MYWORLD115

@t_MYWORLD115

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

MYWORLD115

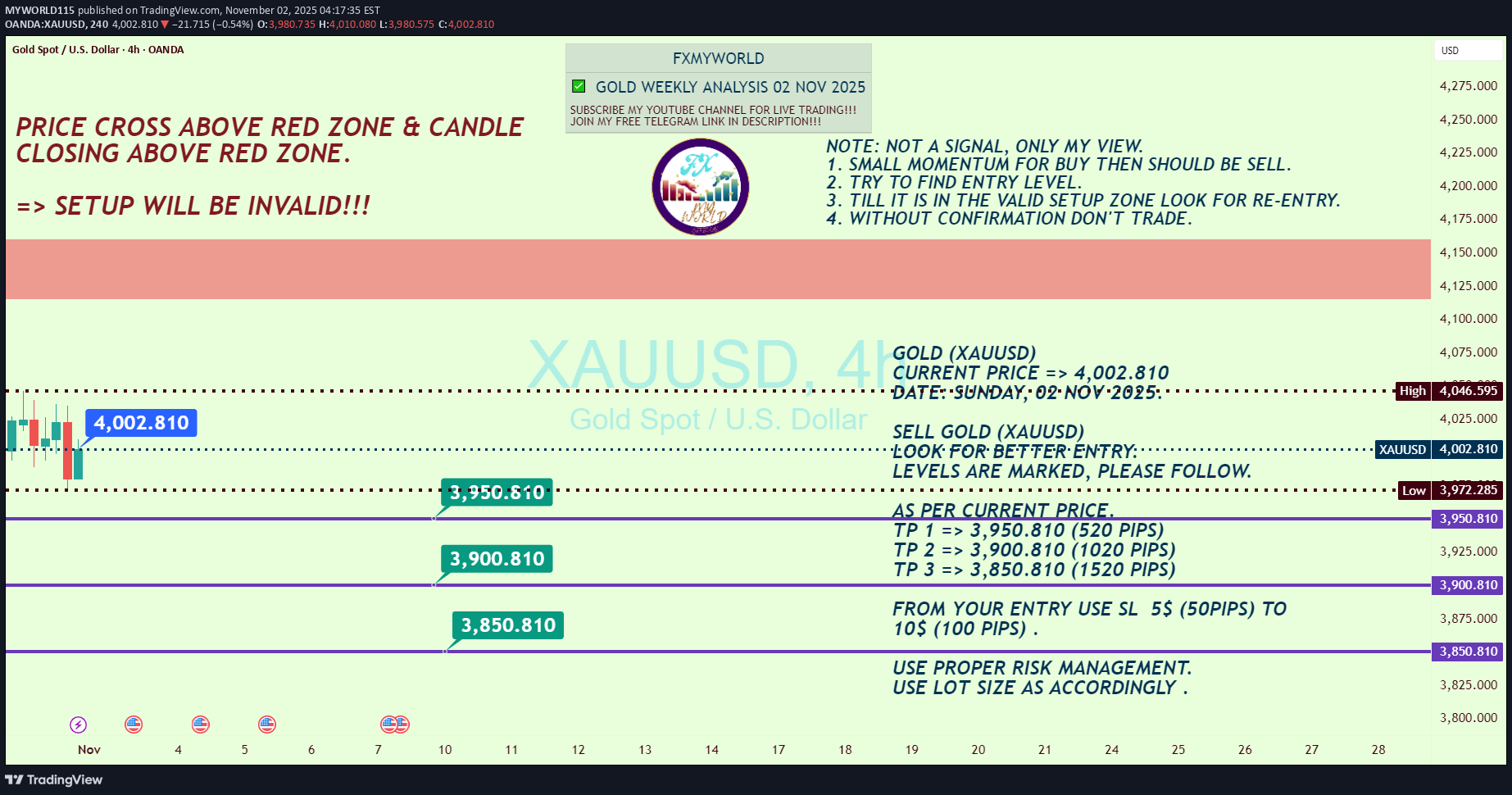

پیشبینی طلای این هفته: منتظر ریزش هستیم!

