KTechnicalLevels

@t_KTechnicalLevels

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

**#XAUUSD Weekly Higher Time-Frame Analysis**

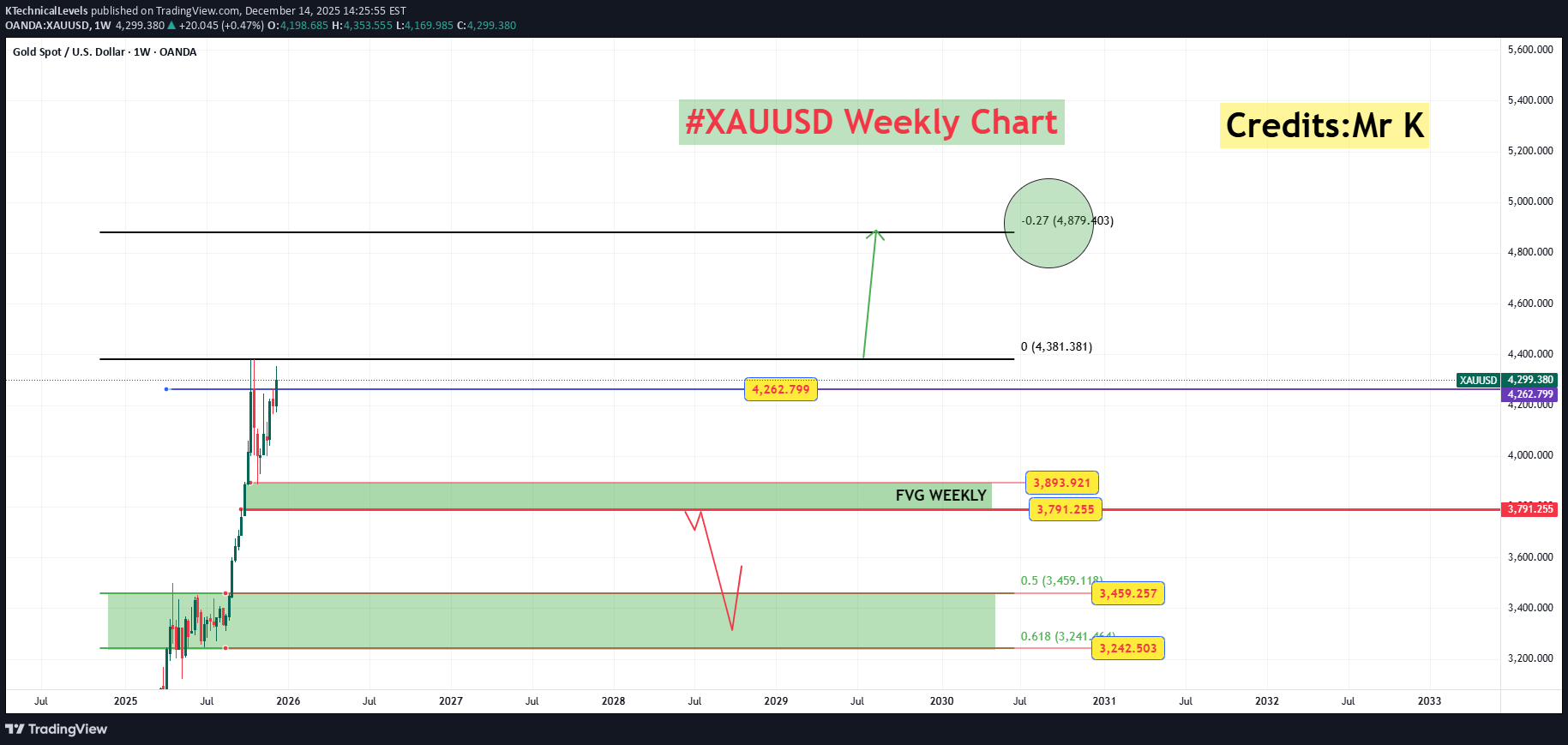

📌 **#XAUUSD Weekly Higher Time-Frame Analysis** The **weekly candle has closed strongly bullish**, which is a very important development. Previously, **no weekly candle was able to close above the 4250–4260 zone**, but this week we finally got a **weekly close above it** — a clear sign that **strong bullish momentum is building**. 📈🔥 --- ### 🔺 **Upside Outlook** On the weekly timeframe, our **major target comes around 4879**, based on the **advanced Fibonacci extension**. However, for this move to unlock fully, we need a **weekly candle close above 4381**, which is the **previous lifetime high**. A confirmed close above this level can open doors for a **very big bullish expansion**. --- ### 🔻 **Pullback Buy Scenario** On the downside, if price **pulls back and retests the 4250–4260 zone**, this area — which was earlier a **very strong resistance** — may now act as **strong support**. If price shows a **bullish reaction from this zone**, we can look for **buy opportunities**. --- 🧠 **Summary:** * Weekly close above **4250–4260** = bullish strength confirmed * Weekly close above **4381** = pathway toward **4879** * Retest of **4250–4260** = potential support-buy zone Patience and higher-timeframe confirmation remain the key. 📊✨

