Opulent_FX

@t_Opulent_FX

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

Opulent_FX

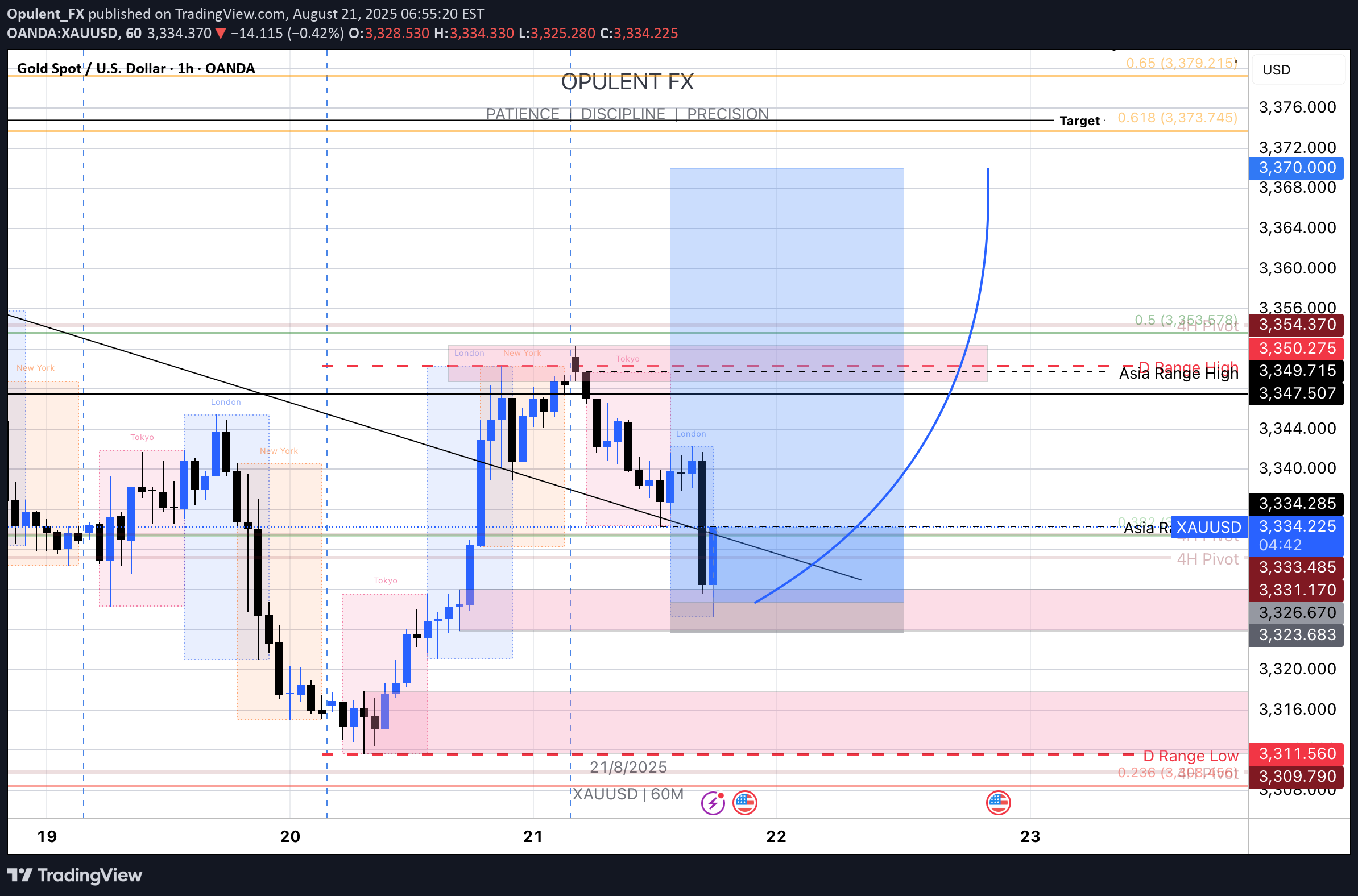

It has been an interesting few days on XUAUSD, with many traders being confused on the direction it intends to go. After yesterdays bullish momentum it is quite clear that the Bulls are not done yet, and given the fact that quite a large gap has now been filled on the daily chart, the possibility of Gold making a move to the upside seems to be the more probable move. Targets are 3350 & 3370 for conservative exits.

