OpiVN

@t_OpiVN

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

OpiVN

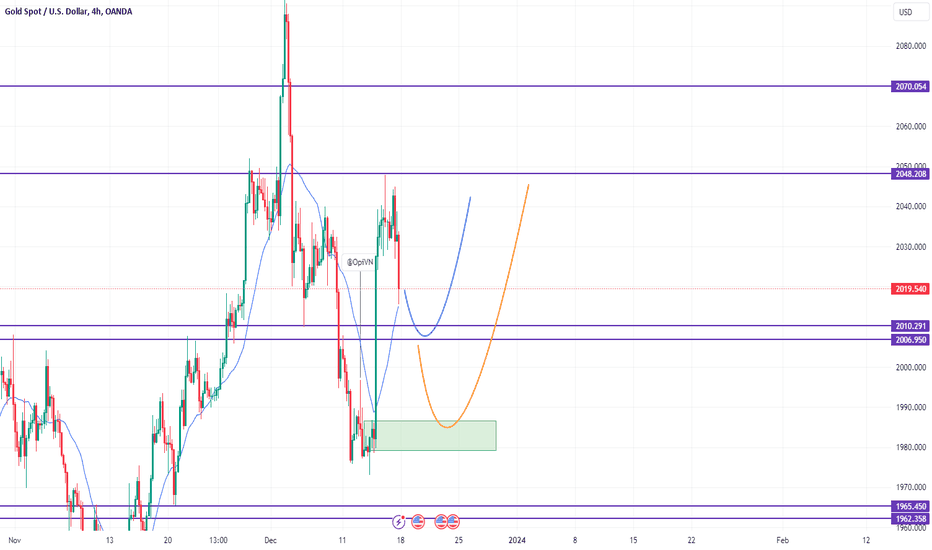

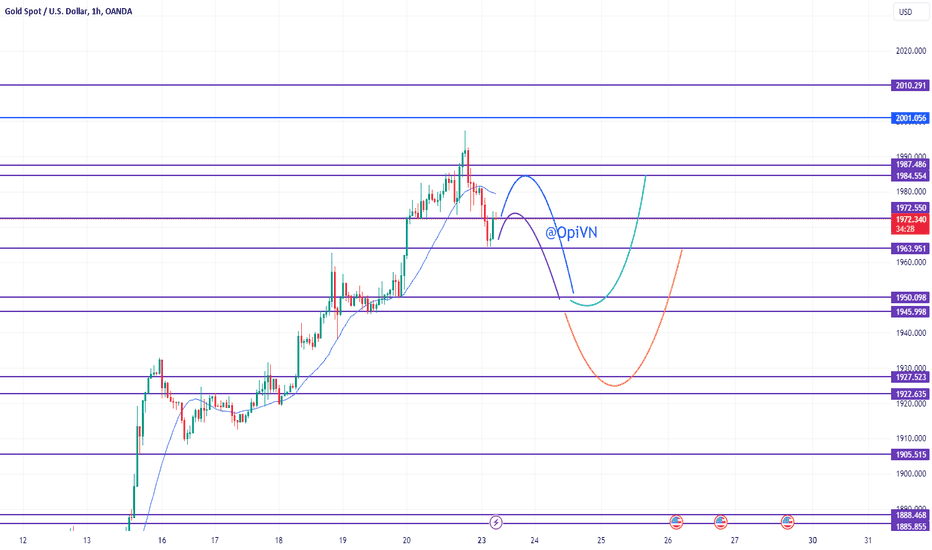

Week 51 is the last trading week before the market closes for the Christmas and New Year holidays. In terms of macroeconomic news, there is only the GDP data for the fourth quarter of the US. It is likely that gold will sideway before the holidays. The plan for next week is to watch for a sideway range between 197x and 204x. Main trend: Uptrend, but is currently reacting strongly at the resistance, so it is easy to get sideway. Trading plan: Plan Buy: + Buy 1980-1982, SL 1977 + Buy 2006-2009, SL 2003 TP 100-150-200 pips for each plan Plan Sell: Sell early in the week when the price tests again around 2023, SL 2029 Sell 2043-2045, SL 2049 TP 100-150-200 pips for each plan Good luck and success to everyone!See more at: Tiktok: @opigoldtrading Twitter(X): OpiTrading_Gold Telegram: OpiVN t.me/OpisupportSell 2043-2045 take profit 100-150pip. Congratz guys! Merry Christmas and Happy New Year!

