KhalilKarimii

@t_KhalilKarimii

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

KhalilKarimii

XAUUSD

The broader trend for gold remains bullish, driven by various factors such as geopolitical tensions, inflation concerns, and central bank purchases. Analysts suggest that the structural drivers supporting high gold prices are still in place, and there is potential for gold to reach new highs, possibly peaking around $2,800 by September before a possible retracement towards the end of the year

KhalilKarimii

XAUUSD

The gold market has recently shown a downward trend against the United States dollar, influenced by various economic and political factors. Firstly, the Federal Reserve's decision to maintain interest rates at current levels for a longer period has contributed to the strength of the US dollar. Despite recent data indicating that inflation has not decreased significantly and remains higher than desired, the Fed has taken a cautious approach. The expectation of fewer rate cuts in 2024 than previously anticipated has supported the dollar, putting pressure on gold prices (DailyFX) (J.P. Morgan | Official Website). Additionally, political uncertainties, particularly those related to the US debt ceiling and fiscal policies, have further supported the dollar as a safe haven, diminishing gold's appeal (DailyFX). As the economic outlook remains uncertain with potential for slower disinflation and a resilient labor market, the dollar's strength is likely to persist, continuing to weigh on gold prices. In summary, the combined effect of the Fed's cautious stance on interest rates and the ongoing political uncertainties in the US are key factors driving the current weakness in gold prices relative to the US dollar. Disclaimer: The information provided in this overview is for educational and informational purposes only and should not be construed as financial advice. It is based on current market analysis and data from credible sources. Always conduct your own research or consult a qualified financial advisor before making any investment decisions. Trading and investing carry risks, including the potential loss of principal.

KhalilKarimii

XAUUSD

Gold recently became extremely overbought in momentum terms against ALL major fiat currencies. For example, the following daily charts show that based on the daily RSI(14), a momentum indicator included at the bottom of each chart, gold recently became as stretched to the upside as it was at any time over the past 15 years, including at the 2011 major peak, relative to the euro, the Yen, the Swiss franc, the Australian dollar and the Canadian dollar.

KhalilKarimii

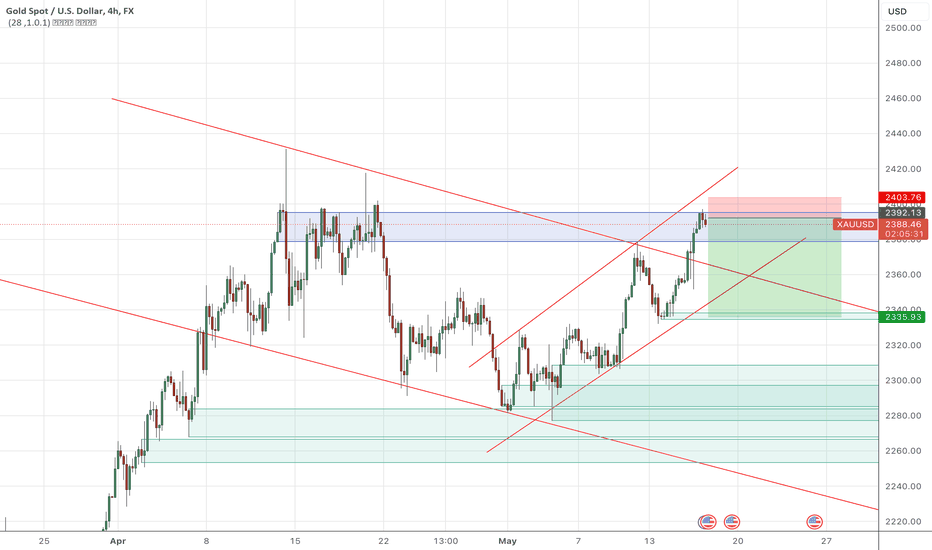

XAUUSD Buy Idea

Investors will be looking at the U.S. producer price index and consumer price index data this week for any indication that price pressures are finally easing after months of strong inflation gave rise to fears that the Federal Reserve may not cut interest rates this year. Markets got some relief earlier this month when Fed Chair Jerome Powell indicated that the central bank was still looking to eventually cut rates and the latest U.S. employment report showed signs of cooling in the labor market. Analysts expect Wednesdays crucial CPI report to show underlying inflation rising 3.6% on a year-over-year basis, which would be the smallest increase in over three years. But a hotter-than-expected inflation reading would likely price out rates cuts for the rest of the year, reigniting market volatility.

