KnightsofGold

@t_KnightsofGold

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

KnightsofGold

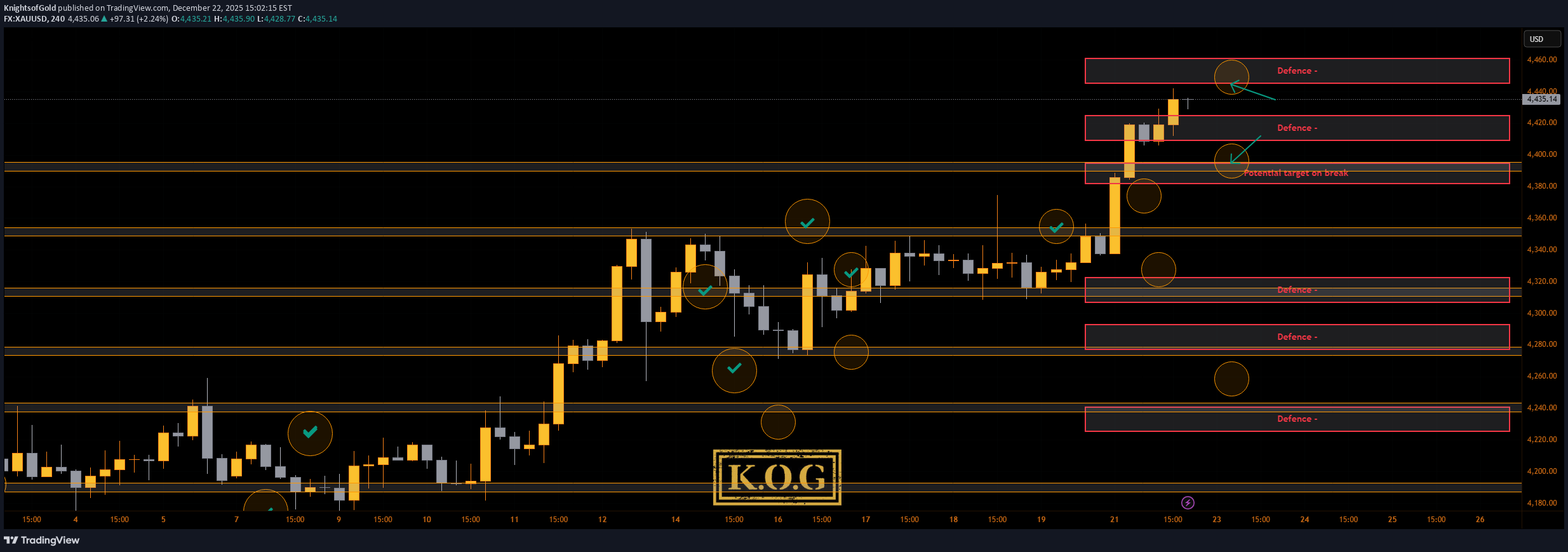

THE KOG REPORT - Update

Quick Boxing day update: You can see we're still playing defence here with a stretch over the MA's due to the gap which looks like it could be getting filled soon. We'll share the red box targets instead today as our set up has already presented itself on the indi's. RED BOXES: Break above 4524 for 4530, 4533, 4537 and 4545 in extension of the move Break below 4504 for 4495, 4490 and 4482 in extension of the move As always, trade safe. KOG