OpiVN

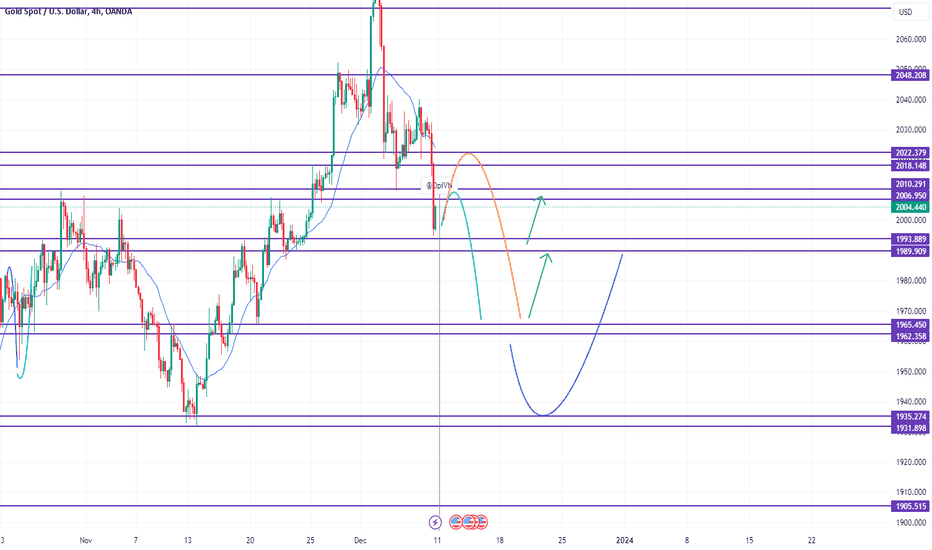

Plan gold week 50 (December 11-15, 2023) The NFP report published on December 8, 2023 shows that all 3 US economic data are good, showing that the US economy continues to recover and grow well, increasing the strength of the USD (DXY) and putting downward pressure on prices of GOLD. With this downward momentum, gold can easily find its way to the 1965 area and 1935 zones. Week 50 is expected to be a highly volatile week with a lot of important economic and financial news such as CPI, PPI and especially the FED's interest rate announcement at the FOMC meeting. Main trend: down, mainly focus on finding entry to sell Plan: 1. Plan sell + Sell 2009-2013 SL 1015 + Sell 2019-2021 SL 2024 TP 1995 1990 1965 1935 2. Plan buy + Buy 1990-1993 SL 1988 TP 2004 2009 2014 + Buy 1965-1968 SL 1962 TP 1977 1990 + Buy 1933-1935 SL 1930 TP 1955 1960 1965 1990 Good luck!See more at: Tiktok: @opigoldtrading Twitter(X): OpiTrading_Gold Telegram: OpiVN t.me/Opisupport

