KevinNguyen-SimpleTrade

@t_KevinNguyen-SimpleTrade

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

📊 Market OverviewGold is currently testing the key 2883 support level, bouncing 10 points during the Asian session, as traders prepare for today’s high-impact US CPI release during the New York session.With inflation data set to shake the markets, today’s price action could decide whether gold continues its bullish rally or faces another major rejection at resistance levels.🔹 Key Fundamental Drivers:✔ Fed’s stance: No urgency for rate cuts, keeping the market in uncertainty.✔ DXY & Bond Yields: US Dollar Index (DXY) weakening, 10-year Treasury yields steady at 4.52%.✔ Stock Market: Risk-off sentiment returns as traders wait for key inflation figures.✔ CPI Expectations:Headline CPI (YoY): Forecasted +2.9%Core CPI (YoY): Forecasted +3.1%📌 Will gold finally break out, or are we set for another sharp reversal?📈 Key Technical Levels to Watch🔺 Resistance Zones:📍 2906 - 2915 - 2926 - 2942🔻 Support Zones:📍 2884 - 2870 - 2860 - 2840📌 A decisive move above 2910 could send gold toward 2926, while failure to hold above 2883 may lead to a retest of 2860.🎯 GOLD Trading Plan for Today🔴 SELL ZONE (Key Resistance for Shorts)📍 Entry: 2926 - 2928❌ SL: 2932🎯 TP: 2922 - 2918 - 2914 - 2910 - 2905 - 2900🔴 SELL SCALP (Short-term Sell Setup)📍 Entry: 2915 - 2917❌ SL: 2921🎯 TP: 2910 - 2905 - 2900 - 2896 - 2890🟢 BUY ZONE (Key Support for Longs)📍 Entry: 2840 - 2838❌ SL: 2834🎯 TP: 2845 - 2850 - 2854 - 2858 - 2862 - 2866 - 2870🟢 BUY SCALP (Short-term Buy Setup)📍 Entry: 2862 - 2860❌ SL: 2856🎯 TP: 2866 - 2870 - 2875 - 2880📌 Watch price action around 2910 closely before entering trades!📌 Risk Management & Key Considerations✔ Strictly follow TP/SL to manage risk in a volatile market.✔ Monitor DXY and Treasury yields for confirmation of gold’s trend.✔ Expect high volatility after CPI – adjust position sizing accordingly.📢 Breakout or Rejection? Where do you think gold is heading? Drop your thoughts below! 🚀🔥💠 Why GOLD Continues to Rise Despite Higher-Than-Expected CPI Inflation? Recent CPI data came in higher than expected, yet gold continues its bullish momentum. Here are key reasons why this might be happening: 🔺 Distortion in Housing Inflation Data According to the latest market insights shared by a group member, the sharp rise in housing and car prices in this month’s inflation report has been significantly influenced by last month’s major wildfire in California. 🔥 How does this impact CPI calculations? Housing accounts for 30% of the total CPI calculation weight, meaning any temporary price spikes can heavily distort the inflation report. The recent unexpected rise in housing prices may not accurately reflect actual market conditions, leading to a misleading CPI figure. Market participants might be pricing in a potential revision or normalization in future inflation reports, allowing gold to remain strong. 🔺 CPI Inflation Data May Not Reflect the True Economic Picture The housing sector's inflation spike is event-driven rather than structural, meaning the data could be overestimated. Traders and investors might be disregarding this CPI report as a one-time anomaly rather than a long-term trend. 📌 For more details, you can check the source here: 🔗 📢 What’s your opinion on this CPI distortion? Do you think gold’s bullish momentum will continue? Let’s discuss below! 🚀🔥