تحلیل هفتگی طلا (XAUUSD): آیا ریزش ادامه دارد یا سقف جدید در راه است؟

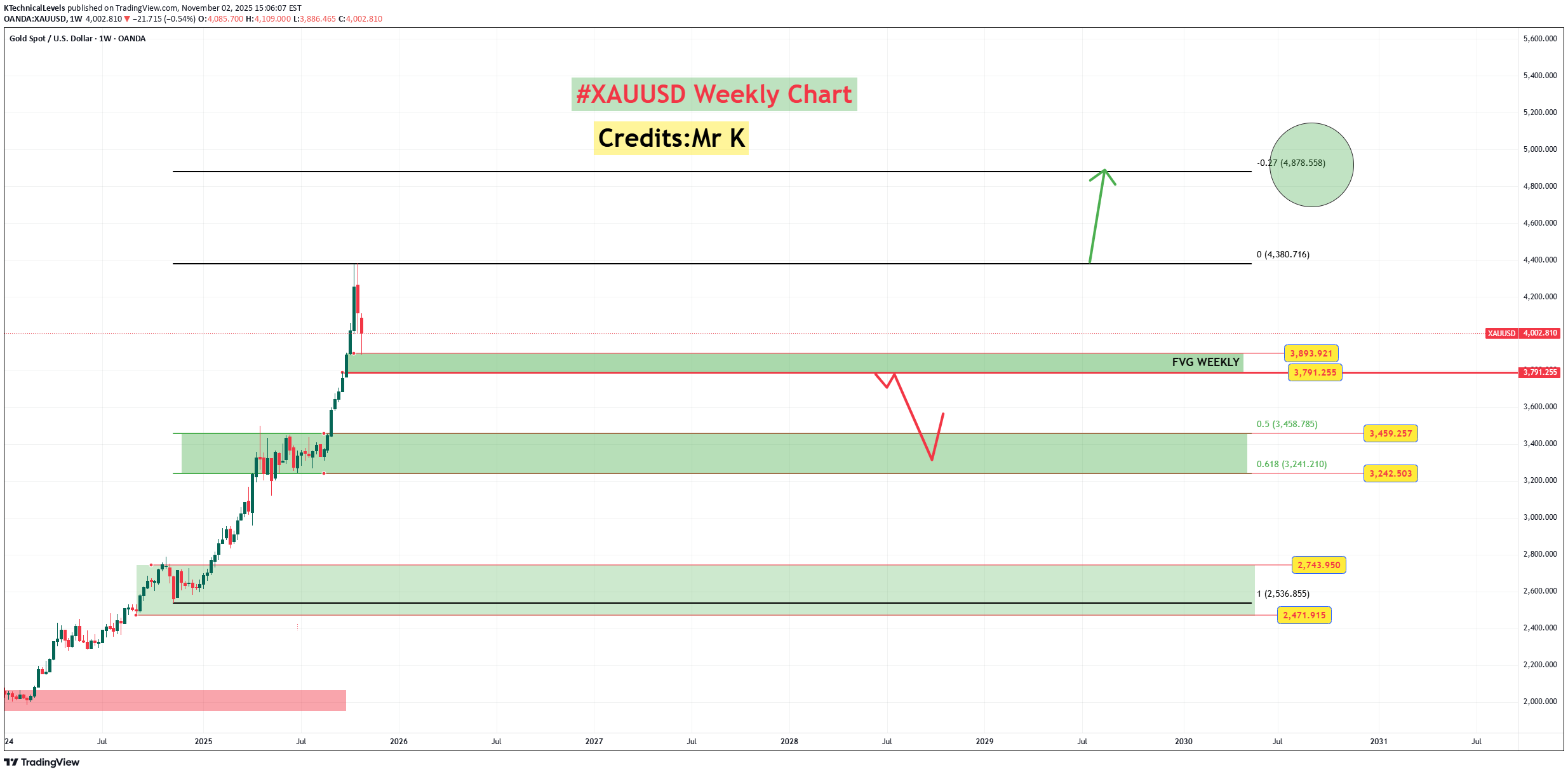

## 📆 We have now extended our view from the **Daily** to the **Weekly timeframe** to get a broader and clearer market structure picture. After creating a new **lifetime high at 4381**, gold faced **strong rejection** and printed **two consecutive bearish weekly closes**. However, last week price reacted sharply from the **Weekly Fair Value Gap near 3886**, showing strong demand from that zone ✅ --- ### 🟥 **Bearish Scenario** The level **3886** remains extremely crucial. If this week gold faces heavy selling pressure and we see a **weekly close below 3790**, then we may witness a **strong downside continuation** towards: 📍 **3460 – 3242 zone** This area can act as a **major long-term buying opportunity** if price reaches there. --- ### 🟩 **Bullish Breakout Scenario** On the upside, if the weekly candle **closes above the previous ATH zone – 4380 to 4400**, then we may see the start of a **fresh bullish leg** towards: 🚀 **4878 – 5000 zone** A weekly close above this range would confirm a **continuation of the bigger bullish cycle**. --- ### ✅ **Conclusion** This week’s **weekly candle close is extremely critical**. It will decide whether gold enters a **deep pullback phase** or **resumes its strong uptrend**. Stay patient and follow structure, not emotions. 📊✨

تحلیل طلا (XAUUSD) در تایم فریم H4: سطوح کلیدی خرید و فروش برای تریدهای پربازده

## 📊 Refining the structure on H4, we can clearly mark key zones from where high-probability trades may trigger ✅ --- ### 🟥 Key Supply Zone: 4026 – 4048 Price has reacted from this zone multiple times last week. So, if price retests this area and we see 1–2 strong H1 bearish candle closures, we may look for a sell setup 🛑📉 Sell Plan (if rejection) * ✨ Entry: 4026 – 4048 rejection * 🛑 SL: H1 candle closing above 4050–4055 * 🎯 TP: To be updated live based on price reaction --- ### 🟩 Bullish Breakout Scenario If price breaks & sustains above 4048 and we get a convincing H4 bullish closing, then we can shift to buy bias ✅ Buy Plan (if breakout) * 📈 Target 1: 4080 – 4120 * 📈 Target 2 / Final Resistance: 4115 – 4160 This final zone (4115–4160) aligns with the Fibonacci 0.50 – 0.618 golden pocket, so if we see 1–2 bearish H4 candle confirmations, this area could offer a high-reward swing short opportunity 🏛💰# 📉 **#XAUUSD – H4 Update** As anticipated, the **4026–4048** zone acted as a strong resistance. Price tapped into the region and faced a **sharp rejection from 4028 down to 3994**, validating our analysis ✅ We have **high-impact news scheduled in the US session**, so rather than rushing into trades, we will remain patient and wait for price action post-news before planning our next entry 🕒📊