Hello Everyone, Welcome to FXMYWORLD. Let's see how this pair will perform based on the analysis. I'm waiting for a pullback and then a drop. Based on my analysis and my view, I'm sharing my view. Make sure you do your research, and based on your confluence, please look for the entry. Don't rush your trades without any confirmation. Thanks in advance for checking my trade idea.Update GOLD (XAUUSD) CHART ANALYSIS POSTED ON SUNDAY 02 NOVEMBER 2025. GOLD (XAUUSD) HIT TP 1 => 3950.810 (520 PIPS)

MYWORLD115

XRUSD Price Market Trend Day TF Long Term BUY

XRPUSD is trading at 2.33674, with a strong recommendation to buy for long-term gains. The chart indicates a potential upward trajectory, with price targets set at: TP1: 2.44200 (Near-term resistance) TP2: 3.00500 (Mid-term target) TP3: 3.40000 (Long-term bullish goal) The mention of 3.40000 at the top of the chart suggests this is a psychological resistance level, reinforcing the optimistic outlook if bullish momentum sustains.

MYWORLD115

SOLUSD Trend Analysis DAY TF BUY

The provided chart and analysis outline a bullish outlook for SOL/USD (Solana against the US Dollar) as of May 26, 2025. The current price is noted at **177.71**, with a strong recommendation to look for long/buy entries, particularly on dips. The analysis emphasizes long-term holding for optimal results, with three key profit targets: **TP1: 194.00, TP2: 227.00, and TP3: 252.00**. **Key Observations from the Chart** 1. **Long-Term Bullish Trend**: The analysis highlights that Solana’s long-run trajectory has significant upside potential. The suggested strategy involves accumulating positions gradually, especially during price retracements, to maximize gains over time. 2. **Green Zone as Critical Support**: The chart indicates a "green zone," which acts as a crucial support area. If the price crosses below this zone and closes a candle beneath it, the bullish setup becomes invalid, signaling a potential trend reversal or deeper correction. 3. **Risk Management**: Traders are advised to exercise caution by using smaller quantities on each dip and conducting due diligence before entering trades. This approach minimizes risk while capitalizing on upward momentum.

MYWORLD115

Pi Network Price Prediction DAY Chart BUY Analysis

The Pi Network (PI/USDT) is attracting increased attention from crypto traders and long-term investors alike, with growing speculation about its future price potential. Based on the current technical chart dated May 26, 2025, several critical insights and projections can be drawn for those considering investment in this digital asset. This analysis reflects personal views and does not constitute financial advice. At the time of analysis, PI/USDT is trading at **$0.7812**, with visible consolidation just above the key support zone. The chart displays three major **Take Profit (TP)** targets, reflecting potential bullish momentum in the medium to long term: TP1: $1.0000 TP2: $1.6700 TP3: $3.0000

MYWORLD115

XAUUSD Chart 4H Analysis BUY Gold

XAUUSD Chart 4H Analysis BUY Gold Doesn't Have To Be Hard Profit Surging! The provided XAUUSD (Gold Spot/U.S. Dollar) 4-hour chart outlines a structured technical setup with clearly defined entry points, retracement zone, and multiple take-profit (TP) targets. The current price at the time of analysis is **$3,198.67**, with the potential for a bullish continuation upon confirmation within the valid setup zone. Let’s break this down in detail: **Current Price and Entry Strategy** * **Current Price:** $3,198.67 * **Recommendation:** Look for better entry around or near the green support zone. The setup is bullish-biased, suggesting a buy-on-dip opportunity. * **Support/Invalidation Zone:** If the price **closes below the green zone**, the setup will be **invalidated**. Hence, risk management and confirmation are crucial before taking any position. **Target Levels Identified** Three Take-Profit (TP) levels are established in the chart, each indicating potential upward momentum if the price respects the support and begins to rise again: * **TP1: $3,220.67** ✔️ Gain of **22 USD (220 pips)** from current price ✔️ Represents an initial move post-entry confirmation ✔️ Ideal for short-term scalpers or conservative traders * **TP2: $3,252.67** ✔️ Gain of **54 USD (540 pips)** from current price ✔️ Mid-level target indicating strong bullish continuation ✔️ Can be a good point for partial profit booking * **TP3: $3,284.67** ✔️ Gain of **86 USD (860 pips)** from current price ✔️ Long-term or full swing trade target ✔️ Represents full bullish momentum with higher reward-to-risk ratioUpdate GOLD (XAUUSD) POSTED ON SUNDAY 18 MAY 2025. GOLD (XAUUSD) HIT TP 1 => 3220.67 (220 PIPS)Update GOLD (XAUUSD) HIT TP 2 => 3252.67 (540 PIPS)Update GOLD (XAUUSD) HIT TP 3 => 3284.67 (860 PIPS)