📊 نظرة عامة على السوقالذهب یتحرک بالقرب من مستوى المقاومة 2910 بعد ارتفاعه خلال الجلسة الآسیویة، حیث یترقب المستثمرون بیانات التضخم الأمریکیة (CPI) التی قد تحدد اتجاه الأسواق فی الأیام القادمة.الأسواق حالیًا تراقب موقف الاحتیاطی الفیدرالی، حیث لا تزال التوقعات تشیر إلى عدم وجود حاجة ملحة لخفض أسعار الفائدة. فی الوقت نفسه، انخفاض مؤشر الدولار الأمریکی (DXY) ودعم العوائد على السندات یمکن أن یعزز ارتفاع الذهب.📈 التحلیل الفنی لمستویات الذهب الرئیسیة🔺 مستویات المقاومة القویة📍 2910 - 2926 - 2942 - 2955🔻 مستویات الدعم القویة📍 2885 - 2870 - 2860 - 2840📌 إذا تمکن الذهب من اختراق 2910 والثبات أعلاه، فقد نشهد استمرارًا للاتجاه الصعودی نحو 2926. ولکن إذا فشل فی الاختراق، فقد یحدث تصحیح نحو 2885.🎯 خطة التداول للیوم🔴 SELL ZONE (فرصة بیع عند المقاومة القویة)📍 دخول: 2926 - 2928❌ وقف الخسارة (SL): 2932🎯 أهداف الربح (TP): 2922 - 2918 - 2914 - 2910 - 2905 - 2900🟢 BUY ZONE (فرصة شراء عند الدعم القوی)📍 دخول: 2840 - 2838❌ وقف الخسارة (SL): 2834🎯 أهداف الربح (TP): 2845 - 2850 - 2854 - 2858 - 2862 - 2866 - 2870📌 یجب مراقبة حرکة السعر عند مستوى 2910 بعنایة قبل اتخاذ قرار التداول!📌 ملاحظات هامة وإدارة المخاطر✔ تحدید مستویات TP/SL مسبقًا لحمایة رأس المال من تقلبات السوق.✔ مراقبة مؤشر الدولار (DXY) والعوائد على السندات الأمریکیة لتأکید اتجاه الذهب.✔ الأسواق قد تکون متقلبة بعد صدور بیانات CPI، لذا یفضل ضبط حجم العقود وإدارة المخاطر بشکل جید.📢 هل سیخترق الذهب المقاومة أم سیعود إلى مستویات الدعم؟ شارک برأیک فی التعلیقات! 🚀🔥

🔥 GOLD MONDAY GAP – WHAT’S NEXT AFTER NONFARM? 🔥📊 Market Overview:Gold started the week with a gap-up after last week’s 20-pip decline, indicating a potential test of psychological resistance at recent highs. However, there is a strong likelihood that price will correct further to fill liquidity gaps (FVG) before resuming its bullish momentum.💡 Liquidity & Price Action Strategy:The Monday gap-up may fill liquidity around 2875 - 2879 before gold resumes its downward move.Markets always balance between high and low liquidity zones, meaning gold is likely to clear the FVG before establishing a new trend direction.If the Asian session maintains bullish momentum, watch for SELL opportunities near resistance at 2873 and 2880.⚠️ Key Considerations:Post-Nonfarm Payrolls (NFP) Monday tends to be highly volatile.Wait for price confirmation at key levels before entering trades.Real-time market updates and trading strategies available on TradingView Kevin Nguyen and our trading community.📉 Gold Trading Plan – Key Levels🔴 SELL SCALP: 2876 - 2878📍 SL: 2882🎯 TP: 2872 - 2868 - 2864 - 2860 - 2855🔻 SELL ZONE: 2883 - 2885📍 SL: 2888🎯 TP: 2878 - 2875 - 2870 - 2866 - 2862🟢 BUY SCALP: 2853 - 2851📍 SL: 2848🎯 TP: 2856 - 2860 - 2864 - 2868 - 2872🟩 BUY ZONE: 2842 - 2840📍 SL: 2836🎯 TP: 2846 - 2850 - 2854 - 2860📌 Risk Management Tips:✔️ Always use TP/SL to protect your account.✔️ Follow TradingView Kevin Nguyen & our trading community for real-time insights and top-tier strategies!📩 Get the latest market analysis and professional trading strategies! 🚀💬 What’s your take on gold this week? Will it drop further or rebound? Share your thoughts in the comments! 🔥🔥 GOLD HITS NEW ATH – WHAT’S NEXT? 🔥 Gold continues its bullish momentum, driven by safe-haven demand amid trade war fears and inflation concerns. With Trump announcing a 25% tariff on steel and aluminum, market uncertainty is fueling gold’s rally. 📉 Trading Plan Update: 📍 Buy Zones: 🔹 2878 - 2880 – Potential retracement entry. 🔹 2873 - 2871 (Fibo 0.5) – Stronger support for a buy setup. 📍 Sell Zones: 🔻 2900 - 2902 – Key resistance level. 🔻 2914 - 2916 – Extended resistance for short opportunities. 🔗 View Full Chart: 📌 Stay cautious, follow TP/SL, and watch for price confirmation! 🚀