Opulent_FX

With the Bullish momentum ramping up on ICP , my next target will be 6.300 for partials. I will leave a runner for as long as possible. Let me know below what your thoughts are.

Opulent_FX

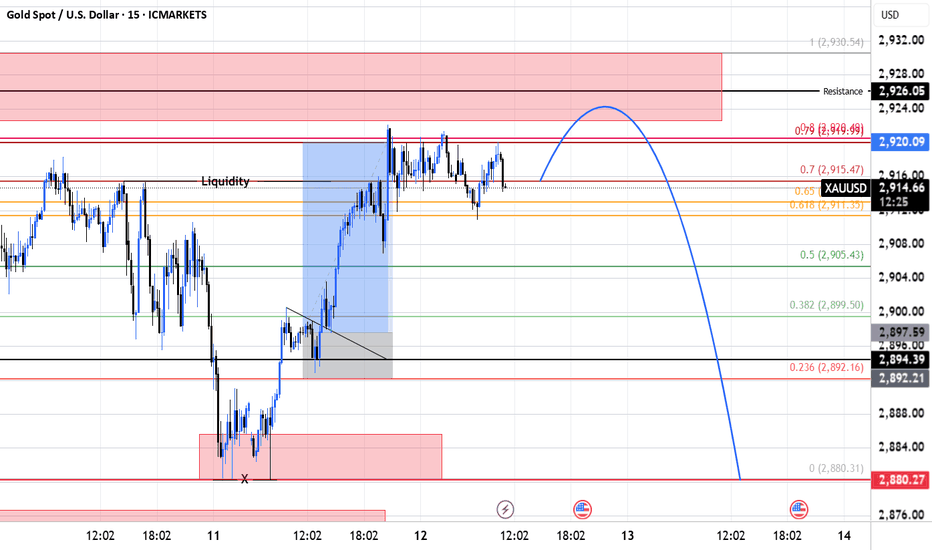

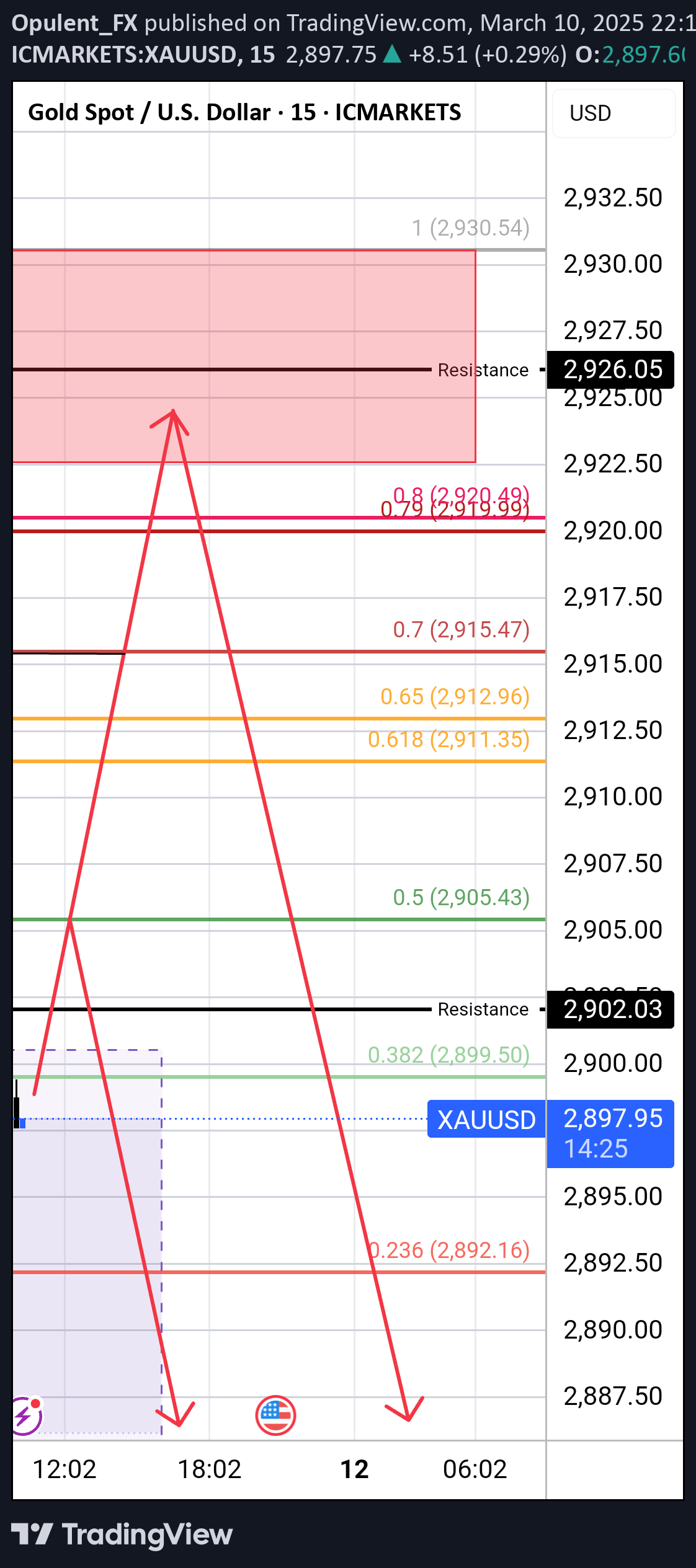

An update from my last idea. We have in fact seen the week start with some bullish momentum, however I think that will end during the course of today and tomorrow as Gold price is approaching the area I will look to short from 2925-2926 area. Once price enters that area I will then await clear sell confirmations in the form of high volume breaks of structure to the downside. Follow for more updates....

Opulent_FX

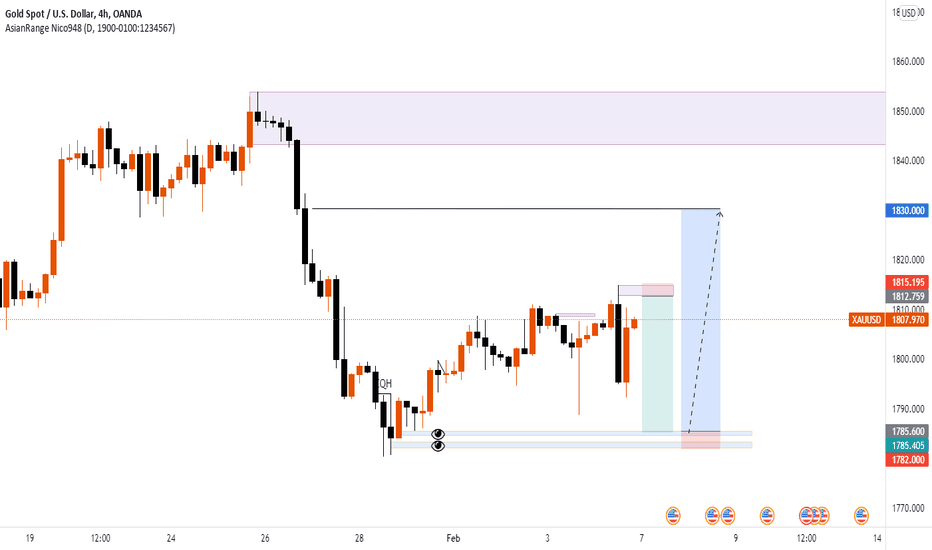

Depending on the moves we see during London session, there is a possibility we could see bullish momentum for the day, and a sweep of various levels of liquidity (equal highs as marked, as well as the previous Asia Range High) and market could potentially only sell off again from higher FIB Levels, being .79 - .80 area. This would also close a previous inbalance left on the 15m timeframe. Let me know your thoughts...

Opulent_FX

I am expecting a sweep of Asia Range High liquidity, followed by a quick fall to the 1820 price area. This will serve as a correction/retracement for further bullish momentum. A potential market reversal can only be expected on Friday during NFP. This is counter trend so use correct Risk Management. It is a 1:9 Risk/Reward Ratio trade.

