NaughtyPines

@t_NaughtyPines

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

NaughtyPines

... for a 6.85 credit. Comments: Selling the 25 delta strike here on weakness. Metrics: Buying Power Effect: 531.15 Max Profit: 6.85 ($685) ROC at Max: 1.29% 50% Max: 3.43 ($343) ROC at 50% Max: .65%At >50% max ten days in ... . Money, take, run. Closing here for a 2.13 debit. 4.72 ($472) profit.

NaughtyPines

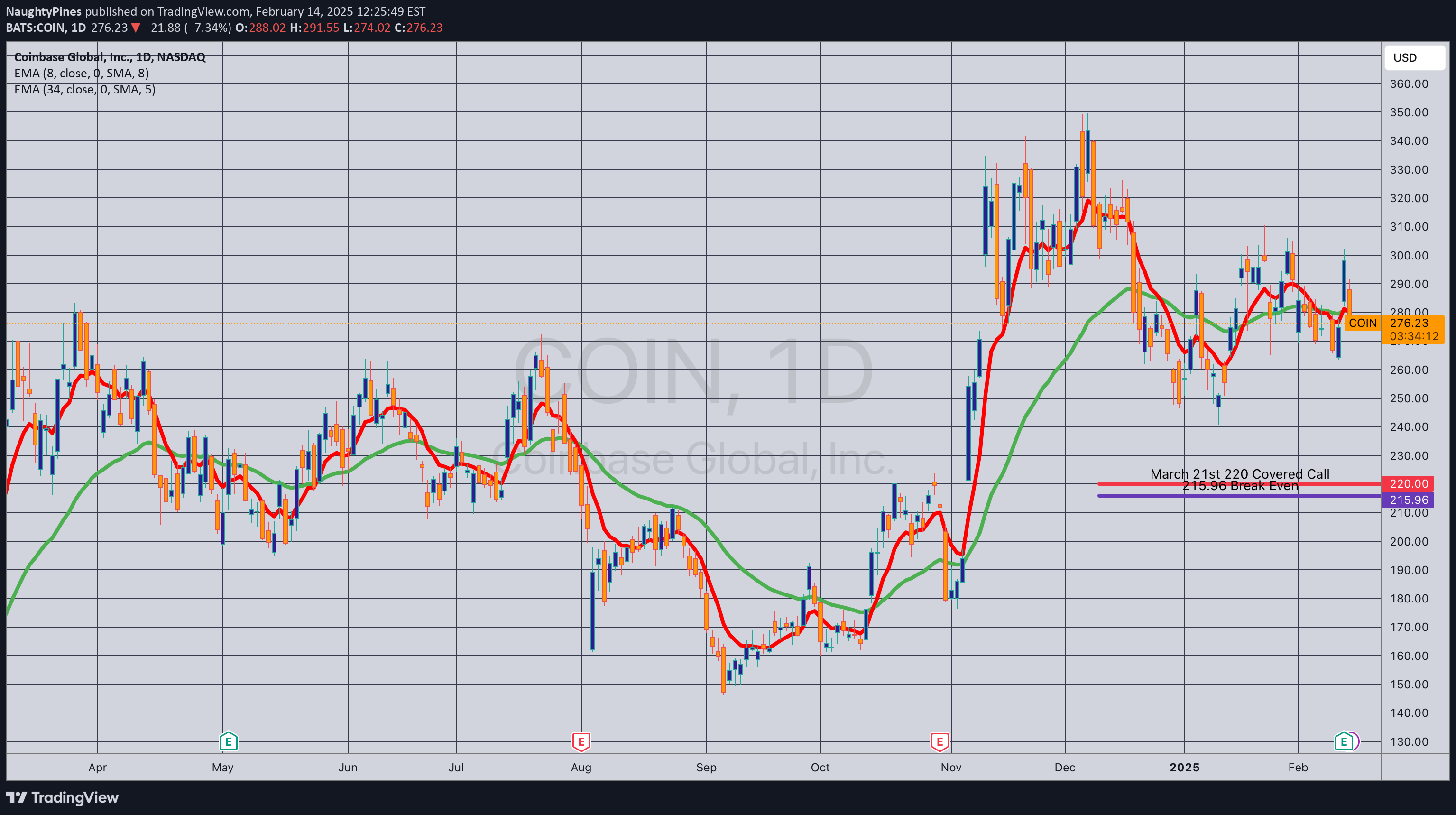

... for a 215.96 debit. Comments: High IV + weakness. Selling the -85 delta call against shares to emulate the delta metrics of a 16 delta short put, but with the built-in defense of the short call. Going lower net delta due to the shorter duration (35 DTE). Metrics: Buying Power Effect/Break Even: 215.96/share Max Profit: 4.04 ROC at Max: 1.87% 50% Max: 2.02 ROC at 50% Max: .94 Will generally look to take profit at 50% max, roll out short call if my take profit is not hit.Rolling the in-profit 220 short call out to the April 17th 210 in this vol expansion for a 12.25 credit (i.e., a credit that exceeds the amount of strike destruction). 203.71 break even with a 6.29 max.Rolling the in-profit 210 short call down and out to the May 16th 200 for a 12.05 credit. 191.66 break even.It's a roll down and out market ... . Rolling the May 16th 200 down to the June 20th 195 for a 7.04 credit. 184.62 break even.Down and out at near 50% max ... . To the August 15th 185 for an 11.35 credit. 173.27 break even.Reducing long delta in advance of "Liberation Day." Rolled the August 15th 185 down to the 175 for a 4.00 credit; 169.27 break even.Throwing in the towel ... . Closed for 133.38. 35.89 loss.

NaughtyPines

... for a 7.00 credit. Comments: IV remains high here at 112.4%. Going "double double" (put spread half the width of the call spread, but 2 x the number of contracts) to accommodate skew. Earnings are on 2/4, so will probably want to get out before then. Metrics: Max Profit: 7.00 Buying Power Effect: 23.00 ROC at Max: 30.43% 50% Max: 3.50 ROC at 50% Max: 15.22% Will generally look to take profit at 50% max, roll in untested side on side test to about half the delta of the tested side. Given earnings on the horizon, will naturally just money/take/run for less if presented with the opportunity.Money, take, runnnnnnn. Closing here for a 6.50 debit; .50 ($50) profit.

NaughtyPines

... for a 2.67 credit. Comments: High IVR/IV at 74.1/91.5. Going low delta with the short option legs and narrower than usual with the wings. Metrics: Max Profit: 2.67 Buying Power Effect: 7.33 ROC at Max: 36.4% 50% Max: 1.34 ROC at 50% Max: 18.2% Will generally look to take profit at 50% max; roll in untested side on side test.Closed for a 1.68 debit; .99 ($99) profit.