📊 Market Analysis from the Chart:Gold has displayed critical signals in the past week, especially around the 2881 resistance level. This level formed a Double Top pattern accompanied by a strong Bearish Marubozu candle, signaling that sellers have taken control at this key resistance zone, driving the price below short-term support levels.💡 Technical Highlights from the Chart:Double Top at 2881: Price tested this significant resistance but failed to break through, triggering strong selling pressure.Bearish Marubozu on H4: The strong bearish candle confirms that sellers dominated at the peak.CP Zone Retest: The Continuation Pattern (CP) Zone was retested before the price dropped sharply, solidifying the correction trend.🔍 Liquidity Plan for Next Week:First FVG Zone (2850 - 2842): Already tested but remains an important area to monitor.Major FVG Zone (2835 - 2828): A critical liquidity zone likely to attract strong buying interest.Final Support Zone (2810 - 2800): If this zone is breached, it could trigger a new bearish trend with deeper corrections.📈 Forecast for Gold’s Trend:Bullish Scenario: If price holds above 2835 - 2828, Gold may rebound and resume its primary uptrend.Bearish Scenario: If price breaks below 2810 - 2800, it may initiate a deeper bearish correction.⚙️ Trading Strategy:SELL: Around 2860 - 2862, targeting lower liquidity zones.BUY: At the support zone 2835 - 2828, expecting a potential bullish reversal.📩 Follow KevinNguyen-SimpleTrade for weekly market insights and actionable trading strategies! 🚀💬 What’s your outlook for Gold this week? Will it rebound or continue to drop? Share your thoughts in the comments! 🔥

NONFARM SHOCK – GOLD FACES LIQUIDITY TEST BELOW! 🔥 NONFARM SHOCK – GOLD FACES LIQUIDITY TEST BELOW! 🔥📊 Massive Sell-off on NFP & Key Liquidity Zones Ahead!Gold closed the week with a sharp rejection as expected, following the Nonfarm Payrolls (NFP) release and Asia’s Golden Day. Price was driven higher during the Asian & European sessions, hitting key resistance at 2881, before experiencing a strong dump in the US session.🚨 Key Observations for Next Week’s Market Plan:The daily candle formed a 20-pip rejection wick, signaling strong selling pressure at the top.H4 closed bearish, reinforcing the correction phase.On H2 and H1, strong Marubozu bearish candles emerged, confirming that SELL orders dominated the 2881 resistance and prevented any breakout.Price has now closed below VPOC (the high-liquidity zone), which previously acted as key support for buyers. Now that Gold has broken below this level, SELL setups become the optimal choice for next week.📉 USD Strength & GOLD’s Liquidity Fill Zones!After this strong rejection, USD shows signs of a potential recovery next week, adding more pressure to Gold.We will now focus on liquidity voids below to determine where price may fill before a possible bullish continuation.