JohnHarry_7

@t_JohnHarry_7

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

JohnHarry_7

Gold buy

Gold’s daily decline now picks up pace and puts the $3,300 mark per troy ounce to the test on Wednesday. XAU/USD remains on the back foot as market emphasis moves to FOMC Minutes amid steady uncertainty on the US trade front and increased geopolitical concerns.Gold remains offered near $3,300, looks at the FOMC MinutesXauusd buy 3307Target 3360

JohnHarry_7

JohnHarry_7

Xauusd signal buy

Despite last week’s marked advance, Gold has started the week on the back foot, with gains capped by the $3,350 zone per troy ounce. The recent uptick in market sentiment makes it tough for XAU/USD to get back on track. Monday is Memorial Day; therefore, financial markets in the United States will be closed.Gold buy 3336Support 3350Support 3370Support 3409

JohnHarry_7

Xauusd weekly signal

Gold extends its weekly advance, trading around $3,350 per troy ounce on Friday. The rally in XAU/USD is driven by broad-based weakness in the Greenback, particulalry after President Trump’s threat to impose 50% tariffs on European imports.From a technical perspective, the overnight pullback from a two-week top shows some resilience below the 23.6% Fibonacci retracement level of the move up from the monthly low touched last week. Adding to this, oscillators on hourly/daily charts are holding in positive territory, suggesting that the path of least resistance for the Gold price remains to the upside. Some follow-through buying beyond the overnight swing high, around the $3,346 area, will reaffirm the constructive outlook and allow the XAU/USD pair to reclaim the $3,400 round figure.

JohnHarry_7

Xauusd signal

Gold builds on its weekly gains and trades above $3,350 in the second half of the day on Friday. The selling pressure surrounding the US Dollar and the risk-averse market atmosphere after US President Donald Trump threatened 50% tariffs on European imports fuel XAU/USD's rally.

JohnHarry_7

Long

Interested in weekly XAU/USD forecasts? Our experts make weekly updates forecasting the next possible moves of the gold-dollar pair. Here you can find the most recent forecast by our market experts:Xauusd signal buy Support 3250Support 3300Support 3400Resistance 3150Resistance 3100Resistance 3050

JohnHarry_7

Xauusd

Technically, the daily chart shows that XAU/USD trades in the green, yet also that it posted a lower low and a lower high. At the same time, the 20 Simple Moving Average (SMA) turns modestly lower around the $3,305 level, while the 100 and 200 SMAs maintain their upward slopes far below the current level. Finally, technical indicators aim higher, but remain below their previous intraday highs and withinXauusd buy 280 pips doneXauusd now buyFree signal

JohnHarry_7

Xauusd sell

In the near term, and according to the 4-hour chart, XAU/USD is bearish. The pair trades below all its moving averages, with the 20 SMA about to cross below the 200 SMA. The latter stands at $3,232, providing relevant resistance in the case of a recovery. Finally, technical indicators lack directional strength but hold within negative levels, reflecting the absence of buying interest.Support levels: 3,173.80 3,158.40 3,142.65Resistance levels: 3,198.20 3,215.80 3,232.10

JohnHarry_7

CPI signal

Close but no cigar”, it seems for President Trump again. Several traders and analysts are wary of the conceived trade deal with China, which is only a 90-day relief. Besides reducing tariffs for 90 days, there are no fundamental elements for markets to cling to, such as forward dates for negotiations, topics, additional numbers, or anything material to see a continuation of momentum. It makes sense for experienced traders to remain cautious and buy securities such as Gold after Monday’s correction. Xauusd buy 3252Support 3298Support 3325Resistance 3206Resistance 3177Resistance 250 pips done 👍Gold now buyCheck my chart