NaughtyPines

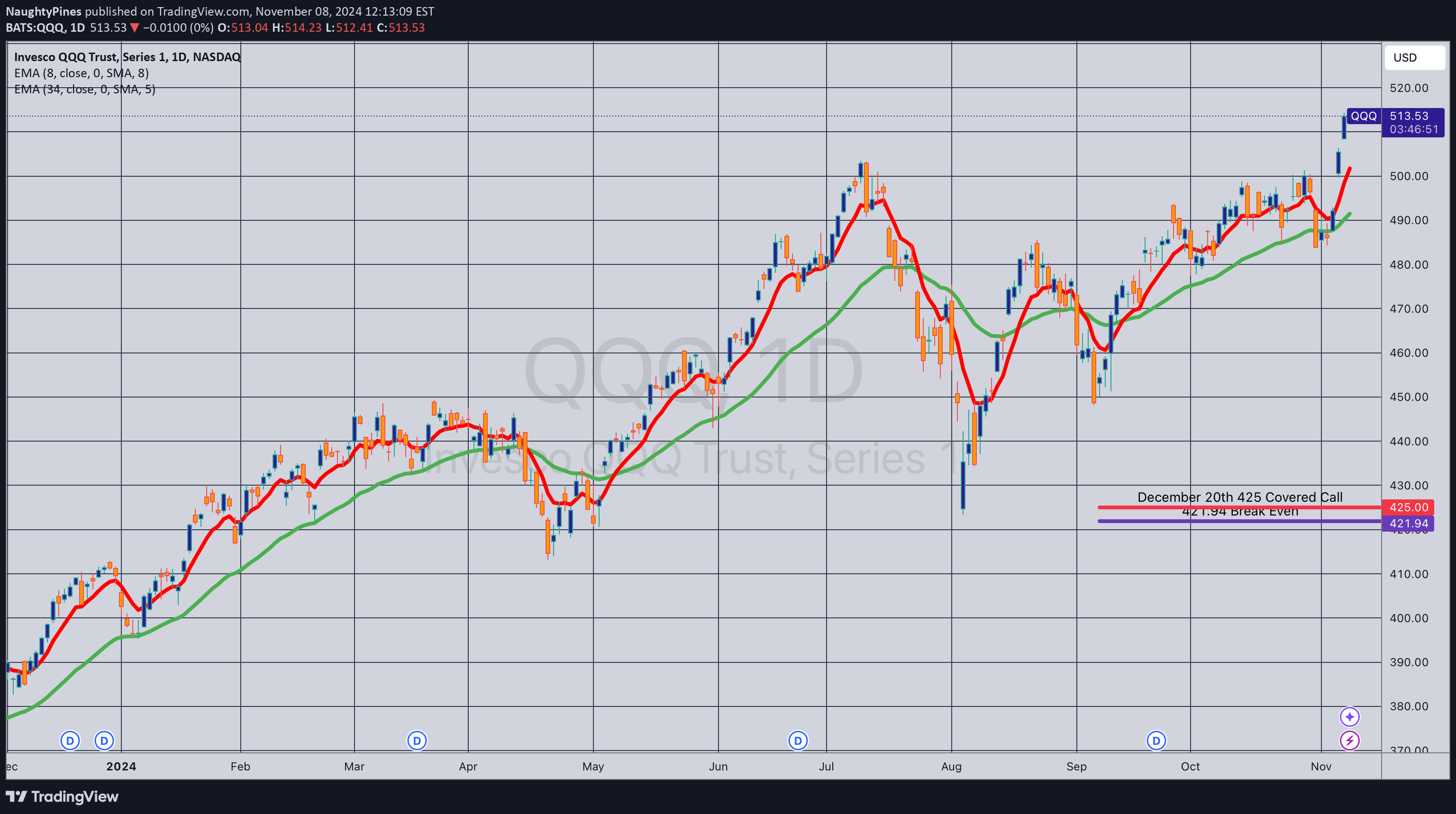

... for a 421.94 debit. Comments: As with my IWM covered call, re-upping in QQQ at a strike higher than the one I just took off in an attempt to capture the next increment of the up move that I missed out on. I'm not expecting a ton out of this (the max is 3.06), but that's okay, since I'm not yet ready to go all the way out to January yet anyhow.Hit 50% max today, closing for a 423.48 credit. 1.54 ($154) profit.

NaughtyPines

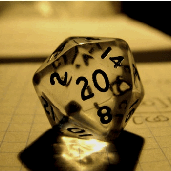

... for a 6.03 credit. Comments: High IV at 95.8%. Here, going delta neutral, 1/10th the price of the underlying for my wing width, and setting up my short option strikes at the 16 delta on both sides. Metrics: Max Profit: 6.03 Buying Power Effect: 23.97 ROC at Max: 25.16% 50% Max: 3.02 ROC at 50% Max: 12.58% Will generally look to take profit at 50% max; roll in untested side on side test.Rolled the in profit -210P/440C to the -220P/450C for a 2.48 credit on BPE of 7.52, resulting in a 180/220/410/450 iron condor on which 8.51 total credits have been collected. I was originally looking to make 3.02 on the trade, so am revising my GTC order to take profit at 8.51 - 3.02 or 5.49.Rolled the 180/220 up to the 300/340 for a 12.25 credit; 20.76 total credits collected.Ay caramba. We've got ourselves a mover. Rolled the -340P/450C to the -420P/530C for a 61.18 credit (yes, you read that right). 81.94 credits collected on a ten-wide inversion, with the resulting setup being the 300/410C/420P/530C.Rolled the 300/420 short put vertical to the 370/490 short put vertical for a 14.33 credit. Total credits collected of 96.27. Will look to un-invert the short strangle aspect of the setup (-410C/-490P) on Friday.Uninverting the -410C/-490P to the -410P/-490C for an 80.28 debit. 