🔍 Key Liquidity Zones to Watch:✅ First FVG zone (already tested): 2850 - 2842✅ Major FVG zone (high probability liquidity fill): 2835 - 2828✅ Final FVG zone (critical support before deeper correction): 2810 - 2800📌 If 2810 - 2800 fails to hold, Gold could enter a deeper bearish correction, confirming a trend shift.🚀 Next Steps:Monitor these key liquidity zones and watch for price reaction.Expect high volatility & potential liquidity sweeps before a trend decision!Weekly plan & trading setups will be updated tomorrow and early next week!📩 Follow KevinNguyen-SimpleTrade for expert market updates & precise trade setups! 🚀💬 What’s your view on Gold next week? More downside or a liquidity-driven bounce? Share your thoughts below! 🔥

🔥 GOLD & NONFARM – TONIGHT’S BIGGEST MARKET EVENT UNDER TRUMP’S PRESIDENCY! 🔥📊 The financial markets are on high alert!Tonight, traders worldwide are focusing on the first Nonfarm Payrolls (NFP) report under Trump’s leadership, an event that could trigger massive moves in USD, Gold, and the broader financial markets.Interestingly, several Asian countries are celebrating "The Golden Day" today, a tradition where buying gold is believed to attract wealth and prosperity. Historically, this often fuels strong buying pressure in gold during the Asian session.💥 Current Market Setup:Gold surged in the Asian session due to FOMO-driven buying, but we’re now seeing some consolidation as the market gears up for the next major move.This NFP is a game-changer, as the ADP report earlier this week suggested a much stronger-than-expected labor market, signaling a possible USD comeback amidst trade war concerns.If NFP beats expectations, USD could rally, putting pressure on gold. Conversely, if the data disappoints, we could see another gold breakout!📈 GOLD TRADING PLAN – POSITIONING AHEAD OF NFP!📌 Main Strategy: Look for BUY setups at key Continuation Pattern (CP) levels and Fibonacci retracement zones, capitalizing on rapid price reactions at lower timeframes.🔍 Key Support Levels for Buying Opportunities:✅ 2859 - 2850 - 2842 - 2835 - 2822🔍 Key Resistance Levels – Testing the Highs Before NFP:🚨 2882 (previous high retest potential) - 2892 - 2900📊 PRE-NFP TRADING PLAN – SCALPING & POSITIONING STRATEGY📌 Buy Scalp Setups for the Asian & European Session🎯 Buy Scalp Entry: 2842 - 2840❌ Stop Loss (SL): 2836🎯 Take Profit (TP): 2846 - 2850 - 2854 - 2860 - 2865 - 2870📊 Adjusted Trading Plan for the US Session (Anticipating Volatility)🎯 Buy Scalp Entry: 2836 - 2834❌ Stop Loss (SL): 2830🎯 Take Profit (TP): 2840 - 2844 - 2850 - 2854 - 2858 - 2865🎯 BUY ZONE (Ideal Long-Term Entry Area): 2816 - 2814❌ Stop Loss (SL): 2810🎯 Take Profit (TP): 2820 - 2826 - 2830 - 2835 - 2840 - 2845 - ???📊 HIGH-RISK SELL ZONE – TESTING RESISTANCE BEFORE NFP🎯 Sell Scalp Entry: 2880 - 2882❌ Stop Loss (SL): 2875🎯 Take Profit (TP): 2876 - 2872 - 2868 - 2864 - 2860 - ????🚨 Our SELL ZONE will be updated LIVE in our channel!👉 Since NFP is a high-impact event, our team will monitor the market closely and adjust the best SELL entry levels in real-time!📌 ⚠️ IMPORTANT: NFP is known for extreme market volatility – risk management is key!✅ Stick to your TP/SL strategy to protect your capital and maximize opportunities!📩 Follow KevinNguyen-SimpleTrade for instant updates, real-time analysis & expert trade setups! 