JosHazler

@t_JosHazler

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

JosHazler

Gold buy signal confirm

Gold buy signal confirm Gold Eyes acceptance above $2,000 amid bullish technical setup Gold price is trading on the front just shy of $2,000 amid thin trading on Black Friday. The US Dollar eases, as Hamas-Israel truce begins, US Treasury bond yields recovery extends. Confirm gold buy Gold buy 1994 Target 1998 Target 2002 Target 2030 SL 1975

JosHazler

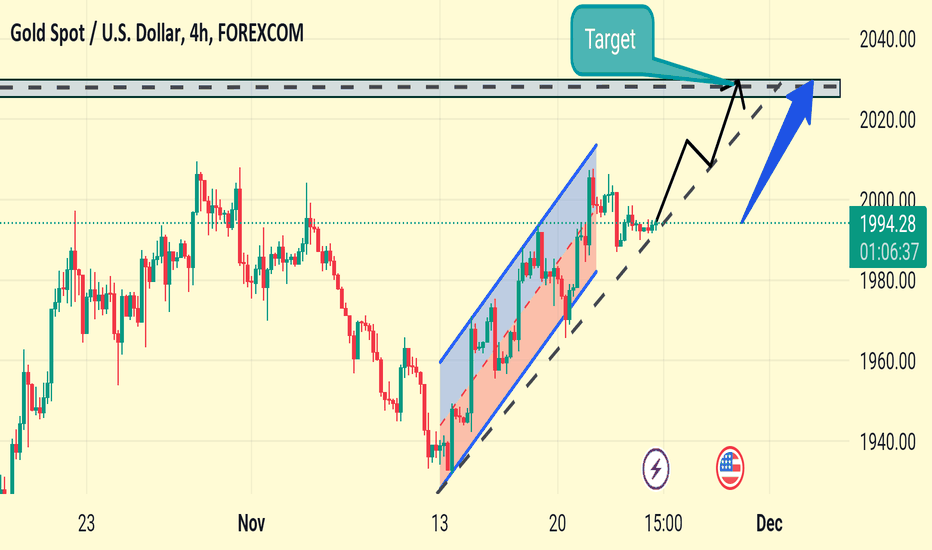

Xauusd gold buy opportunity read

Xauusd gold buy opportunity read Gold is upward move Gold price sticks to intraday gains as Fed rate cut bets prompt fresh US Dollar selling Gold price regains positive traction on Thursday and reverses a part of the previous day's retracement slide from the vicinity of the monthly peak. Gold trade setup Gold buy now 1995 Target 2020 Support 1986

JosHazler

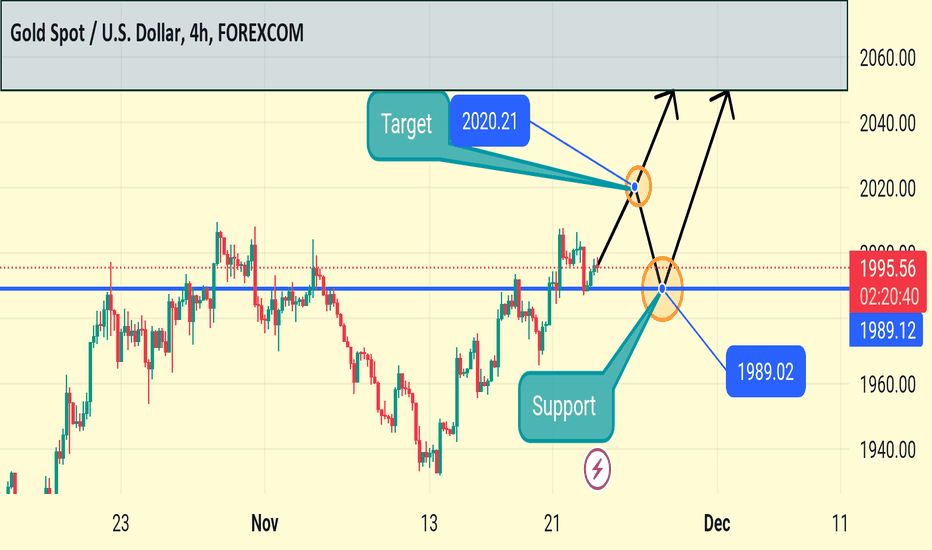

Gold buy confirm

Gold buy confirm GOLD retreats further from monthly peak, downside potential seems limited Gold price extends the overnight modest pullback from the $2,007 area, or the vicinity of a multi-month peak, and remains depressed below the $2,000 psychological mark through the Asian session on Wednesday. CONFIRM TARGET Gold buy 2002 Target 2007 Target 2014 1990