15.99 net credits collected.With 24 DTE, closing the -490C/530C for a 6.97, rolling the 370P/-410P to the January 17th 330/380 for 4.75 credit; and sold an oppositional side against at the -870C/920C for a 1.70 credit. 15.47 net credits collected. The resulting setup: Jan 17th 330/380/870/920 iron condor.Rolled the 870/920 short call vertical down to the 660/710 short call vertical for a 1.62 credit. 17.09 net credits collected, resulting in a 330/380/660/710 iron condor.Delta adjustment: With the short put at the 48 delta, rolling the 660/710 short call vertical aspect down such that the 660 is at the -24 delta strike. 2.09 credit; net credits received: 19.18.Delta adjustment: Rolling the 550/610 down to the 500/460 for a 1.43 credit. 20.61 net credits collected. If the short put aspect is ITM at 21 DTE, will look to roll to ATM, sell oppositional call side against.Thursday: Delta adjustment -- rolled the 500/560 short call vertical down to the 420/470 for a 2.69 credit, 23.30 net credits collected. Friday: Rolled the -420C/330P down to the ATM -320C/230P for a 60.75 credit, resulting in a 60-wide inversion. 84.05 net credits collected. The resulting setup is a 230P/-320C/-380P/470C. Will look to uninvert on Monday.Going ahead and uninverting the -320C/-380P here to the -325P/-380C for a 60.05 debit. Net credits collected of 24.00 even. Delta/theta now 3.03/42.99.Rolling and recentering at 21 DTE to the February 21st 200/290/460/450 for a 2.11 credit; 26.11 net credits collected. (In practice, you can't roll out a four-legged setup in one piece. You have to either (a) close the whole thing, then re-establish in the new expiry; or (b) close out one side, roll the other, then open a new oppositional side). Earnings are on 2/4, so I'll probably want to be out of the trade by then.Delta adjustment: rolling the 460/550 down to the 430/520 for a 1.94 credit. 28.05 in credits collected.Closed for a 25.75 debit; 2.30 ($230) profit.