🚀💬 What’s your NFP prediction? Will gold break out or crash tonight? Drop your thoughts in the comments! 🔥🔥 GOLD REACTS STRONGLY – 70 PIPS PROFIT BEFORE NONFARM! 🔥 📊 Precision Trading Pays Off! Gold has just retested the key trendline resistance & CP (Continuation Pattern) at 2859 and delivered a sharp 70 pips reaction! This level was already highlighted on our chart & shared with the community, and it played out perfectly! ✅ 💰 Profits locked in BEFORE the highly anticipated Nonfarm Payrolls (NFP) tonight! 🔗 Check the chart here: 🚀 What’s Next? The Big Move is Coming! For those who followed the plan, secure part of your profits now and get ready for the real action tonight! NFP is expected to bring major volatility & strong directional waves, setting the tone for the next market trend. ⚠️ Trade Smart, Stay Disciplined! 🔹 Stick to TP/SL – Protect your capital! 🔹 Prepare for high-impact moves – Don’t get caught off guard! 📩 Follow KevinNguyen-SimpleTrade for live updates & expert market strategies! 🚀 💬 What’s your prediction for NFP? Will gold break out or reverse? Drop your thoughts below! 🔥🔥 GOLD EXPLODES ON NONFARM – BIG WIN WITH ADMIN’S PLAN! 🔥 📊 Precision Trading at Its Best! Nonfarm Friday delivered exactly what we expected! Gold retested the previous high at 2881, then sharply dropped back to 286X, respecting the structured market flow. 💰 Admin’s analysis was on point with an 80% accuracy rate! Despite the expected volatility from the NFP release, which caused some wick hunting, SimpleTrade - Money Market Flow still provided a top-tier BIG WIN trade plan! 🚀 What’s Next? Get Ready for More Profitable Setups! This week, we not only nailed big trend moves but also executed multiple high-quality scalping trades, maximizing opportunities for the community! 🔗 Check the chart here: 📌 DON’T MISS OUT! 🔥 Join our trading community NOW to get early insights & weekly trading plans before the market moves! 🔥 Exclusive scalping strategies & precise entry zones shared daily! 📩 Follow KevinNguyen-SimpleTrade for real-time updates, expert analysis & top-tier trading strategies! 🚀 💬 Did you catch the big moves on NFP? Drop your thoughts in the comments! 🔥

Gold Pulls Back at ATH 2880 – Major Move Incoming! 🔥📈 Gold continues its unstoppable rally, setting new all-time highs (ATH) almost daily! With escalating global economic and political tensions, especially the U.S. trade war with other nations, gold remains the top safe-haven asset attracting massive demand.💡 The Fed warns of inflation risks due to Trump’s tariffs, potentially delaying rate cuts. Meanwhile, ADP data exceeded expectations, with 183K new jobs vs. the 150K forecast, signaling a potential USD recovery.🔥 This Week’s Key Event – Nonfarm Payrolls (NFP) on Feb 7!The upcoming NFP report will be the biggest market mover, not just for USD and gold, but for the entire financial market. Expect high volatility and major trend shifts!📊 Technical Analysis – Major Breakout Ahead!Gold pulled back 20 points from ATH, confirming a psychological resistance zone. Currently, price is sideways between 2875 - 2858, waiting for a breakout to define the next move.🔹 Today's Trading Strategy:👉 Follow the breakout direction for maximum profit opportunities!