analysis of the long and short trends. In the big trend, the gold rally did not exceed 3380, so there is still a downward demand, that is to say, it can only be regarded as a rebound during the decline. In the short term, this wave of gains stopped at 3367. Now it broke through 3351 and pierced 3316 to rebound. The main focus on the upper side is the support-to-resistance level of 51, followed by 3342. Specifically, you can wait for the area near 3345 to go short and see the gold price break the previous rebound low of 3314 to 3300. If it breaks down effectively, you can move the protection loss down to see the position of the rebound turning point of 3283 and 3260. On the whole, the short-term operation strategy of gold today is to short on rebound and long on callback. The short-term focus on the upper side is 3350-3370 resistance, and the short-term focus on the lower side is 3300-3280 support.From the analysis of the 4-hour line, the support below is around 3300-3310. If it falls back to this position, you can buy more first and then look for a rebound. The short-term resistance above is around 3340-3356, and the focus is on the suppression of 3360-66. The overall range of long and short fluctuations is maintained in this range. In the middle position, watch more and do less, be cautious in chasing orders, and wait patiently for key points to enter the market. I will remind you of the specific operation strategy during the trading session, so please pay attention to it in time.Gold operation strategy:1. Short gold rebounds at 3340-46, target 3300-3310, and continue to hold if it breaks;2. Long gold falls back to 3300-10, target 3340-45, and continue to hold if it breaks;Today, the short-term support below is around 3320-25. If it falls back and stabilizes at this position during the day, we will continue to look at a rebound. The short-term resistance above is around 3385-90. If it stabilizes at the 3300 mark in the short term, we will continue to look at a second surge. Shorting requires key points to enter the market. I will remind you of the specific operation strategy during the trading session, so please pay attention to it in time.Gold operation strategy:1. Short gold at the 3380-85 line when it rebounds, and short at the 3360-66 line when it is extremely weak, with the target at 3310-3320.2. Go long at the 3310-3300 line when gold falls back, with the target at 3340-45 line.

Patrick-Daniel

US policy news triggers huge shock in gold Analytical Strategy

The short-term 4-hour middle track 3380 line has been lost, becoming a key counter-pressure point. As long as the price cannot stand on this position again, it will maintain a downward correction trend. If it falls below 3292, the gains and losses of the 66-day moving average 3260 will be concerned. The 1-hour level K line is under pressure from ma10 and ma5 and continues to fall. After last night's consolidation and pull-up, the current K line has re-run above ma10, and at the same time, macd forms a golden cross below the zero axis. This wave of 200 US dollars of rapid exploration has almost corrected most of the overbought situation. If the price continues to fall, or with the help of bottom divergence, it will slowly brew a short-term bottom. Today's gold rebound reminds that attention should be paid to the resistance below 3340, and the limit is below 3356. If it is not under pressure, it will still be bearish adjustment. Strong support is at 3260 or 3245. After the position stabilizes, it will begin to consider bottom-fishing. For today's short-term operation of gold, it is recommended to focus on rebound shorting and supplemented by callback longing. The short-term focus on the upper side is 3350-3370 first-line resistance, and the short-term focus on the lower side is 3300-3280 first-line support.From the 4-hour line analysis, today's support is around 3300-3310. If you fall back during the day, you can buy more once before looking at the rebound. The upper short-term resistance is around 3340-3356, and the focus is on the suppression of 3380-90. The overall support is to maintain a wide range of long and short fluctuations in this range. In the middle position, you should watch more and move less, and be cautious in chasing orders, and wait patiently for key points to enter the market. I will remind you of the specific operation strategy during the session, so please pay attention to it in time.Gold operation strategy:1. Short gold rebounds at 3340-50, and the target is 3300-3310Today's operating strategy was really effective. When I learned that many friends' positions were liquidated, I felt mixed emotions. All the hard work and expectations I put in were instantly gone. I just hope that you can cheer up and there will be a turnaround in the future. You all have reaped good returns by following my trading strategy!

Patrick-Daniel

The rise of the US dollar index suppressed gold.