**#XAUUSD H5 Higher Timeframe Analysis**

📊 **#XAUUSD H5 Higher Timeframe Analysis** What we witnessed today was a **tremendous recovery in Gold 🟡** after **3–4 consecutive bearish sessions 📉**. 📅 **Today’s candle** has **completely flipped the weekly structure**, turning a fully **bearish weekly candle into a bullish one 📈** — thanks to the **NFP data** that came in **favor of Gold and against the Dollar 💵❌**. 🔍 However, price is now approaching a **critical confluence zone**: * 🧭 A **long-running trendline** (since April) * 🔴 An **H4 Bearish Order Block** * 📐 The **Fibonacci Golden Zone (0.50–0.618)** at **3362–3372** 📌 **From this level, we have two possible scenarios:** 1️⃣ **Sharp Rejection 🔻:** Price may **reverse sharply** from the 3362–3372 zone and **resume the bearish trend**. 2️⃣ **Breakout & Trap Theory 🔺:** If price **sustains above this zone**, it may signal that the recent **3–4 day drop was a fake breakdown**, designed to **trap sellers** and grab liquidity for a **further upside move**. ✅ **Confirmation will come if we get an H4–H6 bullish candle close above the trendline** and back inside the **buying zone of 3375–3390**. 🔓 **A breakout above the triangle pattern** will likely lead to a **strong bullish continuation 📈🚀**.