KnightsofGold

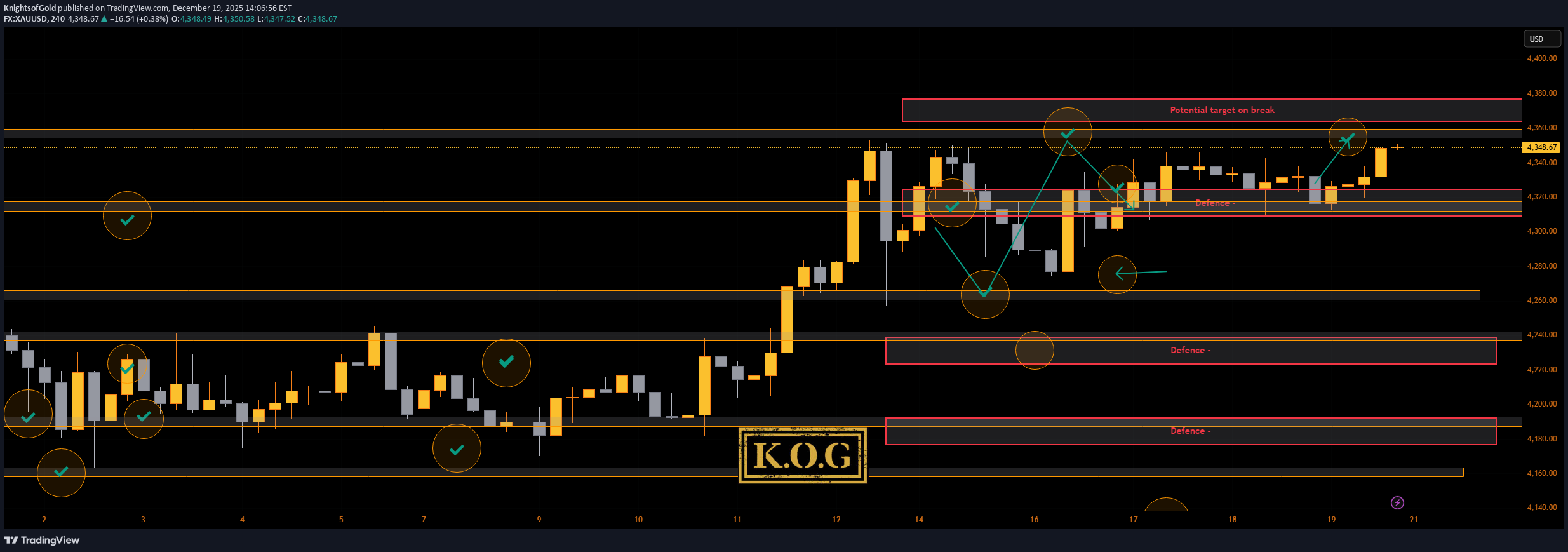

THE KOG REPORT - Update

End of day update from us here at KOG: Interesting start to the week and if you were trading the Asia session you would have done well on the red box targets as they all completed. For those of us who didn't get an opportunity to get in on the move, it was simply scalping on the indicators that gave us a little bonus for the day. We're now in another order region which is where we may see price accumulate again and draw the mean upside which would flip us into support level 4385 which is the level to watch out for in the sessions ahead. Resistance here stands at the 4445-50 region which is the level that will need to break to go higher. For us, we're too high to attempt longs, especially while we're so stretched on the intra-day levels. We'll wait for the algo to give us the heads up and then apply the tools we have to get in tomorrow, if there is a clean set up. RED BOXES: Break above 4340 for 4355✅, 4365✅, 4370✅ and 4376✅ in extension of the move Break below 4320 for 4310, 4304, 4295, 4283 and 4265 in extension of the move As always, trade safe. KOG