From the perspective of technical analysis, the gold daily chart shows a large negative line pattern and then forms an inverted hammer reversal prototype structure. Today, the key support level below has moved down to the 3300 integer mark area. In the US hourly chart cycle, after the gold price short-term touched the price of 3290 US dollars/ounce, the technical indicators showed oversold repair characteristics, suggesting the existence of technical rebound momentum. The upper resistance level of the current price range is locked in the 3350-3360 US dollars/ounce area, and the core defense level below is still 3300 US dollars/ounce. I think if this support level is effectively broken, it may trigger a technical bottoming out of the price in the 3250 US dollars/ounce area.It is worth noting that the US dollar index has a short-term technical retracement. This kind of currency market fluctuation may provide a phased rebound support for the gold price through the exchange rate transmission mechanism. However, we need to be alert that the gold price has fallen below the 23.6% Fibonacci retracement level of the upward trend started from $2,900/ounce. If the 38.2% retracement level of $3,289/ounce is confirmed to be lost, it may trigger the resonance of technical stop loss orders and programmatic trading systems, forming further selling pressure. The current market structure shows typical characteristics of long-short game. It is recommended to pay close attention to the significance of gains and losses of $3,300/ounce for trend judgment.Operation strategy: 1. It is recommended to short gold when it rebounds around 3,310, with the target at 3,290.3250Remember that trading is not easy, but requires meticulous thinking and rigorous operation. If you want to get out of the quagmire of losses as soon as possible and get on the track of steady gains, it’s very simple, just find me and follow my guidance!The uncertainty of the current tariff policy remains the focus of market attention. Gold has shown signs of easing recently, but the specific agreement has not yet been implemented, and the market is still concerned about potential risks.This uncertainty puts pressure on the US dollar, and as a safe-haven asset, gold prices may face callback pressure when risk appetite rebounds. From a technical point of view, the 4-hour trend of gold shows a volatile downward trend, and the price rebound is limited after hitting the previous support level, indicating that short-term short-selling forces are still dominant.

Patrick-Daniel

3280 becomes the key for bulls!

The previous surge in gold prices was mainly due to the market pricing of "stagflation" risks, but as this risk is gradually eliminated, gold may experience a significant correction, especially considering that "long gold" has become one of the most crowded trades in the market, and its parabolic rise is an obvious signal.From a larger cycle perspective, gold is still in an upward trend, because the actual yield may continue to decline under the background of the Fed's easing policy. But in the short term, if the good news about tariffs continues to be released, the price of gold may fall further, and the market will adjust according to the new environment.Views on gold tonight!In fact, the market has a warning for today's retracement. After all, yesterday's closing line was a big negative line, so there must be a continuation in the trend of gold. Moreover, after yesterday's gold rose to the 3500 line, the trend weakened, and the market fell all the way to break the 3400 mark and the 3300 mark, and fell to the lowest 3290 line! To be honest, this round of decline is still quite strong. After breaking the continuous positive, the market ushered in the suppression of the market retracement, and at present, there is still a trend of continuation! In my opinion, the key entry point for long orders today is the previous starting point of 3280. The short-term retracement of gold is obviously continuing, and in the medium and long term, gold is still bullish. So our entry point is actually relatively simple. When it retreats to 3280, we can directly enter the market. There are still many opportunities for long orders. The retracement is not the peak!

Patrick-Daniel

Gold is down 100 points, but it still remains high and short.