OpiVN

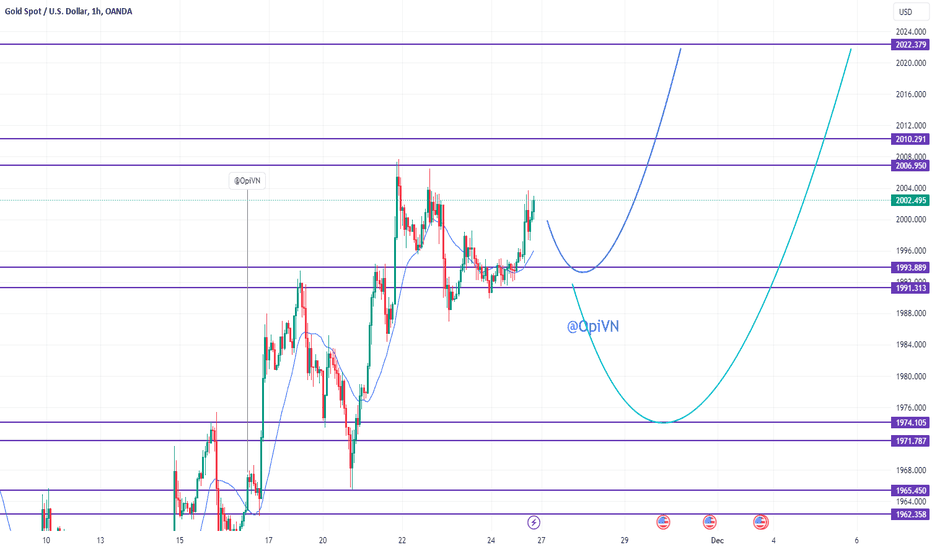

Gold week 48 (November 27 - December 1, 2023) Week 47, as expected, because there was no remarkable news, gold continued to gradually increase thanks to the weakening of the USD with the expectation that the FED is about to end the series of interest rate hikes and may start the beginning of the interest rate cut in 2024 as the FOMC meeting minutes announced last week. In addition, although the war between Israel and Hamas temporarily ceased fire, there is still concern that the war may continue to escalate, which will be a driving force for gold prices going up. Week 48 will not have much remarkable news, so it is likely that gold will continue to increase gradually, the destination may be the 2020 area and beyond that is the 2050 area. Main trend: increase, prioritize buying 1. Plan buy: +plan 1: Buy 1991-1993 SL 1987 +plan 2: Buy 1971-1974 SL 1969 TP 100-150-200-250 pip 2. Plan sell: +plan1: Sell 2048-2050 SL 2053 +plan2: Sell 2020-2022 SL 2025 TP 100-150-200 pip Good luck!See more at: Tiktok: @opitradinggold Twitter(X): OpiTrading_Gold Telegram: OpiVN

OpiVN

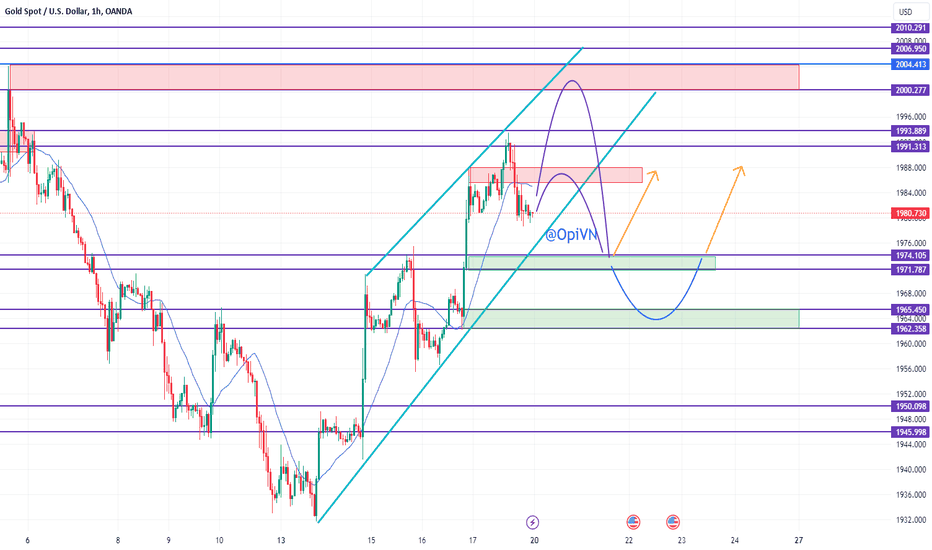

Week 47 with uptrend but there was a good reaction when good reach the Resistance zone around 199x. This week do not have much news on US economic so i suppose gold price will get sideway. But we need to keep an eye on any news on war recently. Plan buy: 1. Buy 1972-1974 SL 1970 TP 1980 1985 1988 199x 2. Buy 1962-1964 SL 1960 TP 1971 1980 1985 Plan sell: 1. Sell 1986-1988 SL 1991 TP 1980 1974 1965 2. Sell 2000-2002 SL 2005 TP 1980 1975 1965

OpiVN

Gold week 43 (October 23-27, 2023) The complicated situation of the war between Israel and Hamas caused gold price to increase sharply, however, if the conflict cools down, gold will be at risk of selling off. Week 43 has news about the US's GDP in the third quarter of 2023 with a forecast of a sharp increase from 2.3% to 4.3%, the predicted news is beneficial for the USD power and will put downward pressure on gold prices if the published data is better in compare with the previous period. Regarding technical analysis, gold reached the strong resistance zone of 199x-2000 and had a correction back to 196x, showing that the selling force in this zone is still strong. If gold cannot break this zone, it will likely decrease to the 195x zone and further to 192x. Main trend: up Price reach strong resistance, it is expected that there will be a correction > sideway gradually decreases Main plan of the week: 1. Plan buy: + Buy 1949-1951 SL 1945 + Buy 1925-1927 SL 1922 TP 80-100-150 pip per plan 2. Plan sell: + Sell 1983-1985 SL 1988 + If it is confirmed today that the price does not break the 1972-1974 range, then sell 1972-1974 SL 1977 TP 80-100-150 pip per plan. During this period, the price range of gold is quite wide, so you should pay attention to tight capital management and do not forget to setup Stoploss. Wishing everyone smooth and successful trading!

