Investors_Faq

@t_Investors_Faq

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

Investors_Faq

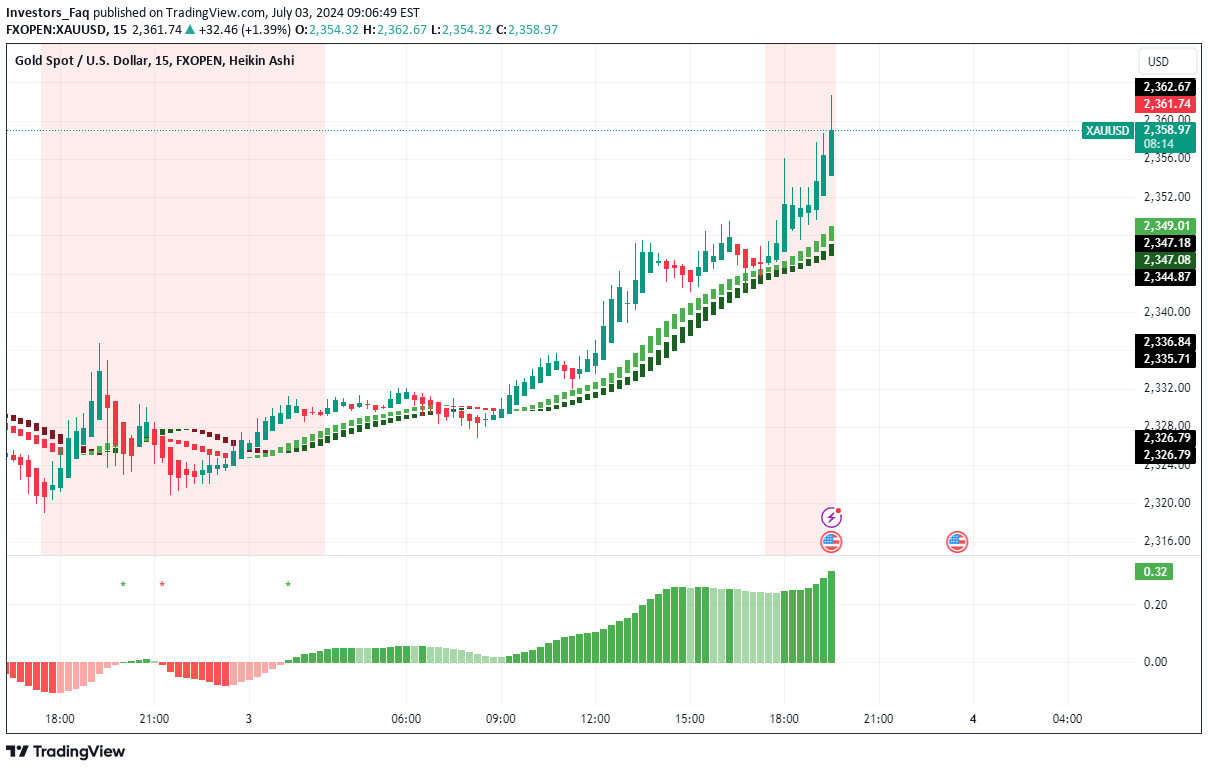

Current Resistance Level Gold (XAU/USD) has recently encountered resistance at the 2361.00 level. This resistance has been tested multiple times, suggesting potential downward movement if it holds. Technical Analysis Overview - **Resistance Level:** 2361.00 - **Support Levels:** Key support levels to watch include 2356.00, 2351.00, and 2346.00. - **Trend Analysis:** The trend shows potential bearish signals if gold fails to break above the 2361.00 resistance level. Sell Signal Details - * *Entry Price:** 2361.00 - **Take Profit Levels:** - **T1:** 2356.00 (50 pips) - **T2:** 2351.00 (100 pips) - **T3:** 2346.00 (150 pips) - **Stop Loss:** 2371.00 (100 pips) #### Market Sentiment Investors are advised to consider the strong resistance at 2361.00 as a potential point for initiating sell positions. With the entry point at 2361.00, the outlined take profit levels provide a structured approach to maximizing gains while minimizing risks. Risk Management It is crucial to adhere to the stop loss at 2371.00 to protect against potential upside risks. This strategy ensures that losses are limited, while the potential for profit remains high given the strong resistance level. Investors FAQ: Providing the Best Analytics Investors FAQ is committed to providing top-tier analytics and signals for forex trading. Our comprehensive market analysis and carefully curated signals are designed to help traders make informed decisions and maximize their trading potential. Risk Disclaimer Trading in forex and commodities carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in forex or commodities, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with forex and commodity trading and seek advice from an independent financial advisor if you have any doubts. --- #GoldAnalysis #ForexTrading #SellSignal #MarketAnalysis #InvestorsFAQ #TradingSignals #RiskManagement #TechnicalAnalysis #Forex #Commodities Please ensure you adapt your trading strategy according to your risk tolerance and market conditions. Happy trading!

Investors_Faq

Current Support Level Gold (XAU/USD) has shown significant resilience at the 2290.00 support level. Despite multiple attempts, it has not broken below this crucial support, indicating strong buying interest and stability at this price point. Technical Analysis Overview - **Support Level:** 2290.00 - **Resistance Levels:** Key resistance levels to watch include 2330.00, 2335.00, and 2340.00. - **Trend Analysis:** The trend remains bullish as long as gold maintains its position above the 2290.00 support level. Buy Signal Details - **Entry Price:** 2325.00 - **Take Profit Levels:** - **T1:** 2330.00 (50 pips) - **T2:** 2335.00 (100 pips) - **T3:** 2340.00 (150 pips) - **Stop Loss:** 2310.00 (150 pips) Market Sentiment Investors are advised to consider the strong support at 2290.00 as a foundation for potential upward movement. With the buy signal entry at 2325.00, the outlined take profit levels provide a structured approach to maximizing gains while minimizing risks. Risk Management It is crucial to adhere to the stop loss at 2310.00 to protect against potential downside risks. This strategy ensures that losses are limited, while the potential for profit remains high given the strong support level. Conclusion Gold's inability to break below the 2290.00 support level signifies a robust buying opportunity. With the entry point at 2325.00 and clearly defined profit targets, investors can strategically position themselves to benefit from the anticipated upward movement. This Risk Disclaimer Trading in forex and commodities carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in forex or commodities, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with forex and commodity trading and seek advice from an independent financial advisor if you have any doubts. --- Please ensure you adapt your trading strategy according to your risk tolerance and market conditions. Happy trading!

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.