KhalilKarimii

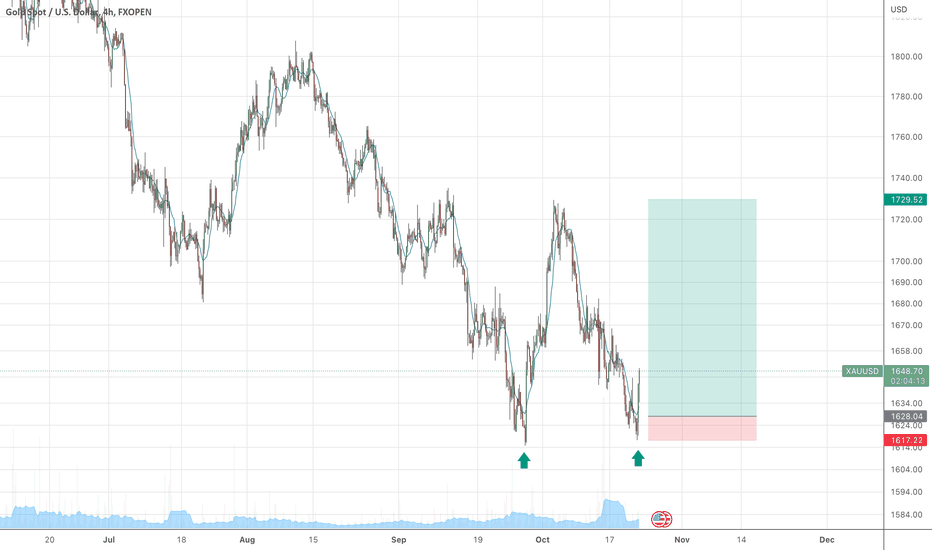

XAUUSD SHORT IDEA

“If swap futures start to believe the Fed will likely deliver two more rate increases, gold could remain vulnerable,” said Ed Moya, analyst at online trading platform OANDA. “However, if risk aversion runs wild, gold could see some flight to safety flows. Gold has key support at the $1,900 level and resistance at the $1,960 region.”Secure profit. move SL to enter point.

KhalilKarimii

XAUUSD

Gold prices moved little on Wednesday after three days of losses as investors awaited more cues from the conclusion of a Federal Reserve meeting later in the day, while copper prices benefited from an interest rate cut in China.take sl to + entry point.

KhalilKarimii

Gold Buy Idea

Investing.com -- Gold and copper prices fell slightly on Wednesday as markets awaited fresh cues on monetary policy from a string of major central bank meetings this week, starting with the Federal Reserve later in the day. The Fed is widely expected to hike interest rates by 25 basis points later in the day. But the central bank’s outlook on monetary policy will be closely watched, with investors waiting to see how Chair Jerome Powell will address recent signs of resilience in the U.S. economy, as well as a recent rally in global financial markets.

KhalilKarimii

XAUUSD Gold Spot

Investors have shied away from buying stocks this year, mainly because of fears over sharp policy tightening by the US Federal Reserve and other central banks around the world amid an environment of high inflation and low growth. Given that the Fed is yet to tilt to a more dovish, low-yielding assets like tech stocks listed on the Nasdaq and gold are likely to remain out of favor as bond yields continue to press higher.source: Investing.com

KhalilKarimii

Beta Vs USDT

4H Chart formed a possible buy position. after +25.4% spike on 14 July I am more confident that we might have greater upcoming pump.Note: Please take action based on your personal analysis.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.