OpiVN

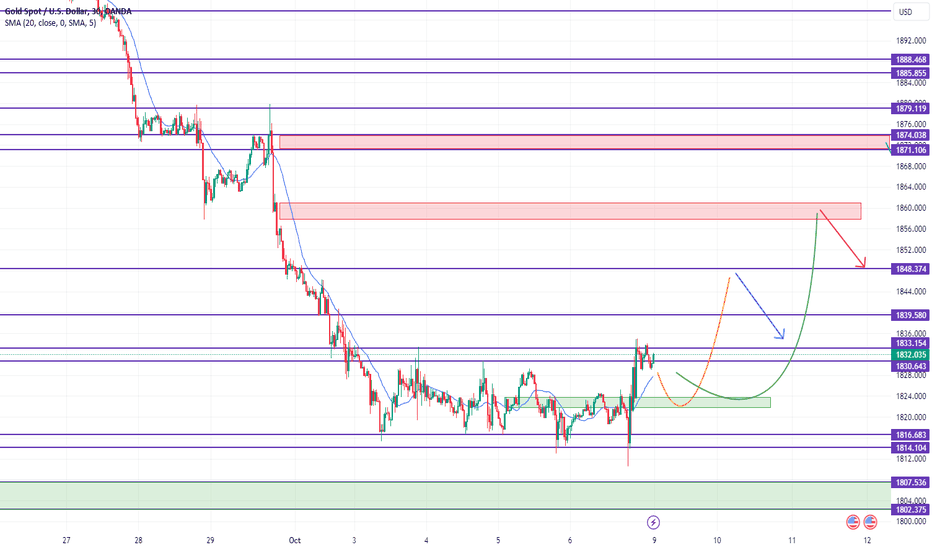

- Gold price in week 40 moved sideways around 1813 to 1833 and repeatedly rejected the181x area. According to NF News last Friday, gold price got a fake decline to 1811 and rebounded upwards, indicating a short-term uptrend. - In addition, combined with some news related to the war at last weekend, may have A GAP on next Monday morning, so you guys beware of setup a sell order and wait to buy gold instead, which is much safer. Plan buy: buy 1823-1825 SL 1821 TP 1840 1845 Plan sell: Sell 1845-1847 SL 1850 TP 1836 Sell 1858-1860 SL 1863 TP 1850 1845See more at: 1. Tiktok: @OpiTradingGold 2. Telegram: @Opisupport 3. Twitter: @OpiTrading_Gold

