OzgurT7

@t_OzgurT7

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

The latest data strengthens our analysis. It is good if the process has been processed after positive data and the targets are won. 1st Age Point: Daily closing above 113,496. 2nd Age Point: Daily closing over 117,463. For those who do not want to take risks, it is suitable for daily closing purchase position above 117,463. Good goals can come after the points of earnings. First of all, we must win the top. Then between 130-135 band! It is not an investment advice, but an analysis interpretation. We always have a share of error.

The return I expected yesterday is currently realizing. We are in the stressful area and 107,528 Six -day closing can lead to deep correction, but my expectation is liquid hunt! Then the first target with rapid recovery closing over 113.485, the second target over 117.440 band closing. The risk is always a close friend of this market. For this reason, if you are looking for mini risks, the closing over 117.440 is suitable. If you want to take risks, closing over 133.485. This is not an investment advice, but an analysis.

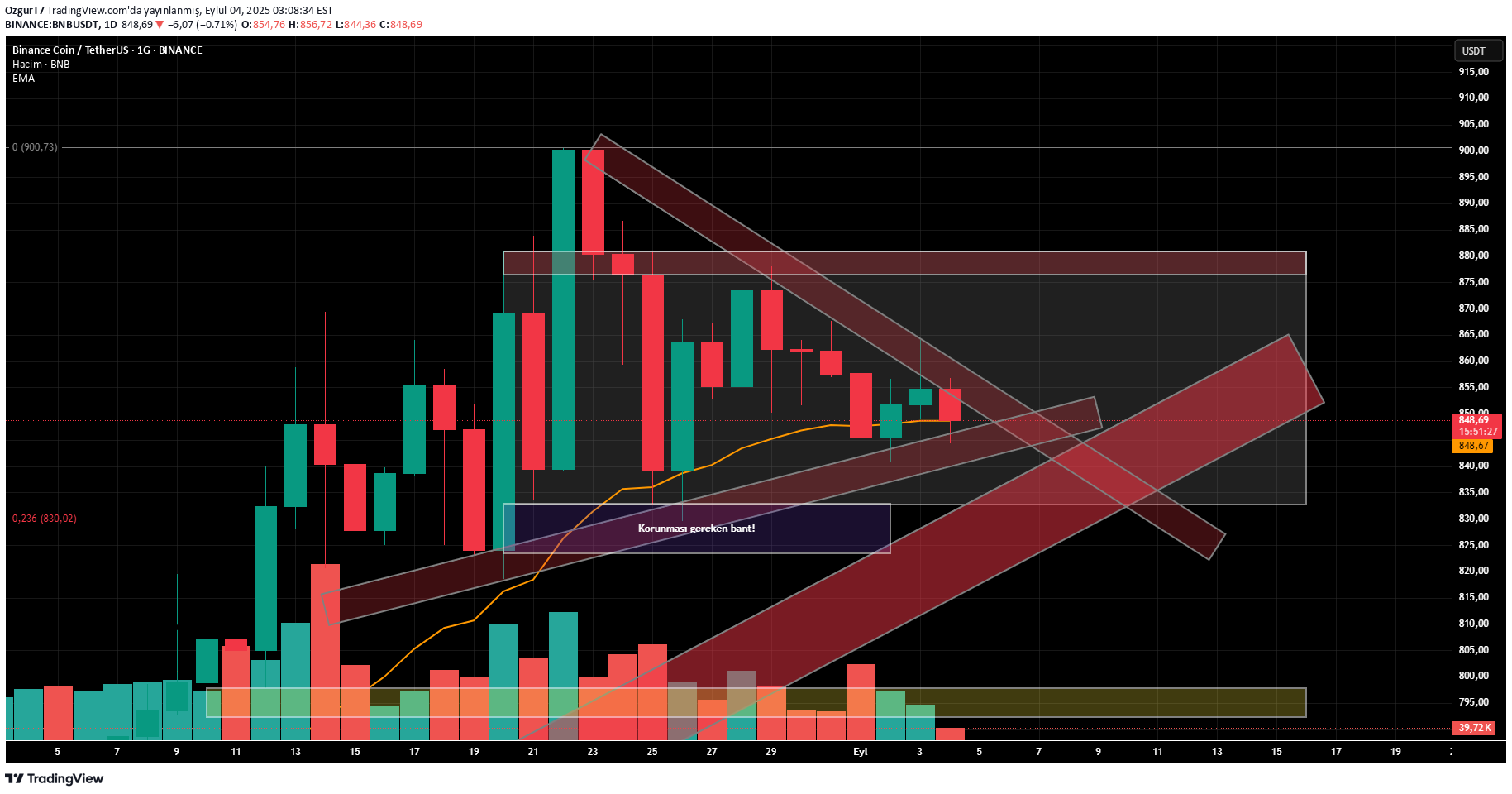

BNB is trying to protect the bottom figure 846.71 in daily timing. In the negative weather conditions of the market, the leveling of the level under the level may lead to a serious correction path. Especially 847 clarifies the under -price closing situation. This will be the opportunity to collect serious liquid for the market Maker. The next resistance level is 797.80 zone. The real name of this market is risk! Closing over 880.86 and then the same figure can be opened with re-test. Reminder is not an investment advice, but an analysis interpretation!

The closure of the decline trend over the 108.254 level is also seen as the fracture of the downward breaking of the trend line seems to have raised the possibility of deep correction, but this is not an end. Because it may be early for the entrance position. The closing above 112.603 -113.483 levels may be a fake rise. Because it requires fuel especially for the upward movement of the price, and in this case the liquide region gains an important place. 106.675 - 107.504 Band range Intensive liquide region. It contains an average of 822.38 million dollars in liquid. This reinforces the likelihood of the price to be brought to those regions by the market Maker.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.