Technically speaking:① Yesterday's daily line hit a high and fell back to close with a hanging neck line with a long upper shadow, which represents a short-term peak signal. Today's opening opened low and rebounded to repair the gap, which can determine the bottom support in the short term. Therefore, today's range has become a large range of 3313-3500.From the daily Fibonacci retracement extension line, the current support is around 3291, that is, the range of 3291-3371, and the middle 0.236 is located at 3370.②The 4-hour indicator macd is dead cross at a high level and runs with large volume, and the smart indicator sto is running near oversold, which means that the 4-hour market is still volatile and weak. In the short term, pay attention to the middle track and the moving average MA5 and MA10 corresponding to the 3403-3358-3404 line, and the short-term moving average MA30 corresponds to the 3350 line. From the 4-hour perspective, the current range is 3291-3371.③ The current MACD of the hourly line is dead cross with shrinking volume, and the dynamic indicator STO is hooked upward, which represents the rebound trend of the hourly line. At present, we focus on the MA60 moving average, the middle track and the MA30 moving average, which currently correspond to the 3397-3354-3405 line, but will gradually move down over time.In summary: short-selling in the area near the upper pressure of 3321-3351-3371, and maintaining high altitude as the main themeSummary: In the short term, the high altitude callback is the main focus, and the key support level is arranged in batches for long orders to follow the long-term trend.Gold has been weakening recently, accelerating downward in the afternoon, and the price once fell below the 3300 integer mark to 3291, refreshing the stage low. The technical side shows an obvious short pattern: the 1-hour moving average system turns downward, the MACD dead cross expectation is strengthened, and the rebound high point moves down step by step (blocked near 3340), suggesting that the short side is leading the rhythm. The current spot gold is at 3331. If it cannot stand firm at 3340 support, it may further test the psychological barrier of 3300.Gold recommendation: short near 3330-3340 rebound, target 3303

Patrick-Daniel

The ultimate safe-haven gold price will not fall! Keep bullish!

Remember that gold is currently the ultimate safe-haven asset. Any pullback is actually an opportunity for you to get on board. Before the current trade war eases, gold is still the most favored asset in the market. A year ago, people thought that it was not outrageous for gold to rise to $5,000 by 2030; now, this prediction has become "conservative".Fundamentally, this is because the current rise in gold is a performance as a "monetary asset" rather than a "commodity asset". This redefinition of gold's "identity" - especially under the catalysis of major events in the past few weeks - has also triggered people's deep thinking about the future role of gold in the international monetary system. It may be moving towards a new positioning: the ultimate safe-haven asset.The current retracement of gold has given you an opportunity, so don’t hesitate to enter the market directly at 3440-3450 for long orders, and buy directly at 3455-60 radically, and continue to watch the upward break to new historical highs!

Patrick-Daniel

Gold market analysis reference

Analysis of gold market trend:Technical analysis of gold: Another daily increase of $100. From the opening to now, the US market has just touched the 3430 line and fell back, but the retracement is still not continuous. Under the current background, the bulls completely dominate the trend. Note that there is no possibility of a sharp drop before the tariff fundamentals are relieved, but this is like a time bomb, so it is best to lock in intraday short-term profits. Gold continued to maintain a shock upward trend during the day and continued to set new highs. The price was close to $3430. Gold is currently maintaining a high shock and strong trend on the daily trend. There is no sign of peaking yet. The 4-hour level trend has been repeating the sideways trend after the rise, and then the continued upward trend after a slight decline. The current rise has slowed down. The hourly level trend is temporarily maintained in a narrow range of shocks, but the strength and continuity of the intraday retracement are not too large. Pay attention to the possible sideways shock and the secondary pull-up after the technical pattern repair. At present, this trend must pay more attention to the adjustment of the small-level cycle trend, and the technical pattern signal is still relatively obvious. Therefore, the current trend can no longer be viewed with conventional thinking, and the high point cannot be judged. It is completely driven by emotions. In the short term, do a good job of risk control to follow the operation.Remember: the current market rise is entirely due to tariffs, and the technical aspect is not of much reference significance. If the tariffs are not eased, gold will be difficult to pull back. Don't guess the high point driven by emotions. Even if the approximate position is given, it is only a reference. No one can tell the real high point. You can only follow the market trend to flexibly adjust the strategy. In the short term, it has risen three times during the day, so you can't chase more. You need to wait for a good retracement later. The hourly line can pay attention to MA10 and MA20 support to go more. Too much rise is not a reason for falling. You just need to pay more attention to risks as you go up. There is no problem with short-term long. The next big target is the 3500 mark. On the whole, today's short-term operation of gold recommends that the callback is mainly long, and the rebound is supplemented by short. The short-term focus on the upper side is 3430-3435 resistance, and the short-term focus on the lower side is 3357-3370 support. Friends must keep up with the rhythm.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.