Opulent_FX

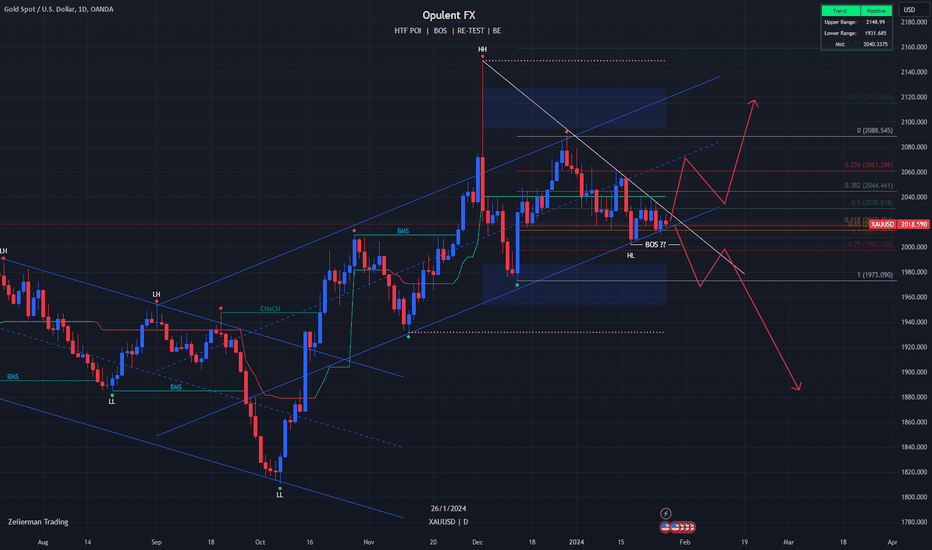

XAUUSD has been trading in an ascending channel as of Friday 13 October 2023 as displayed on my chart. Currently we are trading against the lower trendline, so there is potential for either a break-out from this level OR we can potentially expect a bounce and some bullish momentum to re-test the 2080 level. Another possibility is a fake-out and a bounce from the 2000 Level as this would be a 0.79 Fib Level retracement and would sweep liquidity at the 2003 Level. At this stage as my title mentions, there is no clear direction or any trade opportunities at this stage. So be cautious, be patient, and wait for that A+ Setup.

Opulent_FX

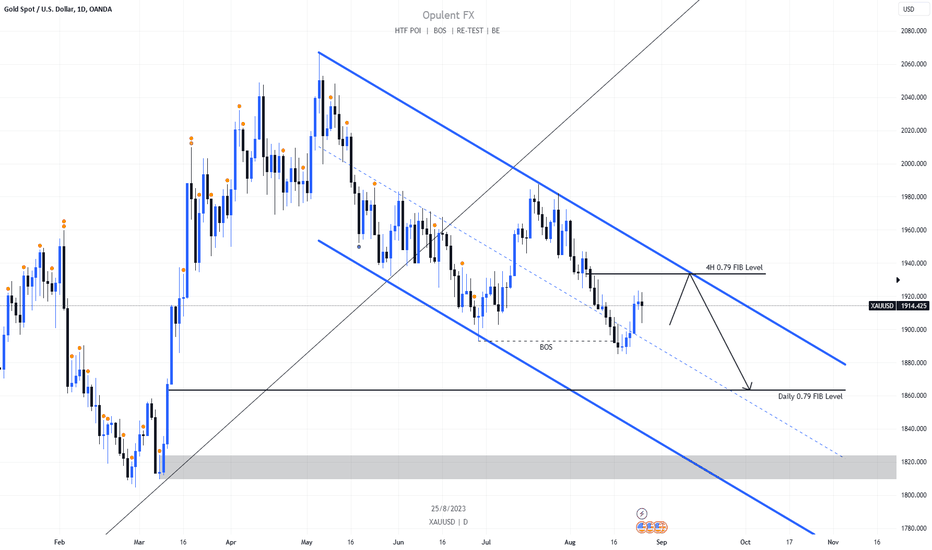

We created a new low last week, so XAUUSD has shown no clear sign of buyer strength. Short-term long positions to the 1930-1932 area are on the cards, then we shorting to 1864 for a conservative exit.