📍 Key Levels to Watch:🔺 Resistance: 2876 - 2882 - 2894 - 2902🔻 Support: 2859 - 2840 - 2830 - 2816📌 Trade Plan – Precision Entries for High Reward!🎯 BUY SCALP:📍 Entry: 2842 - 2840❌ SL: 2836🎯 TP: 2846 - 2850 - 2855 - 2860 - 2866 - 2870🚀 BUY ZONE:📍 Entry: 2831 - 2829❌ SL: 2825🎯 TP: 2835 - 2840 - 2844 - 2848 - 2854 - 2860 - ???🔻 SELL SCALP:📍 Entry: 2893 - 2895❌ SL: 2899🎯 TP: 2890 - 2886 - 2882 - 2878 - 2875 - 2870 - 2866⚡ SELL ZONE:📍 Entry: 2902 - 2904❌ SL: 2908🎯 TP: 2898 - 2895 - 2892 - 2888 - 2884 - 2880 - ???⚠️ RISK MANAGEMENT – LOCK IN PROFITS!📌 We secured solid profits yesterday, but don’t get overconfident!✅ Stick to TP/SL rules to protect your capital amid unpredictable market movements.📩 Follow KevinNguyen-SimpleTrade for daily expert trade setups! 🚀💬 Will gold continue setting new ATHs, or is a major pullback coming? Drop your thoughts below!🔥 Gold Breaks Out of the Channel – Is a Major Drop Coming? 🔥 📊 Key Market Update: During the Asian and European sessions, USD showed a mild recovery at the old FVG resistance of DXY. This led to a notable correction in major USD-related forex pairs like GBP/USD and EUR/USD. 💥 Gold reacted sharply, breaking out of its parallel ascending channel! The price plunged from 2868 down to 2848, dropping nearly 20 points at the start of the European session, creating a significant trading opportunity. 📈 Trading Plan – Watch for a Re-Test Before Entering! 🚀 Gold has retraced, but the 2860 - 2862 resistance zone has already been broken! 👉 Currently, price is forming a Continuation Pattern (CP) around 2860 - 2862, aligning with multiple confluences, signaling a potential strong drop towards our planned target zone! 🎯 Target: Price could continue dropping towards 2840, providing an ideal BUY opportunity according to the plan! 🔗 Check the detailed chart here: ⚡ Don't Miss This High-Probability Move! ✅ Volatility is increasing, stay alert for the next breakout! 📌 Stick to your TP/SL strategy – Wait for the perfect entry! 📩 Follow KevinNguyen-SimpleTrade for real-time market updates & high-accuracy trading strategies! 🚀 💬 Do you think gold will continue dropping or bounce back up? Drop your thoughts in the comments! 🔥

🌍 Market Overview:Last week, gold reached a new all-time high (ATH) but is now facing strong resistance, aligning with the predicted USD rebound from our previous DXY plan.With the Lunar New Year holidays over, liquidity has returned to the market, bringing more trading opportunities in the Asian and European sessions.USD Strength: Positive U.S. economic data and the Fed’s decision to keep rates unchanged in January continue to support the dollar, creating potential pressure on gold.However, gold’s persistent breakout attempts suggest strong bullish sentiment, with price action still respecting a sustainable parallel upward trend channel from the start of the year.📊 Key Market Events This Week:Nonfarm Payrolls (Friday):A crucial event that will determine short-term USD momentum, significantly impacting gold price action.Investors will adjust their positions accordingly, increasing volatility.ISM Services PMI (Thursday):This report will provide further insight into U.S. economic activity and could influence USD strength.Technical Market Reaction:Gold remains in an uptrend, but recent reactions at Fibonacci Extension (FE) levels indicate temporary selling pressure at key resistance zones.