MYWORLD115

ETHUSD Multi Time Frame Trend Analysis, Profit Surging Insights

Daily Chart (1D) Overview The daily chart reflects a powerful bullish breakout, where ETHUSD surged past prior resistance levels, now potentially turning into support. Key observations: Support Zones: The $2,300 to $2,400 zone has emerged as a strong demand area. This zone was previously resistance and has now flipped into support after the breakout. A deeper retracement could potentially revisit the $1,750 to $1,850 demand area, though that would suggest a breakdown of current bullish momentum. Resistance Zones: The price is currently testing minor resistance around $2,600 and $2,650, with historical supply and reaction zones visible from previous consolidation. A broader supply zone exists between $2,800 to $3,400, marked in red, which could be the next major target area if the bulls maintain momentum. Structure: ETH formed a higher low in late April followed by a higher high in early May, confirming a trend reversal from the earlier bearish structure. The clean breakout from consolidation signals a fresh bullish leg, with increasing volume and momentum indicators likely aligning with upward bias. Trend Direction: Bullish on both Daily and 4H ✅ Market Structure: Higher highs and higher lows ✅ Key Short-Term Support: $2,350 to $2,450 ✅ Key Resistance Zones: $2,620 to $2,650 → $2,800 → $3,400 ✅ Upside Targets: 1. Short-Term: $2,650 → $2,800 2. Medium-Term: $3,400 → $4,108 ✅ Potential Retracement Levels: 3. Shallow: $2,420 4. Deeper: $2,200 and $1,850 If the price holds above $2,400, the bullish outlook remains intact, with increasing likelihood of testing higher resistance levels. However, a sustained move below $2,300 could trigger deeper retracements.

MYWORLD115

GOLD (XAUUSD) TRADE SETUP –SUNDAY, APRIL 06, 2025

Hello Everyone, Welcome to FXMYWORLD. Let's see how this pair will perform based on the analysis. I'm waiting for a pull back then drop. Based on my analysis and my view I'm sharing my view. Make sure you do your research and based on your confluence please look for the entry. Don't rush your trades without any confirmation. Thanks in advance for checking my trade idea. LIKE | SAVE | SHARE this analysis if it helps you plan better 📈 => Follow for daily gold & forex insights and others!Update GOLD (XAUUSD) CHART ANALYSIS POSTED ON SUNDAY 06 APRIL 2025. GOLD (XAUUSD) HIT TP 1 => 3010.92 (250 PIPS) GOLD (XAUUSD) HIT TP 2 => 2990.92 (450 PIPS)GOLD (XAUUSD) HIT TP 3 => 2960.92 (750 PIPS)

MYWORLD115

GOLD -XAUUSD 4H Sell Analysis!

Hello Everyone, Welcome to FXMYWORLD. Let's see how this pair will perform based on the analysis. I'm waiting for Liquidity grab then will look for selling confirmation. Based on my analysis and my view I'm sharing my view. Make sure you do your research and based on your confluence please look for the entry. Don't rush your trades without any confirmation. Thanks in advance for checking my trade idea.