KnightsofGold

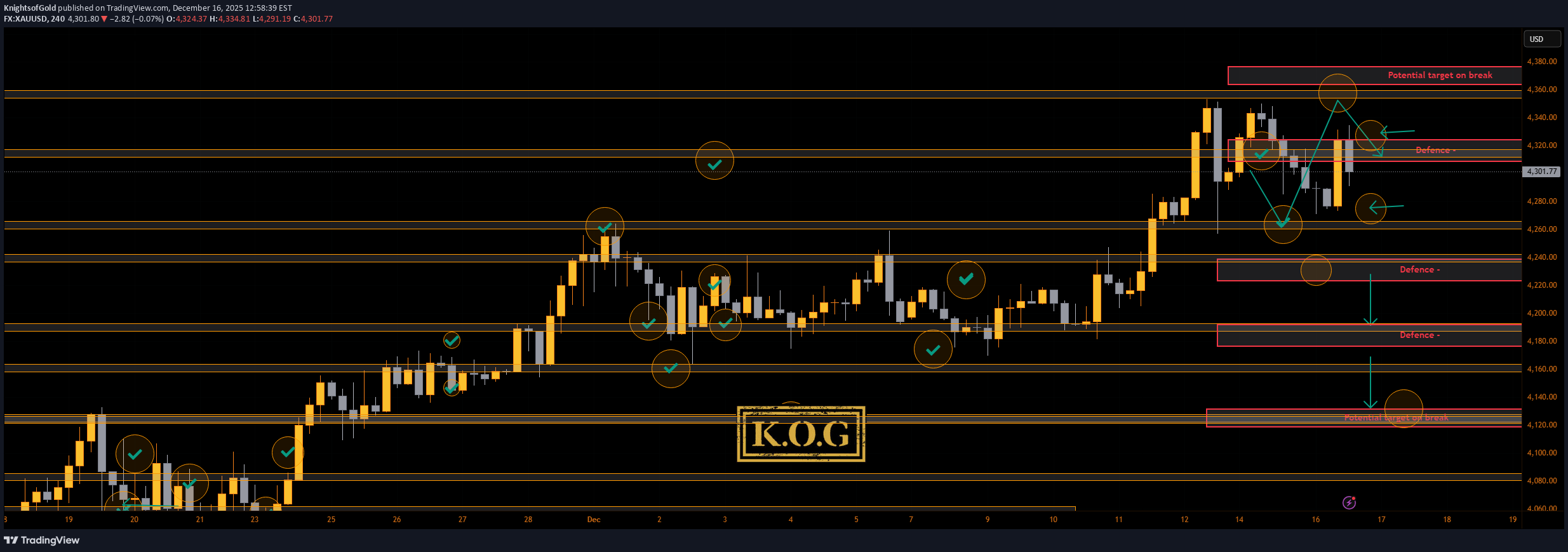

THE KOG REPORT

THE KOG REPORT: In last week’s KOG Report we again published the predictive path and expected price to stay within the range but attempt that high. We managed to follow that path nearly to the tee capturing the high, the low and then the RIP from the level of defence we had given. A great week on Gold completing our Excalibur targets, most of the red box targets and following the bias levels well. So, what can we expect in the week ahead? It’s going to be a short week with exaggerate volume in our opinion. We should see the range continue and a potential test on that high will be ideal for us. For that reason, the path shows support below at defence and then potential for a test on that high which is where we would ideal like to see another RIP! It’s a simple one on the indicators, we’ll wait for the activations, we’ll go with the price so look for the breaks either side. We’ll update traders best we can but please remember, it’s the end of December, not the best market conditions to be in and the less exposed you are the better. RED BOXES: Break above 4340 for 4355, 4365, 4370 and 4376 in extension of the move Break below 4320 for 4310, 4304, 4295, 4283 and 4265 in extension of the move Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated. As always, trade safe. KOG