📈 Technical Analysis for XAU/USD:Key Support Levels:$2781 - $2777: Immediate support in today’s session.$2770 - $2763: Stronger support for a deeper retracement.Key Resistance Levels:$2801 - $2808: Short-term resistance range for intraday trading.$2830 - $2836: Major resistance zone, critical for trend continuation.💡 Trading Plan for Today:BUY ZONE:Entry: $2773 - $2771SL: $2767TP: $2776 - $2778 - $2782 - $2785 - $2790 - $2795 - ????SELL ZONE:Entry: $2834 - $2836SL: $2840TP: $2830 - $2827 - $2824 - $2820 - $2815 - $2810⚠️ Important Notes:Market volatility is still high, and liquidity is returning, which may lead to unpredictable price swings.Caution: Adhere to TP/SL levels strictly to protect capital and avoid overleveraging.🤔 What’s Your Take?Will gold continue its bullish momentum, or will we see a deeper correction before Nonfarm?👉 Follow KevinNguyen-SimpleTrade for real-time updates and premium trade setups! 🚀🚀 EUROPEAN & PRE-US SESSION TRADE PLAN UPDATE – GET READY FOR EXPLOSIVE MOVES! 📌 Morning Session Recap: Right at the start of the week, our BUY ZONE 2772 - 2770 played out perfectly with strong confluence from FIBO 0.618 + trendline + FVG support, delivering a solid +120 pips profit in the Asian session! 🔥 💡 The market is currently trading within a wide range, fluctuating between 2770 - 2792 (over 20 pips range). This creates prime trading opportunities as we head into the European and Pre-US session. 📊 EUROPEAN & PRE-US SESSION TRADE PLAN: 🔴 Sell Setup – Retracement Opportunity: Key Resistance Zone: 2792 - 2794 – a high-volume (VPOC) area on current timeframes. Expected Reaction: If price faces resistance, it could drop 10 pips or even retest the 2774 - 2772 zone. Breakout Scenario: If price falls below 2772, further downside potential is likely. 🟢 Buy Setup – Continuation Play: If price holds at 2770 - 2772, a rebound towards 2792 - 2794 is likely, with further upside potential to 2800+. Breakout Confirmation: If price breaks and holds above 2794, bullish momentum will likely push it higher. ⚠️ IMPORTANT NOTES: 📌 No major economic news today, but markets are still reacting to last week's data. 📌 High volatility expected, especially in the US session with increased liquidity. 📌 Risk management is key: Always set TP/SL to protect your account from unexpected price swings. 🔥 Get ready for high-probability trade setups in the European & Pre-US session! 📍 Are you in position yet? Drop your thoughts in the comments! 👉 Follow KevinNguyen-SimpleTrade for top-tier trade insights and real-time updates! 🚀

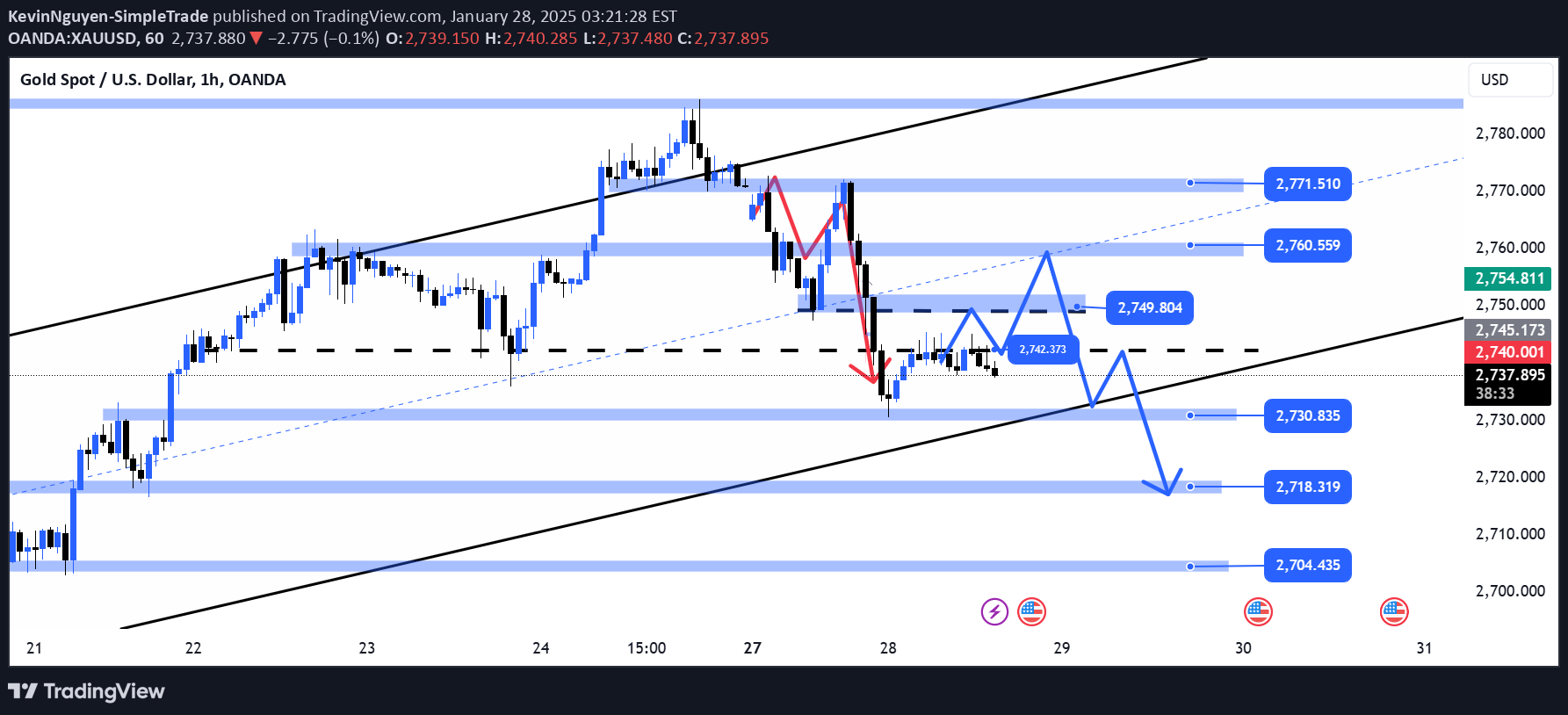

📉 Daily Plan: Global Gold Sell-Off Creates Big Opportunities 🚀🔍 Market OverviewGold prices dropped more than 1% amidst a strong sell-off in the global market, driven primarily by the decline in global stock markets rather than just interest rates or currency movements.This sell-off is tied to liquidity issues, as gold is being sold alongside other risk assets, reflecting a minor liquidity crisis.💡 Key News:Fed Policy Meeting (29/01): Policymakers are expected to maintain current interest rates, but all eyes will be on signals regarding future decisions.Trump’s Tariff Policies: His actions could fuel inflation, creating additional volatility for USD and gold.