JohnHarry_7

Xauusd signal

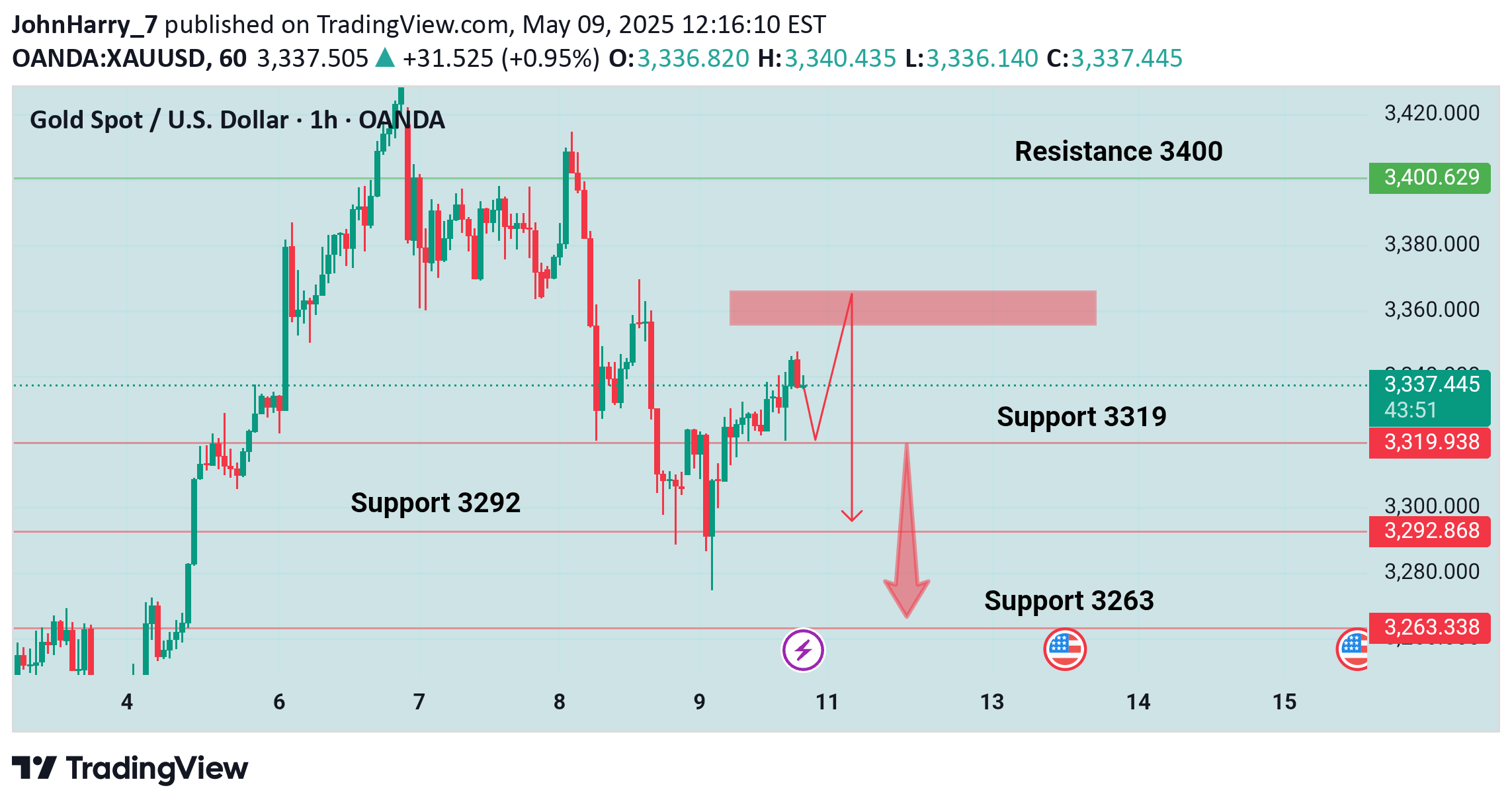

Gold price turns positive on the day above $3,300 following an intraday slide to the $3,275-3,274 area. Geopolitical risks stemming from the Russia-Ukraine war, the escalation of tensions in the Middle East, and the India-Pakistan border, attract safe-haven flows and support XAU/USD.Xauusd signal sell 3336Support 3300Support 3280Support 3266Resistance 3400Xauusd sell 100 pips doneCheck my work

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.