KnightsofGold

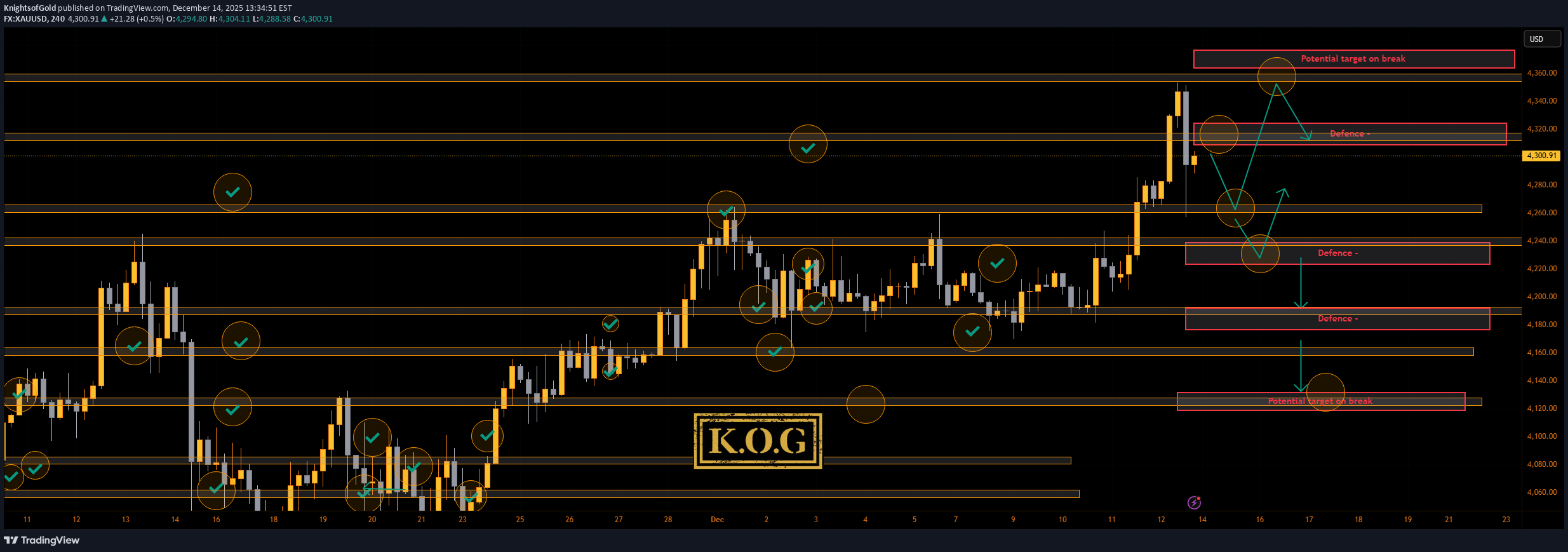

THE KOG REPORT - Update

End of day update from us here KOG: We close out another successful week in the markets and for the KOG Report, which once again delivered as expected. The objective was clear, capture the move from the highs into the lows, anticipate the RIP, and then target the region above levels that ultimately came into play. The projected path highlighted the potential for a RIP at that area, and the market responded decisively. Additionally, yesterday’s highlighted hotspot has now fully played out, reinforcing the effectiveness of a level to level, point to point approach, the Camelot way. Right now, price is trading above the order region in a thin volume environment and is struggling to sustain a break above 4355 into the close. While support remains a possibility at these levels, a failure to hold could open the door to another sell-off similar to yesterday’s move. Given the late Friday session and the risk surrounding an upcoming Trump announcement, we believe standing aside is the prudent choice. We wish you all a great weekend and look forward to seeing you on Sunday for the next KOG Report. As always, trade safe. KOG

KnightsofGold

THE KOG REPORT - Update

End of day update from us here at KOG: That was a mic drop moment again this week with the plan working well. We got the high, the low with the tap and bounce, the target level on the red box break and then what a RIP from that level! Now we have support at the 4330 level with the order region in play and resistance at the 4350 level. Long wick being left here on the 4H so a retest above could be on the cards in the coming session. For us, it's a job well done and with it being Friday and witching day before the Xmas break, it's best to take it easy tomorrow. From Camelot this morning: RED BOXES: Break above 4340 for 4351✅, 4355✅, 4365✅ and 4370✅ in extension of the move Break below 4320 for 4315, 4310, 4304 and 4390 in extension of the move As always, trade safe. KOGTarget completed for the end of a great week.

KnightsofGold

THE KOG REPORT - Update

End of Day update from us here at KOG Gold experienced another choppy trading session today, however, price successfully broke above the bias level. By utilising the red box framework, we were able to capture a few high-quality 50-pip scalps throughout the session. At current levels, price is encountering notable resistance, and the 4H timeframe is indicating potential for a short-term pullback. As a result, we will continue to follow the existing plan, which has been performing well, while exercising increased caution when considering higher level long positions. Support is currently located at the 4330 level, with further support at 4320, which remains the key “line in the sand.” A confirmed break below the bias level would be required to target lower prices. Otherwise, we anticipate another pullback into lower support before a continuation to the upside. One upside target remains in play. Camelot Levels (Morning Session): Price: 4322 Red Box Scenarios: Break above 4325 for 4330✅, 4337✅, and 4352 In extension of the move Break below 4306 for 4297, 4390, and 4386 in extension of the move As always, trade safe. KOG

KnightsofGold

THE KOG REPORT - Update

End of day update from us here at KOG: Although not quite to plan, missing the higher level by a whisker, we did manage to get on the indicator indications following the path no exactly but near enough. We've had a few decent scalps for NFP but as you can see, MA's are being drawn together and price is playing between them while it now accumulates. We have added two hot spots which we expect price to play between with tomorrow being a relatively flat day on the economic calendar. The key level here is 4320 resistance while that 4290 support needs a clean break to target lower. Until then, more up and down in a smaller range looks possible into the late session. From Camelot this morning: Price: 4286 RED BOXES: Break above 4290 for 4302✅, 4320✅ and 4337 in extension of the move Break below 4270 for 4255 and 4243 in extension of the move As always, trade safe. KOG