NaughtyPines

... for a 5.43 credit. Comments: High IVR/IV at 61.1/113.9. Doing something a little different here, selling the 10 delta short put and buying a put that cuts BPE in about half over doing a naked. Going low delta because, well, the underlying kind of scares the poo out of me. Metrics: Buying Power Effect: 74.57 Max Profit: 5.43 ROC at Max: 7.28% 50% Max: 2.72 ROC at 50% Max: 3.64 Compare: Dec 20th 155 Short Put (Cash Secured) BPE: 148.30 Max Profit: 6.65 ROC at Max: 4.48% Will generally look to take profit at 50% max.Another quickee dirtee ... . Closed at the open for a 4.43 debit. 1.00 ($100) profit. Waiting would've netted me quite a bit more. It ended the day at bid 2.63/mid 2.98/ask 3.33.

NaughtyPines

... for a 415.50 debit. Comments: After taking off my Nov 415 covered call in profit (See Post Below), re-upping here, but at a slightly higher strike (there are only five-wides available). The 420 is at the -87 delta, so this is less aggressive than I usually do (-75 delta call). However, I've already booked profit in the November cycle, so am fine with getting what is kind of a weak sauce ROC here with plenty of "room to be wrong," particularly with the elections coming up. Metrics: Buying Power Effect/Break Even: 415.50/share Max Profit: 4.50 ($450) ROC at Max: 1.08% 50% Max: 2.25 ($225) ROC at 50% Max: .54% Will generally look to take profit at 50% max, roll out the short call on side test/IV expansion.On a side note, my IWM and SPY positions aren't quite yet profitable to the extent I would like, so just leaving them alone for now ... .With my short call in profit, rolling the Nov 15th 420C out to the Dec 20th 420 for a 3.78 credit. 411.72 break even; 8.28 max; 2.01% ROC at max. As with my IWM position, just looking to milk a little more out of the position running into elections/year end, after which I will probably "resume regularly scheduled programming."Out ... for a 416.97 credit. 5.25 ($525) profit.