Opulent_FX

Given the bearish engulfing displayed on Friday NFP I will be setting my SELL LIMITS at the top of the Fair Value Gap/Imbalance, and SL just above the swing high. BUY LIMITS are set at the 4H Order Block that has yet to be mitigated. Both are decent RR trades. Please note that this is not financial advise, and is just merely the setups I am looking at taking in the week ahead on XAUUSD.

Opulent_FX

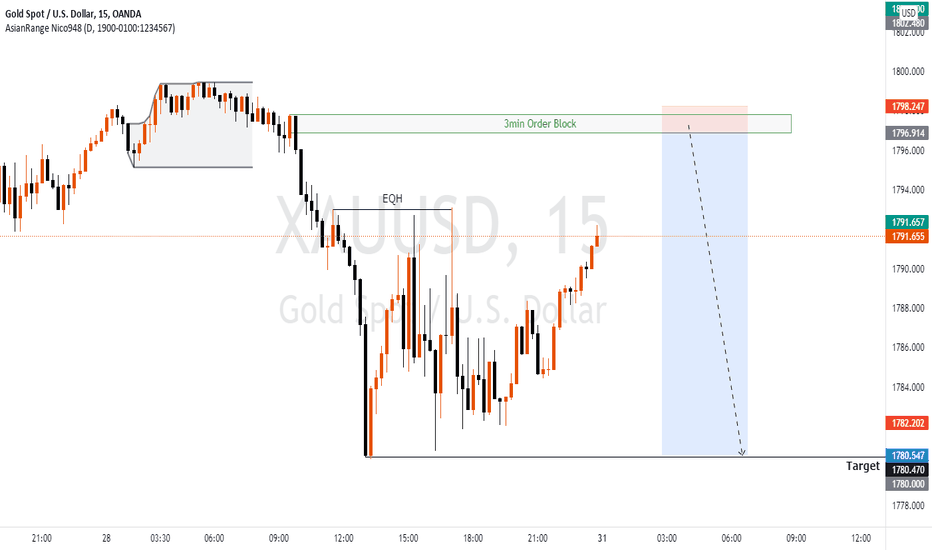

XAUUSD Break of Structure to the downside. Clear 3min Order Block left behind above Equal Highs.

Opulent_FX

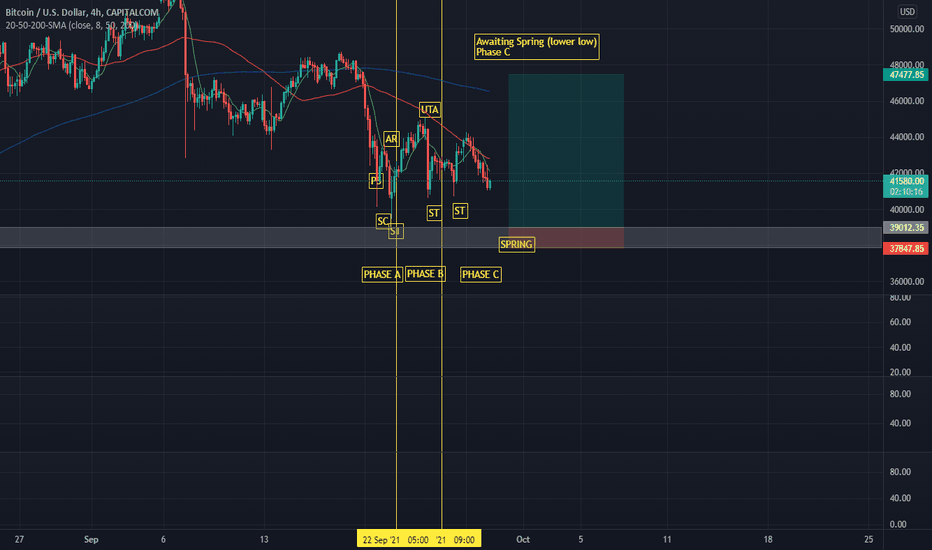

Please note that this is not financial advice, but is merely my analysis of what can potentially be expected. According to my analysis, I am expecting a drop down to the 39012.35 region. Using the Wyckoff Method, combined with my knowledge of institutional order blocks, there is a clear order block in my greyed out area (POI). High Liquidity zone around the 40000 area.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.