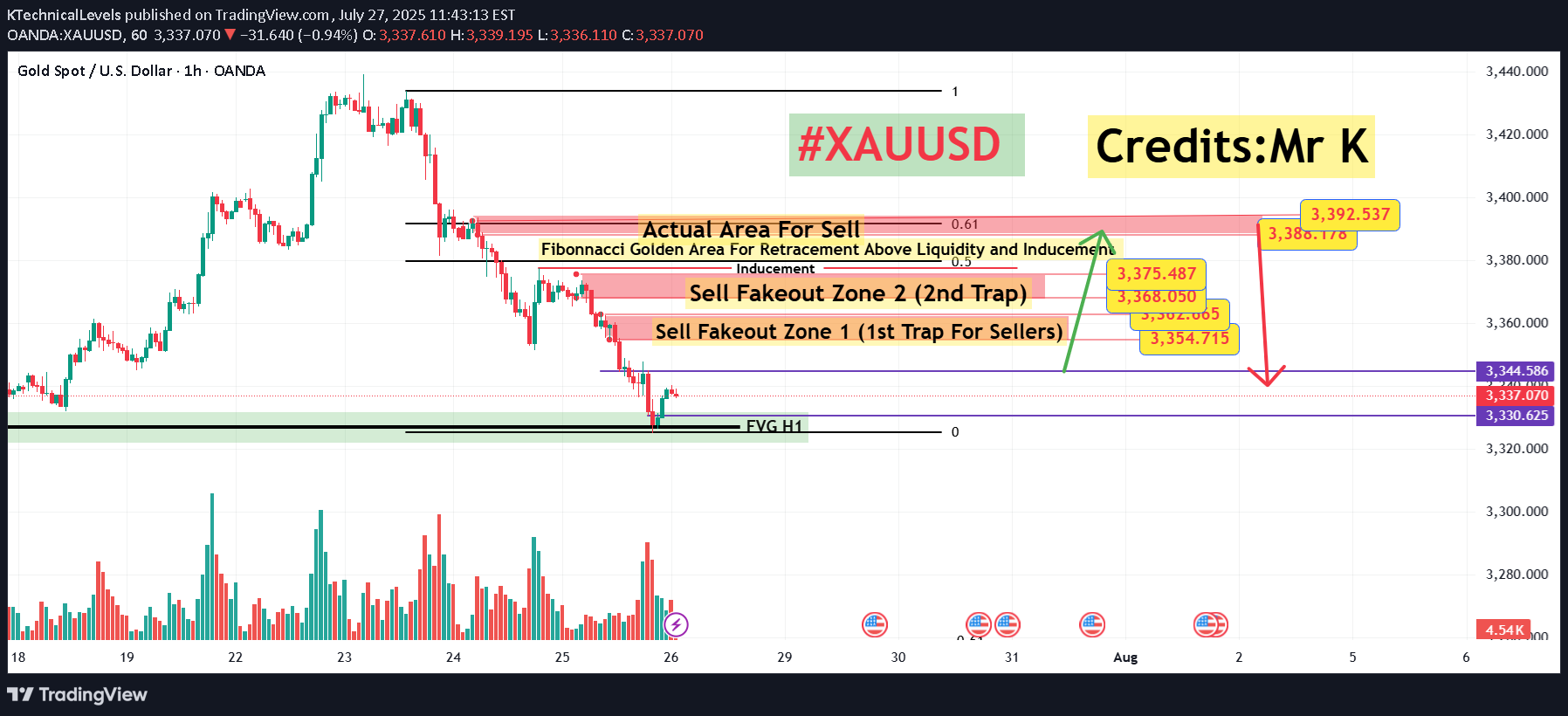

#XAUUSD H1 Setup – Smart Money Outlook

📊 **#XAUUSD H1 Setup – Smart Money Outlook** What we've been observing over the **last 3 sessions** is consistent **selling pressure** with **no meaningful pullback** yet — something that’s usually inevitable, even in strong downtrends. 🔁 A **retracement** is likely, and to identify key levels, we use the **Fibonacci Retracement Tool**. --- ### 🔍 **Market Sentiment Right Now**: * Many traders are expecting a pullback into the **3348–3360 H1 Order Block**, * Others are targeting **3368–3375** as a sell zone. But here’s the twist: ⚠️ **Both these zones** could be potential **sell trap areas** (Fakeout Zone 1 & 2). Why? Because **massive liquidity sits just above these levels**. --- ### 💡 **Smart Money Logic**: Above the second fakeout zone lies an **inducement area** (liquidity pool). And beyond that sits our **true institutional sell zone** at **3388–3393**, which aligns perfectly with the **Golden Fibo Zone (0.50–0.618)**. 📌 This is where we may see the **real bearish reaction**. --- ### 🟢 **Buy Setup Plan (Short-Term Opportunity)**: If we get a **fully bullish H1 candle close above 3345**, we’ll look to **buy** with: * **Entry:** Above **3345** * **Stoploss:** Around **3332** * **Target 1:** **3355** * **Target 2:** **3368** *(Potential final move into the trap zone)* 📢 **Important Note**: No buy will be considered without a strong **bullish H1 candle close** for confirmation. ✅ --- Let the market come to us — stay smart, not emotional. 🧠💰 \#SmartMoneyConcepts #XAUUSD #H1Analysis #LiquidityHunt #OrderBlock #GoldenFiboZone