JosHazler

JosHazler

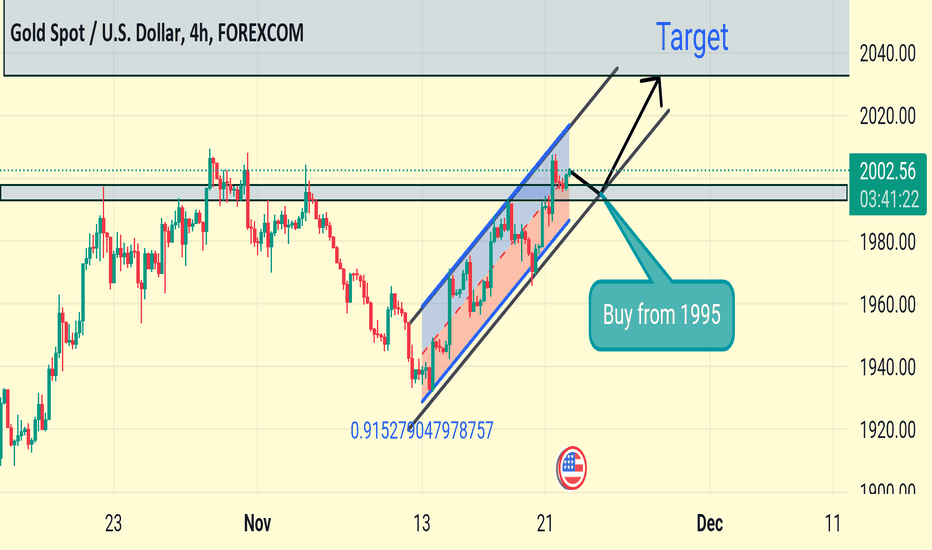

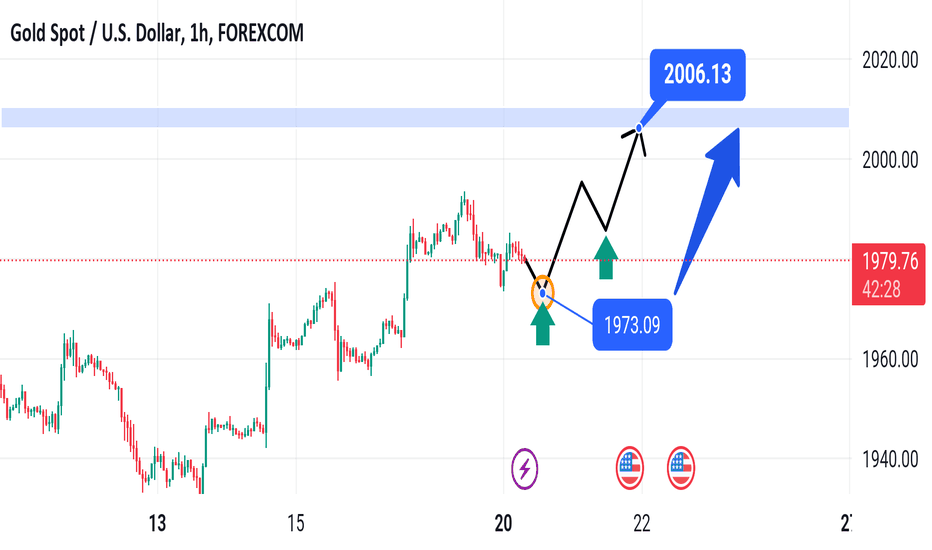

Gold opportunity for buy

Gold opportunity for buy Gold Buy opportunity to 2006 Gold price (XAU/USD) loses traction during the early Asian trading hours on Monday. The softer US Dollar (USD) and a decline in US Treasury bond yields might lift the precious metal, Gold price currently trades around $1,978, losing 0.14% on the day. Gold Buy Now 1979 Buy limit 1973 Target 2006