KnightsofGold

THE KOG REPORT

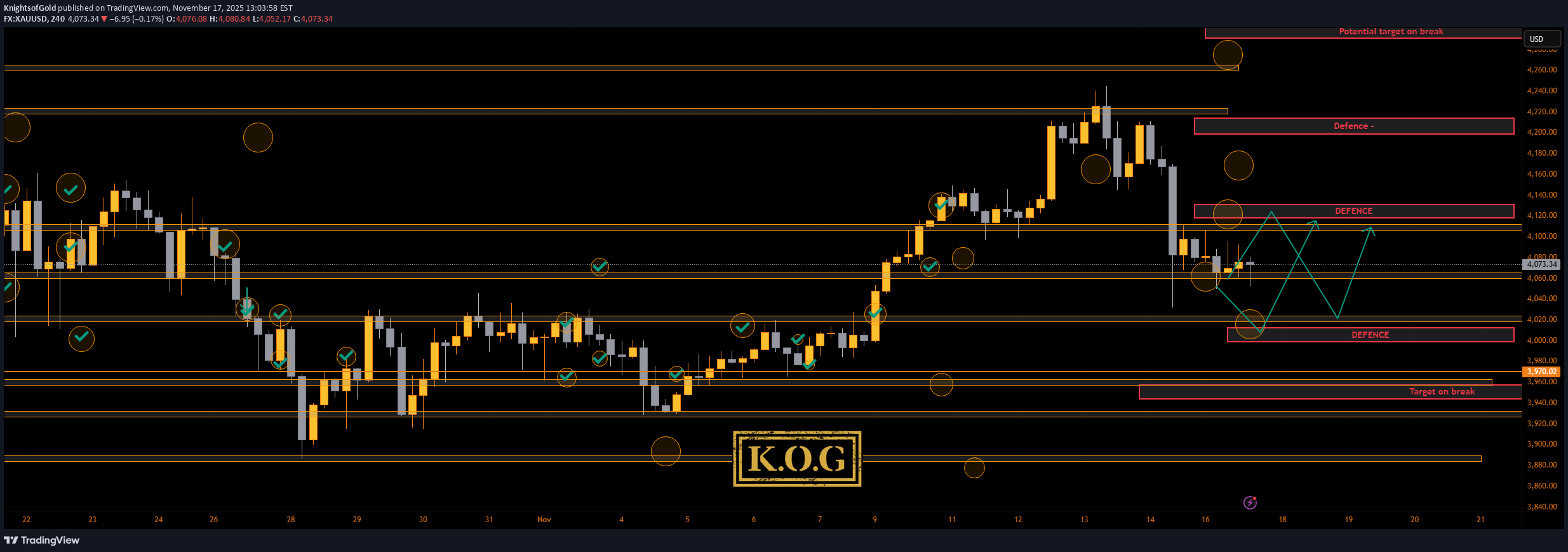

THE KOG REPORT: In last week’s KOG Report, we wanted to see the immediate resistance fail and give us the short trade into defence which worked well. Due to there being now break of defence and our indicators suggesting a long, we managed to get a long into the higher defence box which ultimately broke. You can see the pull back having taken place and the result was our red box targets and target region on Excalibur being completed for the end of the week. The power of boxes and Excalibur coupled with the indicators again giving us direction for the market and a decent result on gold. So, what can we expect for the week ahead? Quick one this week so in brief. Key level resistance for Monday is the 4310 region which will need to break to then attempt a higher high, while the key level of support is sitting at 4260-5 and below that 4250. If either of these levels below are targeted and we get a RIP, we’ll be looking to long into the higher level. It’s that higher level that needs to be monitored this week and will need to break! Failure again there can result in another strong sell off coming up to the Christmas break so let’s play caution and remember it’s December; liquidity is all over the chart and many institutions are winding down for the festive period. December is known to be a very choppy month as most professional traders take it easy. RED BOXES: Break above 4310 for 4320, 4333, 4335 and 4348 in extension of the move Break below 4290 for 4275, 4365, 4260 and 4253 in extension of the move Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated. As always, trade safe. KOGRED BOXES: Break above 4310 for 4320✅, 4333✅, 4335✅ and 4348✅ in extension of the move Break below 4290 for 4275, 4365, 4260 and 4253 in extension of the move