XAUUSD – Daily Higher Time Frame Analysis

📊 **#XAUUSD – Daily Higher Time Frame Analysis** 🕵️♂️ On the **daily chart**, gold has consistently **failed to sustain above the 3450 zone**, with **no daily candle closing** above this key level. 📉 In fact, price has faced **rejection from 3450 nearly 5 times**, each followed by **strong selling pressure**. 🔄 However, from the **second rejection onwards**, price has been forming **higher lows**, indicating underlying **bullish structure** and is currently **respecting the daily trendline**. 📌 **Today’s H6 demand zone**, already marked in our analysis, acted as a **strong support**, triggering a bounce. This zone is part of the **daily demand area** — so **today’s daily candle close will be crucial**. --- 🔻 **Bearish Scenario**: * If price **fails to hold** and **closes below 3360**, we may enter a **bearish phase** on the higher timeframe. * Below **3360–3330**, there is **no major daily support**, so a **weekly close below 3330** could trigger a **sharp drop toward 3071–3000**. --- 🔺 **Bullish Scenario**: * On the flip side, **price is showing rejection** from support and if we get a **bullish H4 or H6 close above 3400**, we may see a move back toward **3450**. * Notably, the **3450 level has been tested 4 times**. Any level tested more than 3 times becomes **weaker**, increasing the **likelihood of a breakout** on the next attempt. 🎯 **Swing Trading Plan**: If we get a **fully bullish H4 candle close above 3400**, we will look to enter a **buy trade**. 📍 *Stop loss and target will be shared upon setup activation.* 📅 **Stay alert!** Today's daily close will set the tone for the next big move.