NaughtyPines

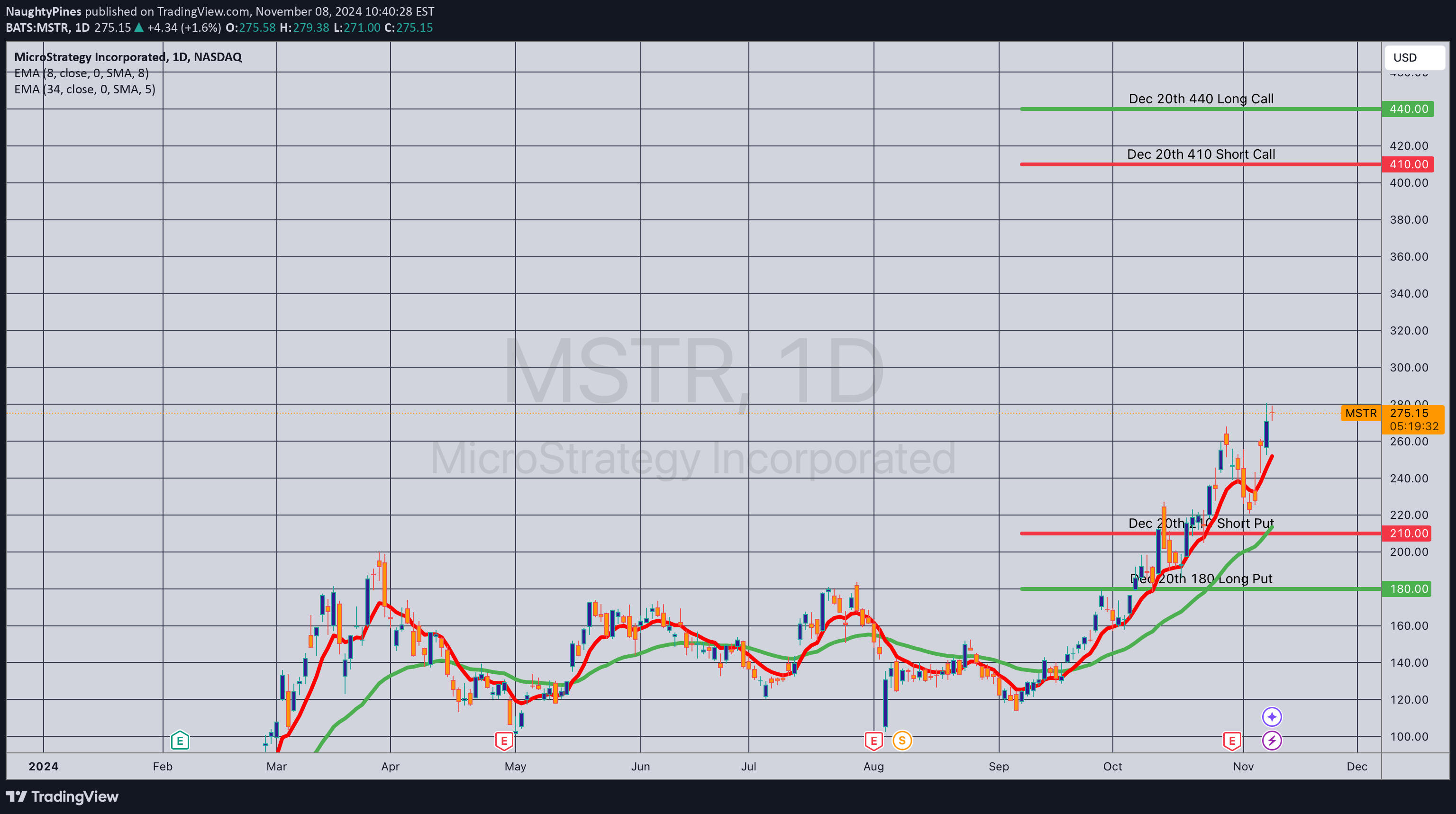

... for a 135.40 debit. Comments: High IV (67.3%). Selling the -75 delta call against long stock to emulate the delta metrics of a 25 delta short put, but with built-in short call defense. Earnings are slated to be announced on 11/7, so will look to be out of the trade by then. Metrics: Buying Power Effect/Break Even: 135.40 Max Profit: 9.60 ($960) ROC at Max: 7.09% 50% Max: 4.80 ROC at 50% Max: 3.55% Will generally look to take profit at 50% max; roll out short call on side test.Closed for a 138.43 credit. 3.03 ($303) profit; 2.24% ROC for 6 days' "work."

NaughtyPines

... for a 111.20 debit. Comments: High IV (88.8%). Selling the -75 delta call against stock to emulate the delta metrics of a 25 delta short put with the built-in defense of the short call. Back into MSTR after taking off my previous November setup in profit. (See Post Below). This has earnings on 11/6, so I'll be looking to take it off before then ... . Metrics: Buying Power Effect/Break Even: 111.20 Max Profit: 9.80 ROC at Max: 8.81% 50% Max: 4.90 ROC at 50% Max: 4.41%Money, take, run ... . Closed here for a 115.20 credit; 4.00 ($400) profit.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.