JosHazler

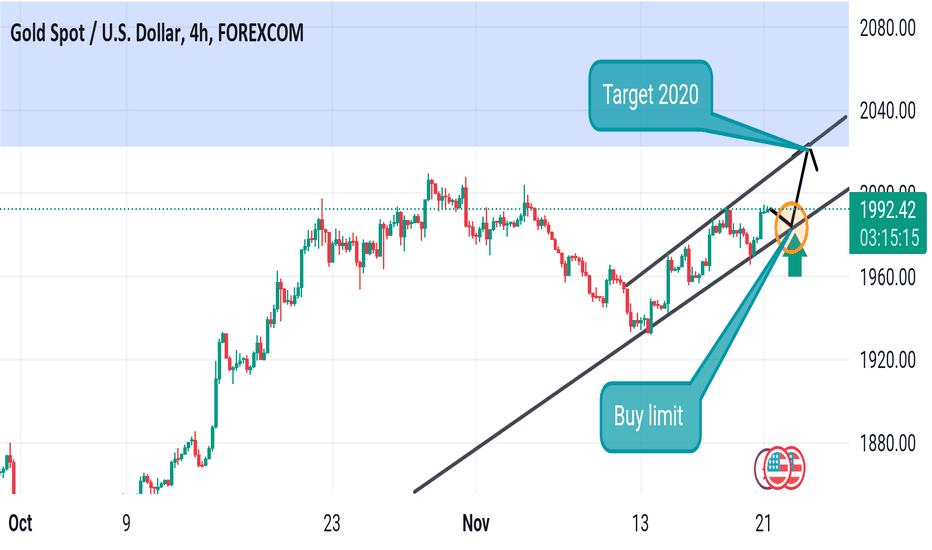

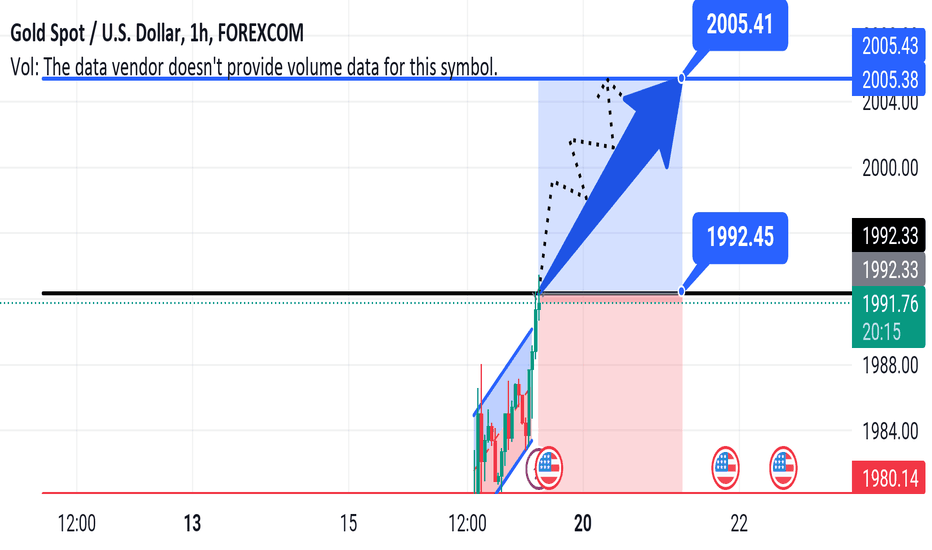

Gold Buy signal confirm trade

Gold Buy signal confirm trade The next upside barrier is seen at the descending trendline resistance of $1992, close to the November 6 high of $1,993. Acceptance above the latter will prompt Gold buyers to challenge the $2,000 Mark confirm trade

JosHazler

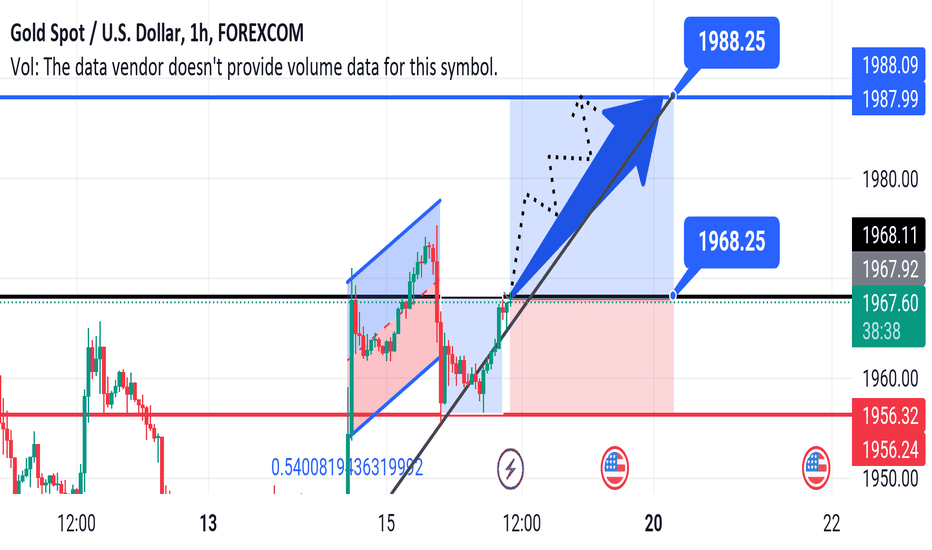

Gold Buy opportunity

Gold Buy opportunity Gold is making buy trend Support is 1982 Resistance 1958 Target 1990a Gold setup price Gold Buy Now 1967 Target 1990