#XAUUSD – H1 High Probability Setup

📊 **#XAUUSD – H1 High Probability Setup** 🔍If you recall our **morning analysis**, we clearly mentioned that price is likely to **mitigate the zone below 3300** —and as expected, **price tapped into 3296**, which aligned with both the **H1 Order Block** and **Golden Fibonacci zone** 🎯📉---📈 **Current Setup in Progress:**We're now watching for a **bullish H1 candle close above 3353** 🔼Once confirmed, we’ll execute a **layered buy strategy**:🔹 **50% entry at activation** (above 3353)🔹 **30% on retracement** (if price dips 50–60 pips below entry)🔹 **Remaining 20%** if price dips **70+ pips** below entry zone---🛡️ **Stoploss:** 3338–3337 (slightly wide due to structure)This is why we **scale into the trade** — for **better risk management** and **position control** ✅🎯 **Minimum Target:** 100–150 pips🏁 **Extended Target (Optional):** 3396 – for those who can hold with conviction 📊💰---🧠 *Follow structure, manage risk, and trust the plan. High probability setups don’t need to be rushed.*

#XAUUSD H4 – Higher Time Frame Analysis

📊 **#XAUUSD H4 – Higher Time Frame Analysis** 🕵️♂️🔍 We drew a **Fibonacci retracement** from **June’s high (3451)** to **low (3246)**, and the **Golden Fibo level (0.618)** comes out to be around **3367**.🎯 That’s **exactly why** we kept a **safer target at 3366** in our **yesterday’s H1 buy setup** – and it worked perfectly!✅ Price made a high of **3365.95** before facing solid rejection from that zone.📉 This area was critical because:* It was a **Golden Fibo zone** ✨* There was also a **visible price gap** on the chart ⚠️🔄 **Current Price Action**:After forming the day’s low, **price is now attempting to recover**. Let’s watch the H4 candle closely. 🕰️---📌 **Two Possible Scenarios from Here:**1️⃣ **Bullish Breakout**➡️ If H4 candle **closes bullish above 3361**, we may witness a **deeper mitigation** of the **supply zone at 3367–3389**. 🚀2️⃣ **Bearish Breakdown**⬇️ If H4 candle **closes bearish below 3334**, then we may revisit the **3300 zone**.📍 Below 3300, **3289–3276** becomes a potential **buy zone**, **if** price shows **rejection signals**. 💰---📌 **Stay sharp, follow structure, and let price action guide you.** 🧠💡🛑 No rush, just execution with precision.

Bitcoin is now **on the verge of one of the biggest breakouts in

\#Bitcoin – **Higher Time Frame Analysis** 📈Bitcoin is now **on the verge of one of the biggest breakouts in its history**.📊 On the **daily chart**, we can clearly see a structure forming that's **similar to a Pole & Flag pattern**, which is typically **very bullish** from a price action perspective.⚠️ However, we remain **cautious** —We don’t just want a breakout above the upper trendline…What we’re looking for is a **strong daily candle close above the previous all-time high** (\~**\$112,000**).💥 If that happens, I’m anticipating a **massive upside move**, potentially towards the **\$123,000–\$125,000** zone.Let’s stay alert and wait for **clear confirmation** before jumping in!

XAUUSD H1 Refined Buy Setup

📈 **#XAUUSD H1 Refined Buy Setup**🎯 **Buy Activation Level:**Wait for a **bullish H1 candle closing above 3308.50–3309** to trigger the buy.🛡️ **Stoploss:** 3295–3293🎯 **Safer Target:** 3323–3324🎯 **Final Target:** 3340📌 **Flip Side Scenario:**If price drops instead, the **last major support zone lies between 3265–3245**.We may see **strong rejection** from this area — so watch it closely for a possible reversal opportunity.🚨 Wait for proper confirmation before executing any trade — always follow disciplined risk management.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.