KnightsofGold

THE KOG REPORT - Update

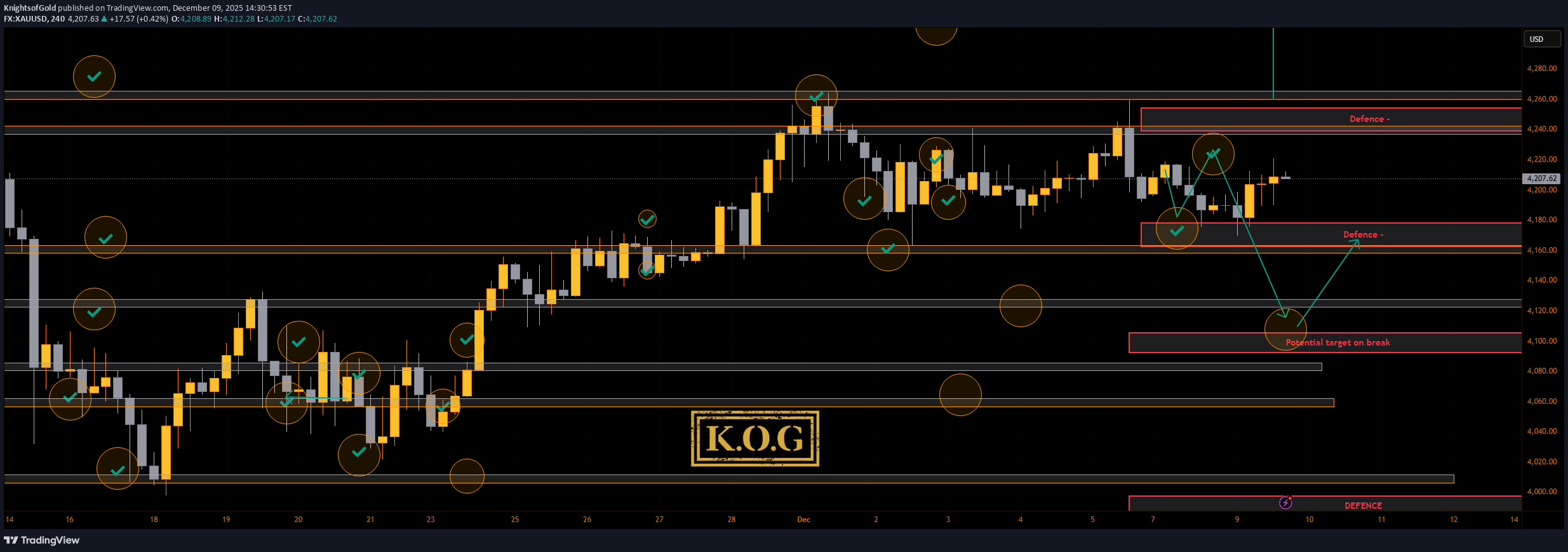

End of day update from us here at KOG: Not a bad start to the week with price following our path and red boxes to pave it's way into our target levels as well as giving buyers opportunity to get that long trade into the immediate EXC target which is now complete. Now, with FOMC tomorrow we would expect this to want to hover around here and attempt the lower support levels which stand at 4002 and below the 4195. 4190 is the key level and price needs to stay above that to continue higher. A break below will confirm the move for us. For us, the plan is working so we'll stick with it. As always, trade safe. KOG

KnightsofGold

گزارش روزانه طلا: تحلیل بازار و سطوح کلیدی پیشرو (KOG)

End of day update from us here at KOG: Ranging day on gold today with not much action. We gave the lower levels yesterday that we wanted price to tap and bounce from which it did, giving a nice long trade to start the week. After that, just small up and down movement not really worth getting involved in. For that reason, we'll stick with the same plan for now and monitor the indicators for any change, otherwise, still looking for a potential undercut low. RED BOXES: Break above 4095 for 4104, 4110, 4120 and 4127 in extension of the move Break below 4080 for 4065✅, 4055✅ and 4040 in extension of the move Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated. As always, trade safe. KOGBias level target complete, tap and bounce from defence!

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.