JosHazler

XAUUSD BUY confirm signal

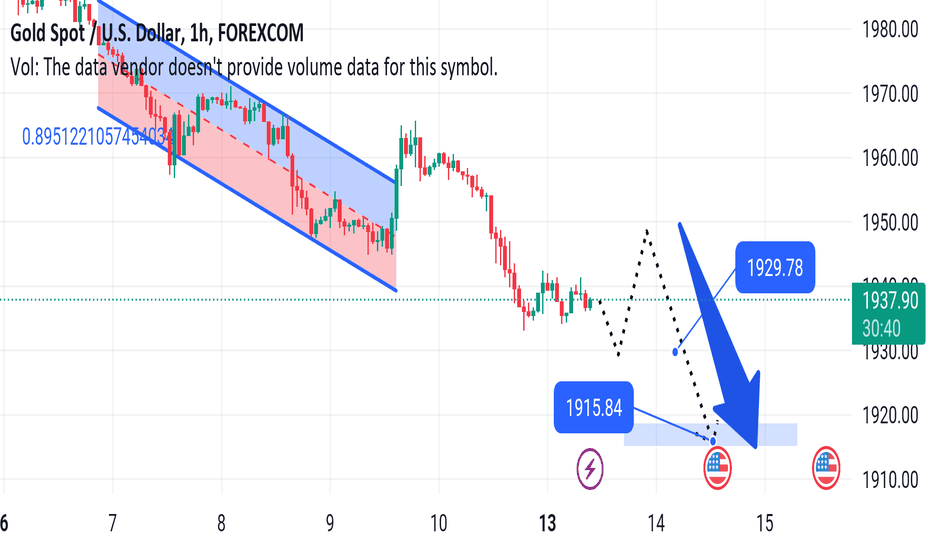

XAUUSD BUY confirm signal Gold reversed lower this month after failing to clear a key ceiling in the $2,010/$2,015 region. Following this pullback, the metal is nestled around the 200-day simple moving average, fluctuating in proximity to it. If prices resolve to the upside and consolidate above this technical indicator in a decisive fashion, initial resistance appears at $1,980, followed by $2,010/$2,015. On the flip side, should sellers reemerge and reignite downward pressure, the initial floor to watch rests at $1,935, located just above the 50-day simple moving average. While gold might establish a foothold in this area on a retrenchment, a breach to the downside could trigger a drop towards $1,920. Below this threshold, attention shifts to $1,900.

JosHazler

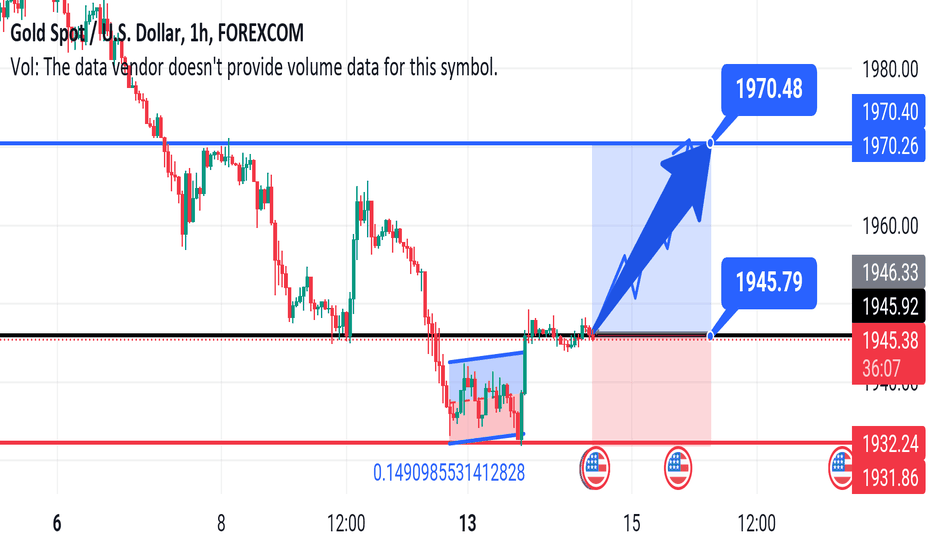

XAUUSD BUY confirm signal

XAUUSD BUY confirm signal Gold recovery appears shallow ahead of US CPI inflation data Gold moves up and down in a tight channel slightly below $1,950 after staging a rebound from the multi-week low it set at $1,932 early Tuesday. The 10-year US T-bond yield holds steady above 4.6% and limits XAU/USD's action ahead of US Consumer Price Index data.

JosHazler

Gold Sell confirm

Gold Sell confirm Gold price struggles for a direction ahead of the US consumer inflation data for October. The near-term demand for the precious metal remains downbeat due to multiple headwinds. On a daily time frame, the correction in Gold price has extended to near the 50-day Exponential Moving Average (EMA), which trades around $1,940.00. Next support for the yellow metal is seen near the 200-day EMA, which hovers near $1,915.00.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.