📊 Technical Analysis & Strategy SummaryYesterday’s analysis played out perfectly, with the market aligning with predictions. Clear corrections delivered 400 PIPS profit from the daily plan and nearly 1,000 PIPS from PREMIUM_SIGNAL.Today, focus remains on retracement waves to find key SELL opportunities at resistance zones.💡 Trading StrategiesSELL SCALP:Entry: 2749 - 2751SL: 2755TP: 2745 - 2743 - 2740 - 2735 - 2730SELL ZONE:Entry: 2760 - 2762SL: 2766TP: 2756 - 2752 - 2748 - 2742 - 2735 - 2730BUY SCALP:Entry: 2732 - 2730SL: 2725TP: 2735 - 2738 - 2742 - 2746 - 2750BUY ZONE:Entry: 2719 - 2717SL: 2713TP: 2723 - 2726 - 2730 - 2735 - 2740 - 2746⚠️ Important NotesWide price range: Recent days have seen broad ranges, like yesterday’s 60-point swing, so trade cautiously.Risk management: Always adhere to Take-Profit (TP) and Stop-Loss (SL) levels to safeguard your account.📢 Take Action Now!👉 Follow KevinNguyen-SimpleTrade to get daily market insights and winning strategies! 🚀👉 Wishing you successful trades and profitable sessions ahead! 💰

📉 Gold Returns to All-Time High: Is a Major Correction on the Horizon?🔍 Strong Reaction at Historical HighsGold has returned to its all-time high zone, and as it touched this level, prices have seen a significant reaction, dropping $20 to around $2,770.On the H4 timeframe, candles show strong selling pressure at the highs, signaling a potential deeper correction. As the market opens next week (Monday), there is a high likelihood of a GAP (price gap) forming on smaller timeframes due to the current momentum.📊 Technical and Fundamental InsightsDouble Top Formation:Gold shows signs of forming a Double Top pattern at its historical peak.Combined with technical signals, this suggests a possible short-term corrective wave.Crucial News from FED and Trump:Next week, the market anticipates critical updates from the Federal Reserve (FED) regarding interest rate policies.President Trump’s fiscal and monetary policy announcements could also drive significant volatility in gold prices.Low Liquidity Conditions:With many Asian nations entering their Lunar New Year holidays, market liquidity is expected to decline, potentially leading to heightened volatility.🌟 Price Behavior AnalysisBased on insights from DXY, SWAP CHARGE, and FVG analyses:DXY Weakness: While DXY's weakness supports gold, heavy selling pressure near the highs indicates a possible corrective phase.SWAP CHARGE Shifts: The shift from buying to selling suggests that selling pressure is currently dominant, supporting the likelihood of a gold correction.💡 Key Levels to Watch Next WeekResistance:$2,786 - $2,790: This is the previous all-time high and a critical resistance level. A breakout above this zone could trigger a stronger bullish trend.Support:$2,758 - $2,735 - $2,718 - $2,694: These are the major support zones to monitor in case of a deeper correction.📢 Conclusion:Given the current dynamics, gold appears poised for a potential correction after testing its all-time highs. This aligns with technical signals and fundamental developments. Traders should closely monitor key levels and upcoming announcements from the FED and President Trump to stay ahead of market movements.👉 Follow KevinNguyen-SimpleTrade for more in-depth analysis and market updates! 🚀

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.