OpiVN

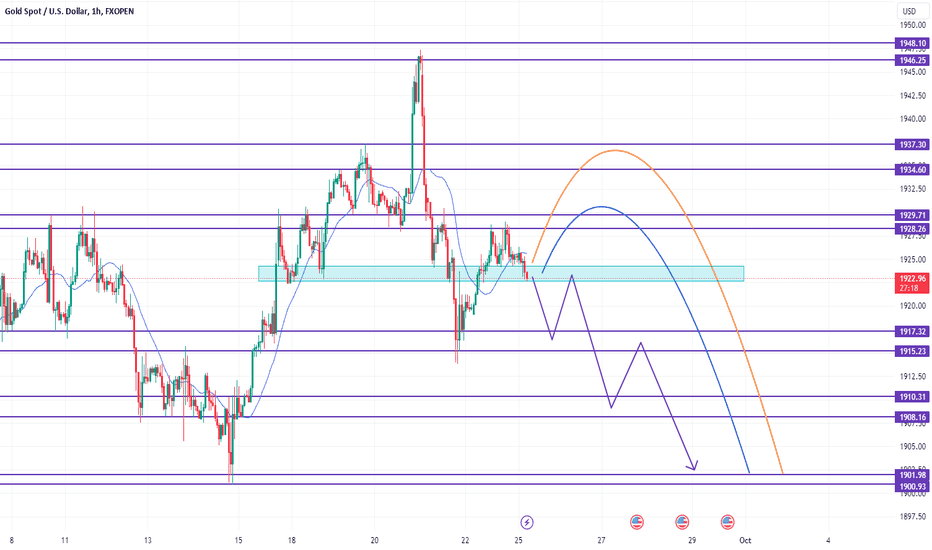

Hawkish FED holds rates steady. This will cause USD power (DXY) goes up and keep pressing gold price goes down. So this week we find entry to sell. Major Plan: Plan 1: If gold price break through 1923-1924, wait retest and sell 1925-1926 SL 1928 Plan 2: Gold sideway 1923-1929 then fake to 1931, wait it cool down and decrease under 1930 > sell 1929-1931 SL 1933 Plan 3: Sell limit 1934-1937 SL 1939 Target for plan sell are 1915 1904 and 188x Plan buy: Plan 1: buy scalping 1914-1916 SL 1912 TP 1920 1924 Plan 2: buy 1903-1905 SL 1901 TP 1910 1915 Plan 3: buy 1885-1888 SL 1883 TP 1895 1900Update plan: Gold broke through 1923-1924 this morning at Tokyo Session, so we action as plan 1: sell 1925-1926 SL 1928 (active) Price now: 1922.x (+30pip average), use BE and hold to TP 1917/1915Update: price now 1922 Order sell 1925 take profit (TP) +30pip Order sell 1926 use BE hold to 1917/1915Sorry guys, i was too busy for update. Order sell 1926 got BE at London session and we setup a new order again at New York session: Sell 1926 SL 1928 and got TP at 1917 (+90pip) See more at: 1. Tiktok: @OpiTradingGold 2. Telegram: @Opisupport 3. Twitter: @OpiTrading_Gold Today (26 Sep 2023) we will setup order sell 1919-1921 SL 1923 TP 1910 and 1904

OpiVN

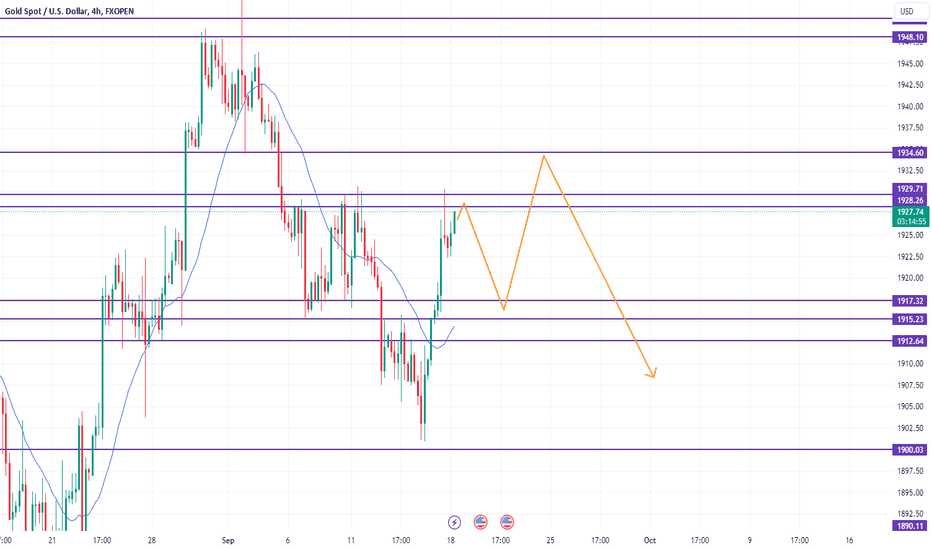

Week 38 (18 Sep - 22 Sep 2023) Gold Price break out 1915 then surge to 1930, but it is only take the uptrend back when it break out the supple zone in 1935. With the expectation of the Federal Fund Rate will stay remain 5.50% and all of good news for US economic recently, gold will have great pressure from the raise of USD power and it will fall again after test the supply zone 1930-1935.SELL LIMIT 1929-1930 SL 1933 ACTIVE Price now: 1925.5 TP order Sell 1929 +45pip Order 1930 use BE and hold TP 1923 or 1918 Set another Order: BUY LIMIT 1915-1917 SL 1913Setup one more Order: SELL LIMIT 1934-1936 SL 1939Order sell 1930 hit TP1 at 1923, Closed 1/2 Order. The rest got BE. SELL LIMIT 1934-1936 SL 1939 ACTIVEPrice now: 1930 Order sell 1934 take TP at 1930 Order sell 1936 use BE hold TP 1924 and 1919Update: Price now: 1928 Sell 1936 running + 80pip. We can close 1/2 order to take profit here or keep holding to TP 1924 and 1919Update: End of week 38 Sell 1936 got BE We will have a new plan next week! Follow us on Telegram "Channel Opi support GOLD" or PM me: OpiVN

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.