MYWORLD115

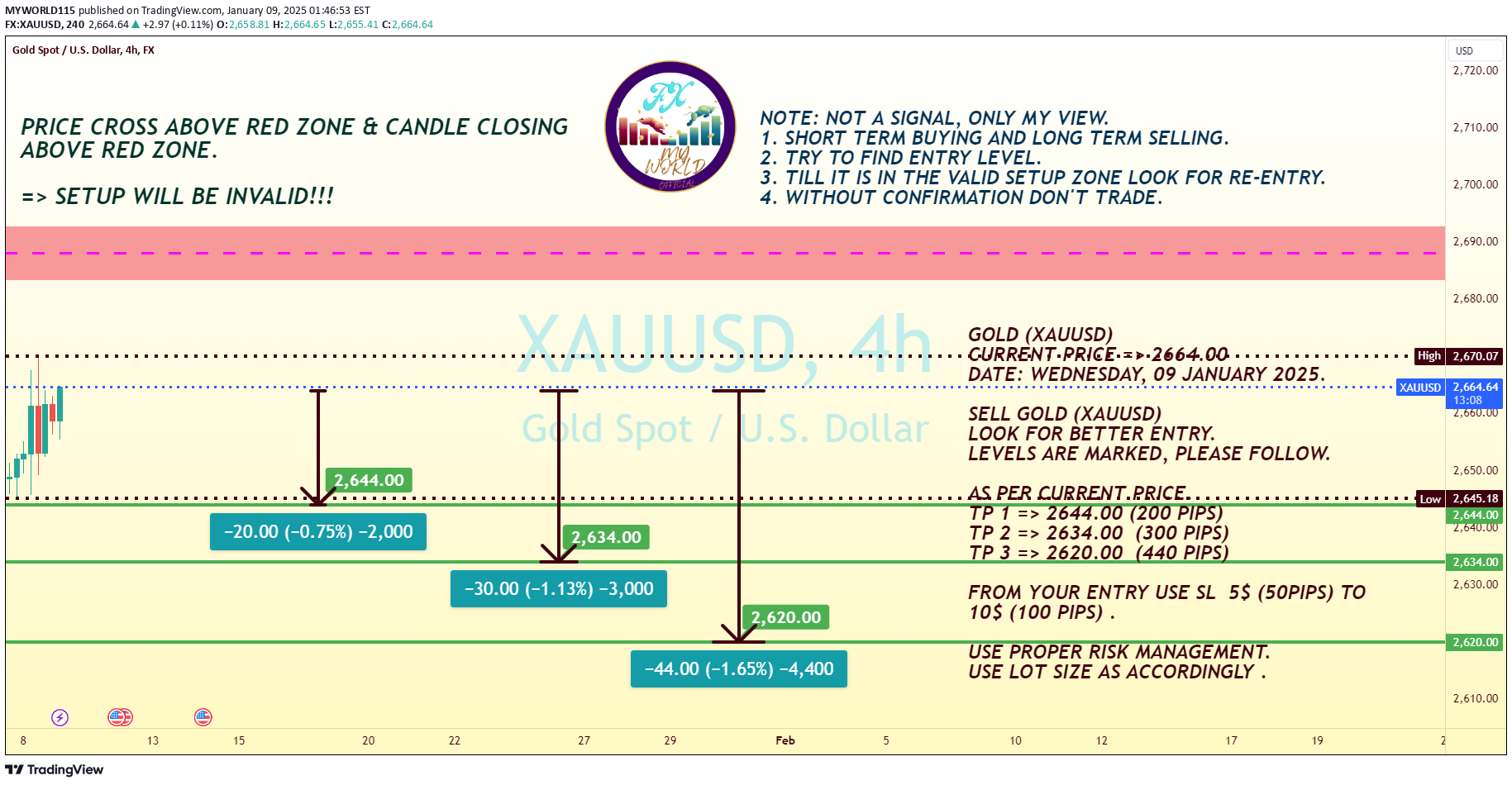

GOLD -XAUUSD 4H Short Term Buying Long Term Selling!

Hello Everyone,Welcome to FXMYWORLD.Let's see how this pair will perform based on the analysis.Make sure you do your research and based on your confluence please look for the entry.Don't rush your trades without any confirmation.Thanks in advance for checking my trade idea.

MYWORLD115

GOLD - XAUUSD 4H Long term Sell!

Hello Everyone, Welcome to FXMYWORLD. Let's see how this pair will perform based on the analysis. Make sure you do your research and based on your confluence please look for the entry. Don't rush your trades without any confirmation. Thanks in advance for checking my trade idea.Update GOLD (XAUUSD) CHART ANALYSIS POSTED ON SUNDAY 07 JANUARY 2024. GOLD (XAUUSD) hit TP 1 => 2025.625 (200 pips)

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.